Internal control is a system that comprises of control environment and procedure, which help the organization in achieving business objectives. On the other hand, internal audit is an activity performed by professionals to ensure that internal control system implemented in the organization are effective.

Internal control is a system that comprises of control environment and procedure, which help the organization in achieving business objectives. On the other hand, internal audit is an activity performed by professionals to ensure that internal control system implemented in the organization are effective.

Control is one of most prominent human need, that is present in almost every human activity. So, in business too, control have a great role to play in ensuring best possible use of resources and escalate profits. Most of the business activities are performed by computers, individuals and other equipment, which requires periodic examination, to make sure that losses and wastes do not occur.

Internal control and internal audit help business firms to keep an eye on the regular activities. These are commonly used interchangeably, but they hold different meanings. Take a read of this article, to learn the difference between internal control and internal audit.

Content: Internal Control Vs Internal Audit

Comparison Chart

| Basis for Comparison | Internal Control | Internal Audit |

|---|---|---|

| Meaning | Internal Control refers to the methods and procedures implemented by the management to control the operations, so as to assist in achieving the business objective. | Internal Audit alludes to the auditing program adopted by the firm, to review its financial and operating activities by the professional. |

| What is it? | System | Activity |

| Verification | One person's work is verified by another. | Each and every component of work is verified. |

| Time of checking | As soon as the transaction is recorded checking is performed. | Checking is done after the work is performed. |

| Objective | To ensure compliance with management policies. | To detect fraud and error. |

Definition of Internal Control

Internal Control can be understood as a system developed, implemented and maintained by the company’s management, in order to ensure the achievement of objectives concerning:

- Effectiveness and efficiency of operations,

- Protecting assets,

- Prevention and detection of frauds and errors,

- Accuracy and completeness of financial reporting,

- Adherence to relevant laws.

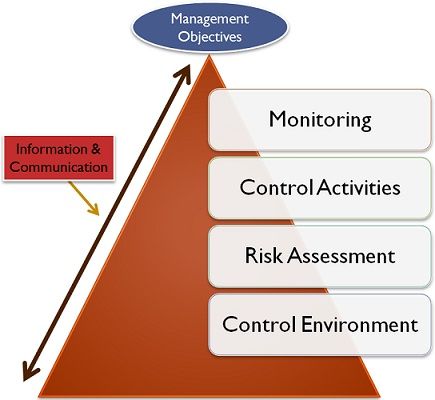

It comprises of five elements, which are interconnected to each other and apply to all firms, but their implementation depends on the size of the firm. The elements are control environment, risk assessment, control activities, information and communication and monitoring.

Objectives of Internal Control

- Examining whether the transactions are executed as per the management’s authorization.

- Checking prompt recording of transactions, in correct amount and account and that too in the accounting period, to which it belongs.

- Ascertaining that assets are protected from unauthorized access and use.

- Comparing recorded assets with the existing ones, at various time intervals and taking actions in case differences are discovered.

Review

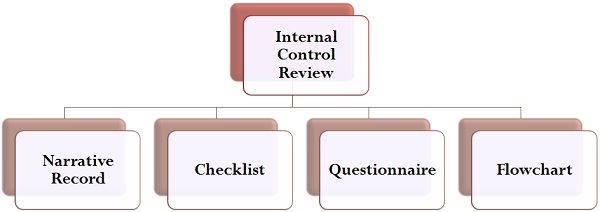

The most important part of the internal control system is its review, for which the auditor can use any of the methods: Narrative Records, Checklist, Questionnaire, and Flowchart.

Definition of Internal Audit

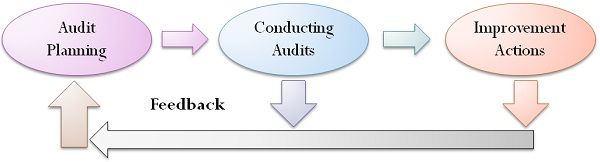

Internal audit is defined as an unbiased, rational assurance and consulting function, developed by the management, to keep a check on the activities of the organization. It involves regular and critical analysis of the functions of an organization, for the purpose of recommending improvements. It is aimed at assisting members of the firm in discharging their responsibilities in an effective manner.

The task is performed by the internal auditor, who is appointed by the company’s management. He/she reports the management regarding the analysis, appraisal, recommendation and all relevant information relating to the activities under study.

Objectives of Internal Audit

- To check the accuracy and authenticity of the accounting records, which are reported to those charged with governance.

- To identify whether the standard accounting practices, which are deemed to be pursued by the entity, are complied with or not.

- To ensure detection and prevention of fraud.

- To examine that there is an appropriate authority for the procurement and disposal of assets.

- To verify that the liabilities are incurred only for business causes and not for any other purpose.

- To review the activities of the internal control system, so as to report management regarding deviations and non-compliances.

Key Differences Between Internal Control and Internal Audit

The difference between internal control and internal audit can be drawn clearly on the following grounds:

- The methods and procedures implemented by the management to control the operations, so as to help the organization in achieving the desired ends, is called as an internal control. The auditing program adopted by the firm, to review its financial and operating activities by the expert, is called internal audit.

- While internal control is a system designed, implemented and maintained in an organization. Internal Audit is an audit function designed by those charged with governance, to keep a check on the activities of the firm.

- In internal control, work of one person is verified by another, whereas in the case of an internal audit, every single component of work is verified.

- In the internal control system, checking is performed simultaneously, while carrying out work. On the contrary, in internal audit system work is checked after it is performed.

- The basic objective of the internal control system is to ensure compliance with management policies. In contrast, internal audit aims at detection of fraud.

Conclusion

By and large, both internal control and internal audit are important for every organization, to assess the overall working. The scope of internal control is wider than that of internal audit, as the former includes the latter.

Hmaidreza Rahmani says

Thank you so much

Good article

Muhammed says

Thank you so much.

I am really appreciate the answer you provide here in this site.

I got clear and precise concepts.

Jide Dina says

Thanks for the writing on the topic, It was very knowledgeable and useful.

Ahmad G A Yar gwanda says

I really appreciate this briefing it helps a lot to brush my knowledge.. I got a very clear and precise knowledge. Thanks.