Retained Earnings imply a part of companies net earnings that are set aside and not paid as a dividend to reinvest it in business or pay off the debt. But, reserves are that part of the profit which is earmarked to provide for business needs in future or to fulfil future contingencies and unexpected liability.

Retained Earnings imply a part of companies net earnings that are set aside and not paid as a dividend to reinvest it in business or pay off the debt. But, reserves are that part of the profit which is earmarked to provide for business needs in future or to fulfil future contingencies and unexpected liability.

Risks and uncertainities are a part of the business. As human beings, we all save some part of our income to cover our future needs and contingencies. Likewise, business enterprises also keep a part of their income as retained earnings or reserves. They do so to cover the unknown losses or liabilities that may arise in future.

Keeping aside profit in the form of retained earnings or reserves ultimately reduces the amount of profit available for distribution among the shareholders of the business. Below we have explained the difference between retained earnings and reserves.

Content: Retained Earnings Vs Reserves

- Comparison Chart

- What are Retained Earnings?

- What are Reserves?

- Key Differences

- Similarities

- Conclusion

Comparison Chart

| Basis for Comparison | Retained Earnings | Reserves |

|---|---|---|

| Meaning | Retained Earnings are a part of company's net income which is left after paying out dividends to shareholders. | Reserves refers to a fund which an enterprise creates for meeting unforeseen liabilities or losses in future. |

| Objective | To reinvest the sum in the main business. | To meet future losses or liabilities. |

| Current Year Profit | Added to retained earnings after paying dividends. | Company transfers certain percentage of profit to reserves every year before giving dividend. |

| Part of | Retained Earnings | Not a part of reserves |

| Classified as | Capital and Revenue Reserves | No further classification |

| Type | General and specific | General |

What are Retained Earnings?

We all know that a company does not distribute all the profit it makes to its shareholders as dividends. The firm keeps a part of such earnings in business for future use. This is what we call retained earnings. It is one of the permanent sources of internal finance available to the firm. It does not have any explicit cost such as interest, dividend or floatation cost. That is why we also call it ploughing back of profits. However, they involve an opportunity cost.

Further, the profit available for ploughing back relies on many factors. These factors are net profits, dividend policy and the age of the enterprise. The company retains and reinvests in the business the part of the profit which remains undistributed among shareholders.

It is the part of the profit which is left after paying all the costs, be it direct or indirect, taxes and dividends. The firm can use this amount to buy new assets or to promote research and development projects.

Definition of Retained Earnings

Retained Earnings refers to the accumulated profits which belong to the shareholders but are not distributed to them. Rather, the company retains it for reinvesting it in the business to further expand it or for meeting contingencies.

Hence, they become cumulative earnings since commencement over the period of time when the company retains profit. So, another term for it is accumulated profit or surplus.

Points to Note

- The primary objective of keeping retained earnings is to ensure the solvency of the company and for meeting any future contingency.

- It increases as the firm generates and reports earnings and decreases as the firm incurs and reports losses or declares dividends.

- The company can reinvest the amount in its core business and obtain lucrative returns in future.

- It provides the basis for the expansion and growth of companies.

- The retained earnings account increases the market value of the company’s stocks.

Accounting Treatment

It appears on the Balance Sheet in the Equity and Liabilities section under the head Reserves and Surplus.

Also Read: Difference Between Provision and Reserve

What are Reserves?

Reserves are the part of earnings that owners earmark and keep in business for several purposes. The purposes include:

- Writing off fictitious assets

- Distribution of dividends if the company does not earn profit in a particular financial year.

- Procurement and replacement of assets,

- Redemption of debentures or preference shares,

- Bonus issue, etc.

Moreover, the primary aim of creating reserve is to strengthen the financial status of the company for its perpetual succession in future years.

Definition of Reserves

Reserves refer to the amount kept aside out of profit for covering any unknown expenditure or loss and meeting future uncertainities and unexpected contingencies. For this purpose, the firm creates a separate account.

Points to Note

- It does not reflect any expense or loss. Also, it is not debited to the profit and loss account or statement of profit or loss.

- It does not reduce the net profit of the enterprise. Rather, it reduces the amount of divisible profits.

- It is an appropriation of profit, but the firm displays it as an item of appropriation of profit.

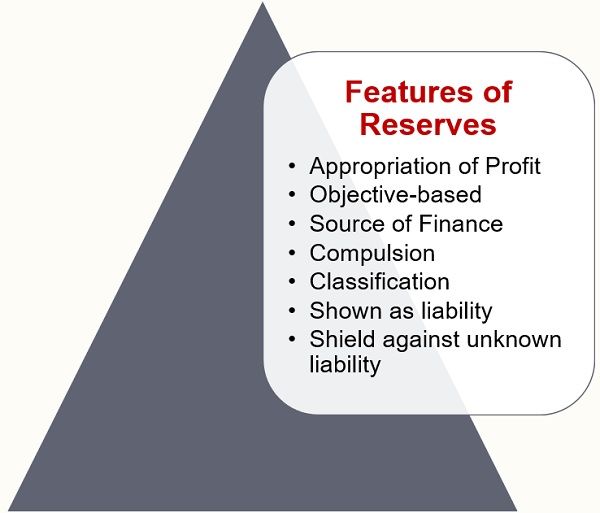

Features of Reserves

- Appropriation of Profit: Reserves are a component of earned income of the enterprise. Hence, it is created out of profits only. And so, if there is a loss in business, reserves are not created.

- Objective-based: Company does not create reserves for any known liability or compensation. Rather, the firm maintains it for unknown liabilities and compensation for the loss.

- Source of Finance: Reserves are an internal source of finance. Hence, profit is kept as capital rather than distributed as dividends.

- Compulsion: The creation of reserves is not compulsory by law. Although, as per Transfer of Reserve Rules, joint stock companies need to create the specified amount of reserves out of profit. But, they must do so before the distribution of dividends.

- Classification: Reserves are classified on the basis of the purposes for which the company creates them.

- Shown as liability: Reserves appear on the liabilities side of the Balance Sheet. As profit is the outcome of the investment made by the investors into the business. The same logic applies to the reserves. Therefore, the reserves appear on the liabilities side of the balance sheet.

- Shield against unknown liability: Reserves provide protection to the enterprise. It also serves as a support to provide for unknown liabilities.

Kinds of Reserves

Revenue Reserves

The firm can create revenue reserves out of the revenue profits of the enterprise. Here, revenue profit means to profit from the sale of goods and services.

- Specific Reserves: Reserves made out of revenue profits for a specific purpose. This may include the Dividend Equalization Reserve, Dividend Redemption Reserve, and so forth.

- General Reserves: The purpose of creating these reserves is to strengthen the financial position of the firm. Also, it aims to keep the funds available for any future contingency or expenditure. Further, an alternative name for these reserves is free reserves. This is because they exhibit profit which is freely available for distribution.

Capital Reserves

Creation of reserves out of capital profits. Now you must be wondering, how do a company earn capital profits? Well, the company earns capital profits from:

- Profit on sale of fixed assets

- Pre-incorporation profits

- Premium on issue of shares or debentures

- Profits on redemption of debentures or forfeiture of shares

- Surplus of revaluation of fixed assets or liabilities

- Amount transferred to Capital Redemption Reserve on redemption of preference shares.

Also Read: Difference Between Revenue Reserve and Capital Reserve

Key Differences Between Retained Earnings and Reserves

- Reserves are that part of the earnings, receipts or surplus of a business entity that the company’s management sets apart for any reason. Conversely, Retained Earnings is that portion of the company’s profit earned, which the company keeps and accumulates in the business for utilisation in future.

- The aim of keeping money aside as retained earnings are to reinvest the sum in the main business to obtain lucrative returns. Also, it improves the financial performance of the firm. As against, reserves aim to meet future contingencies, losses and liabilities.

- We add a part of the current year’s profit to retained earnings after paying dividends. In contrast, the firm transfers a certain percentage of the current year’s profit to reserves every year before giving dividends.

- Reserves are a part of Retained Earnings, i.e. a reasonable part of retained earnings is kept as reserve.

- While reserves are classified as a capital reserves and revenue reserves, there is no further classification of retained earnings.

- Reserves can be general or specific. But, retained earnings are always general.

Similarities

Retained Earnings and Reserves are both a part of the Shareholder’s Fund. Further, they appear under the head Reserve and Surplus. They help in increasing the financial stability of the company. It also facilitates covering future uncertainties and losses. Further, they increase the net worth and promote financial stability.

Conclusion

All in all, retained earnings refer to the portion of profit which is set aside not to pay as dividends but for reinvestment purposes or to pay off debt. While that part of earnings, receipts or surplus of an enterprise appropriated by the management is reserved. Companies Act requires to transfer of a certain part of the profit in reserves.

Jay says

Hi Surbhi,

Nice article.

Venkatachalam V says

Wonderfully explained! Understood the differences clearly.

Girma says

It is easily understood and precisely articulated article with respect to the subject matter.

A.Sam says

Really Precise and elaborate.