In business and financial context, margin is defined as the distinction between production or acquisition of the product to the seller and its selling price. Gross Profit Margin implies a financial tool, employed to identify the financial health of the business, by depiction the amount of money left after deducting cost of production from the sales.

In business and financial context, margin is defined as the distinction between production or acquisition of the product to the seller and its selling price. Gross Profit Margin implies a financial tool, employed to identify the financial health of the business, by depiction the amount of money left after deducting cost of production from the sales.

On the contrary, net profit margin, is a financial metric determining the company’s profitability, by exhibiting the percentage of revenue left over after subtracting operating expenses, interest, taxes and preferred dividend.

“Profitability” is the ability of the company to generate profit from its regular business operations. The parameter which is used for analyzing the profit making capacity of business known as ‘Profitability Ratios.’ The three major ratios in this context are Gross Profit Margin, Operating Profit Margin, and Net Profit Margin.

The article sheds light on the difference between gross profit margin and net profit margin, take a read.

Content: Gross Profit Margin Vs Net Profit Margin

Comparison Chart

| Basis for Comparison | Gross Profit Margin | Net Profit Margin |

|---|---|---|

| Meaning | Gross Profit Margin is the percentage of the Gross Profit over Sales. | Net Profit Margin is the percentage of Net Profit over Sales. |

| Advantage | Helpful in knowing about the percent of profit earned from the core business by the company. | Helpful in knowing about the percent of actual profit earned by the enterprise. |

| Objective | To know about the efficiency of the company in the production and distribution activities. | To know about the financial health of the company |

Definition of Gross Profit Margin

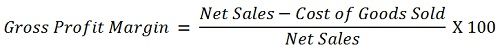

Gross Profit Margin (GP Margin) or Gross Margin is the measure which indicates that how well a company managed its major business activities (regarding material, labor, and direct expenses) so that the organization earns a profit. The Gross Margin is based on the Gross Profit made by the company upon Net Sales.

With the help of Gross Profit Margin, the company is capable of comparing the present gross profit with profits earned in the past. Along with that projection is also done by the company regarding its future profits. After the determination of GP Margin, the entity can also reduce or control various costs, so that the margin may increase in future.

It can be calculated as under:

Definition of Net Profit Margin

Net Profit Margin (NP Margin) or Profit Margin is a metric used by the entities to identify the percentage of actual profit earned during a particular accounting period. It is based on net profit, which is obtained by deducting interest, expenses and taxes from Gross Profit. Net Profit appears in the bottom line of the income statement.

Net Profit Margin enables the company, to find out how efficiently the company allocated its resources, to transform its sales into actual profit. Forecasting for future profits can also be done through NP Margin. Apart from that, the company can also eliminate its fixed or variable expenses, so that the margin should rise in future. Moreover, steps can also be taken to improve profitability after determining Net Profit Margin.

It can be calculated as under:

Key Differences Between Gross Profit Margin and Net Profit Margin

- Gross Profit Margin is a parameter showing the percentage of profit before indirect expenses. Net Profit Margin is a parameter showing profit after indirect expenses.

- Gross Profit Margin is based on Gross Profit whereas Net Profit Margin is based on Net Profit.

- The significant difference between the two is, Gross Profit Margin is a measure for indicating the efficiency of the company in its production and distribution activities. On the other hand Net Profit Margin shows the financial soundness and the actual profitability position of the company.

Similarities

- Expressed as a percentage of sales.

- Both are a barometer of profit.

Conclusion

The determination of Gross Profit Margin and Net Profit Margin is helpful for tracing out the percentage of profit earned by the entity at various levels. At the gross margin level, only the costs and direct expenses are excluded from sales for reaching gross profit. On the basis of which GP Margin is calculated.

At the Net Profit Margin level, the operating and non-operating expenses are excluded while non-operating income is added to Gross Profit to arise at Net Profit. In this way, Net Profit Margin is calculated.

Leave a Reply