The cash flow statement tells you the amount of cash inflows and outflows of a business during a financial year. It will reveal how much cash the firm has on hand and provides an understanding of the company’s liquidity.

The cash flow statement tells you the amount of cash inflows and outflows of a business during a financial year. It will reveal how much cash the firm has on hand and provides an understanding of the company’s liquidity.

If we talk about Income Statement indicates the amount of revenue and expenses during the financial year. These are commonly reported quarterly and annually to disclose financial trends and comparisons. It reflects the net profit or loss from the business activities for a particular accounting period.

The income statement and cash flow statement, together with the Balance Sheet, constitutes Financial Statements. It is helpful to the interested parties in knowing the profitability, liquidity, performance and position of the business. These are used for reporting the financial performance of the enterprise over a period of time.

This post breaks down all the important differences between income statement and cash flow statement.

Content: Income Statement Vs Cash Flow Statement

- Comparison Chart

- What is an Income Statement?

- What is Cash Flow Statement?

- Key Differences

- Conclusion

Comparison Chart

| Basis for Comparison | Income Statement | Cash Flow Statement |

|---|---|---|

| Meaning | A cash flow statement is a snapshot of the cash flows from the three activities of business - operating, financing and investing. | Income statement is a summary that gives information about the business revenues and expenses, gains and losses over a financial term. |

| Purpose | To indicate the movement of cash through the organization. | To highlight the amount of profit business makes, during a particular financial year. |

| Measures | Net profit or loss for the period | Increase or decrease in cash |

| Begins with | Net Sales | Net Income |

| Ends with | Net Income | Cash balance |

| Basis of Accounting | Cash Basis of Accounting | Accrual Basis of Accounting |

| Preparation | On the basis of Income Statement and Balance Sheet. | On the basis of Ledger Accounts and Trial Balance. |

| Depreciation | As depreciation is a non-cash item, it is not included in the cash flow statement. | It records depreciation. |

What is an Income Statement?

An income Statement is a summary of a company’s income and expenses during a particular financial year. It provides a true picture of the company’s profitability position.

The firm prepares the company’s income statements on a monthly, quarterly, or yearly basis. It helps in ascertaining the financial health and performance of the enterprise. Moreover, it is used to represent the revenues, gains, expenses and losses from operating and non-operating activities of the company. The alternative term for the income statement is a Profit or Loss Statement.

It explains the result of business operations between two Balance Sheet dates, i.e., whether the company is earning profit or not.

Using the income statement, we could match the costs incurred with revenues earned for the period. When the total revenues (including gains) exceed the total expenses, then the result would be the net income while if the total expenses (including losses) exceed total revenues, then the result would be the net loss.

What is Income?

Income means the money received as a return or reward for the production of goods and services.

Further, the primary objective of analysing income statements is to separate the contribution of ordinary business sources from other sources. It discloses the accurate dynamic force of the business, i.e. income generating capacity. Also, it helps in making a comparison of a firm’s profitability position with that of other firms operating in the market. To calculate profit or loss, we will add all the revenues and deduct expenses from operating and non-operating activities.

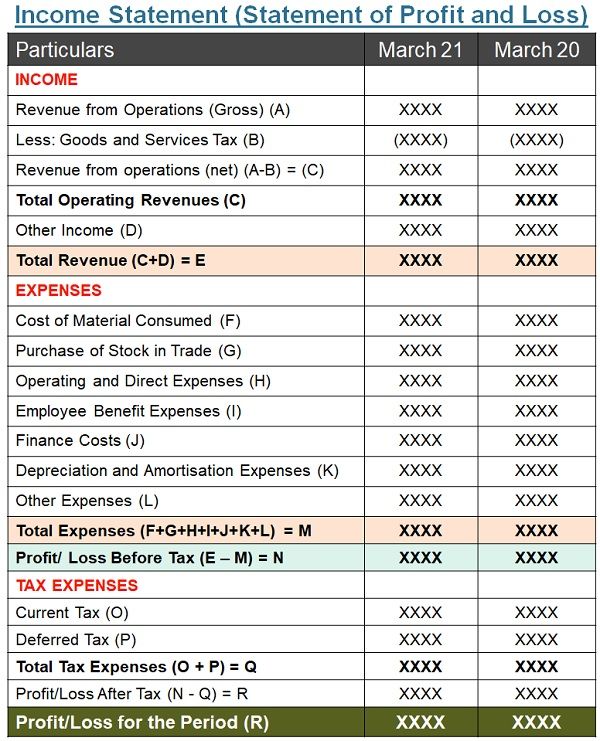

Format of Income Statement

Components of Income Statement

- Expense: It implies the part of expenditure which is used in the process of generating revenue in an accounting period. It amounts to the resources consumed for producing or selling goods or rendering services.

- Sales: It is the company’s proceeds out of sales or services rendered. Sales appear at the top of the statement.

- Cost of Goods Sold: It indicates the direct costs related to the production of goods. Here, direct costs include raw materials, wages, carriage inward, etc.

- Gross Profit: When we deduct the cost of goods sold from sales, we arrive at gross profit.

- Indirect Expenses: It includes selling, distribution and administration expenses which the firm incurs in connection to running and managing the enterprise. This may cover rent, office expenses, insurance, salaries, etc.

- EBITDA: It is the earnings of the company before interest, tax, depreciation and amortization.

- Depreciation and Amortization: The value of assets decreases over a period of time due to wear and tear, use or obsolescence. This decrease is nothing but depreciation. On the other hand, amortization is the process of spreading the cost of an intangible asset over its useful life.

- Operating Income (EBIT): It is the earnings before income and taxes. It is the earnings from regular operations of the business.

- Interest: The company pays interest to debenture holders or the bank for loans raised.

- EBT: It is the company’s Earning Before Tax, but after deducting interest from EBIT.

- Taxes: It is the compulsory obligation which a person or firm pays to the government and is levied on the income of the person or business profits or included in the cost of goods.

- EAT: It is the earnings after tax. It is the Net Income after deducting all expenses, interest, depreciation and taxes.

What is Earning Per Share?

We will get EPS by dividing the Net Income (EAT less Dividend to preference shareholders) by the total number of outstanding shares.

Also Read: Difference Between Balance Sheet and Profit & Loss Account

What is Cash Flow Statement?

A cash flow statement gives an overview of the flow of money into and out of business. It reflects the movement of cash through the firm during the period. In short, the statement reflects the cash and cash equivalents position at the beginning and end of the accounting year. It excludes non-cash transactions.

Companies prepare cash flow statements every month, quarter or year. By keeping an eye on the cash flow statement company can use cash in an optimum manner. Also, it measures the organization’s needs to use the cash flows.

A cash flow statement serves as a tool in the hands of the stakeholders to know the sources and uses of cash and cash equivalents of a firm over a period of time from different activities. Also, it is useful in gauging the ability of the firm to generate cash and cash equivalents.

What is Cash and Cash Equivalent?

- Cash: The term ‘cash’ implies the money in hand or demand deposits at the bank.

- Cash Equivalent: It means quickly convertible and highly liquid instruments or investments. Further, its value is known, and there is no risk of change in its realization amount.

Types of Cash Flows

- Cash Inflow: Simply put, it is the money that is going into your company is a cash inflow. It covers all the transactions that increase the company’s cash position.

- Cash Outflow: When the money goes out of your business, that is a cash outflow. All the transactions that decrease the company’s cash position are cash outflows

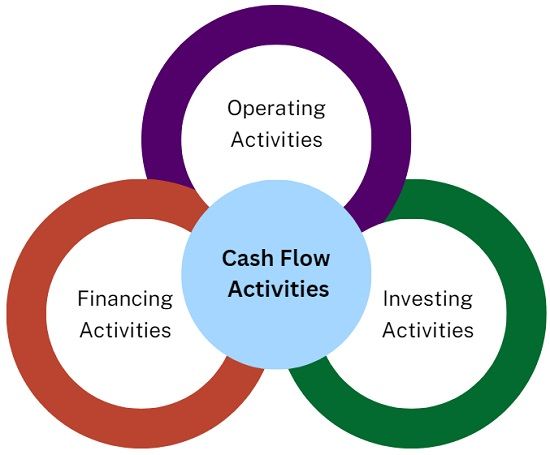

Classification of Cash Flow Activities

It classifies cash flow into three activities:

- Operating Activities: Activities that form part of the revenue-producing activities of the firm are operating activities. It discloses the amount the company has made or spent on operating the business. Hence, it represents the internal solvency level of the firm. It reflects the degree to which operations of the firm generated enough cash flows to keep its operating capability intact.

- Investing Activities: These include the purchase or sale of long-term capital assets. For example, Plant and Machinery, Equipment, Land and Building. It also covers the activities belonging to long-term investment. It depicts the degree to which the firm incurs expenditure on resources expected to generate cash flows in future.

- Financing Activities: It covers the money received from or paid to creditors, lenders and investors. These activities bring about changes in the size and composition of the owner’s equity and borrowings of the company. It anticipates claims on future cash flows.

Classification of cash flows on the basis of activities gives information that allows its users to assess the impact of activities on the financial position of the firm.

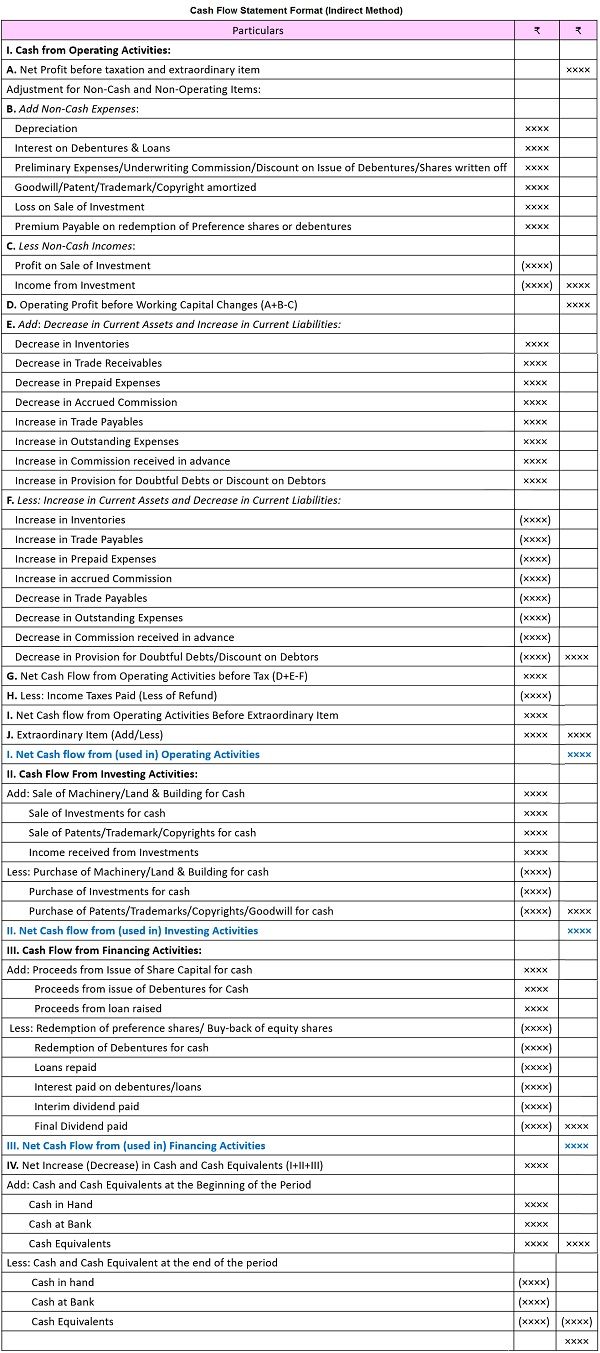

Format of Cash Flow Statement (Indirect Method)

Also Read: Difference Between Cash Flow and Fund Flow

Key Differences Between Income Statement and Cash Flow Statement

- The income statement is a part of a financial statement which shows the revenues, gains, expenses and losses for a particular accounting period. Conversely, a Cash Flow Statement is a sketch of cash receipts and disbursements for a specific period of time. It describes the reasons for the increase or decrease in the cash position of the firm.

- The preparation of the cash flow statements is as per the cash basis of accounting. In a cash basis accounting, revenues are recognized when it is received, and expenses are recognized when it is paid. So, it does not consider accounts receivables and payables. Conversely, the preparation of income statements is as per the accrual basis of accounting. In the accrual basis of accounting, we record the revenues and expenses when they are earned or incurred, regardless of when the money is actually received/paid or not.

- The Cash Flow Statement concerns the company’s financial management regarding the structure and assets. However, the income statement reveals the amount of income generated from the core activities of the company.

- The income statement is classified into two main activities operating and non-operating. Whereas the cash flow statement is divided into three activities operating, investing and financing.

- At the time of preparing the income statement, we will include depreciation. But, the same is excluded from the cash flow statement because it is a non-cash item.

- An Income Statement represents the movement of cash through the organization. On the other hand, Cash Flow Statement highlights the amount of profit a business makes during a particular financial year.

Also Read: Difference Between Cash and Accrual Basis of Accounting

Conclusion

All in all, the preparation of the income statement and the cash flow statement are mandatory for all business organisations. The two statements are of great use to the interested parties, i.e. creditors, investors, suppliers, competitors, employees, etc. This is because it helps to know about the company’s performance, stability and solvency position.

Leave a Reply