Previously, people opted for manual filing of income tax returns. In the manual filing of returns, the taxpayer must fill out the right form, declare his income from various sources and perform calculations to compute the tax. After that, the assessee must submit the form to the IT department. So, it used to be a time-consuming and lengthy process.

Previously, people opted for manual filing of income tax returns. In the manual filing of returns, the taxpayer must fill out the right form, declare his income from various sources and perform calculations to compute the tax. After that, the assessee must submit the form to the IT department. So, it used to be a time-consuming and lengthy process.

As human beings, we all have the same tendency to wait for the deadlines. There are only a few people who complete everything in advance. And so, when the deadline is near, people start hurrying to submit income tax returns.

But there is a way through which you can just stay at home and file the return. That means you can save a lot of time and energy by using the electronic filing or e-filing mode.

In the Indian taxation system, the E-filing of tax returns is a revolutionary change. As we all know that technology is developing with every passing day. Due to this advancement, every task is performed online nowadays, be it shopping, buying insurance, paying an electricity or wifi bill, opening a bank account, or anything else.

Basic Terminologies

Income Tax: The tax levied on the income of the assessee is Income Tax. For this, the assessee needs to communicate the details about his income to the IT Department. And to communicate these details to the IT Department, the assessee has to fill out the income tax return.

Income Tax Return: Income Tax Return is a form for filing information concerning your income and tax to the tax authorities. The tax liability of the assessee is calculated as per the income. If the return displays that the excess amount has been paid as tax during a financial year, then the taxpayer is eligible to get a refund from the IT Department. In this return, a taxpayer declares his income, investments, expenses, tax deductions, exemptions and taxes.

According to IT law, every individual or business whose income exceeds the basic exemption limit must file an income tax return. The rate of income tax is pre-specified for the taxpayers.

Content: Manual Filing Vs E-filing

Comparison Chart

| Basis for Comparison | Manual Filing | E-filing |

|---|---|---|

| Meaning | Manual filing is the method of submitting income tax returns in physical form for the financial year. | E-filing refers to the method of submitting income tax returns for the financial year using online mode. |

| Nature | Paper-based filing | Paperless filing |

| Place | The assessee needs to visit the concerned office and fill out the form. | It can be filed from anywhere around the world. |

| Chances of Errors | High | Comparatively less |

| Processing | Fast | Relatively slow |

| Access to past records | Difficult | Easy |

| Status Tracking | Takes time | Easy and quick |

| Refund | Quick and without any issues. | Delayed |

| Error Revision | Assessee is required to file another physical form. | There is a scope for changes and revisions. |

| Verification | E-verification of ITR is convenient and hassle-free. | ITR has to be sent to the Income tax office in physical form, which is time-consuming. |

What is Manual Filing?

Manual Filing of Income Tax Returns is the conventional submission of Income Tax returns for the financial year, where the taxpayer has to submit the hard copy of the ITR to the Income tax office. Taxpayers compute taxes through mental arithmetic or a calculator. After that, the ITR is sent to the tax authority via postal service or in person.

It must be noted that only individuals who meet the specified criteria can submit their ITR in physical mode. The assessee needs to prepare and file the return directly to the IT Department. To file ITR manually, the taxpayer must meet the following criteria:

- The age of the taxpayer is 80 years or above in the financial year.

- The Gross Total Income of the taxpayer is less than five lakhs. Also, there is no income tax return claim.

If the assessee files income tax in physical form, he must take a printout of the form ITR-V in two copies. The taxpayer should keep one copy of the ITR with himself. The second copy must be signed by the taxpayer and sent to the Income Tax Office.

Demerits of Manual Filing

- In the manual filing of Income Tax Returns, the assessee needs to visit the Income Tax Office multiple times.

- The assessee has to go through a slow process to check whether the document has reached the office on time. The taxpayer needs to wait for the refund to be credited.

Also Read: Difference Between ITR-1 and ITR-4S

What is E-filing?

E-filing is the electronic filing of income tax returns over the Internet for the financial year. For this purpose, Income Tax Department has started a separate portal for the electronic filing of Income Tax Returns. The taxpayers should log on to that website for e-filing of the return of income.

The Income Tax Department has provided free software called e-filing utility for generating and furnishing returns electronically. Also, there is an e-filing help desk provided by the IT Department for resolving any queries of taxpayers.

Important: E-filing is compulsory for companies which require statutory audit under section 44 AB.

Methods of E-filing of ITR

The two ways of E-filing Income Tax Returns are:

- E-filing with digital signature

- E-filing without digital signature

Digital Signature

Digital Signature is nothing but the signature of the assessee in digital or electronic format. It is used to verify electronic documents.

Merits of E-filing

- This facility is available to the assessees round the clock. Also, one can file a return from any place across the globe.

- It ensures that all the documents of the assessee are in one place, including bank loan acknowledgement and income proofs. Hence, you don’t need to spend time searching for them here and there at the last moment. The income tax server saves your data. So, just by logging in to your income tax account, you can fetch this data whenever needed.

- E-filing income tax is not just super easy, but it is also hassle-free. This enables the assessee to fill in and submit the information in a timely manner. Also, it prevents the user from making errors by alerting the user to enter the details correctly.

What is E-payment?

E-payment implies the process of paying taxes electronically using Internet banking.

Also Read: Difference Between PAN and TAN

Key Differences Between Manual Filing and E-filing

- The best thing about e-filing of returns is the easy and anytime access to records. This happens because there is a single platform on which all your documents are uploaded at once. And then whenever you need them, they can be accessed anytime. On the other hand, when you go for manual filing, accessing records when you are in a hurry can be a bit tedious because you need to go through many documents.

- On filing returns online, one can easily check the status of return processing. You can quickly check if the IT department has received your return or if it is processed or not. However, when you go for manual return filing, the status will not be available online. So, your return filing status is provided to you by post by the IT Department. But with e-filing, the tracking of status is just a click away.

- In e-filing, there is software with inbuilt data validation and tax calculation programs that calculate tax without errors. But in manual filing, you need to compute your income and deductions. Also, you need to calculate the amount to be payable as tax.

- Generally, salaried people and contractors receive cheques as their payment, from which TDS is deducted. This can be claimed at the time of filing a return. With e-filing, the refund of TDS is far quicker than the manual filing of returns.

- There is a scope for revisions and reviews when there is online return filing. Hence, the assessee can edit the data provided easily. Thereafter, the form can be uploaded in a simple manner. But, in the case of manual filing of income tax returns, the revision can only be made when you file another form. It is quite obvious that this process takes more time.

- In the manual filing of returns, the assessee needs to send the ITR in paper form to the Income tax office. Further, in the case of e-filing, e-verification of ITR is quite convenient for the assessee. Also, it saves a lot of time.

- When filing a return manually, there is a high chance that you will make mistakes. That is why you will need the help of an expert. However, you have to pay fees to the expert for his assistance. As against, e-filing of income tax returns will save the cost of hiring an expert.

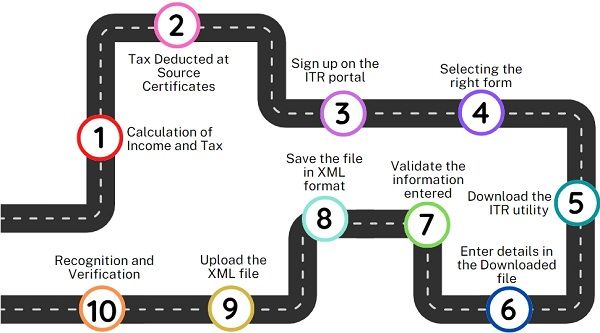

E-filing of Income Tax Return

Calculation of Income and Tax

First, the taxpayer must calculate their income according to the income tax law provisions. For this, the assessee must consider all the sources of income like salary, rental income, profit and gains, interest income, dividend income etc. Also, the taxpayer can claim deductions under section 80C.

Tax Deducted at Source Certificates

The taxpayer should summarize the TDS amount from the TDS certificates received for all four quarters of the financial year.

Sign up on the ITR portal

The initial step for filing ITR online is to register on the website. You need to enter your Name, Date of Birth, PAN and Aadhar Number for this. Then you need to set your password. Please note your PAN is the user ID.

Selecting the right form

Depending on the type of assessee, income and sources of income, you need to choose the right ITR form which is applicable to you and download it. The assessee can complete this form either online or offline.

Download the ITR utility from the Income Tax website

Visit the website and click on the top ‘Downloads’. Select the assessment year, choose the form, and download the Income Tax Return Utility. After that, save the form to your system to fill out the offline form.

Enter details in the Downloaded file

Once the online utility is downloaded to your system, fill in the specified details of your income and check the tax payable or the refund receivable.

Validate the information entered

Look for a few buttons on the right-hand side of the form that you have downloaded. Click on the ‘validate’ button. It will make sure that all the required information is entered.

Save the file in XML format

On completing and validating the downloaded form, you need to click on the ‘Generate XML’ tab on the right side of the file.

Upload the XML file on the Income Tax Website

Login to the income tax e-filing website and go to the e-File tab. Here you need to choose Income Tax Return. Then you will be asked to provide necessary details like PAN, assessment year, ITR form number and submission mode. In the submission mode, choose the option upload XML from the drop-down menu, attach the XML file, and click the submit button.

Recognition and Verification

You will receive an acknowledgement once you return to the website.

Refund of Taxes

The Income Tax Department issues a refund if the taxable amount is less than the actual tax paid. Taxpayers often get a tax refund on their income tax.

You can opt for available verification modes like Aadhaar OTP or electronic verification.

Also Read: Difference Between Tax Planning and Tax Management

Conclusion

As we all know that there is a time limitation with the manual filing of returns, whereas e-filing service is available 24×7. E-filing can be possible from any place. This means all you need is the internet facility. Therefore, it is a very convenient tool for people compared to manual filing.

Generally, people who are not comfortable with e-filing usually go for manual filing of returns.

Leave a Reply