Issuing shares is the primary method of raising funds for companies. Shares are the owned securities, and share capital is the owned capital. Generally, the capital of the company is divided into a number of equal units, i.e. shares. It describes the holder’s right to the specified amount of the company’s share capital.

Issuing shares is the primary method of raising funds for companies. Shares are the owned securities, and share capital is the owned capital. Generally, the capital of the company is divided into a number of equal units, i.e. shares. It describes the holder’s right to the specified amount of the company’s share capital.

Conversely, debenture implies a long-term instrument showing the company’s debt towards the external party. It yields a definite rate of interest, issued by the company and may or may not be secured against assets like stock and debtors.

For every publicly traded company, the issuance of shares is mandatory and must be maintained throughout the company’s life. As against, it is not compulsory for every publicly traded company to issue debentures.

In a world where people want to multiply their income and become financially independent at an early stage of their life, it is crucial to know the difference between shares and debentures.

Content: Shares Vs Debentures

Comparison Chart

| Basis for Comparison | Shares | Debentures |

|---|---|---|

| Meaning | Shares are a form of security indicating the ownership in an organization. | Debentures refer to a kind of security that indicates debt to a company. |

| What is it? | Shares represent the capital of the company. | Debentures represent the debt of the company. |

| Fund | Company-owned | Borrowed |

| Holder | The holder of shares is called a shareholder. | The holder of debentures is called a debenture holder. |

| Status of Holders | Owners of the company. | Creditors of the company. |

| Indicates | A part of the company's capital. | Loan |

| Voting Rights | Yes | No |

| Return | The company pays dividends to shareholders. | The company pays interest to debenture holders. |

| Payment of Return | Dividends can be paid to shareholders only out of profits. | Interest can be paid to debenture holders even if there is no profit. |

| Allowable deduction | The dividend is an appropriation of profit, so it is not allowed as a deduction. | Interest is a business expense and is allowed as a deduction from profit. |

| Convertibility | Not convertible into debentures. | Convertible into shares |

| Repayment in winding up | Repayment of capital to shareholders is made after paying off liabilities. | Debentures get priority over shares, and so they are repaid before shares. |

| Return on Investment | On recommendation by the board, the dividend is paid to the shareholders. | Fixed-rate of interest paid before the dividend declaration. |

| Charge | It does not carry any charge. | Charge on the assets of the company. |

| Trust Deed | No trust deed is executed in the case of shares. | When the debentures are issued to the public, a trust deed must be executed. |

What are Shares?

The smallest division of the company’s capital is share. It is a part, interest, or, say, share in the share capital of a company. A share is the unit into which the company’s capital is divided. It represents the interest in the assets and the company’s profits. It also covers several rights provided by the company’s Articles of Association. Shares have a unique number and face value.

The shares are offered for sale in the open market, i.e. stock market, to raise capital for the company. The rate at which the shares are offered is the share price.

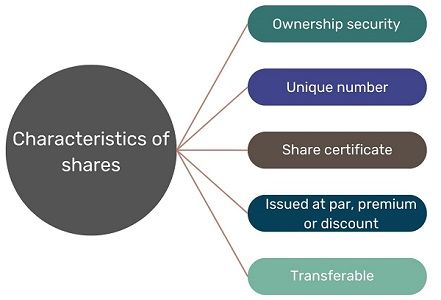

Characteristics of Shares

- It is an ownership security. Simply put, the shareholder is a part owner of the company.

- Shares have a nominal value, and they carry a unique number.

- A share certificate is issued under the common seal of the company. It certifies that the person whose name is stated is the registered holder of a defined number of shares.

- The company can issue shares at par, premium and at a discount.

- The shares are movable, i.e. transferable from one shareholder to another.

What is Share Capital?

Share capital is the total of the nominal value of shares of a company is share capital.

Types of Shares

Shares are of two types:

- Equity Shares: The shares that carry voting rights on which the rate of dividend is not fixed. They are irredeemable in nature. These are ordinary shares of the company. They do not carry any preferential rights or priority in dividend payment and capital repayment. These shares are issued first, before any shares are issued, and their repayment is made at the last. The company pays dividends to shareholders only when it earns profit.

- Preference Shares: Shares that enjoy certain privileges or preferential rights as to dividends and return on capital. The dividend is paid at a fixed rate to the preference shareholders before the payment of the dividend to equity shareholders. In the event of liquidation of the company, capital of preference shareholders must be repaid prior to the repayment of capital to equity shareholders.

Also Read: Difference Between Equity Shares and Preference Shares

What are Debentures?

A debenture is a long-term debt instrument issued by the company under its common seal to the debenture holder. A loan raised by a firm is divided into numerous parts, wherein each part is called a debenture. It shows the indebtedness of the company. Therefore, the capital raised by the company is the borrowed capital. Hence, debenture holders are the company’s creditors. Further, they are freely transferable.

A debenture is a certificate that the borrowing company issues to the debentureholder indicating the amount lent by him. In simple words, the certificate or document is nothing but an acknowledgement of debt, plus it is a formal promise to repay the given sum along with interest on or before the date prescribed. The certificate is issued under a common seal. It is serially numbered.

They do not carry voting rights. There is a fixed rate of interest paid to the debenture holders every year. The interest is paid to the holders periodically till maturity.

A debenture is like a bond by the company. The company offers shares to the public by means of a prospectus. It contains terms and conditions for repayment of both principal and interest.

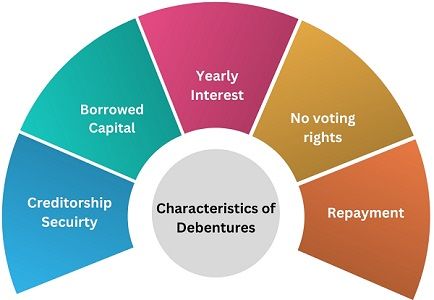

Characteristics of Debentures

- It is a creditorship security.

- It represents borrowed capital.

- Interest is paid yearly, even when the company does not profit. If interest and borrowed funds are not paid to the debenture holders on a timely basis, they can take legal action against the company.

- Debentures do not carry any voting rights.

- Debentures are repayable after a specific period of maturity or when the company goes for liquidation.

Types of Debentures

- Secured Debentures

- Unsecured Debentures

- Convertible Debentures

- Non-convertible Debentures

- Registered Debentures

- Bearer Debentures

Also Read: Difference Between Bonds and Debentures

Key Differences Between Shares and Debentures

- Shareholders are the owners of the share units of the company, whereas debenture holders are creditors of the company. A share is a part of the company’s owned capital. On the other hand, debenture is a part of a company’s borrowed capital.

- The dividend is paid to shareholders as a return. However, it is paid only when the company earns profits. As against, interest is paid to the debenture holder, no matter if the company earns a profit or not.

- The dividend of the company varies with the amount of profit earned by the company. In contrast, the rate of interest on debentures is fixed, and it is not dependent on the profits earned. So, it is regular.

- The company issues shares without any mortgage or charge against the company’s property. However, debentures are usually issued against the security of specific assets like stock or debtors. One should note that debentures can be unsecured while a share is generally secured.

- In case of winding up of the company, shareholders have residual rights. On the other hand, debenture holders have the first right to the company’s assets after paying off dues and employee liabilities.

- As a matter of right, the holder cannot claim a dividend. On the contrary, as a matter of right, the holder can claim interest.

- Shares carry voting rights, and they have the right to participate in the company’s management. Conversely, debentures do not carry voting rights. Also, they cannot participate in the company’s management.

- Share capital is refundable only when the company goes into liquidation. As against, the company can refund the amount of debentures even before the winding up of the company. It must be repaid as per the terms of the issue. The company cannot repay redeemable preference shares without formality.

- Repayment to debenture holders takes place first; thereafter, repayment of capital to shareholders takes place. Sharecapital is repaid after settlement of the claims of debentureholders and creditors.

- Conversion of debentures into shares is possible in the case of convertible debentures. However, it is not possible to convert shares into debentures.

- Interest paid to debenture holders is tax deductible from profits after charging income tax. However, the dividend is not tax deductible.

- A trust deed is not executed in the case of shares. In contrast, a trust deed is executed when the debentures are issued to the public.

- Shares are issued at a discount, subject to some legal compliance. Debentures can be issued at a discount without any legal compliance.

Video: Shares Vs Debentures

Similarities

- Both are Financial assets.

- company issues shares and debentures to public.

- Source of raising money for the company.

- They can be issued at a discount.

Conclusion

Above all, share capital appears under ‘ shareholder’s fund’ on the equity and liabilities side of the Balance Sheet. Conversely, debentures appear under long-term borrowings, under the head ‘Non-Current Liabilities’ in the equity and liabilities side of the balance sheet.

Promise says

This really helped me…thank you

sujatha.s says

i got necessary information from this article, thank you so much.

shani sein says

it has really helped me…i love this

Surbhi S says

Thanks for expressing your views with us. 🙂

lindelwe says

thank u so much it has helped me a lot.

Saurav Kulkarni says

This information is very useful for me , Thank you …..

Waji says

Very helpful, thank you.

Deepansh pratap tyagi says

this is really very helpful, thank you

arkavg says

The explanation cleared my tough doubt. Thanks allot to the publisher.

sruthy says

Really helpful for me to take necessary information regarding this, which helps in my seminar

DURGESH K. PAWAR says

Thanks a lot. Keep improving our knowledge.

Ashok says

nice explain

Shekhar Ruhela says

Thanks for a clear differentiation, much helpful to understand

Rakesh kumar Ranjan says

Thank you so much.

Anmol trivedi says

Very useful notes… Briefly described!!!

Surbhi S says

I am much thankful to all of you for appreciating the content.. 🙂

Gautam Tibrewal says

Simple clear understanding

Neermal says

Thank you it helped me a lot

Pramod says

Thanks.Simple and clear

Purva says

Great Information. Thank you.

puja says

thank u… it was a great help

MUQADDAR KHAN says

THANKU SO MUCH IT HAS HELPED TO ME LOT……

Carol says

Thanks a lot. At least I can now differentiate between the two

Surbhi S says

We are really contented with your views, it motivates us to do better, keep sharing, keep reading 😀 😎

elijah a says

it really helped me in my assignment

Mounika says

Thank you

Avlokit Maurya says

Thank You so much, It has helped me a lot……….

Sarachandran Nair says

Very useful information, Thank you.

Rahul says

Thanx so helpful

Chethan says

Very presize and accurate explanation thank u

shivaji says

It is very helpful, Thank you.

Rajendra Buradikatti says

I got the information I need. Thank you.

Dilip sharma says

Helpful ..

jennifer katram says

This information about Shares and Debentures is very helpful for my students and community members. thanks

Surbhi S says

Thanks a ton to all the viewers for constantly appreciating us. It encourages us to do better. Key visiting and sharing your views with us. 🙂

Suprim says

What is the difference between a debenture and a fixed deposit?

Ram Malav says

Really good article

Riya says

We are privileged to have this contemptuous content from the site .on regards Thank you so much ……….!!!!!!!!😊😊

Mathew says

I have never seen such a wonderful, clear explanation of these concepts….Great!

Rohan Mahant says

Wonderful article

Thank you so much for this helpful article .😀

Benney. J says

Very well explained. Helped a lot, as I’m just getting into this business. Thanks

Dina pascal says

Thank you very simple and clearly

Ahmed EkbaLz says

Thanks a lot to the creator. It helped me the most & fetl comfort over reading it😍

XTOPHER says

Thank You! THANK You for sharing this information in an easily digestible, mentally friendly comprehensive way.

Greatly, deeply, appreciation to the generous author. 🙏

Ajay says

Very helpful, thank you 🙂

Debasish Rout says

Really a very helpful resource..

I cleared my doubt. AWESOME ❤️ SUPERB

Daniel Anamkulya says

Thanks a lot for a clear differentiation and very simple

Rikesh sardar says

Beautiful information , thank you

Christopher says

this indeed deserve high credit. thanks so much for a wonderful work.

Aondover Sughter Amos says

This work is so logical thanks so much

Mohammed Abubakor says

I always prefer this site campared to others when this is any content that I’m looking for. Thank you soooo much for describing the differences in a easy way.

Shopia says

This is a place where you can find information that you can trust, and understand as you observe your importance.

This information is very helpful for your visitors, which will provide a lot of good information to the visitors of your website.

Thank You

Rebecca Mwandalile says

Thanks for the information it’s has really helped me

Leewinsky says

thanks you so much you have really helped me in my revisions