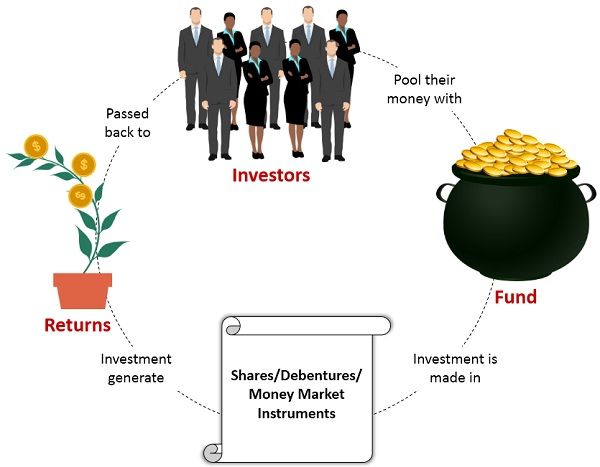

Mutual Funds involve the pooling of money of lakhs of investors and making an investment in financial instruments of multiple companies and sectors.

Mutual Funds involve the pooling of money of lakhs of investors and making an investment in financial instruments of multiple companies and sectors.

On the other hand, a Systematic Investment Plan or SIP is a technique for making investments in mutual funds. It is a method that allows an investor to invest in small but regular amounts, in a mutual fund so as to accumulate wealth over time.

Nowadays, with the introduction of various apps, and new investment avenues, investing in the stock market has become relatively easier. In fact, people do not need to be experienced in this field and so even if you are having little knowledge, that is enough, as there are professionals, who advise you to make better investment decisions and also perform research on your behalf.

In this written account, we will enlighten you with all the points of difference between mutual funds and SIP. Also, we will clear the basic concepts of these two.

Content: SIP Vs Mutual Fund

- Comparison Chart

- Definition

- Key Differences

- Frequently Asked Questions

- Classification of Mutual Fund

- Advantages

- Conclusion

Comparison Chart

| Basis for Comparison | Systematic Investment Plan (SIP) | Mutual Fund |

|---|---|---|

| Meaning | A Systematic Investment Plan (SIP) is a route to invest in mutual funds, that brings discipline to your investment by investing a specified sum, at regular intervals. | A mutual fund is an investment vehicle, which involves the pooling of funds of investors and issuing units to them, and investing the funds in securities, to earn returns. |

| What is it? | Investment Mode | Investment Avenue |

| Method of Investment | Regular | Regular or One time |

| Flexibility | High | Comparatively Low |

| Cost | Cost is averaged, due to Rupee Cost Averaging. | High due to investment is made in a single transaction. |

| Impact of Market Volatility | Low | Comparatively High |

Definition of Systematic Investment Planning (SIP)

Systematic Investment Plan, popularly known as SIP is a form of investing a definite amount in Mutual funds at regular intervals. Hence all the mutual fund schemes offer SIP, but they are considered as most effective that make an investment in equities, in the long term.

- With SIP on the basis of preference, you can make systematic investments, every week, month, or quarter. However, monthly investment is typically preferred, as it tends to synchronize with your monetary inflows.

- It is a proven method of reducing risk while enjoying good returns, through periodic investment in the long term.

- This involves spreading investments over the period and getting good returns even when the market is not stable.

Further, every time an investor invests an extra amount, additional units are purchased from that money at the ongoing rate and credited to the concerned investor’s account. The number of units an individual receives depends on the prevailing Net Asset Value (NAV) of the concerned scheme.

If a person uses the SIP method, to invest in mutual funds, a specified sum is deducted from their concerned account at regular intervals, so discipline is maintained.

Also Read: Difference Between Stocks and Mutual Fund

Definition of Mutual Fund

Mutual Fund, as the name signifies is a shared investment avenue, wherein the investors get proportionate ownership in the diversified pool of assets, based on the number of units held by the particular investor, as per the ongoing market rate.

Due to the pooling of funds of various investors, there is a benefit of professional portfolio management, by a fund manager.

This ensures risk diversification, as the movement of all the stocks in a similar direction and proportion at the same time is not at all possible. And as per the amount invested by each investor, units are issued to them. Hence, profits earned or loss sustained are shared by the investors according to their investment proportion.

To invest in a mutual fund, the Asset Management Company (AMC) accumulates money from various investors and then invests it into stocks, bonds, and other securities.

Such an investment vehicle is high in liquidity as well as it can be sold via both online and offline mode. It relies on the percept of diversification of risk.

They earn money in three ways:

- Capital Appreciation

- Dividends

- Capital Gain distribution

Do You Know?

Back in the year 1774, in Netherlands, Abraham van Ketwich – a Dutch Merchant is acknowledged as the first person to create a ‘mutual fund’, for people having limited means.

Methods of Investing in Mutual Fund

- Lump-Sum: As the name suggests, when a person wants to invest in mutual funds through lump sum investment, he/she makes a one-time investment of a specified amount that he/she wants to invest.

- SIP: Systematic Investment Plan or SIP is just like a recurring deposit, in which you invest a specified sum at regular intervals consistently, over a period.

Also Read: Difference Between Mutual Fund and ETF

Key Differences Between SIP and Mutual Fund

After taking a peep into the basics of these two, we are going to talk about the difference between SIP and Mutual fund:

- Mutual Fund implies a combined savings and investment tool, in which savings of a large group of small savers are put together and invested in a basket of securities for the mutual benefit of all and there is a proportionate distribution of returns. On the contrary, Systematic Investment Plan (SIP) is a route to invest a fixed amount in any mutual funds scheme opted by you, at a regular frequency.

- While a mutual fund is an investment product, SIP is a method of investing.

- One can invest in mutual funds in two ways, i.e. either by making a one-time investment in a lump sum or by making regular investments through SIP. Conversely, when an investor opts for SIP, a fixed amount is debited from his/her account at regular intervals and invested in the scheme.

- Talking about flexibility, SIPs are flexible in the sense one can invest according to his own convenience by deciding a particular time frame when he/she wants to invest, be it every week, fortnight, month, or quarter. In contrast, in mutual funds, if an investor wants to invest a lump sum amount, then he/she must ensure the availability of bulk surplus.

- In mutual funds, if a person has invested his/her funds in a lump sum, then the cost might be high. As against, if a person has invested the sum through SIP, the cost is averaged out which keeps the cost at lower levels.

- Investment in mutual funds in a lump sum is sometimes risky especially when the investor is a novice, as they have no idea regarding the best time to enter the market and so, this poses a threat as to the timing of purchase. Oppositely, with SIP there is no best time to start your investment, you can start it right away, as the purchase is spread over a period of time, and so the investors do not have to face high market volatility.

Frequently Asked Questions (FAQs)

Who can invest in Mutual Fund?

Any person can invest in mutual funds having investible amount, be it just 500 or 1000 rupees. This can be done by purchasing units of a certain mutual fund scheme.

How does Mutual Fund work?

Money pooled from various investors is invested in diversified securities, by the fund manager. The basket of securities may include shares, debentures and, money market instruments like commercial paper, treasury bills, certificate of deposits, etc. Income received by these investments is shared by the unitholders on the basis of their ownership.

What is the Minimum Investment Amount in SIP?

There is no minimum investment amount in the case of SIP, as one can begin SIP with just 500 rupees each month. However, lump-sum mutual funds generally have a minimum amount criteria.

How Mutual Fund is set up?

Mutual Fund is started in the form of a trust, consisting of a sponsor, trustee, Asset Management Company (AMC), and custodian.

- The sponsor acts as a promoter, who sets up the trust.

- The trustee holds the property of a mutual fund, for the interest of unitholders or investors. They administer and direct AMC, as well as analyze the performance and adherence to various regulations of SEBI.

- Asset Management Company (AMC), is for fund management that invests funds in different securities. It is usually approved by the Securities and Exchange Board of India (SEBI)

- Custodian is registered with SEBI, who takes charge of the securities of multiple schemes of the mutual fund.

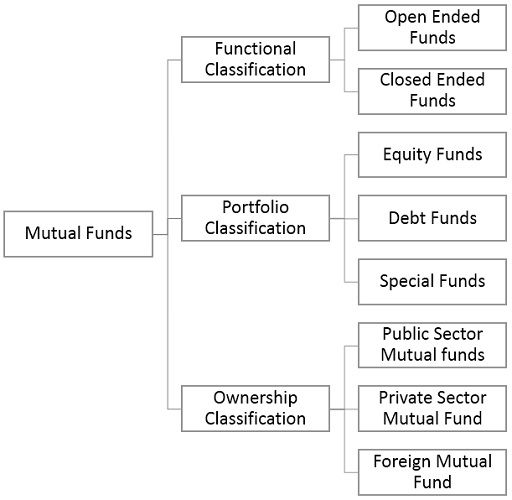

Classification of Mutual Fund

Mutual Funds are broadly classified into three categories:

Functional Classification

- Open-Ended Funds: These funds are sold and repurchased at any time on a continuous basis. So, there is no fixed time for entry and exit of the investor.

- Closed-Ended Funds: Funds that can be bought either through an IPO or from the stock market after they have been listed. Further, these funds have a limited life span and after the completion of the term, the corpus is liquidated.

Portfolio Classification

- Equity Funds: The primary objective of such funds is to facilitate capital appreciation over the medium to long term. Further, the amount is majorly invested in buying stocks. These are of three types – growth funds, aggressive funds, and income funds.

- Debt Funds: These aim at providing a constant income to the investors, so the amount is invested in such instruments that generate fixed income like bonds, debentures, government securities, and money market instruments. They are of two types – bond funds and gilt funds.

- Special Funds: Funds that do not fall in the above two categories are considered special funds. These can be – index fund, international fund, sector fund, offshore fund, money market fund, fund of funds, capital protection oriented fund, and gold fund.

Ownership Classification

- Public Sector Mutual Funds: Funds that are sponsored by a public sector company are public sector mutual funds.

- Private Sector Mutual Funds: Funds that are sponsored by private sector companies are private sector mutual funds.

- Foreign Mutual Funds: The sponsorship of these funds is done by those companies that are operating in India, perform fundraising in India and also invest in India.

Also Read: Difference Between Open-Ended and Closed-Ended Mutual Funds

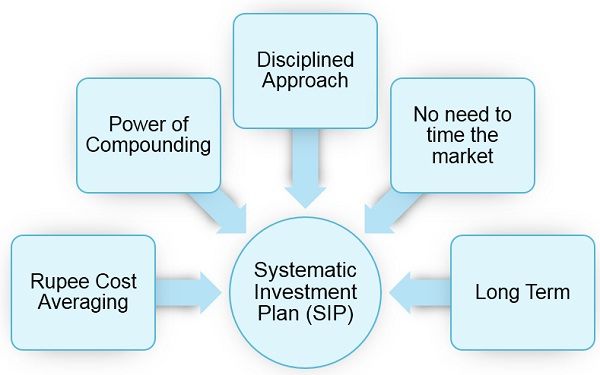

Advantages of SIP

SIP has several advantages that are discussed here:

- Rupee Cost Averaging: It provides the benefit of Rupee Cost Averaging, as the investment continues regardless of the upward or downward trend in the market, and so it averages out the cost of investment.

- Power of Compounding: By investing in mutual funds through SIP, an investor gets returns on the returns, by way of compounding, which ultimately increases the overall value of the investment.

- Disciplined Approach: SIP adds discipline to your investments by maintaining consistency in investments. This helps in building wealth over time.

- No need to time the market: In a systematic investment plan, an investor gets more units, if the price is low whereas if the price is high more units are received. In this way, the average cost remains at a lower level, which makes it irrelevant to time the market.

- Long-term: As you invest small amounts via SIP and so one can start investments at an early stage and grow gradually. In this way, the investments spend more time in the market and grew over time.

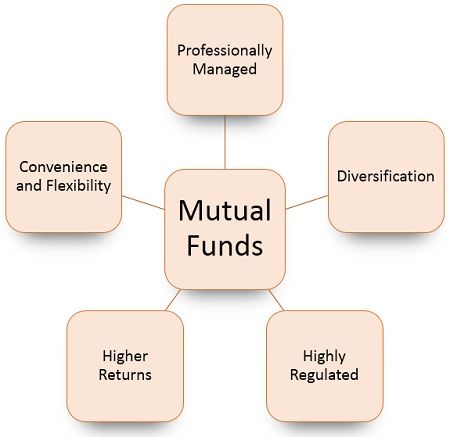

Advantages of Mutual Funds

There are a number of advantages of investing in mutual funds which are disclosed below:

- Professionally Managed: Mutual funds are managed by a team of professionally qualified and experienced fund managers. The team makes buying decisions on the basis of continuous research and analysis.

- Diversification: In mutual funds, the portfolio is diversified and so the investment is not made in a single company, industry, or sector, which prevents you from market volatility.

- Highly Regulated: Mutual Funds are regulated by the Securities and Exchange Board of India (SEBI), as per stipulated provisions, that protects the rights and interest of the investor.

- Higher Returns: In the long run, mutual funds give higher returns to the investors, comparing to other investment products.

- Convenience and Flexibility: Mutual Funds provide a number of convenient features like liquidity, exchange privilege, and automatic investment plans. These are liquid as the investment is made in liquid assets which can be sold and repurchased easily. Also, within a fund company switching to another fund is allowed without any extra sales charge.

With the changing market scenario, the price of some securities may go up while the price of others may go down, and as you make investment regular investment in mutual funds, some shares are bought at a high price while some at a low price, which averages out the cost.

Conclusion

Investing in mutual funds, irrespective of the method tends to give high returns in the long run, when the investment is done systematically.

Leave a Reply