Buying and Selling are a part of daily routine. In fact, we indulge in a commercial transactions even without noticing it. In this context, invoice and receipt are the two business terminologies that we encounter very often. Do you know the issuance of both is on different events by the seller? A seller issues an invoice to the buyer when he delivers the goods on the customer’s order, but the amount is due for payment.

Buying and Selling are a part of daily routine. In fact, we indulge in a commercial transactions even without noticing it. In this context, invoice and receipt are the two business terminologies that we encounter very often. Do you know the issuance of both is on different events by the seller? A seller issues an invoice to the buyer when he delivers the goods on the customer’s order, but the amount is due for payment.

On the other hand, a seller issues a receipt when the customer pays off the amount due to him. Both invoice and receipt are non-negotiable commercial instruments which firms use during the course of a transaction. The difference between an invoice and a receipt lies in the purpose for which the document is issued.

As a businessman, you should always keep these documents for tax purposes. This is because they are needed at the time of filing a return and also at the time of tax audit.

Content: Invoice Vs Receipt

- Comparison Chart

- What is an Invoice?

- What is a Receipt?

- Key Differences

- Similarities

- Example

- Transactions without Invoice

- Conclusion

Comparison Chart

| Basis for Comparison | Invoice | Receipt |

|---|---|---|

| Meaning | An invoice is a commercial document that the seller issues to the customer to request payment. | A receipt is a document that the seller issues to the purchaser when he makes the final payment. |

| What is it? | Request for payment | Proof of payment |

| When it is sent? | Before the customer makes payment. | After the customer makes the payment. |

| Serves as | Statement of the amount owed by the buyer to the seller. | Evidence of purchase and amount received. |

| Indicates | Amount due | Amount paid |

What is an Invoice?

An invoice refers to a document that the seller issues to the customer when the goods are provided to the customer, and the payment is due. The issue can be either physical or electronic. So, we could say that it acts as a formal request for payment.

The seller sends it, along with the goods, at the time of delivery. The aim is to provide the details to the customer about the total amount due. Also, the customer can match the details of the goods listed in the invoice with the purchase order.

It acts as an acknowledgement to request for the payment of goods or services provided.

Invoices are very common among businessmen who sell goods in bulk, like suppliers, manufacturers and wholesalers. The instrument is delivered before the payment of the goods to state the amount due against the merchandise.

Reasons for Issuing Invoice

- Determine expectations about the forthcoming sale in a transparent manner.

- Account for the goods delivered or services rendered.

- Mentioning the terms and conditions of payment

- Estimating future revenues

Contents

- Seller’s name, logo and contact details

- Name of the buyer and contact details

- Business Registration Number

- Unique invoice number

- Invoice Date

- Payment Method (How the customer can pay?)

- Details of goods and services provided, like quantity, price and so on.

- Total amount due for payment, including taxes and fees.

- Signature of the seller

Also Read: Difference Between Proforma Invoice and Invoice

Format

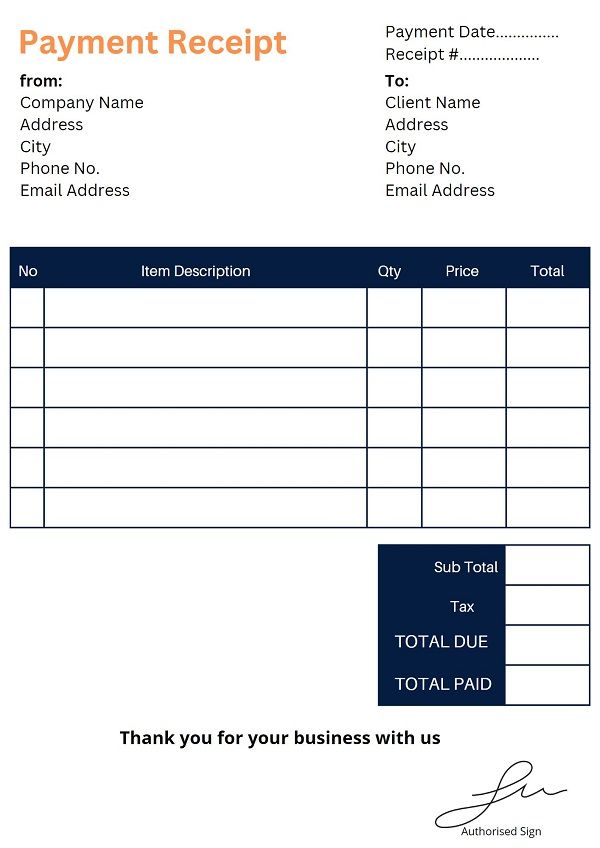

What is a Receipt?

A receipt is another document that a seller issues to its customer, either electronically or physically, when the customer has cleared all the bills due to him. In short, it is proof that payment is made by the customer to the seller for the goods and services listed on it.

In the case of cash sales, receipts are issued instantly. However, in the case of credit sales, receipts are issued on the payment of invoices generated in this regard.

A receipt is a commercial legal instrument used to state that some goods or services of value have been received. The receipt can help the customers to track payments for the stuff.

Use of Receipts

- Businesses often use receipts as a tool to track sales or even inventory.

- Validates the completion of the sale.

- If the customer wants to return or exchange the product, the receipt is necessary to check the details of the product.

Contents

- Seller’s name, logo and contact details

- Date of sale

- List of the items sold with their quantity and price

- Discounts or coupons, if any

- The total amount paid, including GST.

Also Read: Difference Between Voucher and Invoice

Format

Key Differences Between Invoice and Receipt

- Generally, a seller issues an invoice to the customer when he delivers the goods, but payment is due. But, a receipt is a confirmation document which states that the seller has received the amount due on account of the goods sold or services rendered to the customer.

- An invoice is a demand for payment. Conversely, a receipt is proof of the transaction.

- The invoice intimates to the client the total amount due for payment and the due date for payment. As against, the receipt highlights the actual amount paid by the customer, along with the date on which the amount is paid.

- The objective of issuing an invoice is to give the customer an overview of their order, the amount they owe and by which date they should make the payment. On the other hand, a receipt acts as legal evidence that the customer is discharged from all the liabilities, i.e. he has made payment to the seller.

- The invoice indicates the total amount due, whereas the receipt indicates the total sum paid along with the date on which payment is made.

- The purpose of an invoice is to seek payment. While the receipt is given to confirm the completion of the sale.

Similarities

- These are commercial documents.

- Both are a part of the purchase cycle.

- They contain details about the buyer and seller.

- Both are legally non-negotiable instruments.

Example

Suppose you are an event manager, and you have organized a function for your client in a five-star hotel. So, you want to get paid for that. Therefore, the document that you will use to seek payment from your customer is the invoice. It will list out all the costs related to material, labour and overheads. Also, it will show the GST rate and amount along with the total amount due from the client.

As soon as the customer pays for the invoice, it is your duty as a seller to send the receipt of payment to the client. It acts as proof of payment.

Just like an invoice, a receipt contains some of the details like the total amount paid, taxes and discounts and the date on which the amount is paid.

Transactions without Invoice

Do you know transactions can also occur with only a receipt and no invoice?

- Invoices are not required if the payment for goods and services is made upfront.

- In such a case, the buyer gets a receipt from the seller, but no invoice will be required.

Example:

- Buying goods from a departmental store or mall.

- Online shopping or bill payment

As you pay for the goods and services upfront, there is no need for an invoice.

Conclusion

Above all, the main difference lies between the two in the timing when they are issued. This means that the seller issues an invoice to the customer before the payment for the transaction. On the contrary, the seller issues the receipt to the customer after the payment for the transaction.

Tabuya Buzwani says

Thank you for the information!

Amit says

Wonderful… This was very useful…

Agostinho Freire says

Thanks for the information it ws very useful

Phyll Robson says

Thank you for this essential information.

Surbhi S says

Thanks all of you for sharing your views with us, it really means a lot.

Ade Jamie says

Thank for clarity of context…

Daira says

A very simple and explanatory description. Thank you!

Stefan says

Indeed clear, thank you!

Ghiazat says

Clear, concise and explanatory.

Mohammed Aleemuddin says

Very well differentiated, thanks for the information.

BESMAN says

EXPLICIT AND HELPFUL

Surbhi S says

Thank you all the readers, for sharing your views with us 🙂

Narmada says

Thank you very much for the information

Kanchanar says

Many thank for this clarification.

margarita says

Wow! What a great post. I love this post very much. It is very informative and useful.

Dawie says

RECORD KEEPING FOR A BUSINESS (COMPANY), SHOULD INVOICES FOR PRIVATE EXPENSES BE RETAINED FOR ANY PERIOD

iqbal khan says

Finally the concept is CLEAR!! Thanks Alot Habbibi 😉

Rapig says

It helped me with starting of my business very much.

My big thumb to the author! Thank you!!!

Rakesh says

As someone who is a beginner in entrepreneurship this article really cleared the difference between the two. Thanks 🙂

Ron A says

Excellent information! very well done.