Basically, there are two types of circular flow of income – Real Flow and Money Flow. The biggest difference between real flow and money flow is that in case of real flow, exchange of goods and services takes place among various sectors of the economy, but when we talk about money flow, the monetary exchange between the two sectors exists.

Basically, there are two types of circular flow of income – Real Flow and Money Flow. The biggest difference between real flow and money flow is that in case of real flow, exchange of goods and services takes place among various sectors of the economy, but when we talk about money flow, the monetary exchange between the two sectors exists.

A two-sector economy is one where only two sectors exist, i.e. the household sector, which represents the consumer group and producer sector which represents firms.

What is Circular Flow of Income?

The ongoing movement or exchange of goods and services and money across various sectors of the economy is termed as Circular Flow of Income:

Principles of Circular Flow of Income

- In the process of exchange, the amount received by the seller is equal to the amount spent by the buyer.

- In one direction, there is the flow of goods and services, while in the opposite direction there is a flow of money, with respect to the payments for availing the goods and services, which results in a circular flow.

In this post, we will talk about all the important differences between real flow and money flow, using diagram and examples.

Content: Real Flow Vs Money Flow

Comparison Chart

Definition of Real Flow

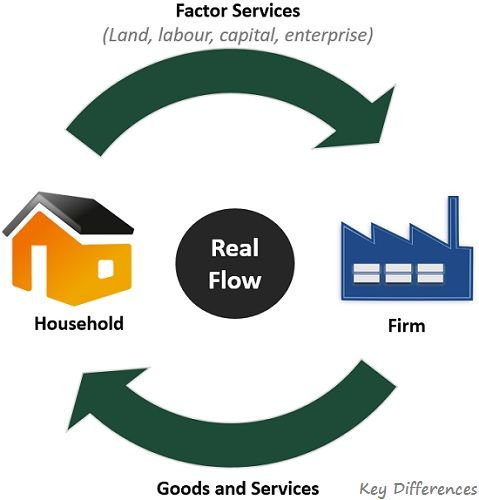

Real flow is when goods and services move from one sector of the economy to another sector. Real flow is named so because there is the physical transfer of goods and services amidst the two sectors, i.e. households and firms. Hence, it is also termed as product flow or physical flow.

In real flow, the household sector being the owners of the inputs supply factor services in the form of raw material, land, labour, capital and enterprise to the firm, and in exchange, the firm provides goods and services to meet the demand of the households. Therefore, real flow is in the form of:

- The household sector provides factors of production to the producer sector.

- The actual flow of final goods and services from producers (firms) to consumers (households).

Further, it acts as a reward for the productive services offered by the households to the firms. And in this way, money does not play any role in real flow, due which the difficulties of barter exchange may take place.

As you can see in the figure shown above, the two arrows represent real flows. Moreover, and the sectors are interdependent on one another.

Also Read: Difference Between Stock and Flow

Definition of Money Flow

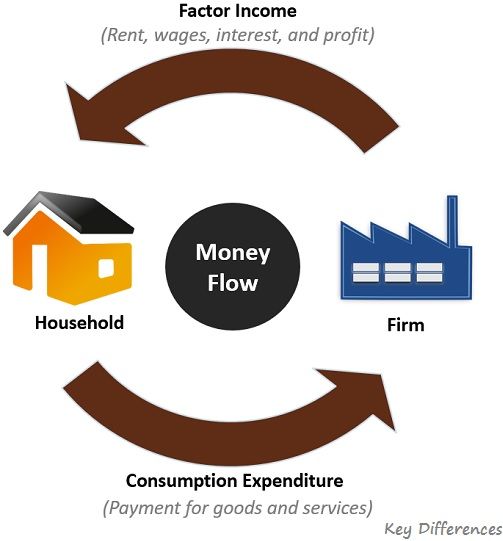

In money flow, the household sector receives monetary payments in the form of rent, wages and salaries, interest and profit, for the factor services offered by them to the firm. In return, the household sector, i.e. the consumers spend the money received by them on buying goods and services produced by the firms, so as to satisfy their wants.

In this way, money flows back to the firms, in the form of consumption expenditure on the goods and services.

The basic concept behind money flow is that goods and services, and factor services are valued in monetary terms in a modern economy. Therefore, all the payments made by the firms to the households for the factors of production provided and by the households to the firm for the goods and services purchased, are made in the legal tender of the country.

In a nutshell,

- Households represent consumers of goods and services, which also owns the factors of production.

- Firms represent the producer group, who produce the goods and services, and for this, they require inputs and so they hire factors of production from the household sector.

- Therefore, firstly money flows from firms to households in the form of factor payments for the factors of production provided by the household sector and then the money flows from households to the firms, in the form of consumption expenditure.

Hence, in a money flow, money acts as a medium of exchange, which facilitates transactions between the two sectors. So, it is free from the difficulties that arise in barter exchange. Alternately, it is called as income flow or nominal flow.

As you can see in the figure, the two arrows indicate the money flow between the two sectors in the economy.

Key Differences Between Real Flow and Money Flow

Let us understand the difference between real flow and money flow, in the elaborated form:

- Real flow involves the flow of factor services from the owners (households) to producers (firms) and a corresponding flow of goods and services from the producers (firms) to consumers (households). Conversely, we all know that flow of factor services generates factor income, i.e. rent, wages, interest and profit, from the firm to the households, and a corresponding flow of consumption expenditure takes place from the household to the firm.

- Real flow is also termed as physical flow because in real flow there is an actual movement of goods and services between households and firms. On the contrary, money flow is alternately known as nominal flow, because the transactions take place, using money as a medium of exchange.

- In case of real flow, the movement of factor services, and goods and services, takes place in a clockwise direction, but in case of money flow, the movement is reversed, and so the flow takes place in an anticlockwise direction.

- Real flows involve the flow of factors of production, i.e land, labour, capital and enterprise and in turn, the firms supply final goods and services to the consumers so as to satisfy their demand. As against, in case of money flow remuneration is provided to households by the firms for factor services in the form of rent for land, wages for labour, interest for capital employed, and profit for enterprise and in return, consumers spend the money to buy goods and services from the firms.

- In a money flow, money is used as a medium of exchange, which facilitates transactions, by valuing them in monetary terms. In contrast, in real flow money is not used as a medium of exchange, rather physical flow of factors of production and goods and services takes place. Therefore, the drawbacks of the barter system may take place.

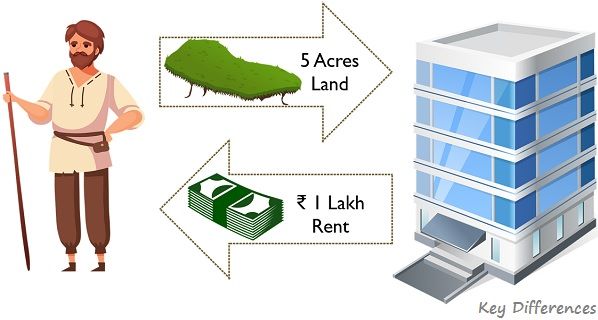

Example

Suppose a person provides 5 acres of land on rent to a company, for which he receives ₹ 1,00,000 every month as rent. It indicates a money flow of ₹ 1,00,000 as factor income, from the company to the person, and at the same time there is a flow of factor of production (land) of the equal amount from the person to the company, indicating the real flow.

So, we can say that the situation prevails in the whole economy.

Conclusion

With the above discussion, it is quite clear that real flows and money flows represents two sides of the coin, wherein the real flow of goods and services is equivalent to the same yet opposite money flow. Hence, goods and services flow in one direction and the monetary payment to avail these services flow in the reverse direction.

Leave a Reply