The Cash Flow Statement shows the changes in the cash position (Inflows and outflows) of a firm. It is an analytical reconciliation statement that explains the reasons for the differences between the opening and closing cash balances over a period. On the other hand, the Fund Flow Statement is a statement that shows the ups and downs of the financial position or the changes in working capital of the entity between the two financial years.

The Cash Flow Statement shows the changes in the cash position (Inflows and outflows) of a firm. It is an analytical reconciliation statement that explains the reasons for the differences between the opening and closing cash balances over a period. On the other hand, the Fund Flow Statement is a statement that shows the ups and downs of the financial position or the changes in working capital of the entity between the two financial years.

While a cash flow statement is concerned with the flow of actual or notional cash, a fund flow statement deals with cash as well as all the other items that constitute working capital. In this way, Cash Flow Analysis help in determining the cash-generating efficiency of the entity. Conversely, Fund Flow Analysis helps in ascertaining the firm’s efficiency in utilizing the working capital.

In this section, we will discuss the difference between cash flow statement and fund statement, using their format and examples.

Content: Cash Flow Vs Fund Flow Statement

- Comparison Chart

- What is Cash Flow Statement?

- What is Fund Flow Statement?

- Key Differences

- Video

- Example

- Points to Remember

- Conclusion

Comparison Chart

| Basis for Comparison | Cash Flow Statement | Fund Flow Statement |

|---|---|---|

| Meaning | Cash Flow Statement is the summarized statement of cash receipts and cash payments of the firm between two financial periods. | Fund Flow Statement is a financial tool, designed to analyse the changes in financial position of the firm, comparing two financial years. |

| Basis of Accounting | Cash Basis of Accounting | Accrual Basis of Accounting |

| Discloses | Inflows and Outflows of Cash | Sources and applications of funds |

| Tool for | Short term financial analysis | Long term financial analysis |

| Objective | To explain the cash movement amidst two points of time. | To explain the causes of changes in the balance sheet items, i.e. asset and liabilities between two financial year. |

| Opening Balance | Opening balance is present | No opening balance |

| Difference in sides | Indicates the closing balance of cash | Indicates the increase or decrease in working capital |

| Part of Financial Statement | Yes | No |

What is Cash Flow Statement?

A Cash Flow Statement implies the statement containing cash inflows and outflows of an enterprise during a particular period of time. To prepare a cash flow statement, a financial statement of two different financial years is required.

Understanding Cash Flow

The term ‘cash flow’ is a combination of two words ‘cash’ and ‘flow’ wherein the words cash refers to the cash balance in hand and at the bank, whereas flow implies the movement of cash in and out of the organization, which can be increased or decrease. It deals with those items which involve cash transactions. Thus, it indicates the changes in the cash status of the company, be it related to receipts, payment, or disbursement.

The cash flow statement reports the Net Cash Flow. Net Cash Flow is the difference between cash inflow and cash outflow, from each activity of the business concern. When there is a change in cash position resulting in an increase in cash, it is called inflow of cash, whereas when there is a change in cash position leading to a decrease in cash position, is called outflow of cash. It involves the reconciliation of opening and closing cash balances.

The economic decision-making by the investors is based on the analysis of the company’s ability to generate cash and cash equivalents, as well as the timing and certainty of generation.

Elements of Cash

As per Accounting Standard – 3:

- Cash: Cash in hand and demand deposits with the bank. Example: Cash in hand and cash at bank

- Cash equivalent: Short-term highly liquid investments readily convertible into cash. Securities with a short maturity period, usually less than or equal to three months from the date of acquisition. Example: Treasury Bills, Commercial Papers, Commercial Bills, Certificate of Deposit, Call Money, etc.

Classification of Cash Flow Activities

- Operating Activities: Operating Activities are the primary revenue-earning activities of the company. It indicates the degree to which a company’s regular business operations have generated enough cash flows in order to maintain operating efficiency, pay dividends to shareholders, repay loans, invest in acquiring assets, etc.

- Investing Activities: Such activities involve the acquisition and sale of long-term assets and other investments, which are not covered in cash equivalents. It indicates the extent to which the company has spent money in acquiring resources that are intended to generate income and cash flows in the future.

- Financing Activities: Activities that cause the size and composition of the owner’s capital and borrowings of the company to change are financing activities. This ascertains the claims of shareholders on future cash flows of the company.

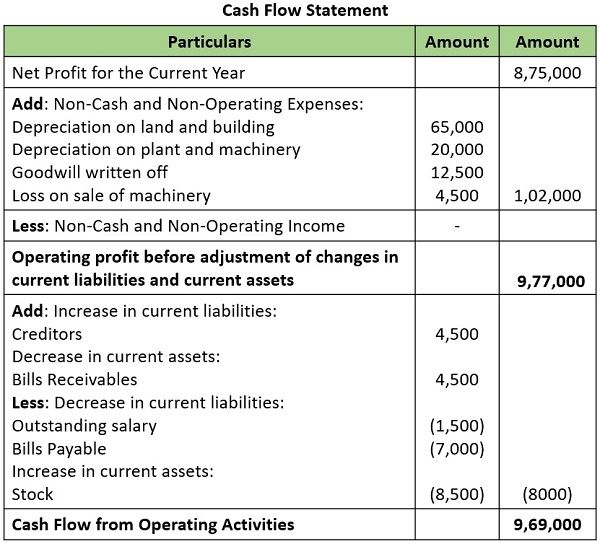

Calculation of Cash from Operating Activities

There are two methods for calculating cash from operating activities:

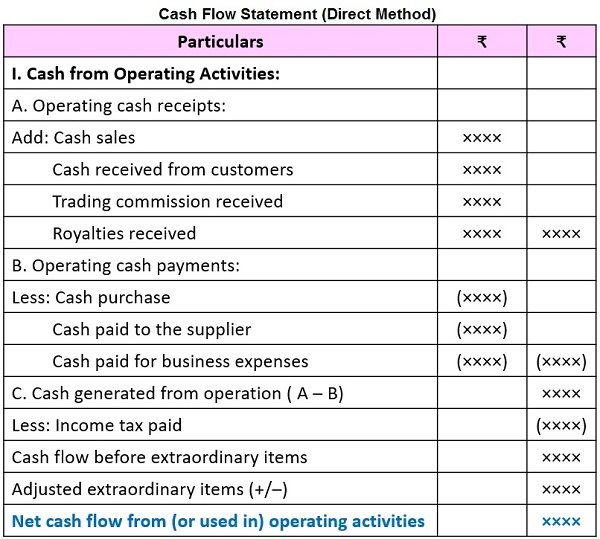

- Direct Method: In this method, gross cash receipts and gross cash payments are taken into consideration, which is available through accounting records.

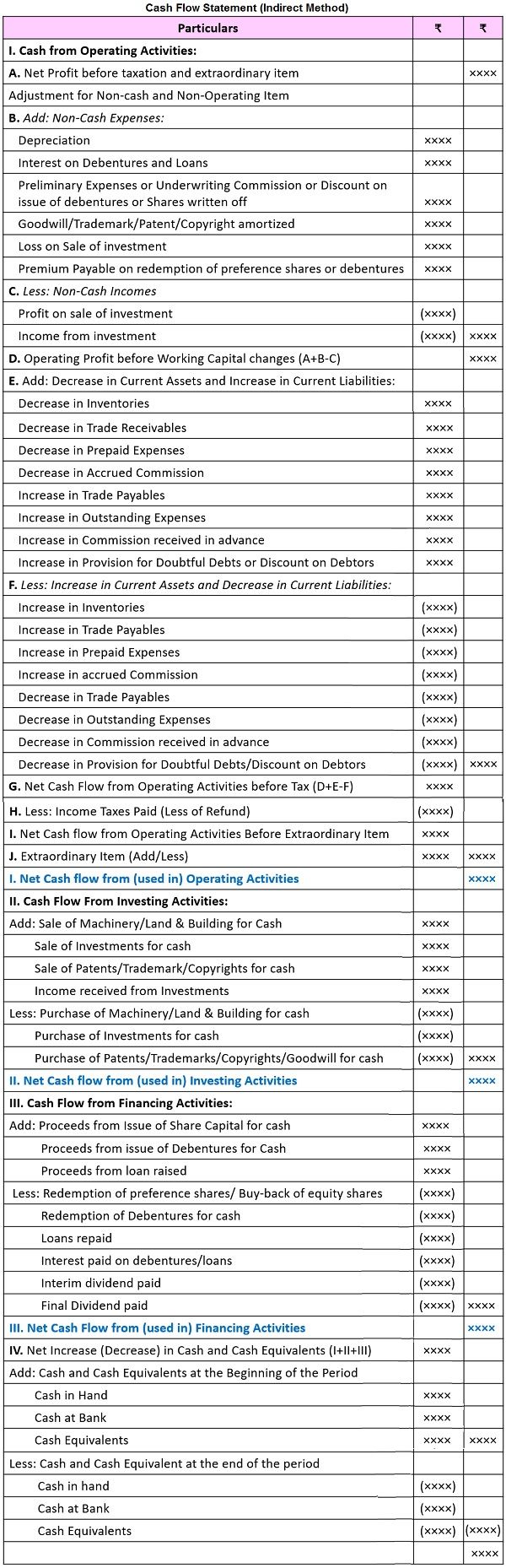

- Indirect Method: In this method, operating activities are ascertained by making a number of necessary adjustments in the net profit or loss, as shown by the profit and loss account.

Format of Cash Flow Statement

Note: It is to be noted that the format of Cash from Investing Activities and Cash from Financing Activities will remain the same, as in the case of the indirect method.

Also Read: Difference Between Income Statement and Cash Flow Statement

What is Fund Flow Statement?

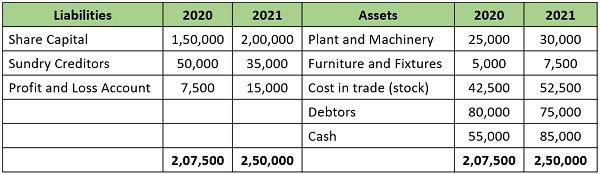

Fund Flow Statement refers to a statement depicting the means by which the business gets funds and the uses of the funds, between two balance sheet dates. It is devised to assess the changes in the financial position of the firm between two different balance sheet dates. It is a record of the movement of financial assets in and out of the enterprise, for a particular time.

The basis of inclusion or non-inclusion of a financial event in the fund flow statement depends on the flow of funds. Here the term ‘flow of funds‘ refers to the changes in the company’s working capital during the cycle of business operations. In short, it is the movement indicating the change in the company’s economic resources, i.e. from a particular asset or liability to another.

To prepare fund flow statements basic financial statements i.e. balance sheets and income statements are used. Now, we will look at some important points:

- Facilitates understanding of the changes in the structure of assets, liabilities, and capital.

- Reconciles the sources of funds with the application of funds.

- Indicates the total funds generated by the firm internally, as well as the total funds raised from outside sources and their application during the year.

- Helpful to the management in the formulation of different financial policies like bonuses and dividends.

What is Fund?

Fund implies the sum of money used for financing the company’s regular operations and procuring assets for the business.

Also Read: Difference Between Cash and Fund

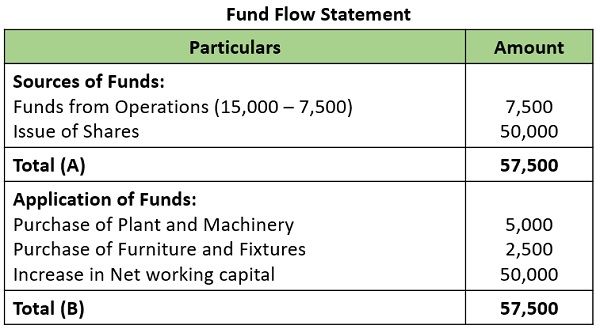

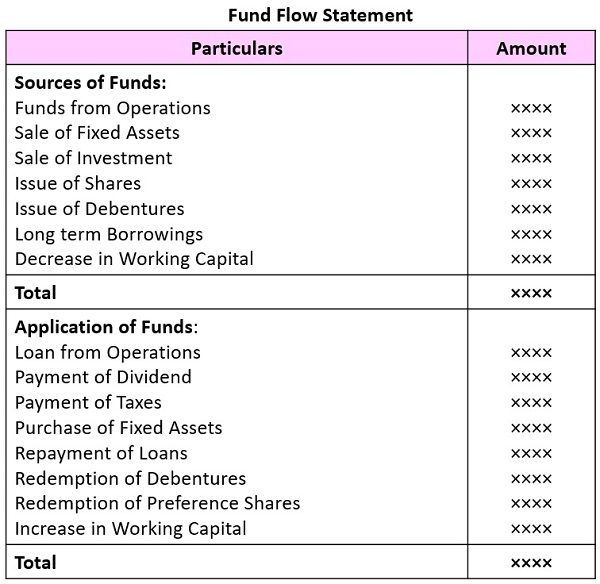

Format of Fund Flow Statement

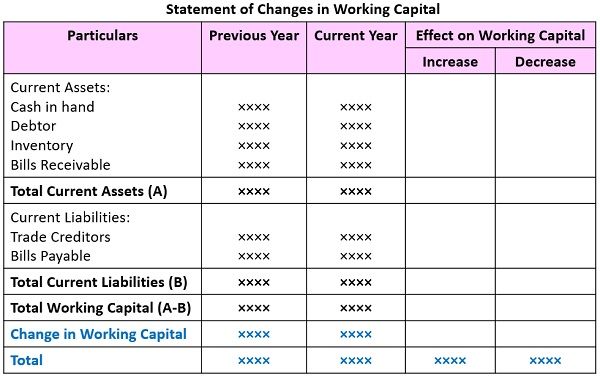

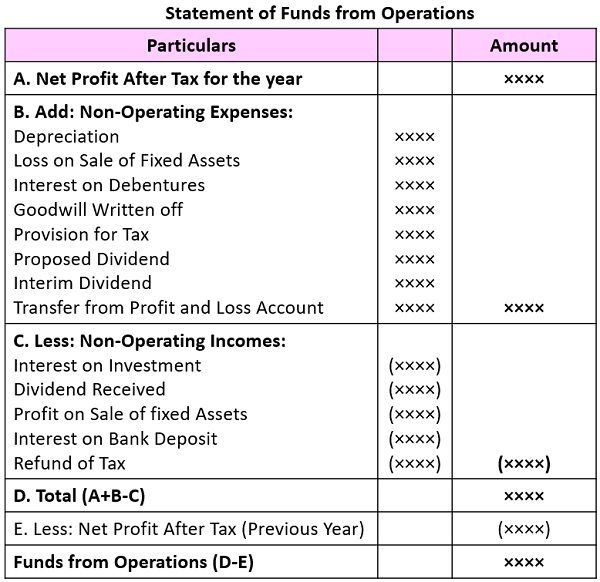

So, there are two things we need to calculate first prior to the preparation of a fund flow statement – Changes in working capital and funds from operation.

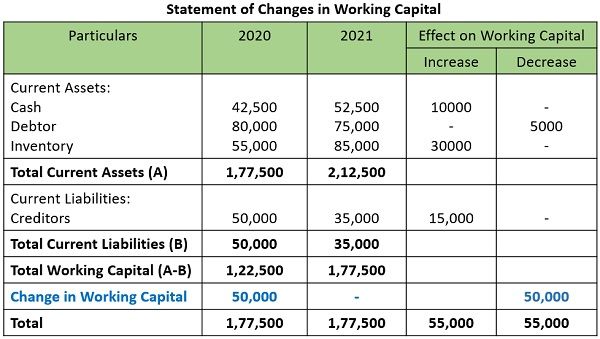

Format of Statement of Changes in Working Capital

Format of Funds from Operation

Key Differences Between Cash Flow Statement and Flow Flow Statement

The difference between cash flow statement and fund flow statement is given in the points that follow:

- Cash Flow Statement is a statement prepared using historical data, indicating the flow of cash in and out of the firm. On the other hand, a fund flow statement is a statement that represents the analytical details relating to various sources of a fund and their application in an accounting cycle.

- Cash Flow Statement is related to the change in the position of cash in the business, whereas the fund flow statement deals with the change in the position of working capital between two balance sheet dates. Cash is just one of the components of working capital.

- While cash flow statement uses the Cash basis of accounting. On the contrary, the fund flow statement uses the Accrual Basis of Accounting.

- For the purpose of short-term financial planning and decision making cash flow statement is prepared, whereas a fund flow statement is suitable for long-term financial planning and decision making.

- Cash Flow Statement begins with an opening cash balance and it ends with the closing cash balance, which arises when sources and uses of cash are adjusted. However, the opening and closing balance are not there in the case of the fund flow statement.

- The cash flow statement shows the inflow and outflow of cash, whereas the fund flow statement shows the sources and uses of funds.

- Cash Flow Statement is helpful in explaining the cash movement amidst two points of time. In contrast, the Fund Flow Statement facilitates in explaining the causes of changes in the balance sheet items, i.e. assets and liabilities between two financial years.

- Cash Flow Statement is a part of the Financial Statement. Unlike Fund Flow Statement which is not a part of the Financial Statement

Video: Cash Flow Vs Fund Flow Statement

Example

Cash Flow Statement

Romys Ltd. earned a profit of Rs. 8,75,000, for the year, ended on 31.03.2021. After taking into account the information given below:

Depreciation on land and building Rs. 65,000

Depreciation on Plant and Machinery Rs. 20,000

Goodwill written off Rs. 12,500

Loss on sale of machinery Rs. 4,500

The position of current assets and current liabilities is as under:

Calculate Cash from Operating Activities.

Using the given details, prepare a schedule for changes in working capital and fund flow statement:

For this we need to calculate the changes in working capital first:

Now we will proceed to prepare a fund flow statement:

Points to Remember

- It is mandatory for listed companies to prepare and present cash flow statements.

- SEBI Guidelines recommend the preparation of Cash flow Statements using the direct method.

- Cash Flow related to extraordinary items is classified as arising from operating, investing, and financing activities. This may include the amount received from the insurance company, loss due to fire, etc.

Conclusion

Cash is one of the constituents of working capital. So, if there is an improvement in the position of cash which leads to the improvement in the position of funds, but vice versa is not possible. To put it simply, when there is cash inflow, it amounts to fund inflow, but the fund inflow does not prompt cash inflow.

Mr. N chali says

Great explanation

Vijay says

Explained very succinctly. Thanks.

Puja garg says

Nycc one.

Harish says

Explanation is superb

Kajl says

Good content👍

Mallik says

Its brief explanation on the two.

Great job

Thanks for u r valuable information.

Tushar Adhvaryu says

Your explanation are ultimate for beginners as well as professionals . thx.

Surbhi S says

Thank you guys, for appreciating Key Differences for its work. It motivates us to do better in future and provide you all the quality stuff. Keep reading 🙂 🙂

sumit kumar gupta says

Explaining very nice. This is very helpful for me . Key differences is better for understanding in table format. thank you for sharing this great article.

Kumar lav says

I only choose this site for comparison.

RAGHU PAL says

thank you so much great one..

Bhanwar Singh says

Thank you so much sir. This is very helpful for me.

Binu M V says

good

Suresh Jacob says

Good Information in this given of this article. I like it

luna says

Nice blog! Thanks for sharing this blog with us. I like the article and it is very helpful for me. Thanks for sharing.