The occurrence of expenditure during the course of business is very natural. These are broadly classified into two categories, i.e. capital expenditure and revenue expenditure. Capital Expenditure is the one which a company incurs to acquire an asset or improve the capacity of the asset or repay long-term liability. Conversely, revenue expenditure implies the routine expenditure, that the company incurs to undertake day-to-day operations.

The occurrence of expenditure during the course of business is very natural. These are broadly classified into two categories, i.e. capital expenditure and revenue expenditure. Capital Expenditure is the one which a company incurs to acquire an asset or improve the capacity of the asset or repay long-term liability. Conversely, revenue expenditure implies the routine expenditure, that the company incurs to undertake day-to-day operations.

Introduction

Basically, we use the word ‘capital‘ for the long term, i.e. which is going to provide benefit for a long period of time or for which we are liable for the long term. So, if something is of a capital nature, its benefit may extend to several years. Next, it is of non-recurring nature, as they occur once in a while. Further, it creates a capital asset or capital liability, such as plant and machinery, land and building or share capital, loan etc.

Revenue items are going to provide benefits in the same accounting period. These occur frequently. They are related to regular operations, i.e. the ordinary course of business. These lead to the creation of current assets or current liabilities.

Here you should take a note that, all capital nature items appear on the balance sheet.

To understand this, think of sales which occur on a daily basis, or rent that a company pays for the use of land or building on a monthly basis. So, these are recurring in nature.

Let us move further in this post and understand the difference between capital and revenue expenditure.

Content: Capital Vs Revenue Expenditure

- Comparison Chart

- What is Capital Expenditure?

- What is Revenue Expenditure?

- Key Differences

- Video

- Accounting Treatment

- Conclusion

Comparison Chart

| Basis for Comparison | Capital Expenditure | Revenue Expenditure |

|---|---|---|

| Meaning | Capital Expenditure refers to the outlay of funds for acquiring or increasing the value of the fixed assets. | Revenue Expenditure is an expenditure whose whole benefit is utilized during the current accounting period. |

| Nature | Non-recurring outlay | Recurring Outlay |

| Tends to | Increase earning capacity | Maintains earning capacity |

| Benefits | Produces benefits over several years. | Produces benefits for an accounting year. |

| Appears in | Balance Sheet | Profit and Loss Account |

| Nature | Real Account | Nominal Account |

| Debited to | Asset Account | Expense Account |

| Adds value to an existing asset | Yes | No |

| Capitalization of Expenses | Yes | No |

| Purpose | For acquiring or erecting fixed assets to be used in business. | For carrying out day-to-day activities of the business. |

| Matching concept | Not matched with capital receipts | Matched with revenue receipts |

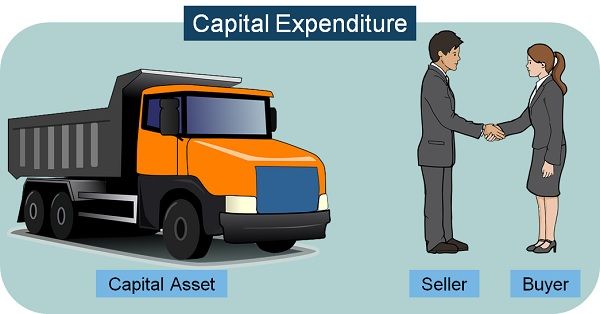

What is Capital Expenditure?

An outlay of funds for acquiring or improving a fixed asset that the company will use to earn revenue over the years is a capital expenditure.

Companies incur such expenses in an accounting year, but it yields benefits for several years.

Further, as the expenditure leads to the acquisition of an asset, the part of the asset the firm consumes in an accounting year during its use is depreciation. Further, the fixed asset is completely consumed over its useful life.

It is a one-time expenditure. The company incurs it in connection to the acquisition of capital assets for using them to generate revenue over a long period.

What is Capital Asset?

A capital asset is one that a company uses for business purposes. This implies that they are not meant for sale in the normal course of business.

It indicates a large capital investment which the company does to maintain or expand its potential to generate more profits. The firm also spends it to increase its lifespan to generate future cash flows or to decrease the cost of production.

Characteristics of Capital Expenditure

- Incurred to purchase the new capital asset or upgrade the existing ones.

- These aim to improve the working capacity or productivity or reduce the operating expenses. For Example: Suppose the plant and machinery installed in the factory produces 1,00,000 units. Thereafter, the company installs an additional part, after which it produces 1,20,000 units. This will lead to an increase in revenue generation.

- The firm incurs capital expenditure in the current accounting year but its benefits are of enduring nature. Simply put, they are spread over several accounting years.

- They are one-off expenses. They are not incurred frequently.

- The purchase of fixed assets is for use in business and not for resale.

- The total cost of purchasing the fixed asset will cover the cost of installation and erection.

- The incorporation or registration expenses of the company are capital expenditures. For Example: In franchising, the firm granting the license is a franchiser. The individual or entity to whom the right is given is the franchisee. The franchisee obtains the franchise by paying initial startup and annual licensing fees to the franchiser. The initial startup cost is a non-recurring expenditure, which is a capital expenditure.

- Expenditure on installation and transportation of fixed assets, to put them to use.

- Expenditure that improves the efficiency of a fixed asset. For Example: Suppose the machinery installed in the factory produces 1000 units in 24 hours, so the company spends money on its overhauling of machinery. After that, the efficiency of the machinery is improved and then it has started producing 1000 units in 20 hours.

Example

- Acquisition of Fixed assets like land and building, plant and machinery.

- Extension or improvement of fixed assets, such as remodelling of the departmental store.

- Installation or erection of plant, such as labour charges for the erection of the plant.

- Carriage, cartage and freight expenses incurred to acquire assets.

- Obtaining the right to undertake business like license, franchise, copyright, patent, etc.

- Substitution of new assets for an existing one.

- Purchase of material for building construction.

Also Read: Difference Between Capital and Revenue Receipt

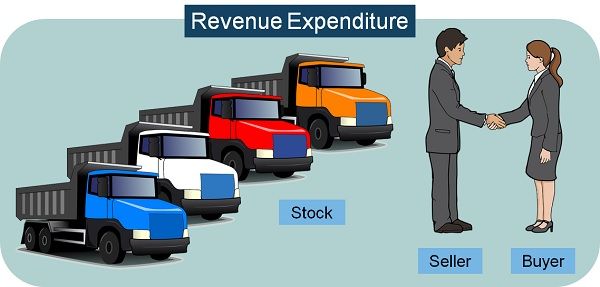

What is Revenue Expenditure?

Revenue Expenditure covers all such expenditures which a company incurs in an accounting year to earn revenue or keep the revenue earning capacity intact. Also, that part of the capital asset which is consumed in an accounting period is also revenue expenditure.

It encompasses ordinary repair and maintenance cost which is essential to keep the asset in working condition.

Revenue Expenditure is fully consumed in an accounting year. The firm incurs it to carry out operating activities, in the normal course of operations.

Characteristics of Revenue Expenditure

- It is of recurring nature, as the firm spends them as a routine business expense.

- The incurrence of expenditure is for undertaking the day-to-day running of the business.

- Incurred for maintaining the revenue earning capacity.

- Any asset that the company buys or creates with this expenditure is meant for sale.

- Expenditure whose benefit exhausts in the current accounting period.

- As per the accrual accounting assumption, we recognize the revenue when it is earned. However, we recognise the expenditure as and when the company incurs it. Therefore, we charge the revenue expenditure to the Income Statement as and when they occur.

- It satisfies the fundamental principle of matching, i.e. for ascertainment of the profit or loss, we will match the revenue expenditure against the revenues of the concerned period.

- Nature of Business: Suppose a company deals in cars, so the purchase of a car, creates inventory that the company uses for the purpose of resale, then this will amount to revenue expenditure. But we do not treat it as revenue expenditure if the company deals in some other goods.

Examples

- Cost of inventory purchased for resale.

- Depreciation of Fixed Assets.

- Salaries, Rent, Taxes, etc.

- Interest on loan

- Repairs, and renewals.

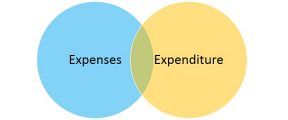

Also Read: Difference Between Expenses and Expenditure

Key Differences Between Capital Expenditure and Revenue Expenditure

The points displayed here will state the differences between capital expenditure and revenue expenditure:

- Capital Expenditure refers to the expenditure that a firm incurs to acquire and increase the value of the capital asset or to make an addition to it. Revenue Expenditure is an expenditure whose benefit exhausts within an accounting period. Also, the firm spends it during the course of regular business transactions.

- Typically firms derive benefits from capital expenditure over a long period. But in the case of revenue expenditure reaps benefits for a maximum period of one year i.e. 12 months.

- As the company invests a huge amount in capital expenditure. So, we capitalize it. This means that the amount of expenditure is spread over the remaining useful life of the asset. Conversely, there is no such capitalization in the case of revenue expenditure.

- A company incurs capital expenditure to improve its profit-earning potential. For example purchase of state-of-the-art technology-oriented capital assets for increasing production. Whereas the firm incurs revenue expenditure with an aim of maintaining the profit earning capacity of the company. For example, periodical servicing of capital assets.

- While capital assets appear on the balance sheet. Revenue expenditures appear in the Trading and Profit and Loss account.

- Because capital expenditures are for acquiring fixed assets, they normally involve a huge investment of funds as compared to revenue expenditure.

Video: Capital Vs Revenue Expenditure

Accounting Treatment of Capital Expenditure

When the value of the fixed asset is acquired or increased by way of capital expenditure, we will debit the asset account. This is because these expenditures result in an increase in the value of assets. And in case of an increase, we typically debit the asset account.

In accounting, we disclose assets on the asset side of the balance sheet.

Accounting Treatment of Revenue Expenditure

There is a debit in the expense account, for such expenditure. Further, they appear on the debit side of the Trading and Profit and Loss Account.

For Example: On the purchase of stock, we debit the purchase account and it appears on the debit side of the Trading Account.

Further, we enter the expenses relating to direct expenses like wages, freight, manufacturing expenses, and so forth on the debit side of the Trading Account. Whereas we record the expenses concerning indirect expenses like salaries, rent, insurance, interest and taxes, on the debit side of the Profit and Loss Account.

Conclusion

All in all, the expenditure to increase current, and future economic benefits, is capital expenditure. It is a long-term investment which an enterprise performs, in the name of assets, to create financial gain for the years to come. The expenditure which we incur on a regular basis for conducting the operational activities of the business is Revenue Expenditure.

RAHUL PRADHAN says

nice explaination

Soham Paul says

Thanks for providing such wonderful information.

ishita verma says

nice

kiran says

nice explaination

Piyush says

Very nicely explained….and I would like to subscribe if option is available.

surabhi prasad says

u r doing well keep it up

Alexious Nota says

Wawoh! well-articulated. Thank you

A.Sam says

You have really simplified it, and I have enjoyed it.