Fundamental Analysis studies all those factors which have an impact on the stock price of the company in future, such as financial statement, management process, industry, etc. It analyzes the intrinsic value of the firm to identify whether the stock is under-priced or over-priced. On the other hand, technical analysis uses past charts, patterns and trends to forecast the price movements of the entity in the coming time.

Fundamental Analysis studies all those factors which have an impact on the stock price of the company in future, such as financial statement, management process, industry, etc. It analyzes the intrinsic value of the firm to identify whether the stock is under-priced or over-priced. On the other hand, technical analysis uses past charts, patterns and trends to forecast the price movements of the entity in the coming time.

Stock prices change every minute, and so every investor is keen to know the future price trends of the stocks of a company, so as to make investment decisions rationally. For this purpose fundamental analysis and technical analysis are used to research and forecast price trend of the stock in future.

Content: Fundamental Vs Technical Analysis

Comparison Chart

| Basis for Comparison | Fundamental Analysis | Technical Analysis |

|---|---|---|

| Meaning | Fundamental Analysis is a practice of analyzing securities by determining the intrinsic value of the stock. | Technical analysis is a method of determining the future price of the stock using charts to identify the patterns and trends. |

| Relevant for | Long term investments | Short term investments |

| Function | Investing | Trading |

| Objective | To identify the intrinsic value of the stock. | To identify the right time to enter or exit the market. |

| Decision making | Decisions are based on the information available and statistic evaluated. | Decisions are based on market trends and prices of stock. |

| Focuses on | Both Past and Present data. | Past data only. |

| Form of data | Economic reports, news events and industry statistics. | Chart Analysis |

| Future prices | Predicted on the basis of past and present performance and profitability of the company. | Predicted on the basis of charts and indicators. |

| Type of trader | Long term position trader. | Swing trader and short term day trader. |

Definition of Fundamental Analysis

Fundamental Analysis refers to the detailed examination of the basic factors which influence the interest of the economy, industry and company. It is meant to gauge the actual intrinsic value of a share, by measuring the economic, financial and other factors (both qualitative and quantitative) to identify the opportunities where the value of share varies from its current market price.

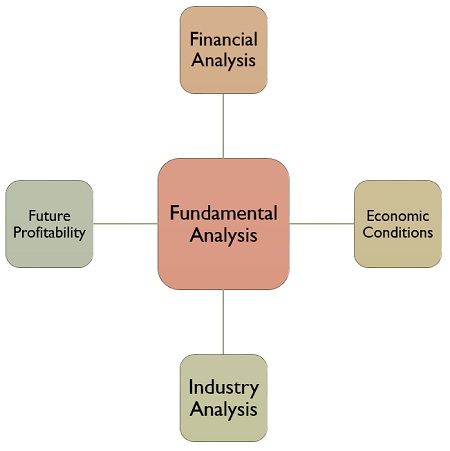

The fundamental analysis assesses all the factors that have the capability of influencing the value of the security (including macroeconomic factors and organization-specific factors), called as fundamentals, which are nothing but the financial statements, management, competition, business concept, etc. It aims at analysing the economy as a whole, the industry to which it belongs, business environment and the firm itself. It relies on the assumption that there is some sort of delay in influencing the share prices by these fundamentals. So, in the short run, the prices of stocks do not match its value, but in the long run, it adjusts itself. It is a three-phase analysis of:

It relies on the assumption that there is some sort of delay in influencing the share prices by these fundamentals. So, in the short run, the prices of stocks do not match its value, but in the long run, it adjusts itself. It is a three-phase analysis of:

- The Economy: To analyse the general economic status and condition of the country. It is analysed through economic indicators.

- The Industry: To determine the prospects of various industry classification, with the help of competitive analysis of industries and industry life cycle analysis.

- The Company: To ascertain the financial and non-financial characteristics of the firm to find out whether to buy, sell or hold the shares of the company. For this purpose, sales, profitability, EPS, are analysed along with management, corporate image and product quality.

Definition of Technical Analysis

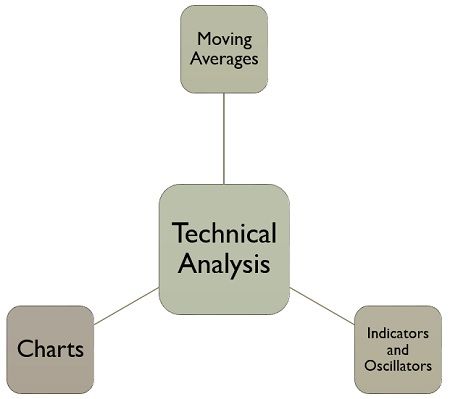

Technical Analysis is used to forecast the price of a share, which says that the price of a share of the company is based on the interaction of demand and supply forces, operating in the marketplace. It is used to forecast the future market price of the stock, as per the past performance statistics of the share. For this purpose, first of all, the changes in the price of the stock are ascertained, to know how the price will change in future.

The price at which the buyer and seller of the share, decides to settle the deal, is one such value which combines, weighs and expresses all the factors, and is the only value which matters. In other words, technical analysis gives you a clear and comprehensive view of the reason for changes in prices of a security. It is based on the premise that the price of share move in trends, i.e. upward or downward, relying upon the attitude, psychology and emotion of the traders.

It is based on the premise that the price of share move in trends, i.e. upward or downward, relying upon the attitude, psychology and emotion of the traders.

Tools used for Technical Analysis

- Prices: The change in the price of securities is represented in the change in the attitude of the investor and the demand and supply of securities.

- Time: The degree of price movement is a function of time, i.e. the time taken in the reversal of trend will determine the change in price.

- Volume: The magnitude of price changes can be seen in the transaction volume that characterizes the change. Suppose there is a change in the price of shares, but there is a small change in the transaction volume, then it can be said that the change is not very powerful.

- Width: The quality of change in price, is gauged by ascertaining if the change in trend is dispersed across many industries or it is specific to a few securities only. It reflects the degree to which changes in the price of securities have taken place in the market as per the overall trend.

Key Differences Between Fundamental and Technical Analysis

The difference between fundamental and technical analysis can be drawn clearly on the following grounds:

- Fundamental Analysis is a method of examining security so as to identify its intrinsic value for long term investment opportunities. As against, Technical Analysis is a method of evaluating and forecasting the price of a security in future, on the basis of price movement and volume of transaction. It identifies what a stock will do in future.

- In fundamental analysis, longer periods are used to analyse stocks as compared to technical analysis. Hence, fundamental analysis is employed by those investors who want to invest in stocks whose value will increase in several years. On the contrary, technical analysis is used when the trade is for short term only.

- The time difference between the two analysis is not only experienced in their approach but in their objective too, wherein the technical analysis is concerned with trading, fundamental analysis talks about investment. As most of the investors use fundamental analysis to buy or hold stocks of the company, whereas traders rely on the technical analysis, to make short term profits.

- While fundamental analysis aims at ascertaining the true intrinsic value of the stock, technical analysis is used to identify the right time to enter or exit the market.

- In fundamental analysis, decision making is based on the information available and statistic evaluated. On the contrary, in technical analysis, decision making is based on market trends and the stock price.

- In fundamental analysis, both past and present data are considered, whereas, in technical analysis, only past data is considered.

- Fundamental Analysis is based on financial statements, whereas technical analysis is based on charts with price movements.

- In fundamental Analysis the intrinsic value of the stock can be ascertained by analysing an income statement, balance sheet, cash flow statement, profit margin, return on equity, price to earnings ratio, etc. However, technical analysts rely on the chart patterns (such as continuation pattern and reverse patterns), price actions, technical indicator, resistance and support, to analyse the future price trends. Here resistance is the point where the investor is of the view that price will not rise further and is ready to sell, and support is a point where the investor is of the view that price will not fall further and is ready to buy.

- In fundamental analysis, the future price of the security is decided upon the past and present performance and profitability of the company. As opposed, in technical analysis the future prices are on the basis of charts and indicators.

- Fundamental analysis is done by long term position trader, while technical analysis is done by swing trader and short term day trader.

Conclusion

In fundamental analysis, the stock is bought by the investor when the market price of the stock is less than the intrinsic value of the stock. As against, in technical analysis, the stock is bought by the traders, when they expect that it can be sold at a relatively higher price.

Sharevidya Consulting says

Thanks for sharing this information because I’m looking for this type of article.

Godwin 5brodaz says

Great explanation .. I’ve gotten broad understanding on the difference between fundamental and technical analysis.

Barrack Obama says

Thank you my fellow Americans for this article.

CHARLES SMITH says

This definitely explains the difference between Fundamental and Technical analysis. Thank you.

Jeena k joy says

Thanks for this Good Explanation. It can easily understanding the differences of fundamental and technical analysis.