Invoices are an important instrument used in day to day operations of the business which acts as an evidence of the transaction. In general, there are two types of invoices – tax and retail. Tax invoice may be understood as the invoice issued by one registered vendor to another, during sales. Conversely, a retail invoice also known as sale invoice is issued, the sale is made to the final consumer.

Invoices are an important instrument used in day to day operations of the business which acts as an evidence of the transaction. In general, there are two types of invoices – tax and retail. Tax invoice may be understood as the invoice issued by one registered vendor to another, during sales. Conversely, a retail invoice also known as sale invoice is issued, the sale is made to the final consumer.

The main purpose of issuing tax invoice is to avail input tax credit. On the other hand, the retail invoice is issued with an aim of requesting the customer to make payment for the goods delivered or services provided to him/her. While working on invoices of different kinds, one must know the difference between tax invoice and retail invoice.

Content: Tax Invoice Vs Retail Invoice

Comparison Chart

| Basis for Comparison | Tax Invoice | Retail Invoice |

|---|---|---|

| Meaning | A tax invoice is an invoice issued by a registered dealer to the purchaser, showing the amount of tax payable. | A retail invoice is an invoice issued by the seller to the buyer for the amount due against the goods sold to him. |

| Objective | Availing an input tax credit | Request for Payment |

| Issued when | Goods are sold with the purpose of resale. | Goods are sold to the ultimate consumer. |

| Tax Identification Number of purchaser | Yes | No |

| Prepared in | Triplicate | Duplicate |

Definition of Tax Invoice

A legal document issued by a registered dealer (seller) in the event of a sale, to another registered dealer (purchaser), who is not the consumer, is known as a tax invoice. The invoice should be created in triplicate i.e. original for the buyer, and the seller retains the rest two.

Tax invoice plays a significant role in any country’s tax system as the dealer’s issue invoices, for recognizing a transaction. At the end of the financial year, they had to submit the details of these invoices to the relevant tax authorities. So, this is an important tool used by the government to avoid tax evasion.

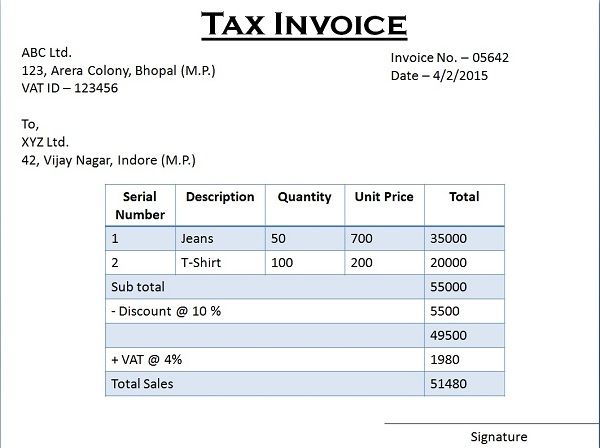

A typical tax invoice looks like the image given above. The tax invoice may consist of the following details:

- Invoice Number

- Date of issue of the invoice.

- Name and address of the seller

- Name and Address of the buyer

- Tax Identification Number (TIN)

- Quantity

- Unit Price

- Total Amount

- Tax Charged

- Signature of authorized signatory

Definition of Retail Invoice

A commercial instrument issued by the seller to the purchaser i.e. end user of the goods is known as Retail Invoice. The invoice is created in duplicate, i.e. original for the buyer and a copy for the seller. It is used to request for payment from the purchaser. The retail invoice can also be issued on account of interstate sales or sale to an unregistered dealer.

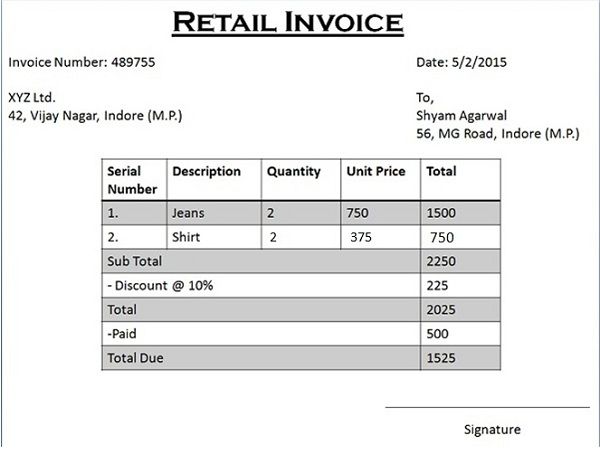

A typical retail invoice may look like the image given above. You can find the following details on the retail invoice:

- Invoice Number

- Date of issue of invoice

- Details of buyer

- Details of seller

- Quantity

- Unit Price

- Total Amount

- Discount (if any)

- Signature of seller or his authorized agent

Key Differences Between Tax Invoice and Retail Invoice

The difference between tax invoice and retail invoice is given as follows:

- Tax invoice implies an invoice prepared and issued by the registered dealer to the purchaser to show the amount of tax payable. As against this, the retail invoice is an invoice prepared and issued by the seller to the buyer showing the amount due to him against the goods sold.

- When goods are sold with the purpose of “resale” – tax invoice is issued, whereas when the goods are sold to the final consumer retail invoice is issued.

- Tax invoice is capable of availing input tax credit (credit on inputs, i.e. tax already paid at the time of purchase) as opposed to the retail invoice which is simply the request for payment.

- Tax invoice contains tax identification number of both purchaser and seller, but retail invoice contains the tax identification number of the seller only.

- Tax invoice is prepared in triplicate, wherein the original and duplicate copies remain with the purchaser and seller takes the third copy. On the contrary, the retail invoice is prepared in duplicate.

Similarities

- Non-Negotiable Instruments

- Shows Amount Payable

- Description of buyer and seller

Conclusion

So, the above-mentioned points explain the differences between tax invoice and retail (sale) invoice, in a lucid way. It is the duty of every registered dealer to issue tax invoices at the time of sales. Here Registered dealer means the dealer who is registered under any tax ‘Act’ while if the dealer is not registered then, the retail invoice is issued to/by him.

NOLASCO GOMES says

can the buyer avail tax benefit on the retail invoice in Maharashtra

Surbhi S says

No, tax benefit is not available to the retail customers because it is issued at the time of sale to final consumer and not for the purpose of resale.

Pradeep Kadam says

thanks

KD Singh says

What will happen if seller issue TAX invoice for the state in which he is not register for VAT.

Surbhi S says

If seller is not registered, then the buyer will not be able to avail VAT credit.

Pranesh Debnath says

Really this note is good for new learners. Because it is quite simple to understand.

partha pratim goswami says

After reading this article I know the difference between tax invoice and retail invoice. Thanks..

Aakash Kuliyal says

Nice explanation Mam….I will recommend my students to read this post.

Hemant Agarwal says

Very well explained in the simplest way possible. I will read your articles regularly now and even click on ads to help you

Surbhi S says

Thanks for your appreciation and support.. Your views are valuable to us.. 🙂

Mikail Ansari says

Good information.

satbir says

thanks for explanation in details

Sehzad says

Whether commercial and retail invoice is one and the same?

Quickbooks Enterprise says

this is really amazing to know about. I am looking to get more in details about it.

Lê Văn Sơn says

Useful knowledge, thank you very much.