At times the parties to the contract decide a reasonable compensation payable at the time of the breach of contract. The amount agreed by the parties concerned beforehand is called liquidated damages. So, these are predetermined damages that the parties agree to pay each other if they break the contract.

At times the parties to the contract decide a reasonable compensation payable at the time of the breach of contract. The amount agreed by the parties concerned beforehand is called liquidated damages. So, these are predetermined damages that the parties agree to pay each other if they break the contract.

As against, the court grants unliquidated damages depending upon the assessment of loss or injury that occurred to the plaintiff on account of the breach of the contract.

What are Damages?

Damages imply a kind of compensation which the defaulting party pays to the aggrieved party because of a breach of the contract, loss or injury.

This post will discuss the differences between liquidated and unliquidated damages.

Content: Liquidated Damages Vs Unliquidated Damages

- Comparison Chart

- What is Liquidated Damages?

- What are Unliquidated Damages?

- Key Differences

- Conclusion

Comparison Chart

| Basis for Comparison | Liquidated Damages | Unliquidated Damages |

|---|---|---|

| Meaning | The pre-agreed damages, which the party breaching the contract pays to the aggrieved party, are called liquidated damages. | The damages which are non-pre-agreed, i.e., are assessed by the court after the breach of the contract is, unliquidated damages. |

| Section | Section 74 of the Indian Contract Act, 1872 | Section 73 of the Indian Contract Act, 1872 |

| Proof of Loss | Not required | Required |

| Amount of damages | Fixed | Not fixed; the law decides it |

| Claim of contract | The aggrieved party to the contract can collect liquidated damages upon a specific breach. | Unliquidated damages are claimed for unforeseeable damages. |

What are Liquidated Damages?

In a contract, when the parties to the agreement decide to pay a stipulated amount, if there is non-performance of the contract on the part of any of the parties, such damages are called liquidated damages. These damages are agreed upon by the parties concerned when they join the contract, i.e. before the execution of the contract itself. Further, this amount is fixed, and no changes can be made after it is signed.

Section 74 of the Indian Contract Act of 1872 regulates liquidated damages. If a party to a contract breaches it, the other party is eligible for reasonable compensation for the loss sustained by that party. Here, it is to be noted that the compensation has to be a genuine pre-estimate of the loss.

Liquidated Damages in a contract is a provision that determines the sum to be paid as damages for the party’s breach. With these damages, one benefit is that there is no need to prove the actual loss. This is because the clause specifies the estimation of damages in advance.

Essentials of Liquidated Damages

- Just and fair pre-estimation of the damages.

- Estimation of the amount which the parties agree to compensate for the breach.

- No matter the loss amount, these damages are awarded in full. Further, the courts do not have the power to increase or decrease the amount decided by the parties concerned.

- The damages are mentioned in the agreement.

Advantages of Liquidated Damages

- Ensures certainty to the parties

- Provides damage recovery by eliminating the need for proof of loss.

- Breaking down the process of dispute resolution.

- This may lead to the performance of the contract.

Also Read: Difference Between Liquidated Damages and Penalty

What are Unliquidated Damages?

Unliquidated Damages refer to the damages for the breach of a party, which are not estimated in advance. Simply put, the damages claimed for unforeseeable losses are unliquidated damages. Such damages apply to any breach of contract that does not comprise a liquidated damages clause. However, it is difficult to assess the compensation amount the plaintiff would claim because the amount is unliquidated.

The court or arbitral tribunals award these damages after they examine the actual loss or injury caused to the plaintiff due to the breach.

Unliquidated damages require an assessment of the damage. The principle behind the assessment of damages is to put the plaintiff monetarily in a position where it would have been if the contract was not broken. Therefore, the rule of the remoteness of the damages applies.

Unliquidated damages depend upon the actual loss or damage suffered by the aggrieved party.

Essentials of Unliquidated Damages

- Breach of contract accounts for the primary condition for claiming the damages.

- It is vital to ascertain whether the breach resulted in a loss.

- The onus of proof of the breach of contract and the loss suffered is on the plaintiff. The quantum of damages has to be proved with reasonable certainty.

- Compensation is not granted for any remote or indirect loss or damage sustained because of the breach of contract.

- Damages are payable for direct, consequential and incidental losses.

- The defendant is also liable to pay for the loss of profit arising due to the contractual breach.

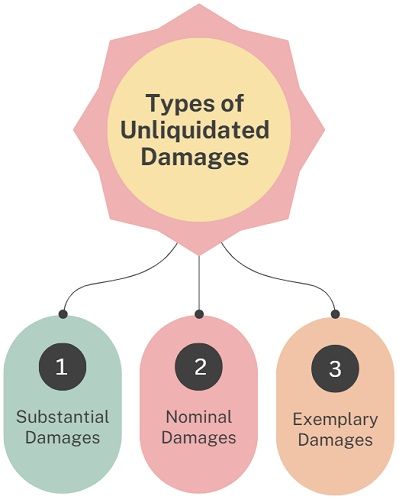

Types of Unliquidated Damages

- Substantial Damages: An attempt made by the court to reflect the innocent party’s actual loss.

- Nominal Damages: The court awards the plaintiff a small compensation, indicating they won the case. However, as per the court, awarding them a big payout is unfair. So, these are for name sake only.

- Exemplary Damages: These damages indicate the displeasure of the court. Hence, it awards a massive payout to the innocent party. Moreover, the court does not commonly award exemplary damages. By awarding such damages, the court attempts to correct the issue and put the aggrieved party in a stage where he was before the breach of the contract.

Also Read: Difference Between Contract and Tort

Key Differences Between Liquidated and Unliquidated Damages

- Liquidated Damages refer to the pre-determined amount agreed upon between the parties while entering into the contract. It becomes payable by the party who defaults in the performance of the contract. As against, unliquidated damages imply the compensation ordered by the court to be payable to the aggrieved party by the defaulting one for the actual loss suffered due to the breach of contract.

- Unliquidated damages are not predetermined. Hence, the court awards this sum equivalent to the damage. Conversely, liquidated damages are predetermined. This means that the parties agreed upon the compensation while joining the contract. Such damages are determined by the parties in anticipation of the breach.

- Liquidated Damages are defined under section 74 of the Indian Contract Act of 1872. On the other hand, unliquidated damages are defined under section 73 of the Indian Contract Act 1872.

- In the case of liquidated damages, there is no requirement for proof of loss on the plaintiff. As against, the proof of loss is mandatory in case of unliquidated damages. Further, the onus of proof lies on the plaintiff. Further, it is difficult to prove the damage.

- The innocent party to the contract can collect liquidated damages upon a specific breach. In contrast, the injured party can claim unliquidated damages for unforeseeable loss or damage.

Conclusion

Above all, liquidated damages are awarded when the injured party is in a position to sue the party breaching the contract for a specific sum. Further, the sum should be a genuine and bonafide pre-estimate of the actual loss arising from the breach of contract. As against, unliquidated damages are awarded when no sum is fixed by the parties concerned, and so the court has the right to decide the amount of compensation to be given.

Leave a Reply