The cheque is just like a paper leaf, containing an order to the bank to pay the specified amount to the person whose name is stated on it. However, there is always a risk of dishonour of a cheque due to various reason, for which many entities prefer demand draft instead, as the payment is guaranteed.

The cheque is just like a paper leaf, containing an order to the bank to pay the specified amount to the person whose name is stated on it. However, there is always a risk of dishonour of a cheque due to various reason, for which many entities prefer demand draft instead, as the payment is guaranteed.

A demand draft is an instrument issued by the bank in favour of the beneficiary and used for the transfer of money. But, again the person has to visit the bank branch to apply for the demand draft.

Banks are an integral part of our life, as millions of financial transaction take place daily, in which bank acts as an intermediary, like for depositing cash and valuables, withdrawal of cash, fund transfer, bill payment, ticket booking, purchase and sale of commodities, etc. For this purpose, various methods of payment are used, in which cheques and demand drafts are also included.

In this writeup, you will get to know about the differences between cheque and demand draft.

Contents: Cheque Vs Demand Draft

- Comparison Chart

- Definition

- Key Differences

- Video

- Contents

- Types

- Frequently Asked Questions

- Conclusion

Comparison Chart

| Basis for Comparison | Cheque | Demand Draft |

|---|---|---|

| Meaning | A cheque is a written document which contains an order to the bank, to pay a certain sum of money to a specified person. | Demand Draft is a negotiable instrument, issued by the bank in favour of a certain person or entity, to transfer of money from one place to another. |

| Order of payment | By the account holder to the bank. | By the branch of a bank to another branch of the same bank. |

| Payment | Payable either to order or to bearer. | Always payable on demand to a specified party. |

| Issuance | The cheque is issued by a customer of the bank. | Demand Draft is issued by a bank. |

| Bank Charges for issuance | No | Yes |

| Drawer | Customer of the bank. | Bank itself. |

| Signature | It must be signed by the party issuing it, be it an individual or authorized signatory of a firm. | It contains seal and signature of the authorized officer and the rubber stamp of the bank. |

| Parties Involved | Three Parties | Two Parties |

| Dishonor | Yes | No |

Definition of Cheque

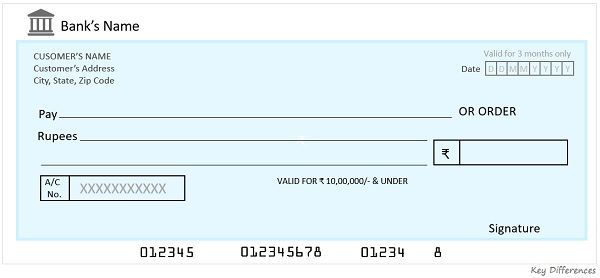

Cheque or check refers to the financial instrument, used for making payment to a party. It is drawn on a certain banker and is not expressly declared to be payable otherwise than on-demand. It has to be presented to the bank for payment, by the payee or holder of the instrument. It is valid for 3 months only.

Always remember cheque does not mean cash because it does not infer certainty of payment. Unless the cheque is not presented before the bank, within a reasonable time, proceeds cannot be realized. Further, the availability of funds in the account is a precondition for payment of the cheque. If sufficient funds are not present in the account, the cheque will be dishonoured.

Specimen of Cheque

What makes a cheque, a negotiable instrument?

The cheque is called as a negotiable instrument because it can be used in exchange for cash. Further, it can be negotiated by way of endorsement and its payment is made, on-demand. Further, when a cheque is payable to the bearer, it is negotiable through a mere hand delivery.

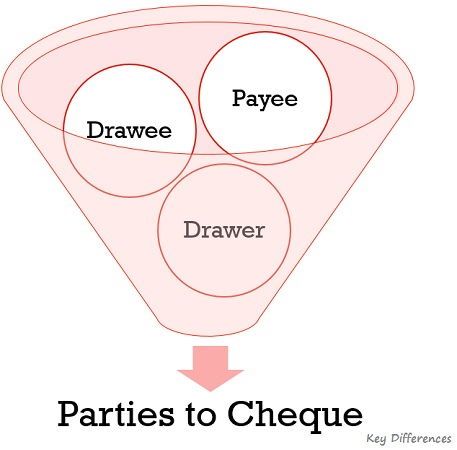

Parties to Cheque

There are three parties to the cheque:

- Drawer: Maker or Issuer of the cheque.

- Drawee: Party directed to make a payment, i.e. the bank on which the cheque is drawn.

- Payee: To whom the amount of the cheque is payable.

It is to be noted that, when the payment is to be made to a third party, the drawer and payee of the cheques are two different persons. But, when the cheque is drawn on ‘Self’, drawer and payee are one and the same person.

Also Read: Difference Between Cheque and Bill of Exchange

Definition of Demand Draft

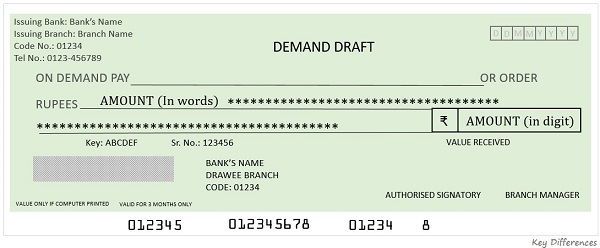

Demand Draft or DD can be understood as a prepaid financial instrument, in which the drawee bank is assumed to make the payment in full, whenever the DD is presented by the payee, to the bank for payment. It is issued by the bank in favour of the recipient to transfer money from one bank branch to another, located outside the city.

Here, the role of the drawee bank is like a guarantor, which assures the release of payment on presentment of the document or collect the money from his/her bank via clearing mechanism.

Further, it is not necessary that the person who applied for demand draft, should be an account holder of the bank, rather any person can fill the DD form, and pay the concerned charges either through cash or cheque, to get it. DD’s are generally used when one has to make payment in another city and it can be cleared at any branch of the same bank.

Specimen of Demand Draft

For example: SBI Kesarbagh Branch, Indore issues a demand draft to you for Rs. 12000 favouring ICAI payable at SBI, Kanpur. So, you have bought the demand draft from the bank by paying Rs. 12000, and the requisite fees (commission) to SBI Kesarbagh Branch. Now, you send the demand draft to the ICAI through speed post and ICAI can present the DD for collection to any branch of SBI in Kanpur, or have it collected through local clearing, to their concerned bankers.

Characteristics of Demand Draft

- The validity period of a demand draft is 3 months, but it can be revalidated, which requires an application.

- Demand Draft is payable at any branch of the bank, on which it is drawn.

- It can never be dishonoured, as it is a prepaid instrument.

- It carries the signature of the branch manager.

Parties to Demand Draft

In the case of demand draft there are two parties involved in it, stated as under:

- Drawer: Bank or any financial institution,

- Payee: Party to whom the amount is transferred.

In demand draft, drawer and drawee are basically two different branches of the same bank, however, the payee is the third party, to whom the payment is to be made.

Also Read: Difference Between Banker’s Cheque and Demand Draft

Key Differences Between Cheque and Demand Draft

To understand the difference between cheque and demand draft in clearer terms, take a read of the points given below:

- The cheque is a negotiable financial instrument containing an order to the bank, to pay the specified sum, to the person whose name is mentioned in the instrument or to the bearer. On the other hand, a demand draft is a prepaid instrument issued by the bank in favour of a certain person or entity, to transfer money from one place to another.

- Both cheque and demand draft contains an order for payment, but in case of the cheque the issuer i.e. account holder directs the bank to make a payment, however, in case of demand draft, it is the bank branch which orders another branch of the same bank, located in another city, to make payment.

- In case of cheque, the payment can be made to order, i.e. the person whose name is mentioned on the cheque or to bearer, i.e. the person who presents the cheque to the bank. On the contrary, as the name suggests, a demand draft is payable on demand, to the person or entity whose name is specified on the face of it.

- A cheque is issued by the customer of the bank, whereas a demand draft is issued by the bank, to the applicant, in favour of another person or entity.

- No charges are levied by the bank, for the payment of cheque, but bank charges a certain sum as a fee for issuing a demand draft.

- In case of cheque, the drawer is the bank customer, while the bank itself is the drawer in case of demand draft.

- A cheque has to be signed by the issuer, be it an individual or authorized signatory of a firm. On the other hand, a demand draft carries seal and signature of the authorized officer and the rubber stamp of the bank.

- There are 3 parties involved in a cheque, but only 2 parties are involved in the demand draft.

- A cheque can be dishonoured due to different reasons, such as insufficiency of funds or other similar reasons. As against, demand draft cannot be dishonoured, as it is paid in advance.

Video: Cheque Vs Demand Draft

Contents of a Cheque

You can find the following details in a cheque

- Drawee bank and branch name

- Issuer’s name

- Date of issue

- Name of the beneficiary

- Account number of the issuer

- Type of Account (Savings or Current)

- The amount, both in words and digits

- Signature of the issuer

- Unique Cheque number

- MICR Code of the bank

Contents of Demand Draft

A demand draft contains the following details:

- Issuing Date

- Issuing bank and branch name

- Recipient’s name in whose favour the DD is prepared

- MICR Code of the bank

- DD Number

- Amount payable in words and digits

- Bank name, with the city where it is payable.

- Signature of the authorized signatory and branch manager

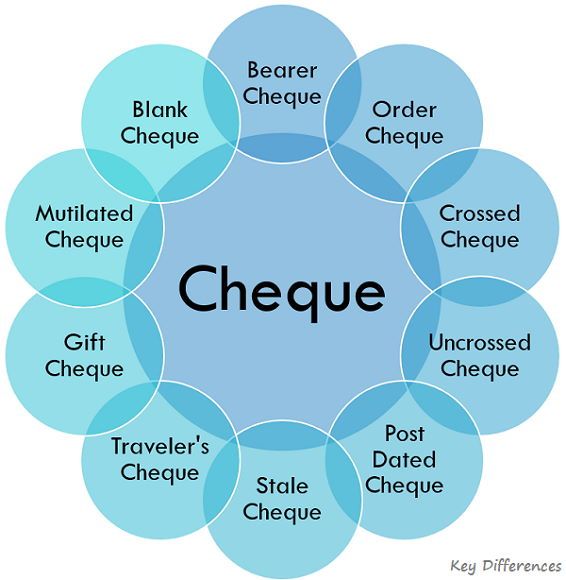

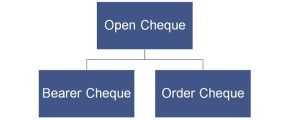

Types of Cheque

Basically, there are various types of cheques discussed hereunder:

- Bearer Cheque: A kind of cheque in which payment is made to any person who presents the cheque to the bank, i.e. the holder or bearer of the cheque, is called a bearer cheque.

- Order Cheque: The cheque in which the payment is made only to the person whose name is specified in the cheque and the words ‘bearer’ is cancelled. Prior to making payment, the bank will authenticate the details of the holder of the cheque, to ensure that the payment is made to the specific person only.

- Crossed Cheque: Crossed cheque means that the two transverse parallel lines are made on the face of the cheque, to give a better title to the holder of the cheque. Such a type of cheque can only be transferred to the payee’s account.

- Uncrossed Cheque: Otherwise called as an open cheque, it is one which is made payable to the person carrying it. The issuer of the cheque has to sign the cheque both at the front as well as at the back.

- Post-Dated Cheque: Cheques carrying a future date for encashment is called a post-dated cheque. This means that the bank will process the cheque, on or after the date mentioned on the cheque, and not before that.

- Stale Cheque: When the cheque loses its validity, i.e. 3 months after the date mentioned on it, such a cheque is called a stale cheque.

Related: Difference Between Stale Cheque and Post-Dated Cheque - Traveller’s Cheque: Cheque used at the time of visiting a foreign country because the domestic currency is not used there. It is issued by the bank and is available in different denominations. Further, they don’t have any expiry date, unlike other types of cheque, so it can be used for the next foreign trip or one can encash it when you reach your home city.

- Gift Cheque: As the name signifies, such cheques are used as gift hampers or prizes, typically huge in size than a normal cheque.

- Mutilated Cheque: When cheque presented to the bank is in torn condition, it is called as mutilated cheque. Such cheques can only be processed when the material details are visible, otherwise, these are rejected.

- Blank cheque: A cheque in which only the signature of the drawer is present, but the rest of the details are not filled, it is a blank cheque.

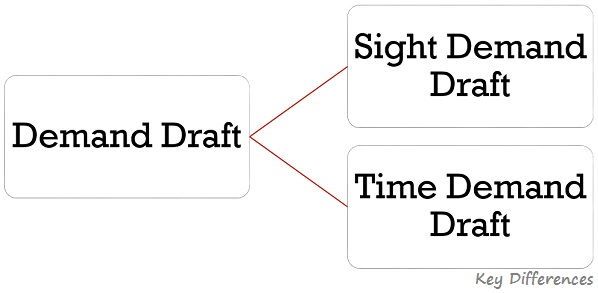

Types of Demand Draft

There are two types of demand draft:

- Sight Demand Draft: The type of demand draft is one which is paid on demand, subject to the presentment of the specific documents at sight. This means that payment will only be made if the payee presents the required documents, and the bank verifies the same, only then it will be honoured.

- Time Demand Draft: The type of demand draft that contains a certain date for payment. The payment is made only after the specified period or prior to that period.

Frequently Asked Questions

Why are cheques dishonoured by banks?

A cheque is dishonoured due to the following reasons:

- Insufficiency of funds in the account

- Irregular signature of the issuer, i.e. signatures do not match.

- Alterations, i.e. corrections or overwriting made to the cheque.

- When a cheque is post-dated

- Stale cheque, i.e. presentment of the cheque after the expiry of the validity period (3 months).

- When the payment is stopped by the drawer.

- Frozen Account

What happens if a cheque is dishonoured?

Dishonour of a cheque due to insufficient funds in the issuer’s account is regarded as a criminal offence. A ‘Cheque Return Memo‘ is issued by the drawee bank to the payee bank, signifying the cause for non-clearance of the cheque, which the payee’s bank gives to the payee along with the bounced cheque.

Now, the payee has two options – first to present the cheque before the bank again within 3 months from the date stated on the cheque, or to legally prosecute the drawer of the cheque.

If the payee continues with the first option, i.e. re-presents the cheque to the bank and the cheque gets dishonoured for the second time in a row, then he/she can file a suit against the drawer for the same, provided the reason for the amount for which the drawer is obligated to pay is related to certain debt or any other liability towards the payee.

Therefore, if the cheque is issued to the payee as a gift, or to lend money, he/she cannot sue the drawer, on those grounds.

What is a Crossed Demand Draft?

A demand draft carrying two transverse parallel lines on it is a crossed demand draft, which means that the amount mentioned on the DD, will be transferred to the account directly and not paid as cash. As per the RBI rules, demand drafts of ₹20,000/- and above are issued with account payee crossing.

What details need to be filled in a Demand Draft (DD) form?

To apply for a DD, one needs to fill the details in the relevant form, and submit it to the authorized officer. The details include:

- Date

- Applicant’s name

- Recipient’s name, in whose favour it is issued

- Name of the city, in which is it payable

- Name of the branch in which it is made

- Amount of DD

- Service charges of the bank

- Signature of the applicant

- Particulars of the amount deposited.

Conclusion

So, both the instruments, cheque and demand drafts have their own uses and limitations. To deal with millions of transactions on a daily basis, one can avail the benefits of a cheque, which is easy and convenient to issue. Conversely, when the amount needs to be transferred from one place to the another or if it requires a guaranteed payment; demand draft is the best option to go for.

JAGANNATHAN R says

Got a clear idea of a cheque and a demand draft. Thank you.

sariga says

Had a great use of this page and got information about dd and cheque

Murari says

Appreciate your way to make us learn these basics technical terms about cheque and DD.

Thanks

Swati says

Really useful for understandng the basic terms in a beautiful manner

Surbhi S says

Thanks a ton to all the readers for sharing your views with us. 🙂

Harikrishna K says

Very much useful. Thank you. GOD bless you.

anonymous says

Good information

Surbhi S says

Thanks a ton to all the readers for sharing your views with us.. 🙂

Ronit Gupta says

Being a student, understanding has become ultimately easier.

ANAND says

So Demand draft means transferring money.

Swetha MK says

well explained

roopesh kumar says

Very informative, thank you for the article.

Banana Republic Credit Card Login says

Thank you very much for writing on this beautiful topic. It is interesting with a lot of info.