In business, all the profit earned during a financial year is not utilized for payment of dividend to the shareholder, rather a certain amount is earmarked and retained in the business, so as to meet out future needs or cope with emergency situations, it is known as reserves. Based on the nature of profit from which reserves are created, they are grouped as revenue reserve and capital reserve. Revenue Reserve is created out of profit arising from day to day business operations while Capital Reserve is created out of capital profits

In business, all the profit earned during a financial year is not utilized for payment of dividend to the shareholder, rather a certain amount is earmarked and retained in the business, so as to meet out future needs or cope with emergency situations, it is known as reserves. Based on the nature of profit from which reserves are created, they are grouped as revenue reserve and capital reserve. Revenue Reserve is created out of profit arising from day to day business operations while Capital Reserve is created out of capital profits

Reserves are nothing but an appropriation of profit and thus it decreases the amount of profit available with the company for distribution to shareholders. It appears on the liabilities side of position statement (Balance Sheet) under the head Reserves and Surplus. In this article excerpt, you can find, substantial differences between revenue reserve and capital reserve.

Content: Revenue Reserve Vs Capital Reserve

Comparison Chart

| Basis for Comparison | Revenue Reserve | Capital Reserve |

|---|---|---|

| Meaning | Revenue Reserve refers to the sum of money retained in business, so as to meet out future contingencies. | Capital Reserve alludes to a fund, that is created to finance long term project or write off capital expenses. |

| Source | Revenue profit of the firm are the source of revenue reserves. | Capital profit of the firm are the source of capital reserve. |

| Aim | To meet unforeseen contingencies and improve entity's financial position. | To adhere to the statutory requirements or accounting principles. |

| Utilization | Based on the type of reserve it can be utilized for any or particular purpose only. | Capital reserve can be utilized for the purpose for which it is created. |

| Dividend | It is freely available for distribution as dividend. | It is not available for distribution as dividend. |

Definition of Revenue Reserve

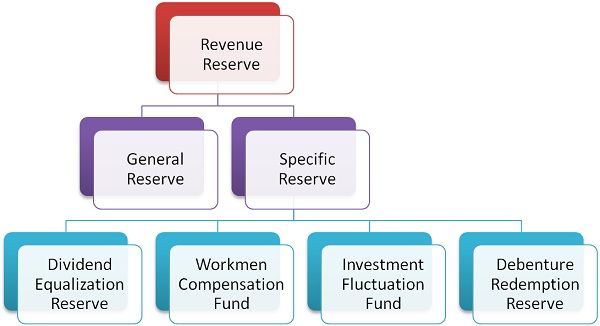

Revenue Reserve refers to the part of profit set aside and not distributed to shareholders as the dividend but kept in the business to meet out unforeseen future expenses or losses, or to invest in business expansion. It is created from revenue profit, which is a result of operating activities performed by the business entity, during the financial year. It is used to improvise the financial position of the entity. There are two types of revenue reserves:

- General Reserve: The reserve whose purpose for creation is not mentioned is called general reserve. As the management can use the reserve for any purpose, a general reserve is also known as a free reserve.

- Specific Reserve: the reserve fund, which can be utilized for the definite purpose only, is known as a specific reserve. Some examples of such reserve are:

- Debenture Redemption Reserve

- Workmen Compensation Fund

- Investment Fluctuation Fund

- Dividend Equalization Reserve.

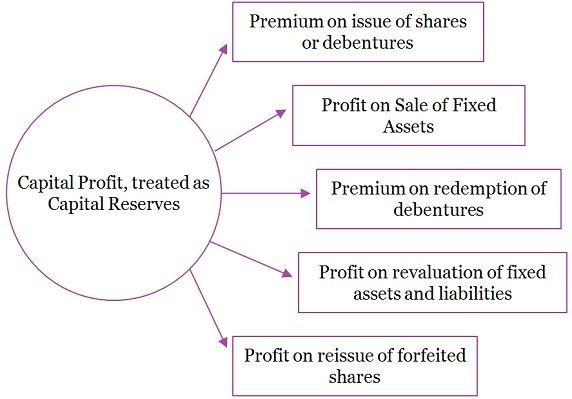

Definition of Capital Reserve

Capital Reserve can be understood as the sum earmarked for specific purposes or long term projects. It is the result of capital profit that is earned by the company from transactions of capital nature, such as:

- Profit on sale of fixed assets or investment.

- Pre-incorporation Profit

- Premium on issue of securities

- Profit on redemption of debentures.

- Profit on reissue of forfeited shares

- Profit on revaluation of assets and liabilities.

Capital Reserve is aimed at writing off capital losses, that occurs due to the sale of fixed asset, investment, etc. The amount of capital reserve can be used by the company to issue fully paid bonus shares, to the shareholders.

Key Differences Between Revenue Reserve and Capital Reserve

The points given below, explain the difference between revenue reserve and capital reserve:

- By revenue reserve we mean a portion of profit retained in business, so as to meet out future expenses or losses. On the contrary, the capital reserve may be defined as a reserve fund, which is created for a specific purpose, i.e. to finance large-scale projects or write off capital expenses.

- Profit arising out of the day to day business activities can be used for the creation of revenue reserves. Conversely, the profit arising as a result of non-operating business activities are the source of capital reserve.

- The primary objective of the creation of revenue reserve is to meet unforeseen contingencies and improve entity’s financial position. Unlike, the capital reserve is created to comply with the legal requirements or accounting principles.

- Revenue reserve is of two types, i.e. general reserve which can be utilized for any purpose, and specific reserve which can be utilized for a specific purpose only.

- The dividend can be declared out of revenue reserve, but it cannot be declared out of capital reserve.

Conclusion

Creation of reserves is vital for the business, to safeguard itself from any unexpected losses or contingencies, that may arise in future. It can also be used to strengthen the overall financial position of the firm and to redeem long-term debt such as debenture. While a revenue reserve represents the operational efficiency of the concern, which is not in the case of capital reserve.

Chukwuka says

I got the difference in the very first section. Thanks a lot, Surbhi!