A centre for which cost is ascertained and used to control cost is Cost Center. Whereas a centre whose performance we can measure through its income earning capacity is Profit Center.

A centre for which cost is ascertained and used to control cost is Cost Center. Whereas a centre whose performance we can measure through its income earning capacity is Profit Center.

We divide the organization into various sub-units for the purpose of costing. That is the collection and utilization of cost data in an optimum manner. These sub-units are the smallest area of responsibility or segment of activity. Such sub-units are nothing but cost centres.

In the simplest sense, those sections of the organization where costs are incurred and recorded, either by item, by product or by the department, are cost centres. On the other hand, profit centre is that section of the organization, in which the incurrence and recording of both costs and revenue are either by product or product line.

Both of these play a prominent role in the organization. These supply information that assists the managers in decision making. Also, it improves accountability, helps identifying issues and benchmarking.

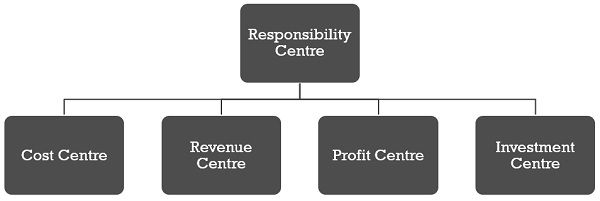

What is Responsibility Centre?

A responsibility centre is the unit of a business organization, a person or department responsible for a specific task or activity. Another term for responsibility centre is activity centre. We measure the performance of these centres in terms of:

- Expenditure

- Revenue

- Return on investment

- Profitability.

Hence, there are four major types of responsibility centres:

In this post, you will come to know the fundamental differences between cost centre and profit centre.

Content: Cost Centre Vs Profit Centre

- Comparison Chart

- What is Cost Centre?

- What is Profit Centre?

- Key Differences

- Transfer Price

- Conclusion

Comparison Chart

| Basis for Comparison | Cost Centre | Profit Centre |

|---|---|---|

| Meaning | A cost centre is a separate part of business wherein direct and indirect costs are incurred and recorded. | The profit centre is the responsibility centre that measures inputs as expenses incurred and output is measured as revenue reaped. |

| What is it? | Smallest organizational unit for which cost is collected separately. | Any sub-unit to which both cost and revenue are assigned. |

| Objective | To identify and control cost. | To delegate authority and fix responsibility to individuals or departments to evaluate performance. |

| Autonomous | No | Yes |

| Responsible for | Cost only | Both cost and revenue |

| Area of Operation | Narrow | Wide |

| Performance | Measured against pre-determined standards or budgets. | Profitability |

| Division is a result of | Accounting convenience | Decentralization of operations |

What is Cost Centre?

A cost centre can be a location, person, an item of equipment for which we determine cost. Thereafter, this cost is charged to the product. For effective control of costs, we divide the factory into various departments. Further, on the basis of the activities performed, these departments are sub-divided into cost centres. In a cost centre, it is pertinent to classify cost into fixed cost and variable cost.

To make a periodical comparison and control cost, determination of an appropriate cost centre and analysis of cost under the cost centre is important. To select an appropriate cost centre the firm takes the following factors into consideration:

- Organization of factory

- Information availability

- Condition of incidence of cost

- Requirement of cost

- Management policy as regards selection method

Note: A large number of cost centres will be expensive whereas a few cost centres won’t serve the purpose. Hence, the size of the cost centre is rely on three factors:

- Operation

- Activity

- Feasibility

Example of Cost Centre

Cloth making involves:

- Spinning,

- Weaving

- Dyeing, printing and finishing

- Garment manufacturing

To accumulate cost, we treat each such activity as a cost centre. And to calculate the cost of production of the respective cost centre, all the costs related to that particular activity would be accumulated separately.

Why do a firm needs cost centres?

Think of a situation when the whole factory is treated as a single unit for both budgeting and cost control purposes. What a mess it could be to compare the standards with the actual figures. In this situation, the desired objective will not be achieved. Hence, the subdivision of the factory into a number of departments becomes essential.

However, this division is still not appropriate because the departments are big. And due to this reason comparison becomes difficult. So, these departments are further subdivided into a cost centre. Therefore, we can make a comparison of the cost that is accumulated cost centre-wise, with the standards, estimates and budgets. This helps to control cost and fix responsibility.

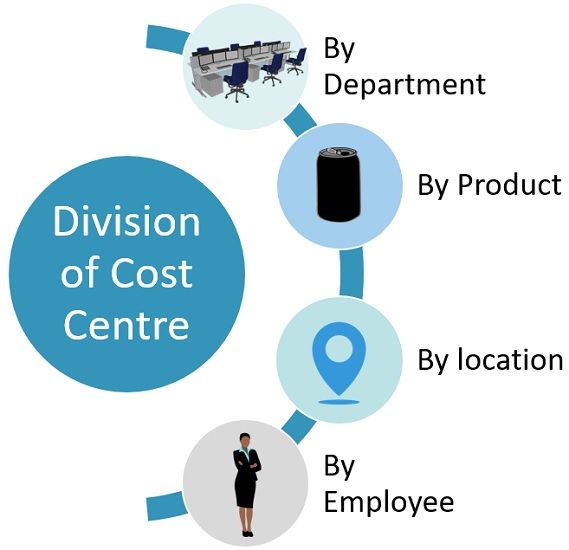

Division of Cost Centre

- On the basis of Department: Here, each department is a separate cost centre. For example Finance, Human Resources, Purchase, Production, Marketing, Research and Development.

- On the basis of Product: An organization producing multiple products could make each product a specific cost centre. For Example, LG manufactures refrigerators, washing machines, microwaves, television, smartphones and so on. Each such product can be a cost centre, as the firm incurs a cost on their production.

- On the basis of location: MNCs like Pepsico or Apple are located in various parts of the world. Each of these areas in which the business are present is a cost centre.

- On the basis of Employee: There are some organizations wherein individual staff members incurs costs. So, these individuals are cost centres. For Example, Salespersons or managers as cost centres.

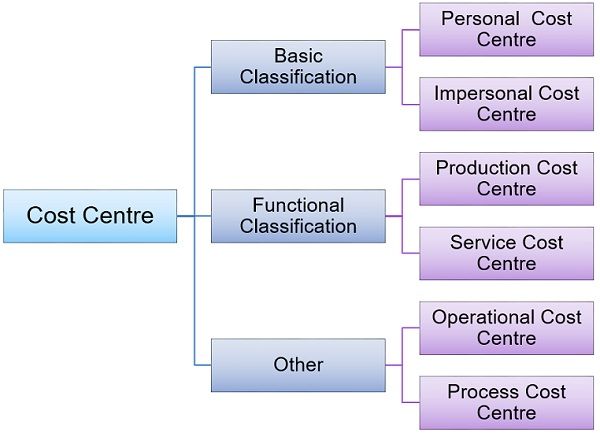

Types of Cost Centre

The type of cost centre reflects the span of the organization for which separate costs are determined to make decisions. It can be:

Basic Classification

Personal Cost Centre

This type of activity centre comprises persons or groups thereof in connection to which costs are ascertained. For example, sales manager works manager, and so forth.

Impersonal Cost Centre

Such an activity centre comprises of location, department or an item of equipment is an impersonal cost centre. For example sales region, warehouse, machine shop, and so on.

Further Classification

Production Cost Centre

The centres where the firm undertakes production or conversion activities is production cost centres. Here transformation of raw material into such products which are ready for sales takes place. For example Machine shops, Milling shops, Baking shops etc.

Service Cost Centre

These centres act as auxiliary units to the production cost centre. For example Canteen, Maintenance shop, Toolroom, Accounts, Power House, etc.

Other Types

Operation Cost Centre

It represents such machines or persons which undertake the same operations. The aim is to determine the cost of each operation regardless of the location within the unit.

Process Cost Centre

It represents those cost centres that undertake a specific process or a series of operations. For Example Oil Refineries, Steel rolling etc.

Also Read: Difference Between Cost Centre and Cost Unit

What is Profit Centre?

A profit centre is a type of responsibility centre wherein the manager of the centre or unit is responsible for both cost and revenue for the asset assigned to the division. Here, we measure inputs in terms of expenses. Whereas we measure outputs in terms of revenues. In this way, the measurement of both the elements, i.e. cost (input) and revenue (output) is in terms of money. And the difference between these two elements is the profit.

Profit Centre refers to that part of the firm for which collection of both cost and revenue takes place. These are responsible for generating profit be it through controlling cost or increasing revenue. The managers of profit centres focus on both the production and marketing of the product. It is the responsibility of the manager of the profit centre to generate revenue and incur costs in a manner to maximize profit.

We measure the performance of a profit centre on the basis of whether the centre succeeded in achieving its budgeted profit or not. We can also say that the company’s division that produces and markets products is the profit centre. The manager of the division decides:

- Selling price

- Marketing programmes

- Production policies

With the help of the profit centre, it is easier to analyse how much each centre generates profit.

Example of Profit Centre

Kia can identify the highly profitable car models by making a comparison of the profit made by each model.

Similarly, a Supermarket chain like Big Bazaar or Walmart can identify their highly profitable stores by making a comparison of the profit made by each centre.

Advantages of Profit Centre

- Broad-based measurement

- Relief to top management from day-to-day decision making

- Improvement in the quality of decisions

Disadvantages of Profit Centre

- Sub-units may compete with each other, leading to a lack of coordination

- Increase in friction among various divisions.Also arguments over transfer price that one profit centre is going to charge from another may be there.

Also Read: Difference Between Cost Control and Cost Reduction

Importance of Profit Centre

Because managers take all the important decisions regarding product mix, promotion mix and technology used. Thus, their decision influences both revenues and expenses. So, we can measure the performance of the division in terms of profits.

Profit made by a profit centre is a result of revenue minus cost. The firm may face difficulty in measuring profit due to transfer prices, joint revenue and common cost. This is because, in most manufacturing firms, intra-company transactions take place. This may include sales by one unit to another.

Transfer price is nothing but the value placed on the exchange of goods and services between two profit centres. And the way in which we determine this profit, will decide the profitability of the supplying (selling) and receiving (buying) profit centre.

Key Differences Between Cost Centre and Profit Centre

- Cost Centre is an area of activity in which we divide the organization into various sub-units in a proper manner for the purpose of product costing. On the other hand, the monetary measure of output is revenue and the monetary measure of input is the expense. And when we deduct expenses from revenue, we get the profit. Thus, when we measure the performance of a responsibility centre in terms of revenue earned and cost incurred, is a profit centre.

- Cost Centre is the smallest unit of the organization for which cost is accumulated separately to determine cost incurred. But, Profit Centres help in evaluating both segmental performance and managerial performance.

- The objective of the cost centre is to ascertain and control cost. Whereas the aim of a profit centre is to delegate authority and fix responsibility to individuals or departments to evaluate performance.

- While the cost centre is not autonomous, the profit centre is autonomous.

- The cost centre is responsible only for costs. While the profit centre is responsible for both the costs and revenue.

- As the cost centre keeps a record of costs only, its area of operation is narrower in comparison to the profit centre.

- One can measure the performance of the cost centre by comparing actual data with the standard of budgeted targets. In contrast, the profitability of the centre acts as a measure of the performance of a profit centre.

- The creation of a cost centre is for the convenience of accounting. Whereas, the creation of a profit centre is a result of decentralization and delegation of authority.

What is the Transfer Price?

Transfer Price refers to the price we use to measure the total amount of goods and services that one profit centre supplies to another within the organization. This implies that when the internal transfer of goods and services occurs between different profit centres, its expression should be in terms of money. Hence, the monetary amount of inter-divisional transfers is the transfer price.

The major issue that profit centres encounter is the ascertainment of the transfer price. The use of transfer price is that for the centre whose goods are being transferred, it is a source of revenue. But for the centre which is receiving the goods, it is an element of cost. In this way, it has a great impact on the revenue, cost and profits of the centre. So, one should determine it carefully.

Conclusion

All in all, we have understood that the two are quite similar but the difference lies in the fact that besides keeping a record of the costs at each centre, profit centre also keeps a track of revenues in the profit centre. However, cost centres only record costs.

Kevin Olsen says

Very interesting read, nice and simple.

siva says

short and simple explanation in understandable way….