Normal loss is an unalienable loss, that occurs during the production process. These losses are immediately recorded in the books of accounts and apportioned over the remaining product units. On the other hand, any loss arising accidentally due to unforeseen events is termed as an abnormal loss. As these are considered as an expense to the company, the cost is not included in the cost of production.

Normal loss is an unalienable loss, that occurs during the production process. These losses are immediately recorded in the books of accounts and apportioned over the remaining product units. On the other hand, any loss arising accidentally due to unforeseen events is termed as an abnormal loss. As these are considered as an expense to the company, the cost is not included in the cost of production.

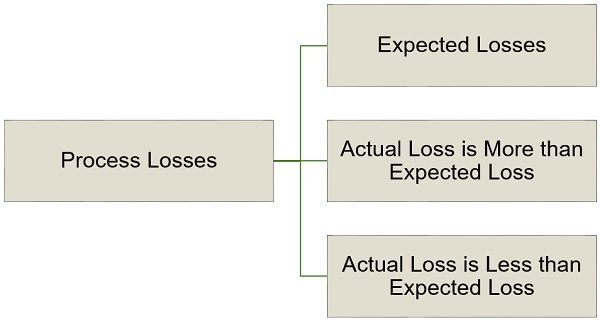

Losses generally occur at the time of processing input during the process. Such losses arise because of issues in the operating environment, defects in raw materials, problems with machinery, evaporation, spoilage, shrinkage, etc. In case of losses, there can be three possibilities:

Here, the first possibility indicates normal loss, the second possibility indicates abnormal loss, and the last one is an indicator of abnormal gain.

Process Loss = Normal Loss + Abnormal Loss

This content describes the difference between normal loss and abnormal loss.

Content: Normal Loss Vs Abnormal Loss

Comparison Chart

| Basis for Comparison | Normal Loss | Abnormal Loss |

|---|---|---|

| Meaning | Normal Loss is a loss that takes place due to the inherent nature of the raw materials and process of production under ordinary circumstances. | Abnormal Loss refers to a loss that arises due to unexpected events like defective material, carelessness, machinery breakdown, etc. |

| Estimation | It can be estimated beforehand, based on past experience. | It cannot be estimated beforehand. |

| Nature of loss | Expected | Unexpected |

| Realizable Value | Credited to Process Account | Credited to Abnormal Loss Account |

| Treatment of Cost of Loss | Treated as an element of the cost of production. | It is not treated as an element of the cost of production. |

| Insurable | No | Yes |

| Value of Stock | Inflated to cover the normal loss | No impact on value of stock |

Definition of Normal Loss

Normal Loss refers to the loss that cannot be avoided due to the nature of raw material. There are instances when at the time of the production process some quantity of material is lost, which is named as spoiled units, shrinkage, rusting, or evaporation. However, when it happens on a regular basis, then the loss is regarded as a normal loss.

Such losses can neither be eliminated nor reduced, irrespective of the operating conditions. Prior to the starting of production, provision is generally made for such losses.

Forms of Normal Loss

- Normal Waste

- Normal Scrap

- Normal Spoilage

- Normal Defectives

Normal Losses are not charged to closing work in progress, as they are deemed as a part of the cost of production. At the time of computation of equivalent units, normal losses are not considered and in this way, the cost of normal loss is instinctively apportioned to the total units produced, when it is subtracted from the cost of raw material.

Features of Normal Loss

- It can be easily estimated in advance, using past experience and empirical formulas.

- It is expressed in terms of the percentage of input to each process.

- It may occur either at the beginning of the process or during a process.

- It is expected to occur in normal conditions of the process.

Calculation of Units

Number of Normal Loss Units = Input × Expected Percentage of Normal Loss

Calculation of Cost of goods per unit

Accounting treatment

- The cost of normal loss is considered as a part of the cost of production. In this way, the cost of normal loss absorbs the units of goods produced which increases the per-unit cost.

- Further, the cost of the process is reduced when any amount is recovered as sale proceeds.

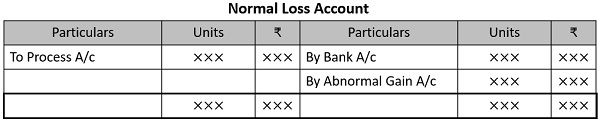

Format of Normal Loss Account

Also Read: Difference Between Cost Sheet and Production Account

Definition of Abnormal Loss

Loss which arises due to unexpected or abnormal conditions including substandard materials, mishandling, carelessness of workers, bad plant design, unplanned operations, lack of knowledge, accident, theft, machinery breakdown, etc is called abnormal loss.

It is a loss that exceeds the anticipated margin for normal process loss.

Features of Abnormal Loss

- It is an unanticipated loss.

- Losses occur as a result of non-recurring and unusual events.

- These are not inherent to the process of production or manufacturing.

- It is represented by the difference between actual loss and expected loss.

- It can be controlled if appropriate preventive measures are taken.

- It is written off to the profit and loss account as period cost.

Calculation of Units

Units of Abnormal Loss = Expected Output – Actual Output

Expected Output = Input – Normal Loss

Calculation of Cost of Abnormal Loss

Accounting Treatment

- The cost of abnormal loss is not added to the cost of production. Further, it is not subsumed by the units of goods produced.

- The cost of abnormal loss is charged to a separate account called Costing Profit and Loss Account.

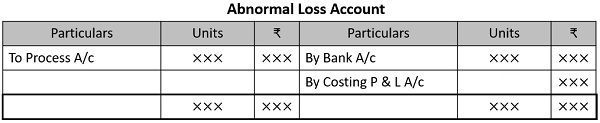

Format of Abnormal Loss

Also Read: Difference Between Job Costing and Process Costing

Key Differences Between Normal Loss And Abnormal Loss

After understanding the meaning, calculation, and format of the two types of process losses. We are going to talk about the difference between normal loss and abnormal loss:

- Normal Loss refers to the amount of loss that can’t be avoided, due to the nature of material or process is called normal process loss. Conversely, the abnormal loss is one such loss that is unlikely to occur under normal conditions.

- Management of the firm estimates the normal loss in advance based on the previous experience and data of the past period, as a part of cost control. As against, Abnormal Loss is not possible to estimate in advance, as these are non-recurring in nature and they occur abruptly.

- Normal losses are expected as they occur at the normal process of production. In contrast, abnormal loss is unexpected, as they arise due to inefficiencies in the production process and can be avoided when the production environment is efficient.

- When normal loss is physical, i.e. as a scrap. Hence, some value can be realized by selling the scrap at a certain price. and whatever the amount received from the proceeds, it is credited to Process Account. On the other hand, if the abnormal loss is physical in the form of scrap, any value received as sale proceeds, the amount is credited to the Abnormal Loss Account.

- Fundamentally, it is the cost of production that bears the cost of normal loss. Unlike normal loss, the abnormal loss is transferred to the Costing Profit and Loss Account (CPLA).

- While the abnormal loss is insurable, the normal loss is non-insurable.

- The value of the stock is inflated so as to cover the normal loss, whereas the value of the stock remains unaffected in case of abnormal loss.

What is Abnormal Gain?

There are a number of exceptional cases when the actual process loss is comparatively less than the expected loss. It is called abnormal gain. It is also known as effectiveness.

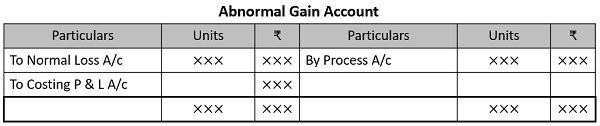

The reporting of abnormal gains has to be done separately so that the management has knowledge of the gains. Basically, the treatment of abnormal gain is similar to abnormal loss. It is credited to the abnormal gain account. Further, the abnormal gain account is shown at the debit side of the concerned process account.

Calculation of Units of Abnormal Gain

Units of Abnormal Gain = Actual Output – Expected Output

Expected Output = Input – Normal Loss

Calculation of Cost of Abnormal Gain

Format of Abnormal Loss

Example

Using the given information compute:

- Normal Loss in units

- Abnormal Loss in units

- Abnormal gain in units

Input 4000 units and normal loss is 10% of the input

Actual Output is –

- Case a: 3400 units,

- Case b: 3800 units

Case a: Actual Output is 3400 units

Normal Loss = 10% of 4000 units = 400 units

Abnormal Loss = Expected Output – Actual Output

Expected Output = Input – Normal Loss

= 4000 – 400 = 3600 units

Abnormal Loss = 3600 – 3400 = 200 units

Case b: Actual Output is 3800 units

Normal Loss = 10% of 4000 units = 400 units

Abnormal Gain = Actual Output – Expected Output

= 3800 – 3600 = 200 units

Conclusion

Identification of abnormal loss is quite important so that the company’s management has an idea of the extent to which the actual losses are not in line with the expected ones.

Dinuka Sandaruwan says

The content is very helpful and very understandable, and I solved my doubts in doing process accounting too.