Gross Profit and Gross Profit Margin are two closely related terms that it is hard for one to recognize their difference, in general. Gross Profit is described as the difference between amount earned from the sales and the amount spent on production activities. And if we talk about gross profit margin, it is a profitability ratio, which is expressed as a percentage of gross profit to sales, during the accounting period.

Gross Profit and Gross Profit Margin are two closely related terms that it is hard for one to recognize their difference, in general. Gross Profit is described as the difference between amount earned from the sales and the amount spent on production activities. And if we talk about gross profit margin, it is a profitability ratio, which is expressed as a percentage of gross profit to sales, during the accounting period.

These two are used as a key indicator of operational efficiency, overall profitability and financial performance of the company. Let’s take a look on the article presented to you, to learn the difference between gross profit and gross profit margin in detail.

Content: Gross Profit Vs Gross Profit Margin

Comparison Chart

| Basis for Comparison | Gross Profit | Gross Profit Margin |

|---|---|---|

| Meaning | The amount left after deducting cost of goods sold from the net sales is known as gross profit. | A parameter used in the business to know about the profitability of the concern is gross profit margin. |

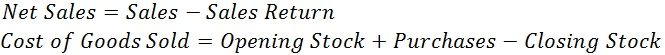

| Calculation | Gross Profit = Net Sales - Cost of Goods Sold | Gross Profit Margin = (Gross Profit * 100) / Net Sales |

| Result | Figures | Percentage |

| Objective | To know that how a company will earn if it do not pay any indirect expenses. | To know the efficiency of a company of earning profit. |

| Shown in Income Statement | Yes | No |

Definition of Gross Profit

The amount remained with the company after paying off the cost of goods sold is known as gross profit. Gross Profit is a key phenomenon that signifies the profit earning capacity of the company. The more the amount of gross profit, the more is the profit earned by the entity from every single unit sold. The trading account can disclose Gross Profit.

In the above paragraph, the cost of goods sold means the direct cost, i.e. material, labor and overhead charged during a particular accounting year. The Gross Profit can be calculated as under:

Definition of Gross Profit Margin

Gross Profit Margin is the percentage of gross profit over sales of the company during a particular financial year. It is important to calculate the gross profit margin as it shows the profitability of the company. The more the percentage, the higher is the profit earned by the concern from each unit sold.

Let’s take an example – a company’s GP margin is 40%, it means that it earns Rs. 40 from every single unit sold of Rs.100.

Gross Profit margin is also helpful in making comparisons between two companies or comparing the company’s past and present performance. The Gross Profit Margin can be calculated as under:

Key Differences Between Gross Profit and Gross Profit Margin

- Gross Profit is the left out amount remained after deducting all the direct costs from the sales. Gross Profit Margin is the margin of profit over net sales.

- Gross Profit is calculated in figures while Gross Profit Margin is calculated in percentage.

- Gross Profit is shown in the income statement. Conversely, Gross Profit Margin is not shown in the income statement.

- Gross Profit is the basis through which net profit of the company can be calculated. Gross Profit Margin helps the company to know the incremental sales of a particular year and take pricing decisions.

Similarities

- Both come under the profitability ratios.

- Shows the profit earning capacity of the company.

- Increase in cost and other things, being constant will decrease both.

- The increase in price and other things, being constant will increase them.

Conclusion

Every business firm has to calculate its gross profit to get a rough estimate of the profit earned during the financial year. On the other hand, gross profit margin works as an indicator that how efficiently the resources have been utilized, to get best results. Both the terms are very helpful for the stakeholders to know the profitability, performance, and efficiency of the company.

Now, I hope that you won’t get confused again between these two terms.

amy says

Thanks for clarifying!