In a barter exchange, goods were used as a medium of exchange, and so, it is difficult to determine the value of an item due to lack of – a common unit of measurement, double coincidence of wants, division of goods, etc. To cope with such issues, the money system was introduced in the economy. Money is commonly accepted by society as a common medium of exchange. Any type of exchange of goods and services can be performed with money as a consideration.

In a barter exchange, goods were used as a medium of exchange, and so, it is difficult to determine the value of an item due to lack of – a common unit of measurement, double coincidence of wants, division of goods, etc. To cope with such issues, the money system was introduced in the economy. Money is commonly accepted by society as a common medium of exchange. Any type of exchange of goods and services can be performed with money as a consideration.

Money is often misinterpreted with currency, but a fine line of difference exists between the two. Every country in this world has its currency. Currency is nothing but a system of money which is in general use or circulation in an economy.

Money plays a very crucial role in our everyday life. As you look around, you will notice that you can buy the stuff you need or of your interest and the services you look for, with money. Indeed, money is like the blood of the economy, which keeps it going.

Content: Currency Vs Money

Comparison Chart

| Basis for Comparison | Currency | Money |

|---|---|---|

| Meaning | Currency refers to a form of money which is commonly in circulation, for the people in the economy. | Money implies anything having value, which can be used as a means of exchange and maintains purchasing power. |

| Value | Loses value over time | Store of value over time |

| Objective | To facilitate transaction | To facilitate exchange |

Definition of Currency

Currency can be understood as a widely accepted form of money which is flowing or in use as a means of exchange for buying and selling goods and services, in the economy. It is a token that serves as money, whose issue and circulation is controlled by the apex bank of the country. There are four types of currency – fiat currency; asset-backed currency, commodity-backed currency and digital currency.

It can be legal tender in some jurisdictions, which acts as a medium of payment to meet financial obligations. It includes both hard money (coins) and soft money (bank notes).

The worth of currency is based on the value it contains as per the economy and issuing authority and not from the material it is made of. The value of a currency of an economy depends on factors like imports and exports, growth rate, trade deficit, inflation, interest rates, foreign exchange reserves, macroeconomic policies, foreign investment inflows, employment level, geopolitical conditions, and so forth.

Some common examples of currency are US dollars (US$), Australian dollars (A$), Indian Rupees (₹), Pounds sterling (£), Russian rubles (₽), and European euros (€).

Definition of Money

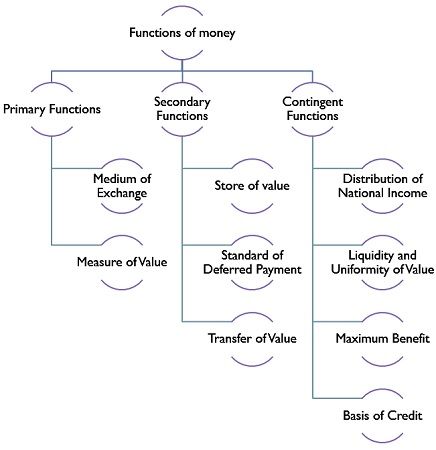

Money refers to any item of value which is commonly accepted as a medium of financial exchange for goods and services, a unit of account, store of value, and a standard of deferred payment. It is movable, durable, divisible and fungible. The central bank regulates the supply of money in an economy. To understand the meaning of money, one has to know its functions:

- Primary Functions:

- Medium of Exchange: Money serves as a medium of exchange, thus playing an intermediary role. Double coincidence of wants is one of the major issues in a barter exchange, and with the introduction of money, this limitation is completely removed and it has smoothened the exchange system.

- Measure of Value: Money helps in determining the value of a product or service by acting as a standard measure of value, in terms of which the actual worth of anything can be expressed in price. The monetary unit which we use for computing the value of an item is called the unit of account.

- Secondary Function:

- Store of Value: Money also acts as a store of value, as a part of money can be saved for future contingencies and to repay debt because it is durable and stable in value.

- Standard for Deferred Payment: Money acts as a base for making deferred payments, such as interest, salaries, insurance, rent, pension, and so forth, because of its general acceptability and its value not changing over time. Hence, it facilitates lending and borrowing, when money is taken as a loan, it can be repaid after some time along with interest for the use of money for the concerned period.

- Transfer of Value: Money is also used to transfer value from one individual to another or location to another. Indeed, most people transfer value by selling goods and services to other people and buying with others.

- Contingent Functions:

- Distribution of National Income: The different factors of production jointly contribute to the production of national income, which is then distributed to the factors in the form of wage, rent, interest, and profit. These are paid in money only, as factor incomes.

- Liquidity and Uniformity of Value: The liquidity feature of money helps people carry and withdraw money from the account as a convenience. Further, the uniformity characteristic of money makes it easy for us to compare those items in terms of money with different measurement units. Hence, it is a general form of capital.

- Maximum Benefit: Maximum satisfaction can be derived from one’s own income with the help of money, as per the law of equi-marginal utility.

- Basis of Credit: Nowadays, credit money is gaining much importance in the form of a cheque, demand drafts, promissory notes and bills of exchange.

Key Differences Between Currency and Money

The difference between currency and money are discussed in the points given below:

- Currency refers to any kind of money that is in public circulation and holds a certain value, making it a medium of exchange. On the other hand, money implies any item of financial importance, which is used as a means of exchange, an estimate and store of value, legal tender for repayment of loans and a standard for outstanding remittances.

- One of the major problems with currency is that the government can print as much currency as it want, which increases the flow of money in the economy, leading to increasing inflation, i.e.rise in the price of items. In this way, currency does not have consistent value, i.e. it loses value with time. On the other hand, money does not lose its value over time due to its limited supply in the economy, and thus it maintains the purchasing power.

- Currency is a tangible concept, which includes tokens that act as money in a nation to facilitate financial transactions. On the other hand, money is the store of value that maintains buying power over an indefinite period. It is used as a medium of exchange, through which one can buy goods or services for consideration.

Conclusion

By and large, currency is just a system of money, which is used as a mechanism for facilitating the transaction. On the other hand, the use of money has highly assisted in the process of exchange, by removing the drawbacks of the barter system.

Leave a Reply