Factor Income refers to the income of means of production such as rent, wages, interest and profit, which accrues to land, labour, capital and entrepreneur, respectively. On the other hand, Transfer Income are the incomes which are not received by the person in the form of rewards for the services rendered, i.e. there is the transfer of money without the exchange of goods or services,

Factor Income refers to the income of means of production such as rent, wages, interest and profit, which accrues to land, labour, capital and entrepreneur, respectively. On the other hand, Transfer Income are the incomes which are not received by the person in the form of rewards for the services rendered, i.e. there is the transfer of money without the exchange of goods or services,

National Income is the summation of all factor incomes earned by the country’s residents during the period of the accounting year. It takes into account those incomes or payments which results in the flow of goods and services. Basically, there are two types of incomes (payments), i.e. factor income and transfer income.

In this piece of writing, you will find the differences between factor income and transfer income.

Content: Factor Income Vs Transfer Income

Comparison Chart

| Basis for Comparison | Factor Income | Transfer Income |

|---|---|---|

| Meaning | Factor Income refers to an income that can be derived by selling inputs or means of production, i.e. land, labour, capital and entrepreneur. | Transfer income refers to any income which a recipient receives without providing any goods, services or assets in return to the payer. |

| Payment | Bilateral | Unilateral |

| Concept | Earning (earned income) | Receipt (unearned income) |

| Includes | Rent, Salary and Wages, Interest and Profit | Scholarship, Pension, Grant, Donation, Gift, Allowance etc. |

| National Income | Included while estimating National Income. | Not included while estimating National Income. |

Definition of Factor Income

Factor Incomes refers to the payments made by the production units(firms), to the owners of factors of production (households), for using factor services such as land, labour capital and entrepreneur.

Basically, factor income is generated when there is any productive activity and paid to the factors for the services provided in the production of current output. That is why it is an earned income and considered at the time of calculating national income.

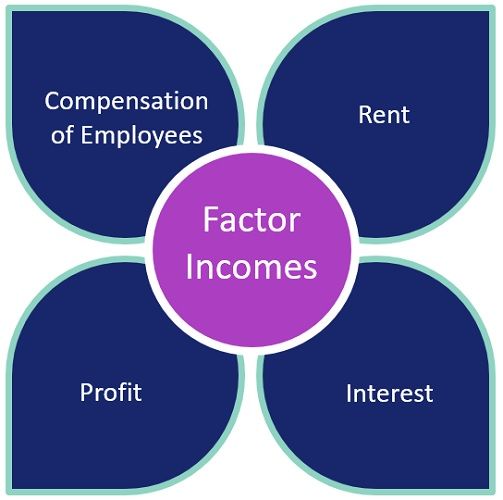

Classification of Factor Incomes

Factor Incomes are mainly classified into four main categories:

- Compensation of Employees: Any type of physical or mental efforts of human beings employed by the firm for the purpose of production, attracts remuneration, in the form of salaries to employees or wages to workers. It may also include, bonus, commission, employer’s contribution to provident fund, and other fringe benefits.

- Rent: Rent is charged on the use of land, by the people who own it. In economics, land implies all the free resources of nature like soil, water, minerals, forest, petroleum, sunlight, wind, etc.

- Interest: Payment made to the owner of the capital, for its usage, is called capital. Here, the word ‘capital’ covers all kinds of man-made resources like plant and machinery, equipment, furniture, stock of materials, vehicles, computer, etc.

- Profit: Entrepreneurship implies the initiative taken by the person or group thereof, in promoting and setting up the business. And the person who takes this initiative is called an entrepreneur. The income earned by the entrepreneur for applying entrepreneurial skills is profit.

Individuals render their factor services to the production units, i.e. firms. Now, these services are used for the purpose of the production of goods or services. In this way, the higher the level of production, the higher will be the level of income and vice versa. And so, what is distributed as factor income, is nothing but the value of production.

All the factor incomes are taken into account while calculating the national income due to the corresponding flow of goods and services.

Also Read: Difference Between Real Flow and Money Flow

Definition of Transfer Income

Transfer Income implies the income received without any corresponding flow of goods and services, i.e. it is a unilateral payment. Hence, there is no sacrifice involved on the part of the recipient

It can be received by the individual as financial help, a gift in cash, a donation to a trust or NGO, unemployment allowance, pocket money to children, pension to elderly people, scholarship to the students, grant, etc. So, a person receiving a transfer payment does not take part in the process of production.

These are not earned as consideration or reward for the provision of services to the production units. This is the reason why these incomes are not included in the national income.

Important: It must be noted that, while wages to labour are included in national income, pensions to the retired workers are excluded from national income.

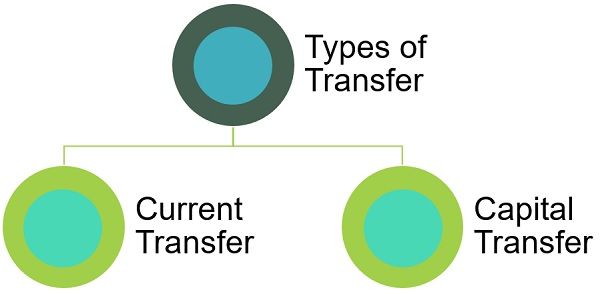

Types of Transfer

Transfer payment (income) can be current transfer or capital transfer. These are discussed hereunder:

- Current Transfer: Current transfer is the transfer payment made out of the payer’s current income and included in the current income of the recipient, be it within the country or amidst two countries. For example Tax, donation, scholarship, gift, unemployment allowance.

- Capital Transfer: When the transfer payment is made out of the wealth of the payer and included in the wealth of the recipient it is termed as a capital transfer. It can influence the wealth of both the payer and recipient. For example capital grants, international grant, compensation for war damages, compensation for natural calamities, etc.

Here, it is to be noted that no transfer be it current or capital, included while estimating the national income of the country.

Also Read: Difference Between GDP and GNI

Key Differences Between Factor Income and Transfer Income

After understanding the basic concept, let us understand the points of difference between factor income and transfer income:

- In the production process, factor income implies the income accrued to the factors of production in return for rendering productive services, i.e. land, labour, capital and enterprise, to the firms. As against, when the income is received, but without the provision of goods, services or asset in return, it is called as transfer income.

- Factor income is an earned income, i.e. it is an earning concept. As against, Transfer income is an unearned income, it is only received but not earned by the recipient. So, it is a receipt concept.

- While factor income is a bi-directional payment, transfer income is a unidirectional payment.

- Transfer income is not added while calculating national income, because it does not indicate any production of goods and services. On the other hand, the total of all factor incomes generated by the normal residents results in the national income of the country, as factor income considers the market value of goods produced or services rendered during a particular period. So we can say that the total income of society is the value of what it produces.

Examples

| Factor Income | Transfer Income |

|---|---|

| Payments made to suppliers for raw materials. | Unemployment compensation |

| Interest paid to creditors for a loan. | Social Security Benefit |

| Rental Charges of Plant and Machinery. | Old Age Pension |

| Payment of insurance premium of vehicle. | Welfare payments |

| Payment of electricity bill. | Fines and Penalty |

Conclusion

In a nutshell, Factor income is the income received against the goods and services. On the other hand, transfer income is the income against which no products or services are provided.

Leave a Reply