Bearer cheques are the ones on which payment is made to the bearer, i.e. the holder of the cheque who presents it to the bank. But order cheques are just the opposite, as only that person whose name the drawer writes on the cheque as the payee can take the payment. Further, the payee can pass this cheque to another party by signing on the back of the cheque, who can take payment on the payee’s behalf.

Bearer cheques are the ones on which payment is made to the bearer, i.e. the holder of the cheque who presents it to the bank. But order cheques are just the opposite, as only that person whose name the drawer writes on the cheque as the payee can take the payment. Further, the payee can pass this cheque to another party by signing on the back of the cheque, who can take payment on the payee’s behalf.

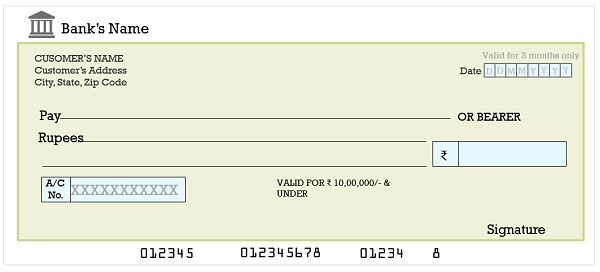

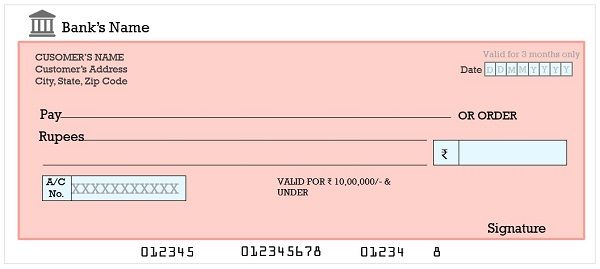

The best way to identify whether a cheque is an order or bearer is to look for the words in the cheque leaf itself. The bearer cheque has the word ‘or bearer‘ written on it. Whereas in order cheques, the word ‘or bearer‘ is struck out or the word ‘or order‘ is there after the end of the payee’s name.

What is a Cheque?

A cheque is a financial instrument which contains an order in writing that directs the bank to pay the sum specified in it from the concerned bank account. For this, all you need to do is – fill the required fields in the cheque leaf, such as:

- Date

- Amount both in number and words

- Name of recipient and

- Signature of the drawer.

The validity of the cheque is for 3 months.

Unless there is some specific reason, banks generally hand over the funds when the payee produces the cheque at the counter.

Banks provide a chequebook facility in both savings accounts and current accounts. Also, both individuals and corporate entities can use cheques as a mode of payment.

Parties Involved in a cheque.

- Drawer: He/She is the person who has the bank account and issues (draws) the cheque for making payment.

- Drawee: It represents the bank that will make the payment.

- Payee: It is the party to whom the money specified in the cheque is payable.

Content: Bearer Cheque Vs Order Cheque

- Comparison Chart

- What is Bearer Cheque?

- What is Order Cheque?

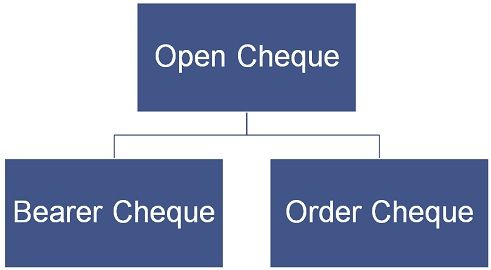

- Open Cheque

- Key Differences

- Conclusion

Comparison Chart

| Basis for Comparison | Bearer Cheque | Order Cheque |

|---|---|---|

| Meaning | Bearer Cheque is the one payable to the bearer, i.e. holder who carries and presents the cheque at the bank counter gets the payment. | Order cheque is a cheque payable when the only person named on the cheque presents it at the counter of the bank. |

| Identification | At the end of the name of the payee, you will find the word 'bearer' on it. | At the end of the name of the payee, you will find the word 'order' on it. |

| Encashment | Any person can encash the cheque by any person holding or carrying the cheque. | Only payee or as per his order the cheque can be encashed. |

| Transferred through | Simple delivery | Proper endorsement |

| Receipt | The recipient's signature acts as a receipt itself. | The signature of the payee of the cheque acts as an endorsement only. |

| Banker's Responsibility for payment of funds to the wrong person | No responsibility of the banker or drawee. | Banker or drawee will be held responsible. |

| Conversion | The drawer can convert a bearer cheque into an order one. | The drawer cannot convert an order cheque into a bearer one. |

What is Bearer Cheque?

A bearer cheque is payable to the bearer, i.e. the person who carries the cheque and presents it to the bank for payment. And in this way, the bank is discharged from liability by making payment in due course to the bearer. But there is an exception when there is the conversion of cheque from bearer to order.

Moreover, one must note that a bearer cheque is always a bearer. Meaning that no endorsement can make the cheque payable except to its holder.

In short, these cheques are payable over the counter to the bearer or presenter of the cheque by the bank on which the cheque is drawn. It is easily transferable through mere delivery, without any endorsement by the transferor of the cheque.

Points to Remember

- Though there is no rule of taking the signature of the holder of the cheque at the time of its encashment. But for safety purposes, the bank asks the bearer to sign at the back of the cheque in the presence of the cashier. This is to confirm the receipt of the funds from the bank.

- Further, the paying cashier does not need to take many precautions to decide the faithfulness of the payee’s ownership. Nevertheless, the bank doesn’t ask for identification proof of the bearer, but when the amount is substantial, the bank may ask for identification proof.

- The transfer of such cheques takes place through simple delivery. This means that if you take the cheque to the bank, the bank issues payment to you against the cheque. Further, no additional authorization from the issuer is necessary in this case.

What is Order Cheque?

The cheque which bears the word ‘or order’ after the name of the payee or any cheque in which the word ‘bearer’ is cancelled out is an order cheque.

In these cheques, the bank makes payment to the person whose name is present in the cheque. This means that the bank is bound to pay money to the payee or the ordered person only and not anyone else. Hence, either payee can receive the funds against the cheque, or the payee may authorize someone else in writing to receive the amount.

Points to Remember

- The transfer of the cheque takes place through endorsement. If the payee endorses an order cheque in favour of another person, the endorsee must also sign the cheque to get the payment. In this way, the bank is discharged from liability.

- In these cheques, there is a condition that the funds are released only when the person whose name is stated on it presents the cheque to the bank. Also,

- To verify the identity of the holder of the cheque, the bank performs a background check at the time of its presentment. The payment of these cheques is made across the bank account.

- The paying cashier of the bank releases the funds and pays the same only when he is certain about the rightfulness of the ownership of the payee. Otherwise, the paying cashier would be held responsible for the same.

Key Differences Between Bearer Cheque and Order Cheque

The points given hereunder elaborate on the difference between bearer cheque and order cheque:

- A bearer cheque is one that can be encashed by any person who presents the same at the counter of the bank for payment. But, an order cheque is one which is payable to the payee or any other person to whom the payee authorizes.

- In bearer cheques, the words ‘or bearer’ is present after the name of the payee. As against, in order cheques, the words ‘or order’ is there after the name of the payee. Also, when the word ‘or bearer’ is cancelled out, the cheque becomes an order one.

- The payee himself or anyone else to whom the cheque is given can take the payment of the bearer’s cheque. In the case of an order cheque, only that person whose name the drawer mentions on the cheque as the payee can take the payment. Further, any person to whom the payee authorizes can also receive the payment.

- Transfer of bearer cheques can take place through simple delivery. Conversely, the transfer of ownership of the order cheque can be possible only through proper endorsement.

- In a bearer cheque, the signature of the receiver of the funds on the back of the cheque acts as the receipt itself. In contrast, in the case of an order cheque, the signature of the payee acts as an endorsement only.

-

What happens if the cashier makes a payment to the wrong person?

Well, in the case of a bearer cheque, the banker or drawee has no responsibility. So, if the bank pays money to the bearer of a stolen cheque, it would not liable for it. But, in the case of an order cheque, the paying cashier must perform a preliminary examination of the recipient’s identity. After that, he can make payment when he is satisfied with the details provided. However, if the cashier pays funds to the wrong person, then the bank (drawee) will be held responsible.

- The drawer can convert a bearer cheque into an order cheque. But by simply striking off the word ‘or bearer’. As against, there is no way to convert an order cheque into a bearer one.

Open Cheque

Both of these cheques can be open cheques. An open cheque is one whose payment can be received over the counter. That means an open cheque is the one which is not crossed.

Further, even after the crossing of the cheque and the drawer can cancel the crossing when the payee requests for the same. For this, the drawer needs to affix his signature with the words ‘crossing cancelled pay cash‘. This also makes a cheque an open one again.

Conclusion

Moreover, the payment made by way of an order cheque is safer in comparison to a bearer cheque. This is because the person presenting the cheque at the counter needs to prove his identity to the paying cashier. Once the cashier is satisfied with the details provided, he releases the funds.

Leave a Reply