In business, the recording of transactions takes place only when there is some documentary evidence present. They confirm the transaction. These can be in the form of receipt, counterfoil, cash memo, pay-in-slips, and invoice. These evidences are nothing but a source document. These documents act as a base to prepare vouchers. Based on these vouchers, the accountant passes entries in the books of accounts.

In business, the recording of transactions takes place only when there is some documentary evidence present. They confirm the transaction. These can be in the form of receipt, counterfoil, cash memo, pay-in-slips, and invoice. These evidences are nothing but a source document. These documents act as a base to prepare vouchers. Based on these vouchers, the accountant passes entries in the books of accounts.

Coming to invoice, whenever any credit sale transaction takes place, the firm prepares a source document. So, the source document which the supplier prepares is an invoice. This invoice is then sent to the purchaser of goods who calls it a ‘bill’. Therefore, an invoice or bill is one and the same thing.

In this written material, we are going to explore the differences between voucher and invoice.

Content: Voucher Vs Invoice

Comparison Chart

| Basis for Comparison | Voucher | Invoice |

|---|---|---|

| Meaning | Vouchers are a detailed statement in writing which forms the basis for passing accounting entries | An invoice is a non-negotiable instrument that the seller prepares at the time of credit sale and sends it to the customer. |

| What is it? | Documentary evidence | Type of source document |

| Use | They support entry shown in the books of accounts. | Used to prepare vouchers. |

| Preparation sequence | Second | First |

| Contains | Complete details of the transactions | Focuses on which account to be debited and credited. |

What is Voucher?

A voucher refers to a written document, that acts as evidence for the transaction carried out. These contain a serial number and are in printed/digital form. They are prepared in different colours, for distinguishing them from one another. On the generation of invoice, or receipt of the bill, the entries are first made in vouchers. After that, on the basis of these vouchers recording in journal or subsidiary books is performed.

Also, they substantiate the accuracy of the entries in account books. These vouchers are very beneficial for auditing purposes. This is because the company keeps proper records of all the transactions. This document indicates that:

- Goods purchased

- Services rendered

- Payment authorized

- Ledger accounts in which transactions are entered

Nature of Vouchers

- Receipt Vouchers: When there is some cash inflow, to the business concerning the transaction, then the firm prepares a receipt voucher.

- Payment Vouchers: When there is some cash outflow from the business with regard to the transaction, then the firm prepares payment vouchers.

- Contra Vouchers: When the transaction affects the debit and credit of the main account, leading to zero effect on the account. Then contra vouchers are prepared. Take this for an example: Cash deposited in the bank. It involves both the cash and bank accounts of the firm.

- Adjustment Vouchers: Transactions against which there is no cash movement need preparation of adjustment vouchers.

Also Read: Difference Between Purchase Order and Invoice

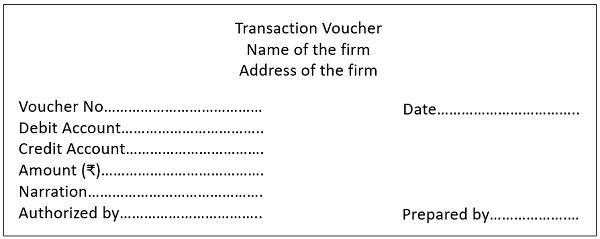

Format of Voucher

What is an Invoice?

An invoice is a written document that contains details of the sale transaction. Preparation of invoice takes place when the supplier sells goods on credit.

The seller prepares an invoice and sends it to the purchaser who calls it a bill for purchases. So, these two words are opposite sides of the same coin and one should not get confused between the two.

Further, at the time of sale of goods and services, the invoice generated by the seller becomes trade receivable for the seller.

On the contrary, the bill received by the purchaser becomes trade payable for the purchaser.

Copies of Invoice

Three copies of the invoice are prepared. These are:

- First copy which is the original copy is sent to the customer by post,

- Second copy is kept on the packet of the consignment or container of goods.

- Third copy is retained by the seller for future reference purposes. And it is also used for recording credit sales.

Contents of Invoice

It carries full details concerning:

- Consecutive Serial Number

- Name, address, and GSTIN of the supplier

- Name, address, and GSTIN of the recipient

- Date of its issue

- Delivery address

- Description of goods

- Total value of supply of goods or services

- Discount

- Rate of tax

- Amount of tax charged

- Digital signature or signature of the supplier

Also Read: Difference Between Tax Invoice and Retail Invoice

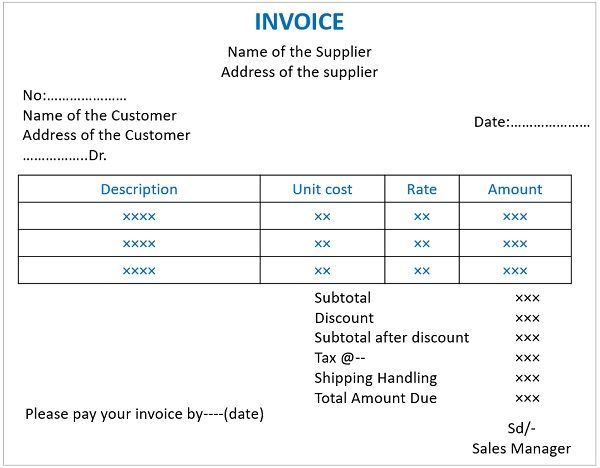

Format of Invoice

Key Differences Between Voucher and Invoice

The pointers stated hereunder explain the difference between voucher and invoice:

- A voucher is a written document on the basis of which the company maintains accounting records. In contrast, an invoice is termed as a written commercial document issued to a buyer by the seller. It states the transaction details of the sale of goods or services.

- An invoice is generated at the time of sale. But, the preparation of voucher takes place after matching with three documents. These documents are purchase order, invoice and receiving report. After matching with the above three documents the voucher is attached to them. Issue of voucher implies that the invoice has been verified. And it confirms payment of invoice to be made by the firm. So, we can say that the voucher is dependent on the invoice.

- Vouchers are documentary evidence supporting entries displayed in the books of accounts. As against, invoices form the base for preparing vouchers.

- Vouchers contain details of:

- Total quantities

- Total amount of the goods purchased

- Ledger account in which entry is made.

As opposed, an invoice includes details of the goods purchased from a particular company.

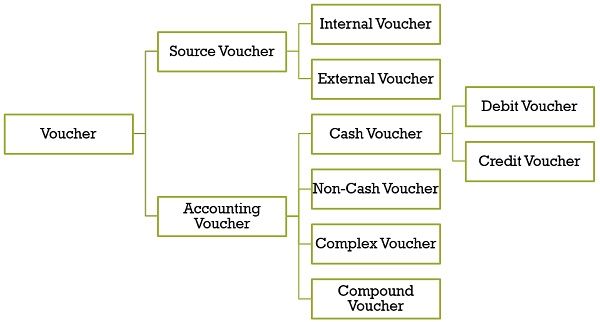

Types of Voucher

Source Voucher

Whenever the transaction occurs, it is recorded using source documents/vouchers. These are cash memos, invoices or bills, debit notes and credit notes. There can be two circumstances:

Either a third party prepares the source vouchers. Or organization prepares it but their validation is done by independent sources. These are also called supporting vouchers. It is classified into:

- Internal Voucher: The voucher which the company prepares but a third party like a bank authenticates is an internal voucher.

- External Voucher: These are the vouchers which the third parties prepare and send to the company in the form of bills, cash memos, and invoices.

Accounting Voucher

These vouchers determine the posting of transactions, i.e. on the debit or credit side of the account. It is the analysis of the source voucher. They are also called secondary vouchers. An accountant is responsible for preparing it. Also, it carries the signature of the authorized signatory. These are subdivided into:

- Cash Voucher: Those vouchers that the firm uses to enter cash transactions. It also records those transactions for which cheques are received or issued with respect to receipt or payment. These are further divided into:

- Debit (payment) Vouchers: Preparation of transaction for the settlement of payment is a debit voucher. In this regard cash payments are made in connection of:

- Payment of expenses like rent, salaries, etc.

- Purchase of fixed assets and investments

- Payment to creditors

- Purchase of goods

- Deposit into bank

- Drawings

- Credit (receipt) Vouchers: On the receipt of cash, preparation of credit vouchers takes place. Receipt of cash takes place in instances of:

- Sale of goods

- Sale of fixed assets and investments

- Collection from debtors

- Receipt of rent, interest, or any other income

- Borrowing from the bank

- Bank withdrawal

- Debit (payment) Vouchers: Preparation of transaction for the settlement of payment is a debit voucher. In this regard cash payments are made in connection of:

- Non-Cash Voucher: Another name for such vouchers is a transfer voucher. If there is no involvement of cash in a transaction, then the firm prepares them. This may include:

- Credit sales or purchase of goods

- Credit sale or purchase of fixed assets and investments

- Return of goods sold or purchased on credit

- Provision for depreciation

- Writing off bad debts

- Complex Voucher: Another term for such vouchers are journal vouchers. The firm prepares these vouchers when transactions with multiple debits and credits take place.

- Compound Vouchers: The vouchers that keep a record of multiple debits and one credit or multiple credits and one debit are compound vouchers.

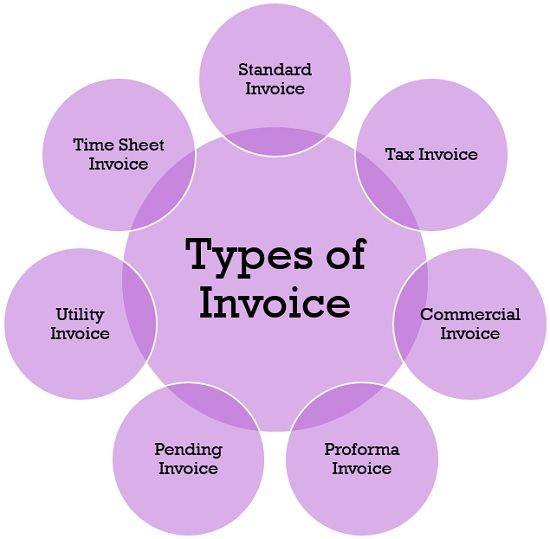

Types of Invoice

- Standard Invoice

To request payment from the recipient of the goods or services, a supplier uses standard invoice. - Tax Invoice

All registered person issues this invoice except:- Supplier of exempted goods or services and

- Composite dealer

- Commercial Invoice

Another name of this invoice is a business invoice. It is an export document acting as legal proof of sale amidst buyer and seller. The firm uses this invoice for commercial purposes, as regards customs. It also helps in ascertaining the amount of tax and duties payable. - Proforma Invoice

It is a pre-shipment document. The supplier prepares and issues to the recipient of the goods to be supplied. The supplier uses it to send the estimation quote of goods or services to the purchaser.

Also Read: Difference Between Proforma Invoice and Invoice - Pending Invoice

A pending invoice is used for clearance of the due bill. The seller sends it to the customer when the amount is due for payment and the buyer makes only part payment. - Utility Invoice

Bill that the customer receives for using gas, electricity, internet, TV, etc. every month is a utility invoice. - Time Sheet Invoice

When the consultants, businesses, or professionals request payment from their clients for the service rendered, they use this invoice.

Conclusion

Think of a situation when there is no documentary evidence. In the absence of the invoice and vouchers, there won’t be any record of the transactions that took place. So, these evidences form a sound and systematic foundation for maintaining accounting records. Hence, they should be carefully prepared and maintained.

Charles Dick says

Good

Ganesh says

Very useful information.

ridha says

Thanks for the article