In auditing, verification implies the process of checking the accuracy of the value of assets and liability. The auditor checks the accuracy with regard to the title and the existence of the assets and liabilities as the company’s books reflect.

In auditing, verification implies the process of checking the accuracy of the value of assets and liability. The auditor checks the accuracy with regard to the title and the existence of the assets and liabilities as the company’s books reflect.

Valuation of assets means the determination of the value of the specific asset of the enterprise on the balance sheet date. It involves testing the correct value of assets depending upon their utility. In short, it is all about finding out the monetary value of an asset, at which the asset appears in the company’s books of accounts.

Introduction

The aim of carrying out an audit is to find out if the company’s financial statement represents its actual financial position in a true and fair way. Besides, only the presence of an entry in accounts does not prove the existence of assets at the date of the balance sheet.

More precisely, the entry in the company’s books indicates that the asset ought to exist. However, it is the work of the auditor to make sure that the asset exists in reality too and not only in books. Plus, the value appearing on the Company’s Balance Sheet is correct. Hence, verification and valuation together form an indispensable part of an audit.

In this post, you will get to know the difference between verification and valuation.

Content: Verification Vs Valuation

Comparison Chart

| Basis for Comparison | Verification | Valuation |

|---|---|---|

| Meaning | Verification is the process in which the auditor checks whether the assets displayed in the balance sheet, exist in the name of the business. Also, it confirms whether they exist in reality or not, or whether there is any charge on them. | Valuation is the examination of the actual value of the assets and liability of the enterprise as depicted in the Balance Sheet. |

| Time | It takes place at the end of the financial year. | It takes place for the whole year's transactions. |

| Objective | To check the existence, ownership and possession of assets. | To find out the real values of assets as per GAAP. |

| Who performs the work? | Auditor | Management |

| Advice | The auditor does not seek external support for verification. | The auditor may seek advice from valuers for valuation. |

| Basis | Facts and Information | Estimations |

| Documentary Evidence | Title Deed, Receipt for payment etc. | Certificate offered by owners, directors or experts. |

| Performance of Work | Work is performed by an auditor or his staff. | Work is performed by the client's staff but tested by an auditor or his staff. |

| Guarantee by auditor | The auditor guarantees the verification of assets and liability. | The auditor does not guarantee the accuracy of the valuation of assets and liability. |

| Nature | Objective | Subjective |

| Sequence | Second | First |

Definition of Verification

Verification implies proof of evidence that confirms the truth. The auditor checks that entries posted in the Balance Sheet of the firm properly classify the items into assets and liabilities.

In short, verification satisfies the auditor about the authenticity of the assets and liabilities.

Besides, at the time of verification of the assets, it is preferable to divide the assets into two groups:

- The assets which are purchased during the year under review.

- The assets which are held at the date of the previous Balance Sheet.

In the first case, it is pertinent to vouch for their acquisition. In this regard, verification of cost and authorization aspects takes place.

Activities in Verification

- Comparing Ledger Accounts of the assets with Balance Sheet.

- Verifying the physical existence of the assets as on the Balance Sheet date.

- Ensuring that the purpose of acquiring assets is for business use and are used for that only.

- Making certain that the acquisition of assets is authorized by the designated officer.

- Confirming that the assets are actually owned by the firm only.

Items of Verification

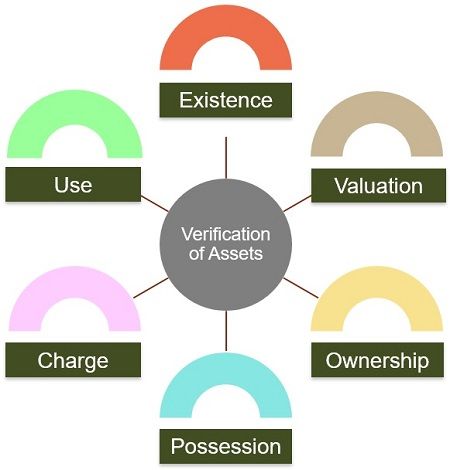

Verification of Assets involves:

- Existence: Assets do exist at the date of the Balance Sheet.

- Valuation: Assets are valued in the Balance Sheet correctly.

- Ownership: Legal ownership and title lie with the enterprise.

- Possession: Possession of assets lies with the enterprise.

- Charge: Assets are free from any charge.

- Use: Assets are acquired for business and the Balance Sheet discloses them.

Verification of Liabilities involves:

- Existence: Liabilities appearing in the Balance Sheet are actually due for payment.

- Obligation: Liabilities that indicate the creation of business obligations towards external parties are for the legal operation of the business.

- Completeness: Check whether all the known liabilities have been duly accounted for. Also, contingent liabilities are appearing as a footnote to the Balance Sheet.

- Valuation: Liabilities appear in the financial statement at a correct and reasonable value.

- Disclosure: Ensuring that there is proper classification and disclosure of liabilities in the financial statements as per the relevant accounting principles.

Also Read: Difference Between Vouching and Verification

Definition of Valuation

Valuation of assets refers to the assessment of the accuracy of the value of assets based on the utility which appears on the Balance Sheet of the firm at the end of the financial year. It facilitates checking the correct financial position of the enterprise. It covers:

- Collecting all the necessary information about valuation.

- Analyzing all the figures

- Confirming the fact that the valuation follows the rules of GAAP.

- Ensuring consistency in the methods followed for the valuation of assets every year.

- Getting an opinion about the accuracy of valuation.

In addition, the auditor has to ensure the correctness of the basis of valuation and calculation. He must confirm that provisions for contingencies are created. Further, the primary objective of the valuation of assets is to exhibit that the Balance Sheet indicates a true and fair view of the enterprise. Also, he must confirm that the accounts are free from any manipulations that inflate the company’s profits.

What is the Cost Price?

The price at which the company has bought the asset.

What is Market Price?

It refers to the price prevalent in the market on a particular date for that asset. In essence, it is the amount which the buyer is ready to pay on the sale of an asset at that particular date.

Issues relating to Valuation

- Checking if the assets should be valued at replacement or realizable value.

- Valuing the assets at the time of inflation.

- Break up value or scrap value of assets.

Objectives of Valuation

Valuation aims to:

- Evaluate the actual financial position of the enterprise.

- Determine the true position of assets at the Balance Sheet date.

- Check the mode of investment of the company’s capital.

- Estimate the firm’s goodwill.

- Identify the difference in the value of assets when the company purchased them and at the date of the Balance Sheet. Also, find out the reasons for the difference.

Points to Ponder

One should take note that the assets are valued by taking into account the following points:

- Original cost

- Expected working life of the asset

- Wear and tear of the asset

- Break-up value of the assets

- Chances of assets turning obsolete

Types of Values

- Replacement Value: Amount needed to acquire another asset of a similar type to replace the existing one.

- Realizable Value: The amount which an existing asset would get if the company sells it in the open market.

- Break-up Value or Scrap Value: Amount that a company realizes if it sells a particular asset when it turns out as unserviceable.

- Book Value: The value at which assets appear in the books of accounts of the enterprise.

- Liquidation Value: The value that a firm gets for the asset at the time of liquidation of the Company.

Also Read: Difference Between Accounting and Auditing

Key Differences Between Verification and Valuation

- Verification deals with the examination of the ownership rights, their existence and possession together with valuation. Conversely, Valuation is all about ascertainment of the actual worth of the assets and liabilities of an enterprise in monetary terms, which the enterprise depicts in the Balance Sheet.

- Verification involves checking the genuineness of the title of ownership and valuation of the assets of the enterprise. In contrast, valuation involves the assessment of the propriety of the methods which a company uses for the valuation of assets and liabilities.

- The objective of the verification is to find out whether the assets and liabilities that a company owns are appearing accurately in the financial statement at their right values. Oppositely, the objective of valuation is to make certain that the valuation of assets and liabilities of the enterprise is accurate. Also, the company has followed prescribed rules.

- The verification process does not need services from other experts by auditors. But, the process of valuation needs the services of the valuer.

- In case of verification, the auditor does not issue a specific certificate for verifying the assets and liabilities. As opposed, when the company seeks services from a valuer for the valuation of assets and liabilities, then he must provide a certificate of valuation.

- The auditor or his staff performs the work of verification. On the other hand, the client’s staff performs the work of valuation but the auditor performs its testing.

- While, verification is objective, as it relies upon documentary evidence and physical examination. As against, valuation is subjective because it relies upon documentary evidence and certificate which a valuer and officials of the client issue.

- Valuation precedes verification work.

Conclusion

Above all, the valuation of assets is an integral part of verification. In the absence of the valuation of assets and liabilities, verification will not be possible. Verification includes other than valuation, the examination of ownership rights, the existence of the asset and checking if they are free from any charge or mortgage.

Leave a Reply