One of the universally accepted fact is, money has time value, i.e. one rupee has higher value today, than one year later. Time value of money is helpful in determining the value of financial assets. There are two techniques used in this context, i.e. annuity and perpetuity. Annuity, may be defined as the a series of cash flows, usually of fixed amount, paid/received at regular intervals. The interval can be annually, semi-annually or tri-monthly, monthy etc.

One of the universally accepted fact is, money has time value, i.e. one rupee has higher value today, than one year later. Time value of money is helpful in determining the value of financial assets. There are two techniques used in this context, i.e. annuity and perpetuity. Annuity, may be defined as the a series of cash flows, usually of fixed amount, paid/received at regular intervals. The interval can be annually, semi-annually or tri-monthly, monthy etc.

Perpetuity, on the other hand, is a type of annuity that continues for infinite number of years. It is also known as perpetual annuity.

In other words, Annuity has a definite end, but Perpetuity is never ending, it is indefinite. After a deep analysis of the two methods, we have compiled the differences between Annuity and Perpetuity, to help you understand the two terms quickly and clearly.

Content: Annuity Vs Perpetuity

Comparison Chart

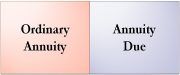

| Basis for Comparison | Annuity | Perpetuity |

|---|---|---|

| Meaning | A chain of regular cash flows up to a certain period of time is known as Annuity. | A series of cash outflows which goes on forever is known as Perpetuity. |

| Term | Specified | Unending |

| Payment | Made or Received | Made |

| Future Value | Can be calculated with the help of compounding. | Cannot be calculated. |

| Example | Life Insurance Premium per annum. | Dividend of irredeemable preference shares. |

Definition of Annuity

The constant periodic cash flows, over a specified period, is known as Annuity. The cash flows can be receipts or disbursements of equal amounts made at a set time interval, i.e. weekly, monthly, quarterly, semiannually, or annually. The following are the types of annuity:

- Ordinary Annuity: The payment or deposit of cash occurs at the year.

- Annuity Due: The inflow or outflow of cash occurs at the beginning.

- Perpetuity: The annuity which is everlasting.

- Others: Some other annuity types are fixed annuity and variable annuity.

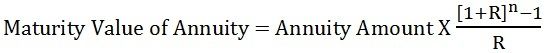

Formula:  Where, n = number of years

Where, n = number of years

R = Rate of return

Examples: Payment of instalment to the bank for recurring deposit.

Definition of Perpetuity

An indefinite series of payment of equal amounts at regular intervals on a fixed date is known as Perpetuity. The word ‘Perpetuity’ is a combination of two terms perpetual annuity, i.e. a form of annuity which goes on forever and therefore its future value cannot be calculated. Hence, it is a continuous stream of consistent cash flows over the years.

First and foremost the initial fund i.e. principal is established and then the payments flow from the funds for an infinite period. These fixed cash flows are the annual interest payments.It starts at a particular date and lasts forever. Perpetuity is divided into two categories:

- Constant Perpetuity: Remains constant over the years

- Growing Perpetuity: Grows at a uniform rate forever.

Formula:  Where, C = Cash flow, i.e. interest or dividend

Where, C = Cash flow, i.e. interest or dividend

R = Interest Rate

G = Growth Rate

Example: Scholarships paid to the endowment fund.

Key Differences Between Annuity and Perpetuity

The following are the major differences between annuity and perpetuity:

- A series of continuous cash flows of an equal amount over a limited period is known as Annuity. Perpetuity is a type of annuity which continues forever.

- The annuity is for a fixed period, but Perpetuity is everlasting.

- In an annuity, the payment is made or received. Conversely, in perpetuity, only cash outflow is there.

- Future Value of annuity can be easily calculated which is not possible in case of Perpetuity.

- Perpetuity is an annuity, but an annuity is not perpetuity.

Conclusion

Time value of money says that the value of a rupee at present is going to be changed in future. For calculating the worth of the financial assets like stocks, bonds, debentures and bank deposits, the Annuity and Perpetuity methods are employed. Traditional Annuities, pension payment, mortgage payments are some example for an annuity which will give uniform and predictable returns over a limited number of years. On the other hand, lease rentals, corporate stock dividends are the examples of perpetuity.

Leave a Reply