In any country’s financial sector, banks play a crucial role in the overall economic development, by mobilizing savings of individuals and entities. They act as an intermediary amidst depositor and borrower. Besides lending money, banks provide various other value added services, that help in the smooth functioning of the economy. The Central bank, as the name suggest is the apex body, that regulates the entire banking system of the economy.

In any country’s financial sector, banks play a crucial role in the overall economic development, by mobilizing savings of individuals and entities. They act as an intermediary amidst depositor and borrower. Besides lending money, banks provide various other value added services, that help in the smooth functioning of the economy. The Central bank, as the name suggest is the apex body, that regulates the entire banking system of the economy.

The Central bank is not exactly same as a commercial bank, which is the financial institution that provides banking services to individuals and firms. There is a big difference between central bank and commercial bank in India, in the sense that the former is the top financial institution in the country, whereas the latter is an agent of the Central Bank. Check out the article in which we have compiled some differences in tabular form.

Content: Central Bank Vs Commercial Bank

Comparison Chart

| Basis for Comparison | Central Bank | Commercial Bank |

|---|---|---|

| Meaning | The bank which looks after the monetary system of the country is known as Central Bank. | The establishment, which provides banking services to the public is known as Commercial Bank. |

| What is it? | It is a banker to the banks and the government of the country. | It is the banker to the citizens of the nation. |

| Governing Statute | Reserve Bank of India Act, 1934. | Banking Regulation Act, 1949. |

| Ownership | Public | Public or Private |

| Profit motive | It does not exist for making profit for its owners | It exist for making profit for its owners. |

| Monetary Authority | It is the supreme monetary authority with wide powers. | No such authority. |

| Objective | Public welfare and economic development. | Earning Profits |

| Money supply | Ultimate source of money supply in the economy. | No such function is performed by it. |

| Right to print and issue currency notes | Yes | No |

| Deals with | Banks and Governments | General Public |

| How many banks are there? | Only one | Many |

Definition of Central Bank

Central Bank is the supreme financial institution that regulates the banking and monetary system of the country. It is formed to bring monetary stability, issue notes and maintain the value of a country’s currency in the international market. It administers the currency and credit system of the nation.

In India, the Reserve Bank of India plays the role of a central bank, which came into existence, after passing an act in parliament in 1934. The bank is headquartered in Mumbai, Maharashtra. The following are the main functions of the Central Bank

- It is authorized to issue currency notes except coins and notes of small magnitude.

- It has the power to control, direct and supervise the commercial banks. It also helps them at the time of need.

- It employs various measures to control the credit operations of the commercial banks.

- It is the banker and advisor to the government of the country.

- It acts as a manager of foreign exchange reserves.

- It collects and publishes the information relating to banking and financial sector.

- It oversees the credit and monetary policy of the nation.

Definition of Commercial Bank

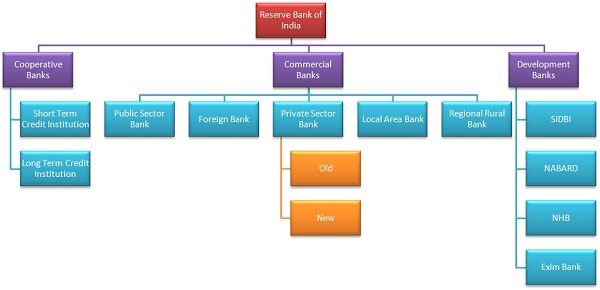

The entities that provide banking and financial services to a large number of people are known as Commercial Banks. They act as a mediator between the borrowers and savers. The Commercial Banks receive deposits from the general public and lends it on high interest to the individuals and organizations. In this way, the mobilization of savings takes place, and the economic cycle goes on smoothly.

In earlier times, people used to deposit money in post offices for saving purposes, when the requirement of the banking system was felt. The people want an establishment where they can deposit their savings and withdraw it at the time of need. At present, there are more than 600 commercial banks in India, which include public sector banks, private sector banks, scheduled banks, non-scheduled banks, nationalized banks, etc. The essential functions of a Commercial Bank are:

- It accepts deposits from the general public, firms, institutions and organization. Further, it gives the facility to withdraw money on demand. Banks pay interest on deposits at various rates on different deposits.

- It lends money to public, institutions, and organization in the form of long term and short term loans for a particular period and charges interest on the amount lent. Moreover, it provides overdraft and cash credit facilities to the customer.

- It performs agency functions like collections of bills of exchange and promissory notes, trading of shares and debentures, payment to third parties on standing instructions of the customer, etc.

- It provides the facility of safe keeping of valuables like jewelry and documents.

- It collects, transfers and makes payment of funds on behalf of the customer.

- It provides the facility of ATM card, Debit Card, Credit Card, Cheques, etc., to its account holders.

Key Differences Between Central Bank and Commercial Bank

The following are the differences between central bank and commercial bank

- The bank, which monitors, regulates and controls the financial system of the economy is known as Central Bank. The financial institution which receives the deposits from people and advances them money is known as Commercial Bank.

- Central Bank is the banker to banks, government, and financial institution, whereas Commercial Bank is the banker to the citizens.

- The Central Bank is the supreme monetary authority of the country. As against this, the commercial bank does not have such authority and powers.

- The Central Bank of India i.e. the Reserve Bank of India is governed by RBI Act, 1934. Conversely, the Commercial Bank are regulated by the Banking Regulation Act, 1949.

- The Central Bank is a publicly owned institution while the Commercial Bank can be publicly or privately owned institution.

- The Central Bank does not exist for making a profit, whereas commercial bank operates for making a profit for its owners.

- The Central Bank is the fundamental source of money supply in the economy. On the contrary, the commercial bank does not perform such function.

- The Central Bank does not deal with the general public, but Commercial Bank does.

- The Central Bank has got the authority to print and issue the notes. On the other hand, the commercial bank does not have such authority.

- The main purpose of Central Bank is public welfare and economic development. In contrast Commercial Bank, which runs for-profit motive.

- There is only one Central Bank in every country, but the Commercial Banks are many which serve the whole country.

Conclusion

The Central Bank is the leading public financial institution that governs the entire banking system in the country. It has full control over all the commercial banks in the country. The Central Bank regulates the flow of money in the economy. The apex bank adopts various measures like Cash Reserve Ratio, Statutory Liquidity Ratio, Bank Rate, Repo Rate, Reverse Repo Rate, etc. to control the supply of money.

Harsh Oza says

Very helpful, easy to understand and fun to read articles. Nice work 🙂

Hriddhimoybose says

Good

praveen says

It is seems easy to read your articles than reading enormous books .

This article is simple and precise

nalwanga fatima says

Good notes. Thanks

Silu lata sahoo says

Nice word 👌 👏

faiz says

Thank you so much for providing an easy way the difference between commercial bank and central bank