Have you any idea of the shipping agreements? There are two famous international shipping agreements, i.e. CIF contract and the FOB contract. These contracts are used for the transportation of goods between the buyer and seller. In FOB contracts, the seller’s duty is to load the goods onto the ship proposed by the buyer. As against, in CIF contracts, the duty of the seller is to deliver the goods to the shipping company for transmitting them to the buyer.

Have you any idea of the shipping agreements? There are two famous international shipping agreements, i.e. CIF contract and the FOB contract. These contracts are used for the transportation of goods between the buyer and seller. In FOB contracts, the seller’s duty is to load the goods onto the ship proposed by the buyer. As against, in CIF contracts, the duty of the seller is to deliver the goods to the shipping company for transmitting them to the buyer.

Do you know?

FOB and CIF contracts are a part of 11 international commerce terms also known as Incoterms, defined by the International Chamber of Commerce, in the year 1936.

What is a Shipping Agreement?

A shipping agreement is one that specifies the party responsible for the order, while it is on the way between shipment and delivery. A shipping agreement plays a crucial role in the case of trade between two different countries. Here, what happens is the shipment goes through international waters, for which they are subject to the rules and regulations of different countries.

Content: FOB Contract Vs CIF Contract

Comparison Chart

| Basis for Comparison | FOB Contracts | CIF Contracts |

|---|---|---|

| Expands to | Free on Board | Cost, Insurance and Freight |

| Meaning | FOB Contract states that the responsibility of the seller is till the time goods are loaded up on the ship. However, once they are loaded on the ship, the responsibility passes on to the buyer. | CIF Contract is a contract wherein it is the responsibility of the seller to load the goods on board the ship and bear the cost of freight and insurance to the destination port. |

| Shipping | The buyer is responsible for the booking of the ship through which the products will get to the final destination. | The seller is solely and completely responsible for finding the ship. |

| Insurance | The seller does not need to buy insurance for the products. | The seller enters into an insurance contract for the products. |

| Cost | Less | Comparatively High |

| Risk | Buyer will bear all the risk of damage or loss of goods. | The seller will be responsible for meeting all the charges for damage or loss to the product. |

| Cost | FOB includes ex-factory costs, packing charges, inland transportation charges, documentation and loading charges. | Free on Board and charges of Freight and Marine Insurance. |

| Right of Lien on Goods and Stoppage in Transit | The seller has no right of lien on goods and right of stoppage in transit. | The seller has the right to lien and stoppage in transit. |

What is a FOB Contract?

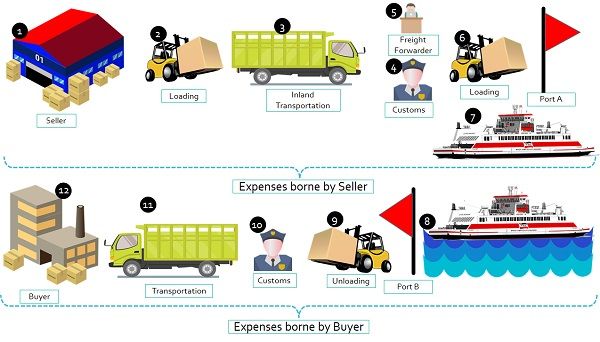

FOB contract refers to the contract of sale of goods between parties. In this contract, the seller will deliver and load the goods on board a ship at his own expense, for the purpose of dispatching them to the buyer.

One must take note that only the expenses concerned with the loading of goods will be borne by the seller. Further, the moment when the goods are loaded on the deck, the risk passes on to the buyer. Resultantly, he will be responsible for the freight, insurance and other subsequent charges.

As per this contract, the shipper or seller of the goods clears them for the purpose of export and also delivers the same to the port. Further, as and when the goods are loaded on the deck at the concerned port of shipment the buyer will be responsible for the goods, from that very moment.

Duties of the Seller

- Careful loading of goods on the ship named by the buyer.

- Meeting the expenses of loading the goods.

- Entering into a contract with the shipping company for the purpose of transportation of the goods and getting the bill of lading. The contract will be based on reasonable terms.

- Delivery of bill of lading to the buyer.

- Notifying the buyer about the shipment to enable him to insure the goods at the time of transit via sea route.

Once the seller performs these duties, the contractual obligation of the seller comes to an end. Also, the delivery of the goods to the buyer is complete on the part of the seller. Hence, the buyer would be liable to pay the price of the goods on the presentation of the shipping documents to him. The buyer has to pay the price even when the goods have been lost by that time.

Transfer of Ownership under FOB contract

So, what we have understood so far is that under FOB contracts, as soon as the seller loads the goods on board the ship, the transfer of ownership to the buyer takes place. The transfer of ownership to the buyer takes place even when goods are not specific.

However, no transfer of ownership will take place if through shipping documents the seller reserves the right of disposal. Thus, in the absence of any reservation of rights, the goods are at the buyer’s risk, after it is loaded on the deck.

Charges in FOB Contract

| Charges | Who will pay? |

|---|---|

| Warehouse Services | Seller |

| Loading at Origin | Seller |

| Inland Transportation | Seller |

| Forwarder & Customs | Seller |

| Terminal Charges | Seller |

| Loading on Vessel | Seller |

| Ocean or Air Freight | Buyer |

| Insurance | Buyer |

| Unloading from the ship to port and Loading from port to vehicles for transportation | Buyer |

| Transport to Destination | Buyer |

| Customs Clearance | Buyer |

| Import Duties | Buyer |

Points to Remember

- FOB contract is used in case of Sea or Inland Waterway Transport only.

- Ideally, FOB has to be used in a situation in which the seller can directly access the vessel for loading. For instance bulk cargo or non-containerized goods.

Note: Free Carrier (FCA) is used in case of non-containerized goods. - The shipper delivers the goods which get clearance for export and then loads them onto the ship.

- From Port B, the buyer will be responsible for transportation, cost and risk.

- The seller will provide the following documents to the buyer:

- Commercial Invoice

- Packing List

- Wood Packaging Certificate

- Ocean Bill of Lading (title document)

Also Read: Difference Between Import and Export

What is CIF Contract?

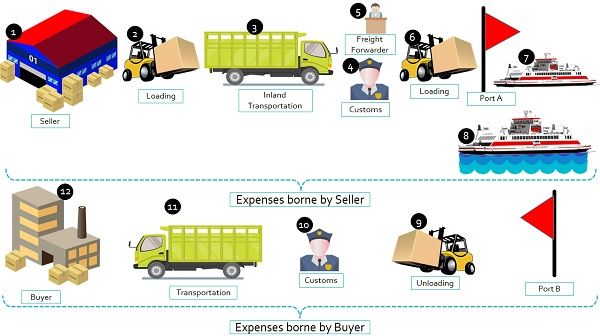

CIF stands for Cost, Insurance and Freight Contract. As per this contract, the seller takes the responsibility for loading the goods on the deck, chosen for delivery of the goods. Further, the cost of freight and insurance to the port of destination is borne by the seller. As per Clause C of the Institute Cargo Clauses, the purchase of a minimum level of insurance is a must.

A CIF contract is a contract for the sale of goods at a price in which the cost of goods, insurance and freight charges are included. Therefore, in these contracts, the buyer bears the charges of insurance at the time of transit and freight charges. This is because these charges are added to the price of the goods.

Duties of the Seller

- Preparing the invoice of goods sold.

- Shipping the goods at the port of shipment

- Getting a contract of affreightment under which delivery of goods at the destination specified by the contract takes place. This means that the seller will enter into a contract with the shipping company for the purpose of transporting goods and obtaining a bill of lading.

- Insuring goods and getting the insurance policy

- Delivering shipping documents like invoices, bills of lading, and insurance policies to the buyer within a reasonable time.

So, the crucial part of this contract is that the seller is required to offer to make time-bound delivery of the shipping documents to the buyer. Further, in case of failure of the seller in the delivery of the documents within a reasonable time, then the seller will be guilty of breach of contract.

However, on the timely delivery of the documents to the buyer, the buyer will check if they are complete in all respects. So, the buyer should take them and pay the agreed sum.

Transfer of Ownership under CIF contract

In these contracts, the transfer of the ownership of goods to the buyer takes place when he gets the shipping documents by paying the price of the goods. Hence, if the buyer refuses to take the shipping documents, the seller is entitled to sue him for the damages for the breach of contract and not the price of the goods.

Why CIF Contracts are expensive?

The CIF contract is among the highly expensive alternative when it comes to shipping products from one point to another. Now, there might be a question arising in your mind – Why it is an expensive option?

Well, in this contract, the seller chooses the freight forwarder, who may or may not charge the buyer any amount which exceeds the actual price. So, it includes a certain amount of margin or profit at the time of performance of the work.

Charges in CIF Contract

| Charges | Who will pay? |

|---|---|

| Warehouse Services | Seller |

| Loading at Origin | Seller |

| Inland Transportation | Seller |

| Forwarder & Customs | Seller |

| Terminal Charges | Seller |

| Loading on Vessel | Seller |

| Ocean or Air Freight | Seller |

| Insurance | Seller |

| Unloading from the ship to port and Loading from port to vehicles for transportation | Buyer |

| Transport to Destination | Buyer |

| Customs Clearance | Buyer |

| Import Duties | Buyer |

Points to Remember

- CIF contract is used when the goods travel through Sea or Inland Waterway Transport only.

- Ideally, CIF has to be used in a situation in which the seller can directly access the vessel for loading. For instance bulk cargo or non-containerized goods.

Note: Cost & Insurance Paid (CIP) is used in case of non-containerized goods. - The shipper or Seller delivers the goods which get clearance for export and then loads them onto the ship and pays the ocean freight and insurance

- From Port B the buyer will be responsible for transportation, cost and risk including unloading at the destination port.

- The seller will provide the following documents to the buyer:

- Commercial Invoice

- Packing List

- Wood Packaging Certificate

- Ocean Bill of Lading (title document)

Also Read: Difference Between Fire and Marine Insurance

Key Differences Between FOB and CIF Contract

- CIF or Cost Insurance and Freight Contract is a shipping contract wherein the seller of the goods bears responsibility for the cost and risks involved with the shipment. Contrastingly, FOB is such a shipping contract in which the responsibility passes on to the buyer right from the second the shipment leaves the port of origin.

- Under the CIF contract, the seller is responsible for the shipment till the time it reaches the final destination. Conversely, under a FOB contract, the responsibility is transferred to the buyer from the seller, as and when the products are loaded on the ship and the ship journey starts.

- The FOB option is preferred because the buyer gets control over the shipping process and the cost is quite less. Oppositely, under a CIF, the cost is high. This is because the seller has control over shipping charges. Also, he is solely responsible for arranging the ship with the help of a freight forwarder, due to which the cost is higher.

- In CIF contracts, the price of goods covers the cost of goods, insurance and freight. Whereas under FOB contracts, the price of the goods does not cover insurance and freight charges.

- Under CIF contracts, the buyer gets ownership when he gets the delivery of the shipping documents by paying the price of the goods. Contrarily, in FOB contracts the buyer gets ownership as and when the goods are loaded on the ship chosen by the buyer.

- In CIF contracts, the insurance of goods is mandatory. It provides an insurance policy of a minimum of 110% of the product value. Whereas, in FOB contracts, insurance of goods is optional. Buyer can insure the goods to secure his interest because the goods are at high risk during sea transit.

Conclusion

All in all, the CIF contract is among the highly expensive contracts, wherein the cost of goods covers the price of insurance and freight too. But, in the case of FOB contracts, the price of insurance and freight is not included.

Leave a Reply