In finance, the term ‘insolvency’ can be used in the context of both individuals and organizations. Insolvency represents that particular ‘state’ in which the individual or organization is not able to settle debts on time when they fall due for payment because of lack of funds or bank balance. On the other hand, Bankruptcy can be defined as a formal and legal declaration of an individual’s inability to settle debts.

In finance, the term ‘insolvency’ can be used in the context of both individuals and organizations. Insolvency represents that particular ‘state’ in which the individual or organization is not able to settle debts on time when they fall due for payment because of lack of funds or bank balance. On the other hand, Bankruptcy can be defined as a formal and legal declaration of an individual’s inability to settle debts.

What is Liquidation?

Liquidation implies the closure or winding up of the company, legally, due to its inability to discharge debts. For the purpose of clearing the indebtedness of the enterprise, the liquidator is appointed to carry out the process of liquidation who sells the assets at reasonable prices.

Also Read: Difference Between Bankruptcy and Liquidation

Do you know?

In India, a financial creditor, an operational creditor, or a corporate debtor can initiate the insolvency resolution process for the company when there is a default of ₹ 1 lakhs or more.

Having said that, let us take a read of the differences between insolvency and bankruptcy.

Content: Insolvency Vs Bankruptcy

- Comparison Chart

- Definition

- Key Differences

- Introduction to Insolvency and Bankruptcy Code

- Conclusion

Comparison Chart

| Basis for Comparison | Insolvency | Bankruptcy |

|---|---|---|

| Meaning | Insolvency is a financial state in which an individual or entity is not able to clear the dues/debts due to the insufficiency of funds. | Bankruptcy is a legal concept, wherein the court declares a person as bankrupt, on the failure of a resolution mechanism to settle the debts. |

| What is it? | State of Economic Distress | Conclusion |

| Nature | Temporary and amount can be recoverable. | Permanent and final, resulting in the selling of an individual's assets. |

| Last Resort | No | Yes |

| Process | Involuntary | Voluntary |

| Reversal | Individuals or companies can reverse course by using various means. | There is no reversing back. |

| Arises when | Assets are not sufficient to pay off liabilities. | Untreated insolvency results in bankruptcy in the case of individuals and liquidation in the case of corporates. |

| Used for | Individuals or body corporate | Individuals only. |

Definition of Insolvency

Insolvency is such a financial state which is caused due to the inability of an individual or company to pay off outstanding debts timely to the creditors or banks because the assets are insufficient. This usually arises when the cash inflows of a person are less than the cash outflows. So, their income is not enough to cover up their liabilities.

In the case of a company, it means that the total money inflows and the assets combined are less than its liabilities. It is reflected in:

- Cash flow crisis

- Loss of business contracts

- Fall in sales

- Loss of customers

- Poor Credit Ratings, etc.

Therefore, insufficient funds and liquidity can make the repayments of debts almost impossible, which makes a person insolvent.

When a person becomes insolvent, he/she may opt to file for bankruptcy to the court or he/she can also deal with the debts through other options, by taking necessary steps for its resolution.

Further, in the case of company insolvency arises when there is a continuous decline in sales and the company lacks enough working capital to finance its regular operations, for which the company raises loans from creditors or financial institutions. And when the situation does not get better it results in insolvency.

Also Read: Difference Between Liquidity and Solvency

Definition of Bankruptcy

Bankruptcy refers to the legal proceeding, with respect to a person who is not able to meet the financial obligations or has no such prospect of being able to repay the dues in the future when they fall due.

- It starts when a petition is filed by the debtor himself or the creditor before an appropriate authority or court by sending an application, wherein the individual declares himself as insolvent.

- So, it is up to the court to accept or dismiss the petition.

- On the acceptance of the petition, the court decides the appropriation of the personal assets of the insolvent among different creditors or banks.

- Hence, when a person files a petition regarding bankruptcy, he obliges to pay off what is owed by him for which he seeks help from the court.

It is the final stage of insolvency and gives a new lease to the insolvent to start afresh, i.e. it relieves the individual or a company from all the debts and other disadvantages of insolvency.

In this process, the assets of the debtor are measured and evaluated and these are used for the repayment of a part of the debt, the person or entity owes to their creditor. It takes place when the insolvency is determined by the court and legal orders are given for its resolution.

Also Read: Difference Between Assets and Liabilities

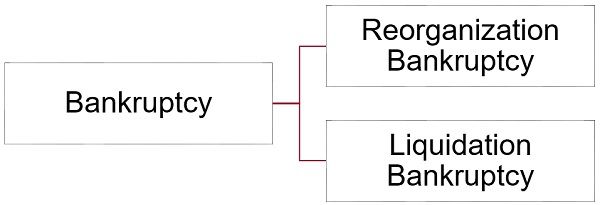

Forms of Bankruptcy

There are two forms of Bankruptcy which are discussed hereunder:

- Reorganization Bankruptcy: In this form, repayment plans are restructured by the debtor to make them more easily met.

- Liquidation Bankruptcy: In liquidation bankruptcy, certain assets are sold by the debtors to arrange money so that they can use the same for repaying creditors.

Key Differences Between Insolvency and Bankruptcy

As we have talked about the meaning of the two, let us discuss the difference between insolvency and bankruptcy:

- Insolvency refers to a state of financial distress wherein a person or enterprise is no longer able to pay the debts when they fall due for payment. On the other hand, Bankruptcy is a legal declaration by the court, on the failure of the insolvency resolution process to settle the debts of the person.

- Insolvency can be temporary and the initial stage defines the incapability to clear dues, whereas bankruptcy is permanent and the final stage, wherein the assets of the individual are sold to recover the debt.

- Insolvency is not the last resort, but bankruptcy is.

- Insolvency is non-voluntary, it takes place when the cash inflows are less in comparison to cash outflows of a person. Conversely, bankruptcy is voluntary in nature, i.e. debtor can file a petition to the court declaring himself as insolvent.

- Insolvency can be reversed by reducing cost, selling assets at reasonable prices, raising finance, negotiating debt, and getting acquired by a larger corporation. In contrast, once the bankruptcy is declared, there is no going back.

- Insolvency arises when the value of assets owned by the individual or company is less than the value of its liabilities. As against, bankruptcy arises when it remains untreated for the long term.

- While insolvency implies a state of economic distress, bankruptcy is a conclusion. A person who is bankrupt is conclusively insolvent, but all the insolvent persons are not bankrupt. That is to say, the situation of insolvency can be resolved, by following the mechanism as per the code. But if the resolution mechanism fails, it amounts to a liquidation process (in the case of corporates) and bankruptcy process (in the case of individuals).

- Insolvency happens in the case of individuals and companies, whereas bankruptcy takes place in the case of individuals only.

Introduction to Insolvency and Bankruptcy Code, 2016

Insolvency and Bankruptcy Code 2016 was implemented as a reform to provide comprehensive insolvency resolution which covers individuals, partnerships, and body corporates. Further, as per this code, both the parties debtor and creditor can begin the insolvency resolution process. It is also one of the major initiatives taken by the Indian Government to promote Ease of Doing Business (EODB).

- It consists of the Insolvency and Bankruptcy Board of India (IBBI), Insolvency Professionals (IP), Insolvency Professional Agencies (IPAs), Adjudicating Agencies (AAs), and Information Utilities (IUs). Basically, these are the foundations of the code.

- It contains 255 sections divided into five parts.

- It is aimed at providing a formal and timely insolvency resolution process.

Conclusion

While both situations denote the inability to pay off debts, insolvency can lead to bankruptcy, but this is not with every case as only those insolvencies turn into bankruptcies that remain untreated.

Jenny harisson says

Thank you for the information!

ABHINAV says

Great insight on ‘differences’. Will love to read a lot from your website about minute minute differences on various issues. Thanks !

FactorLoads says

Great article! Very informative. Thanks for sharing the key differences between insolvency and bankruptcy. This helps me to understand a lot of things about it.

We Factor says

This article is very helpful. This definitely help me to understand the difference between insolvency and bankruptcy. Thanks for sharing this article. This article will definitely help a lot of business owners.

Lauren says

Great article! I easily understand the difference between Insolvency and Bankruptcy. I think that this article is very informative and easy to understand. Thanks for sharing this article.

Birungi Mukalere Samuel says

thanks for the information

Ronald says

One of the best blogs I read about bankruptcy. This post was truly worthwhile to read. I wanted to say thank you for the key points you have pointed out as they are enlightening.