Accounting is the art of keeping the record of business events and transactions in a systematic manner. It helps in determining the financial position and profitability of the company at the end of the financial year. It is not exactly the same as finance. Technically, finance is a part of economics that is concerned with resource allocation and management of funds. While accounting is a sub-domain of finance.

Accounting is the art of keeping the record of business events and transactions in a systematic manner. It helps in determining the financial position and profitability of the company at the end of the financial year. It is not exactly the same as finance. Technically, finance is a part of economics that is concerned with resource allocation and management of funds. While accounting is a sub-domain of finance.

The two differ in the sense that accounting is all about recording the flow of money in and out of the business. While finance is related to how an individual or a firm manages its assets and liabilities.

This post presents all the differences between accounting and finance. Along with that, you will also get to learn the basics of the two subjects.

Content: Accounting Vs Finance

Comparison Chart

| Basis for Comparison | Accounting | Finance |

|---|---|---|

| Meaning | Accounting is a methodical record-keeping of transactions of business. | Finance is the study of the management of funds in the best possible manner. |

| Part of | Finance | Economics |

| Focuses on | Past | Future |

| Concerned with | Ensuring that all the financial transactions are recorded in the financial system with accuracy. | Understanding financial data of the enterprise keeping in mind the growth and strategy. |

| Thinking Process | Rules-Based | Analysis Based |

| Financial Statements | It is prepared. | It is analyzed. |

| Drive | Tax Driven | Plan Driven |

| Career | Accounting professionals can become accountants, auditors, tax consultants, etc. | Finance professionals can become investment bankers, financial analysts, finance consultants, etc. |

What is Accounting?

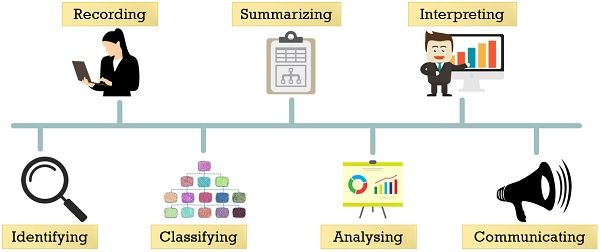

Accounting refers to a process with a series of steps related to keeping a track of business activities of financial nature. After that, presenting the same to its users. In this, we keep a date-wise record of the financial transactions. After that. we classify, summarize, analyse and interpret them. And then, the results of these financial transactions are communicated to users.

As language acts as a means of communication. Accounting being the business language that communicates financial information to its users. Hence, the basic objective of accounting is to determine profit or loss, for a particular period. This enables users to know the financial condition of the firm on the specified date.

How does accounting generate financial information?

- Identifying: Ascertaining what transactions to record. This includes observation and selection of such events which are financial in nature.

- Recording: Entering financial transactions in a systematic manner, as and when they occur. And to do so, we use Journal or subsidiary books.

- Classifying: After the recording of data, the transactions of similar nature or type are grouped together. For this purpose, the firm opens various accounts in a ledger which is a secondary book. Thereafter, the posting of transactions in those accounts takes place.

- Summarizing: It involves the preparation and presentation of the classified data. The classification takes place in a manner that is useful to the users. In this step, the firm prepares financial statements.

- Analysing: Analysis is the systematic classification of data provided in the financial statements. Unless the figures stated in the financial statements are presented in a simplified manner, they won’t mean anything.

- Interpreting: It involves explaining the meaning and importance of relationships created through data analysis. Therefore, analysis and interpretation of the financial statement help the users to make a rational judgement.

- Communicating: Preparation, presentation and communication of accounting information is in the form of accounting reports. These reports are submitted to the management and users. The users of the financial statement include all the stakeholders:

- Creditors

- Debtors

- Lenders

- Suppliers

- Investors

- Shareholders

- Employees

Also Read: Difference Between Bookkeeping and Accounting

Accounting Process

It is a seven-step process:

- Identification of Transaction

- Preparation of Documents

- Recording in Journal

- Ledger Posting

- Preparing Trial Balance

- Passing Adjusting Entries

- Preparation of final accounts, i.e. Income Statement, Balance Sheet and Cash Flow Statement

Objectives of Accounting

Accounting aims to:

- Systematically record all the monetary transactions

- Determine the outcome of the recorded transaction

- Determine the financial position of business

- Provide information to the users for making sound judgement

- Know the company’s solvency status

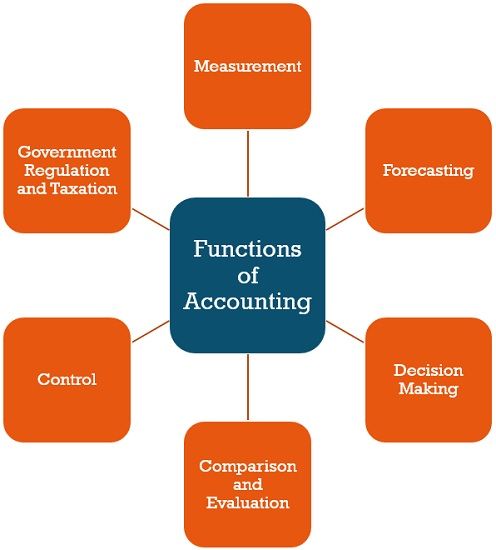

Functions of Accounting

- Measurement: It measures the performance of the enterprise in the past. Also, it discloses its financial position in the current scenario.

- Forecasting: With the help of past information one can forecast future performance and trends.

- Decision Making: For sound and rational decision making, accounting provides useful data to all the users.

- Comparison & Evaluation: Using the accounting information, one can compare past and present performance. Also, it helps in the evaluation of the financial results.

- Control: It plays a crucial role in identifying the loopholes in the operational system. In addition, it gives feedback about the effectiveness of the steps implemented to curb those loopholes.

- Government Regulation and Taxation: As we all know that for some entities maintenance of books of accounts is mandatory. This is because it helps the government in exercising control. Besides, it helps in the collection of taxes and auditing as well.

Also Read: Difference Between Accounting and Accountancy

What is Finance?

In the layman language, finance is all about money management, in a way that it is available at the time when it is required. From the enterprise point of view, finance indicates all the economic resources, which a company uses and mobilizes so as to grow it over time.

Also, it is a process of arranging funds for any kind of expenditure and spending money. It involves the allocation of funds in such a way that it can reap the highest return over time. It is not just about managing funds but also multiplying them to the best in interest. For this purpose, all the risks and uncertainties are taken into account.

Types of Finance

- Personal Finance: It is the activity of managing the finances of an individual. Also, it involves assisting the individual in achieving the desired financial goals.

- Corporate Finance: It is related to funding the expenses of the enterprise and developing a capital structure for the company. It includes sourcing and application of funds in a manner that increases the value of the firm in long term.

- Public Finance: This branch is concerned with government revenue, expenditure, debt and its impact on the whole economy. It is how the central, state and local government of the country manages its revenue and expenses to provide public utility services.

Organization of Finance Function

It refers to the division of finance functions and establishing an efficient organization. The organization of finance function varies from one firm to another. This is due to the difference in the size and nature of the organization, and type of financing operations.

The company’s CFO, i.e. Chief Financial Officer is not just responsible for the management of day to day finances. Rather, he/she is also responsible for drafting policies and decision making. In a large organization, the CFO divides the finance functions into two separate functions. These are management of finance and management of financial control.

Treasurer

The responsibility of the treasurer is to look after the procurement and application of funds. In addition, he performs the following functions:

- Cash Management: It involves the management of cash receipts and disbursements to/from the business. It also involves procuring finance from different sources and timely payment of business obligations.

- Credit Management: It involves the ascertainment of the credibility of customers and making arrangements for the timely collection of credit sales.

- Asset Management: This is all about the arrangement for procurement, disposal, and insurance of assets.

- Securities Management: It is related to the investment of surplus funds of the business into various securities.

- Banking Relations: Maintenance of banking relations like operating the company’s current account.

Controller

The controller has to manage the funds and look after accounting for the same. Besides, he performs the given functions:

- Planning & Budgeting: It involves financial planning, budgeting, sales forecasting, inventory control and so forth.

- Financial Accounting: It is that system of accounting that involves recording and reporting monetary transactions.

- Cost Accounting: Setting up of cost accounting system to determine the cost of production.

- Data Processing: It is all about data collection and data analysis.

- Internal Auditing: This function is related to internal audit and internal control of the firm

- Annual Reports: Preparation of annual reports and all other reports which the firm’s top management requires for sound decision making.

Also Read: Difference Between Public finance and Private finance

Key Differences Between Accounting and Finance

As we have discussed the meaning of the two. Now we will go through the difference between accounting and finance in detail:

- Accounting is the art of systematically recording transactions. This helps in keeping a proper track of financial statements on the basis of Accounting Standard (AS). But, finance is all about the study, creation and management of money, credit and investment. It involves activities like lending, borrowing, investing, saving, budgeting and forecasting.

- Accounting is a subset of Finance. Whereas finance is a part of Economics.

- Finance is a future-oriented activity that uses past data provided by accounting to make rational decisions and plan for the future.

- The accounting information is helpful for the users of the financial statement for understanding the financial position of the business. As against, finance is useful in forecasting the performance of the entity in the future.

- Accounting is done to ensure that all the financial transactions are recorded in the books of accounts with accuracy. In contrast, finance is all about understanding the financial data of the firm while keeping in mind the growth of funds over time.

- Accounting is performed on the basis of rules. That is to say, there are principles, concepts and conventions which must be followed. On the contrary, finance is analysis based. This means that before making any financial decision, analysis of various aspects of business is required. This helps in reaping maximum benefits.

- In accounting, we prepare the financial statement. But when we analyse financial statements, that is finance.

- Practically, accounting is tax-driven. But financing is plan-driven.

Relationship

As accounting is a part of finance, it is obvious that finance is a broader concept. Finance makes use of the accounting data, like income statements, cash flow statements and balance sheets to make a sound financial decision. That is to say, it helps in allocating the funds of business in such a manner that will reap the best out of them.

Conclusion

Therefore, in finance, we combine accounting data and business intelligence. Accounting is related to the recording and reporting monetary transactions. However, finance is all about taking decisions relating to buying/selling assets, investing, making a budget and so forth.

Francis says

very good piece of information. can i get more materials on finance i want to study at my masters level this year

Surbhi S says

Yes, you can find a good collection of financial terms on this site.

Factor Loads Factoring says

Great article!This article really provide great information on how accounting and finance is different from each other. Thanks for sharing this article.

Nova Cash Flow Finance says

I believe that it is very important to know the difference of accounting from finance. I believe that reading article like this can open up our mind about it. Thanks for sharing this article. This is very interesting and knowledgeable.

HIMABINDU RAVELLA says

good explanation

Thembi Ramothibe says

Best information, clear to understand as we always tend to say accounting and finance is one and the same when we recruit financial officers.

Debtor Finance says

Thanks for sharing the comparison of finance and accounting. I believe that it is necessary to know the difference of accounting and finance especially if you are in the finance or business industry.

Zin Mon Htwe says

This is best information for everyone who want to know the difference between Accounting and Finance.It”s so clear and easy to understand. I love it and thanks for your information.

Gopal Chandra Basak says

Gopal Basak says

November 29, 2020 at 5:30 pm

This is best information for everyone who want to know the difference between Accounting and Finance. It”s so clear and easy to understand. Thanks for your information.

Kenneth Hox says

Everyone needs to understand this basic difference between accounting and financing. Thanks for posting this valuable information.

Shaun Pant says

Understanding the difference between accounting and financing seems basic but it is very crucial. Thanks for the article. It is quite valuable information.

Marvellous Bisola says

I really love this article and I won’t lie when i say I’m greatly helped. Salute to the writer of this!🙌

Jaya Chaudhary says

It is an informative article. It is essential to know the difference between accounting and finance. It is suitable for those who are just getting into accounting and finance.

kaushik patel says

Thanks for Sharing Such Beautiful Information with Us. I hope You Will Share Same More Information about Accounting. Please Keep Sharing Your Brilliant idea !

Bhargey Patel says

Thanks for this awesome post. nice information about the Difference Between Accounting and Finance. I learned something amazing.

DS Accountants And Advisors says

It is an enlightening article. It is critical to recognize the distinction between accounting and finance. It is appropriate for people who are simply entering into accounting and finance.

Vishal says

Best information

Vinu says

I feel very grateful that I read this. It is very helpful and very informative and I really learned a lot from it. I can also refer you to one of Finance and Insurance analytics service in Hyderabad.

Anna Cooper says

Very informative. Great article!

Ana says

Thank you for all of your help.

Solomon Arshad says

More than enough facts related to Accounting and Finance in short detail.

Nice.

Miherete Tibebe says

WOW!