A balance sheet, or otherwise known as a position statement. It is a statement which shows the financial position of the company on a specific date. It lists all the Ownership, i.e. assets and Owings, i.e. liabilities of the company. A profit and loss account, on the other hand, is an account that shows the revenue earned and expenses sustained by the company, during the course of business, in a financial year.

A balance sheet, or otherwise known as a position statement. It is a statement which shows the financial position of the company on a specific date. It lists all the Ownership, i.e. assets and Owings, i.e. liabilities of the company. A profit and loss account, on the other hand, is an account that shows the revenue earned and expenses sustained by the company, during the course of business, in a financial year.

These two along with the cash flow statement constitute the financial statement. It is helpful to all the stakeholders in ascertaining the financial position, profitability, and performance of the enterprise.

In this post, we have elaborated on the differences between balance sheet and profit and loss account.

Content: Balance Sheet Vs Profit and Loss Account

- Comparison Chart

- What is Balance Sheet?

- What is Profit and Loss Account?

- Key Differences

- Format

- Conclusion

Comparison Chart

| Basis for Comparison | Balance Sheet | Profit and Loss Account |

|---|---|---|

| Meaning | A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date. | A profit and loss account is an account that shows the revenue and expenses of the firm from business operations during a financial year. |

| What is it? | Statement | Account |

| Represents | The financial position of the business on a particular date. | Profit earned or loss suffered by the business for the accounting period. |

| Preparation | Prepared at the end of the financial year. | Prepared for the financial year. |

| Information Disclosed | Assets, liabilities, and capital of shareholders. | Income, expenses, gains and losses. |

| Sequence | It is prepared after the preparation of the Profit and Loss Account. | It is prepared before the preparation of the Balance Sheet. |

What is a Balance Sheet?

A balance sheet is like a mirror that gives the user a clear view of the actual position of the firm. The position will be reflected through the status of the assets, liability and capital of the firm on a particular date. Due to this very reason, the balance sheet is called a position statement.

As we follow a double-entry system of bookkeeping, in which every debit has a corresponding credit. So, as per the accounting equation also the total of the asset side must tally the total of liabilities side.

On the liabilities side, you will find creditor’s equity and owner’s equity i.e. capital. In short, the claim of the creditors and owners must be equal to the firm’s assets.

There are two sides of a Balance Sheet:

- Equity and Liabilities

- Assets

Also Read: Difference Between Balance Sheet and Financial Statement

Features of Balance Sheet

- It is a statement of assets and liabilities. It contains the final balances viz the closing balance of all assets and liabilities of the enterprise.

- We prepare a balance sheet on a specific date which is the end of the accounting period.

- Gives knowledge of the true financial position of the business.

Nature of Balance Sheet

The balance sheet highlights the financial position of the firm in terms of liquidity and solvency at the end of the financial year. The financial status of the firm is revealed by way of the total amount of resources raised from different sources in the form of equity and liabilities and applied in the form of assets. It is a periodic statement. The company prepares after the preparation of the income statement.

The amount with which assets of the firm exceed liabilities is the capital of the firm. The financial position so reflected is in terms of historical cost. Hence, it does not disclose the actual realizable value of assets.

Functions of Balance Sheet

- It discloses the total value of resources and obligations of the concern at the end of the financial year.

- Helps in the ascertainment of the working capital and capital employed by the firm.

- With the help of the data available from the balance sheet, the financial strength of the company can be determined.

- Provides relevant information to the stakeholders that help in making rational decisions in future.

What is a Profit and Loss Account

The Profit and Loss Account of the enterprise discloses the net profit or loss of the firm. This account is prepared for one operating cycle of the enterprise. Because it is a nominal account, the transactions are recorded as per the golden rules regarding the concerned account.

Here you should note that we prepare profit and loss accounts for a single operating cycle i.e. a 12 month period. However, firms can also prepare quarter-wise profit and loss accounts. In this, all the expenses and losses appear on the debit side whereas all the incomes and gains appear on the credit side.

You might be thinking why do we bring down the gross profit/loss account of the trading account into the debit/credit of the Profit and Loss Account?

So, we do this to conform to the nominal accounting ruling with regard to debiting all expenses and losses and crediting all incomes and gains.

The expenses which are taken into account to reach the net profit are classified into four major sections:

- Administrative Expenses

- Selling & Distribution Expenses

- Financial Expenses

- Legal Expenses

We prepare the profit and loss account of an enterprise at the end of the financial year. It is prepared to identify the end result of the business operations.

Features of Profit and Loss Account

- Nominal Account

- Prepared at the end of the financial year

- At the time of preparation of the profit and loss account, the firm should follow the accrual concept.

- All the incomes except income from the sale of goods are taken into consideration.

- The end result of the profit and loss account is called net profit or loss. This amount is taken to the capital account in the case of proprietory business. However, in the case of the partnership business, it is taken into profit and loss appropriation account.

Also Read: Difference Between Trading and Profit and Loss Account

Key Differences Between Profit and Loss Account and Balance Sheet

The points given here will explain the difference between profit and loss account and balance sheet:

- A Balance Sheet is a statement that shows the financial position of the entity at a given date. As you have seen that on the top of the Balance Sheet there is, “as at……” written which states the particular date at which it is prepared. On the contrary, the Profit and Loss Account is just one part of the income statement. It is also referred to as a statement of revenue and expenses. It represents the profitability position of the enterprise for a particular period.

- Because a balance sheet is a statement and not an account, it can be drawn up vertically or horizontally. On the other hand, a Profit and Loss Account is an account. You must be wondering:

Why a balance sheet is a statement and not an account?

So, an account is created on the basis of journal entries, but a balance sheet is based on closing balances of the accounts and not journal entries.

Moreover, a ledger account indicates a short description of the classified transactions. Whereas a balance sheet does not indicate a short description. Also, the two sides of a balance sheet are always equal, but the two sides of a ledger account rarely tally. And that is why balancing of the account is done.

- The Balance Sheet reveals the entity’s financial position. Whereas the Profit and Loss, account discloses the entity’s profitability and performance, i.e. profit earned or loss suffered by the business for the accounting period.

- Accounts which are transferred to profit and loss accounts are closed and lose their identity. On the contrary, those accounts which are transferred to the Balance sheet do not cease to exist rather their balance is carried forward to the next accounting year and considered as opening balances.

- A Balance Sheet gives an overview of the assets, equity, and liabilities of the company, but the Profit and Loss Account is a depiction of the entity’s revenue and expenses.

- When it comes to sequence, we prepare a trading account first, then we prepare a profit and loss account. After that, we start preparing a balance sheet.

Format of Balance Sheet

Equity and Liabilities

Shareholder’s Funds: It is sub-classified into three parts i.e. Share capital, Reserves and Surplus and Money Received against share Warrants.

- Share Capital: The total amount of shares – equity plus preference issued to the general public.

- Reserves and Surplus: It comprises reserves like:

- Capital Reserve

- Capital Redemption Reserve

- Securities Premium Reserve

- Debenture Redemption Reserve

- Revaluation Reserve

- Share Options Outstanding Account

Surplus is the remaining amount in the statement of profit and loss account indicating the allocations and appropriations. This may cover the dividend, bonus shares and transfer to or from reserves.

- Money Received against Share Warrants: First, we will understand what is Share warrant. A share warrant is an instrument that represents that the holder of the shares has ownership of such shares. And the money received on the sale of share warrants of the company is Money Received against Share Warrants.

Share application money pending allotment: Share application money that is not more than the amount of issued capital and up to the extent not refundable is displayed here.

Non-Current Liabilities:

- Long term Borrowings: Loans whose repayment date falls after twelve months are long term borrowings.

- Deferred Tax liability: The tax debt that a business has. And it has to pay in the future is Deferred Tax Liability.

Current Liabilities:

- Short term Borrowings: Loans which are repayable on demand or whose repayment date falls within twelve months are short term borrowings.

- Trade Payables: It includes sundry creditors and bills payable.

- Provisions: Those provisions which need settlement within one year from the date on which the balance sheet is prepared

Assets

Non-Current Assets:

- Fixed Assets: Assets which remain in the business for the long term is a fixed asset. It covers:

- Tangible Assets: Assets that can be seen and touched are tangible assets like Building, Furniture, Plant and Machinery etc.

- Intangible Assets: Assets that can neither be seen nor touched but they can only be experienced are intangible assets like Goodwill, Patent, Copyright, etc

- Capital Work in Progress: When the development of a tangible asset is not complete at the time of preparation of the balance sheet. So, all the costs incurred on that particular asset up to the balance sheet date are transferred to this account.

- Intangible Assets under Development: When the development of an intangible asset is not complete at the time of preparation of the balance sheet. So, all the costs incurred on that particular asset up to the balance sheet date are transferred to this account.

- Non-Current Investments: Investments expected to take more than twelve months to realize are non-current investments.

- Other Non-Current Assets: Trade Receivables whose date of maturity falls beyond twelve months are other non-current assets.

- Deferred Tax Assets: A business tax credit for future taxes is a deferred tax asset.

Current Assets

- Current Investments: These are the investments which are expected to realize within the period of twelve months are current investments.

- Inventory: Stock to be sold by the business.

- Trade Receivables: It includes debtors and bills receivables which are to be realized within twelve months.

- Cash and Cash Equivalents: Funds which are readily available with the business refer to cash and cash equivalents. Here, cash equivalents cover those instruments which can be converted into cash within 3 months.

Also Read: Difference Between Assets and Liabilities

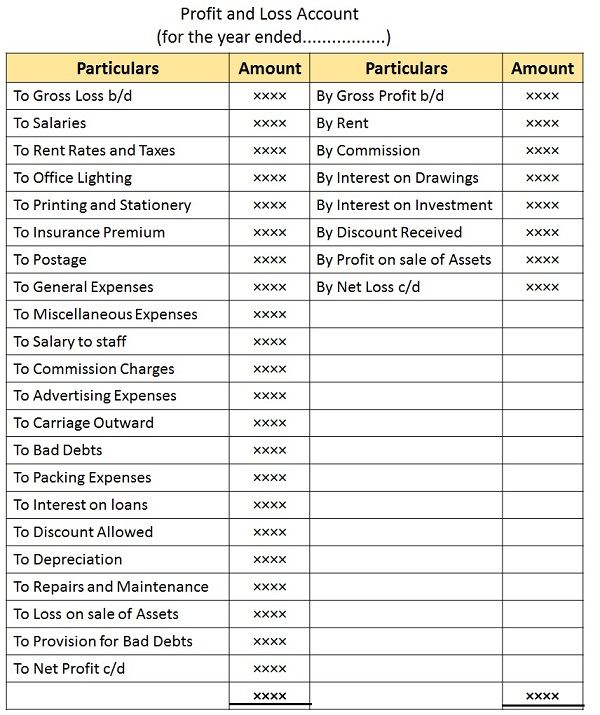

Format of Profit and Loss Account

From the above format, you should note that the balancing process of the Profit and Loss Account can result in:

- Net Profit: It is the result of an excess of incomes and gains appearing on the credit side over the expenses and losses appearing on the debit side of the account.

- Net Loss: When the expenses and losses appearing on the debit side exceed the incomes and gains appearing on the credit. The result will be a net loss.

Conclusion

All in all, a Balance Sheet is a statement of assets and liabilities. In contrast, the Profit and Loss Account is an account that shows revenues and expenses for the period. So, the Profit and Loss Account presents the net results of business activity during an accounting period.

Jeevanthi says

Well explained about the differences between balance sheet and Profit& Loss Account.

Vaibhav Karn says

Can u plz post differences between on balance sheet and off balance sheet?