About 10 years ago, only full-service brokers were ranked at the top positions on the stock brokers list. But now, if you see the charts, most of the top brokers are discount brokers covering more than 50% of the active investors. Isn’t it a big change? In fact, the total number of active investors is doubled all this time.

About 10 years ago, only full-service brokers were ranked at the top positions on the stock brokers list. But now, if you see the charts, most of the top brokers are discount brokers covering more than 50% of the active investors. Isn’t it a big change? In fact, the total number of active investors is doubled all this time.

While Discount Brokers provide trading platforms and free trading software to the investors. It is just like a self-service facility for investors. Full-Service Brokers not just provide a trading platform but also provides advisory for various investment products. They give information where you read those advisories and learn.

Introduction

As we all know that everyone needs a Demat account for investing in the stock market. And a Demat account is opened with a depository participant or DP, i.e. broker for which numerous firms are there. These brokerage firms can be grouped into three kinds which include – full-service brokers, banks, and discount brokers.

All the brokers provide a range of investment products. They also provide margin trading. Apart from that, they provide trading apps to facilitate buying and selling transactions. These facilities are provided by almost all brokers.

Together with your saving account and trading account, the investor can use his Demat account for buying, holding, and selling securities.

Also Read: Difference Between Demat Account and Trading Account

What are Stockbrokers?

A stockbroker is a professional with a license who purchases and sells stocks on behalf of the clients. It also offers advice to its clients on which stocks to invest in. The stock broker, in return, makes a commission on whatever items the investor buys. A stockbroker is a person who is employed in a brokerage company or it refers to the brokerage firm itself.

In this post, we will discuss the difference between a discount broker and a full-service broker.

Content: Full-Service Broker Vs Discount Broker

- Comparison Chart

- What is Full-Service Broker?

- What is Discount Broker?

- Comparison of Charges and Taxes

- Key Differences

- Which one to choose?

Comparison Chart

| Basis for Comparison | Full-Service Broker | Discount Broker |

|---|---|---|

| Meaning | A full-service broker is a broking company that provides a host of services to their clients. | A discount broker is a broker firm, that allows you to trade in stocks and other investments online. |

| Brokerage | High as they charge commission in percentage terms of each trade executed. | Comparatively low. They offer a flat fee on each trade executed. |

| Services provided | Provides a platform for trade and advisory for investment purposes. | Only a trading platform is provided. |

| Suitable for | Beginners and Busy people | Those who have got time and knowledge to research on their own or have a financial advisor. |

| Network | Numerous branches are present all over the country. | Do not have branches |

| Customer Support | Both online and offline customer support is available. | Online customer support is available. |

What is Full-Service Broker?

A Full-Service Broker is a professional stockbroker who advises their clients about which securities investors should buy or sell. For this purpose, they take into account the investment goals of the investors in the first place, along with their risk tolerance level.

Moreover, the information that the investor provides and the knowledge of the broker about the market are taken together to select stocks to help you reach your goal. Not just this, they also suggest the right timing for stock trades. Also, they carry out the transaction on your behalf. They have many branches across the country. Clients can reach out to those branches and discuss their queries with the executive.

For all these services, you will be charged some commission as brokerage. Brokerage charged by the full-service broker is high because of the array of services that they offer. They do not just provide fundamental reports but also technical calls for investors and traders.

Services Provided by Full-Service Broker

Full-Service Broker provides a number of add-on services to the investor along with providing a trading platform. This includes services like:

- Relationship Manager: It provides personalized services by appointing a relationship manager or advisor for the investor who will work on making the portfolio profitable. It comes under portfolio management services, which means the professional will keep the portfolio updated.

- On-call support: Whenever the investors have any query then, they have this facility to contact the relationship manager and resolve the query.

- Free call and trade facility: They also provide call and trade facilities. So you can call the broker and tell them to buy or sell the shares. And based on the request of the investor, the broker executes the order.

- Recommendation facility: Full-Service Broker provides recommendation tips by means of SMS, Whatsapp, calls and email.

- Research Reports: They also provide research reports to their clients.

- Updates: Full-Service Brokers also keep you posted about your account activity and balances.

- Advise to clients: Full-Service Brokers, along with offering trading platforms and trading accounts for the purpose of trade, also provide advice to the investors on:

- How to invest?

- How much to invest?

- Where to invest?

- What is the right timing to invest?

Example

- Sharekhan

- Motilal Oswal Securities

- Edelweiss

- IIFL

Also Read: Difference Between Bull Market and Bear Market

What is Discount Broker?

A discount broker is a professional stockbroker who buys and sells securities at a minimum commission on behalf of the investor. They are known for offering low-cost brokerage. Due to this reason, they offer essential services only, i.e. undertaking buying and selling of orders. However, they also provide no advice. Generally, they charge a flat fee for providing services such services.

Features of Discount Brokers

- These are technology-oriented brokers, as they use online platforms to provide services to clients. The investors can execute trade electronically via an app or website.

- They do not provide stock recommendation tips. Due to this reason, their brokerage charges are less.

- Their operation cost is low, as they offer a trading avenue to the investors and do not provide any advisory services.

- Now you must be wondering: Why the operation cost of the discount broker is low?

Well, Discount Brokers do not appoint any relationship manager. And that is why in case the investor has any query related to the trading process or if he wants to get some information, then he needs to mail the message to the company’s mail id or contact them on the toll-free number provided by the broker. However, they charge a fee for call and trade services.A number of discount brokers do have educational tools and resources which an investor can use as a guide for investing purposes.

Services Not Provided

- Free Trading calls

- Free Research Reports

- Margin Funding (However, some discount brokers provide this service also.)

Services Provided

- Margin Against shares

- Mobile trading

- Charting

- Automated trading

What is Margin Funding?

Margin Funding is a facility provided by brokers in which the investor can buy shares of more amount than they actually have for investing. Suppose a person has ₹ 50,000 in their account, and he buys shares of ₹ 1,20,000. So, the additional amount, i.e. ₹ 70,000, which is a net of ₹ 1,20,000 less ₹ 50,000, is extended by the broker as a loan to the investor. And on this amount, interest is charged at a fixed rate.

Example

- Zerodha

- 5paisa.com

- Upstox

- Groww

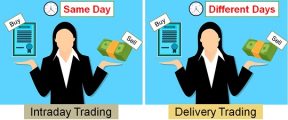

Also Read: Difference Between Trading and Investing

Comparison of Charges and Taxes

| Basis | Full-Service Broker | Discount Broker |

|---|---|---|

| Intraday | ||

| Brokerage | High | Comparatively Low |

| Exchange Transaction Charge | NSE: 0.00325% BSE: 0.003% | NSE: 0.00325% BSE: 0.003% |

| GST on Brokerage | 18% | 18% |

| GST on Exchange Transaction Charges | 18% | 18% |

| Securities Transaction Tax (STT) | 0.025% on sale | 0.025% on sale |

| SEBI Turnover Charges | 0.0001% (buy and sell) | 0.0001% (buy and sell) |

| Stamp Duty (varies state-wise) | 0.010% - 0.015% | 0.010% - 0.015% |

| Delivery | ||

| Brokerage | High | Comparatively Low |

| Exchange Transaction Charge | NSE: 0.00325% BSE: 0.003% | NSE: 0.00325% BSE: 0.003% |

| GST on Brokerage | 18% | 18% |

| GST on Exchange Transaction Charge | 18% | 18% |

| Securities Transaction Tax (STT) | 0.1% on sale | 0.1% on sale |

| SEBI Turnover Charges | 0.0001% on buy and sell | 0.0001% on buy and sell |

| Stamp Duty (varies state-wise) | 0.010% - 0.015% | 0.010% - 0.015% |

Points to Note:

Apart from the above charges, the investor has to pay these charges as well:

- Account Opening Charges: It is a one-time expense that differs from broker to broker.

- Annual Maintenance Charges (AMC): The investor has to pay AMC every year. They also differ from broker to broker.

- DP Charges: In case of delivery, DP, i.e. Depository Participant, charges are levied per scrip (i.e. per company). These are charged by both depository (NSDL or CDSL) and a broker. Along with that, GST on DP charges is also applicable at 18%.

Key Differences Between Full-Service Broker and Discount Broker

- A discount brokerage account is one that you can choose when you want to learn to invest and trade by yourself or if you possess enough experience. On the contrary, Full-Service Brokers are traditional brokers who offer an array of services along with providing trading platforms. The services include client-dedicated relationship managers, advisory, customized support, financial planning services, and wealth management services.

- Full-service brokers provide a range of services to the people; they charge a high amount as brokerage. Whereas Discount Service Broker offers essential services only and that is why their brokerage charges are less.

- Full-Service Brokers not only provide buy and sell orders to the clients. They provide a range of services which include research on trending subjects, sectoral and stock research, and tax planning. Conversely, Discount Brokers are self-directed. They do not provide advisory services to their clients.

- Discount Brokers do not have many branches. They are pure-click companies. Whereas Full-Service brokers operate through numerous branches. The presence of full-service brokers is both online and offline. So they are brick-and-click companies.

- While most discount brokers provide investments in stocks, commodities, derivatives, and mutual funds only. Full-Service Brokers offer investment in various investment products under a single roof.

- Full-Service Brokers are best for those who are busy in their lives and career and do not have much time to perform research to manage their own investments. It also suits novice investors with no or limited knowledge about stock trading and requires assistance in every step of the trading process. As against, Discount Brokers are apt for those who are experienced in the trading field and can research on their own. Also, those who have good financial advisors can also opt for discount brokers.

Which one to choose?

Well, the answer to this question relies upon your knowledge, time, and needs. This means that if you have been investing for a long time and have good knowledge about investing, then you could go for a discount broker.

Oppositely, if you do not have much time to research by yourself, then a full-service broker is the best pick for you. Also, if you need a financial advisor to guide you in your investing, then a full-service broker is a good choice. But at the same time, if you do not want to pay extra charges to your broker, then you could go for a discount broker.

In short, the choice is yours; invest wisely. As an investor, you should always check the charges of brokerage and taxes.

KRISHNA KUMAR says

Hey, I have understood the full-service and discount broker.

which is better discount broker, Zerodha or upstox?