When there is a profit from the sale or transfer of a capital asset such as building, car, jewellery, shares, etc. it is known as capital gain, which is taxable under the Income Tax Act, as it is regarded as the income of the previous year in which the transfer occurs. It can be short-term capital gain or long-term capital gain. The short-term capital gain refers to the profit earned by an individual on account of the transfer of the short-term capital asset.

When there is a profit from the sale or transfer of a capital asset such as building, car, jewellery, shares, etc. it is known as capital gain, which is taxable under the Income Tax Act, as it is regarded as the income of the previous year in which the transfer occurs. It can be short-term capital gain or long-term capital gain. The short-term capital gain refers to the profit earned by an individual on account of the transfer of the short-term capital asset.

On the other extreme, when a long-term capital asset is transferred by an individual, the profit earned is called long-term capital gain. The primary difference between short-term and long-term capital gain lies in the period for which the capital asset or investment is held by an individual.

Content: Short Term Capital Gain Vs Long Term Capital Gain

Comparison Chart

| Basis for Comparison | Short Term Capital Gain | Long Term Capital Gain |

|---|---|---|

| Meaning | Profit arising out of sale of short term capital asset is known as short term capital gain. | Long term capital gain is one that arises on the transfer of long term capital asset from an individual. |

| Capital Asset | Less than 24 months for immovable property and 36 months in case of movable one. | More than 24 months for immovable property and 36 months in case of movable one. |

| Financial Asset | Holding period is less than 12 months | Holding period is more than 12 months |

| Rate of taxation | Normal income tax rate | 20% |

Definition of Short Term Capital Gain

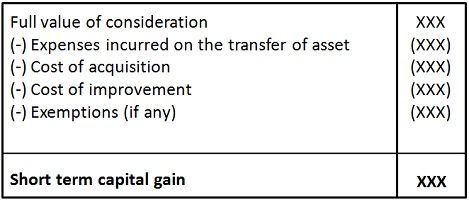

Short-term capital gain, as the name suggests, is the profit earned by an individual from the transfer or sale of the short-term capital asset. Here short-term capital asset implies the asset (movable) which is owned by the assessee for a period less than 36 months just before the transfer date. Although, in the case of immovable property, the period of holding is less than 24 months immediately preceding the date of transfer.

In the case of financial assets that are quoted in the recognized exchange, the asset holding period should not be exceeding 12 months and for unlisted securities the period of holding is less than 24 months.

- Cost of acquisition refers to the amount for which the asset is purchased by the assessee.

- Cost of Improvement implies the amount expensed by the assessee for any addition or improvement in the capital asset.

Definition of Long-Term Capital Gain

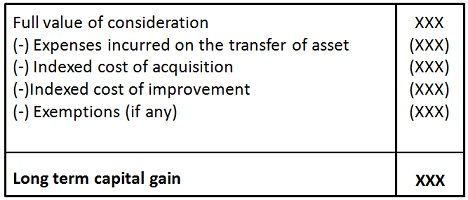

When the period for which the asset (movable) is held is greater than 36 months, just before the transfer date, the capital asset is regarded as the long-term capital asset, and the gain is known as long-term capital gain. However, on the transfer of immovable property such as land, building, etc., the holding period should be 24 months or more.

In case of securities, which are listed on a recognized exchange, the period of holding is reduced to 12 months or more and for unlisted securities, the holding period must be 24 months or more.

Where, Indexed Cost of Acquisition =![]()

Key Differences Between Short Term and Long Term Capital Gain

The differences between short term and long term capital gain are drawn clearly on the following grounds:

- Short-term capital gain is one in which profit earned from the sale of the capital asset, is owned by the assessee for a period less than 36 months. Conversely, when the asset transferred is held by the assessee, for more than 36 months, the gain arising out of such transfer is termed as long-term capital gain.

- On the transfer of immovable property by the assessee, if the period of holding is less than 24 months, then the gain arising out of such transfer is known as short-term capital gain, while if the same is held for a period exceeding 24 months, the gain is termed as long-term capital gain.

- In the case of financial assets, the period of holding is reduced to 12 months, so if the asset is held for less than 12 months, then the gain from the transfer of such asset will be short-term capital gain. On the contrary, if the securities like shares or zero coupon bonds are held for more than a year, the gain effected from the transfer will be long-term capital gain.

- Short-term capital gain is taxable as per normal income tax slab rates. In contrast, the long-term capital gain is chargeable to tax is 20%.

Conclusion

To sum up, the capital gain is one of the heads of income under the income tax act. Both short term and long term capital gains are chargeable to tax, but exemptions are also defined in the income tax act. The basic difference between these two lies in the length of time for which the assessee owns the asset.

Naveen Kohli says

It’s very interesting,