Stock Exchange is a marketplace, wherein the trading of securities between buyers and sellers takes place. The two largest and famous stock exchanges of India are the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Sensex is a flagship index of BSE, whereas Nifty is a main index of NSE.

Stock Exchange is a marketplace, wherein the trading of securities between buyers and sellers takes place. The two largest and famous stock exchanges of India are the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Sensex is a flagship index of BSE, whereas Nifty is a main index of NSE.

Nifty and Sensex are basically market indices, which serve as a benchmark to indicate a market trend, development in the industry, and the portfolio of the individual investor.

What is Index?

To measure the country’s economic development, the financial performance of the share market acts as a parameter. However, there are many companies listed on the stock exchange and to know the market’s performance, one cannot track the stocks of all the companies. In this way, a sample is chosen to represent the movement of the entire market, and that small sample is called Index.

The index reflects the economic growth of the companies and the country as well. It is basically a sample of a certain number of companies, which are the best and biggest according to free-float market capitalization. Considering the direction of the sample companies, a general opinion can be made, regarding the market trend for the day.

Further, the reasons for up and down movement of the index may include a change in government policy, or change in government, forecasting of good weather, international affairs, industry future, etc.

Therefore, Nifty and Sensex are like exit polls, which helps in determining the overall market trend using the index as a sample.

When the arrow in Nifty and Sensex, appears green in color it signifies that the trading is done at a higher price, as compared to the closing value of the previous trading day, whereas when the arrow appears red it indicates that the trading is done at a lower price, than the closing value of the previous trading day.

Content: Nifty Vs Sensex

- Comparison Chart

- Definition

- Key Differences

- Video

- Frequently Asked Questions (FAQs)

- Salient Features

- Limitations

- Conclusion

Comparison Chart

| Basis for Comparison | Nifty | Sensex |

|---|---|---|

| Stands For | Nifty stands for National+Fifty. | Sensex stands for Sensitivity Index. |

| Meaning | Nifty is an indicator that indicates the average trend, of the top fifty companies which are actively traded on the National Stock Exchange. | Sensex is a benchmark index which indicates the average trend, of the top thirty companies which are actively traded on the National Stock Exchange. |

| Launched in | 21 April 1997 | January 1, 1986 |

| Officially known as | C&P Nifty | S&P BSE Sensex |

| Operator | NSE Indices | Asia Index Pvt. Ltd. |

| Total companies listed in the Exchange | More than 1700 | More than 5500 |

| Companies in Indices | Top 50 company's stocks | Top 30 company's stocks |

| Base Year | 1995-96 | 1978-79 |

| Base Number | 1000 | 100 |

| Index value | (Current market value/Base market value) × 100 | Free float market capitalization/Index divisor |

Definition of Nifty

Nifty is a conjunction of two words ‘National+Fifty‘. It is a true indicator of the Indian Stock Market. Therefore, the stocks of the 50 best and biggest companies operating in different sectors are selected, which are basically market leaders in the concerned sector, with a good track record are represented by Nifty. Hence, the movement of nifty is based on the fluctuation in the share price of these underlying companies.

- The ownership and management of Nifty are with NSE Indices Limited which was earlier known as India Index Services & Products Limited, IISL It is the first company in India, that focused on an index as the main product.

- It entails 50 of around 1700 companies traded on the National Stock Exchange (NSE) and occupies almost 65% of the float-adjusted market capitalization.

- All the major sectors of the economy are covered in stocks of fifty companies represented by Nifty.

Nifty is the free-float market capitalization-weighted average index of fifty well-established companies listed in the National Stock Exchange.

Sector Representation in Nifty

The chart given hereunder represents the sector-wise representation in nifty along with weights (in %):

Also Read: Difference Between BSE and NSE

Definition of Sensex

The term ‘Sensex’ expands to Sensitivity Index, which was given by Deepak Mohoni – a Stock Market Analyst. It is a yardstick of the top 30 companies operating in different sectors which highly traded by the public on the Bombay Stock Exchange. That is why it is also known as BSE-30. It is the oldest stock index in India.

Of all the companies listed in the Bombay Stock Exchange, 30 companies are selected, based on their market capitalization. These 30 companies belong to various sectors and they change from time to time, as per the rules of the stock exchange. It represents stocks of 30 popular and well-recognized companies from various sectors having a good track record. And so, Sensex’s movement is based on the movement of the share price of these 30 companies.

- The first benchmark in the country, reflecting the free-float market capitalization methodology.

- It shows time data over a very long period, which is appropriate for the purpose of research.

- The selection of 30 companies in the Index, are from diverse industries and picked up only after they fulfill the prescribed criteria of the exchange.

Sector Representation in Sensex

The chart given below represents the sector-wise representation in sensex along with weights (in %):

Source: bseindia.com

Also Read: Difference Between NYSE and NASDAQ

Key Differences Between Nifty and Sensex

After having a detailed discussion on these indices, let us take a peep into the differences between nifty and sensex:

- Nifty is the main index of the National Stock Exchange (NSE). It tracks the performance of a portfolio of large and well-recognized companies. On the other hand, Sensex is the main index that measures the behavior of the top 30 stocks, of all the companies listed, as per the free-float market capitalization and liquidity.

- Nifty is composed of the top fifty largest and most traded companies out of 1700+ companies listed on the National Stock Exchange. As against, Sensex comprises of top thirty largest and most traded companies out of 5500+ companies listed on the Bombay Stock Exchange.

- 1995-96 is the base year of Nifty, whereas the base year in the case of Sensex is 1978-79.

- The base number of Nifty is 1000, while the base number of Sensex is 100.

- The operator of Nifty is NSE Indices Limited. Conversely, the operator of BSE is Asia Index Pvt. Ltd.

- While Nifty is officially known as C&P Nifty, Sensex is officially known as S&P BSE Sensex.

- The market capitalization factor in the case of Sensex is the free float factor, whereas Investible Weight Factor (IWF) is the market capitalization factor for Nifty.

- The formula for calculating the Nifty index value is (Current market value/Base market value) × 100. Conversely, the formula for calculating Sensex index value is Free float market capitalization/Index divisor.

Video: Nifty Vs Sensex

Frequently Asked Questions (FAQs)

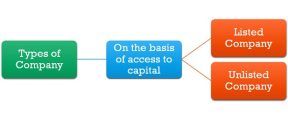

Do companies listed in BSE can also be listed in NSE?

The stocks of a company can be listed in both the stock exchanges. And in both the exchanges the stock prices may differ, as the prices depend on the number of buyers and sellers. Further, such companies are called dual listed. It helps in increasing the company’s access to capital and brings more liquidity.

What happens if the stocks of a certain company are continuously performing badly?

When the stocks of a certain company are performing badly, for a long time, then the stock exchange replaces the stocks of that company with some other company that is well established and whose stocks are performing well in the market.

How the companies in indices are selected?

The companies in indices are selected on the basis of free-float market capitalization, that includes companies from all the sector.

What is Free float market capitalization?

When a company offers shares to the public for sale, it never offers 100% shares. This is due to the fact that the owner always keeps the majority shares to keep the decision-making power with himself. It is considered an ideal method to calculate equity indices.

Free-float market capitalization means market capitalization of the index’s underlying companies, which considers only those stocks that are readily available for sale to the general public in the market. This means that unlike a full market capitalization wherein both active and inactive shares are considered, in a free-float market capitalization, shares owned by the company’s management are not taken into account.

Categories Excluded from the Calculation of Free Float Market Capitalization

- Shares held by promoter or group of promoters

- Government holding being a strategic investor

- Shares held by promoters by way of ADR or GDR.

- Strategic stakes by corporate bodies (only to the extent to which it is identifiable)

- Employee Welfare Trusts

- Investments under the FDI category

- Shares under the lock-in category

- Equity that associate or group companies (cross-holdings) held.

What is Investible Weight Factor?

Investible Weight Factor (IWF) refers to the unit of floating stock denoted as the number available for trading and not owned by the entities who have a strategic interest in the company.

Salient Features of Nifty and Sensex

- Calculated as per free-float market capitalization: Total Market capitalization – Promoters or Government Holdings

- Sectors covered are represented by the market-leading companies.

- Represents largely the sentiments of people about the economy.

- The market moves in excesses.

Limitations of Nifty and Sensex

- It represents only a specified number of companies whose free-float market capitalization is highest and not the biggest companies.

- Market sentiments are determined on the basis of a very small sample of companies.

- Survivorship Bias

Conclusion

In a nutshell, Nifty reflects the price fluctuations of the stocks of the top 50 companies, which are listed on the National Stock Exchange (NSE). As against, Sensex comprises of the 30 highly traded stocks on the Bombay Stock Exchange. These two reflect the overall trend of the companies and the entire economy.

Feroz Khan says

Where is National Stock Exchange is located? Some say it is in New Delhi and some Bombay. Which is correct?

Surbhi S says

Mumbai (Bombay)