An annuity is described as a stream of fixed cash flows, i.e. payments or receipts, that occurs periodically, over time. For example, payment of housing loan, life insurance premium, rent, etc. There can be two types of annuities, i.e. ordinary annuity and annuity due. Ordinary annuity means an annuity which is related to the period preceding its date, whereas annuity due is the annuity related to the period following its date.

Most of the people use an annuity as a retirement tool (pension) that guarantees steady income in the coming years. An equal amount should be paid or received as an annuity and the time lag between payments occurring consecutively should be same.

There is a difference between ordinary annuity and annuity due which lies in the timing of the two annuities. So, the article makes an attempt to shed light on the differences between the two, have a look.

Content: Ordinary Annuity Vs Annuity Due

Comparison Chart

| Basis for Comparison | Ordinary Annuity | Annuity Due |

|---|---|---|

| Meaning | Ordinary annuity is one in which the inflow or outflow of cash fall due for payment at the end of each period. | Annuity due is described as the series of cash flows occurring at the beginning of each period. |

| Payment | Belongs to the period preceding its date. | Belongs to the period following its date. |

| Appropriate for | Payments | Receipts |

| Example | Housing loan, payment of mortgage, coupon bearing bonds, etc. | Rental lease payments, life insurance premium, etc. |

Definition of Ordinary Annuity

Ordinary Annuity is defined as a series of regular payments or receipts; that occurs at regular intervals over a specified number of periods. It is also known as annuity regular or deferred annuity.

In general, ordinary annuity payment is made on a monthly, quarterly, semi-annual or annual basis. The present value of the ordinary annuity is computed as of one period prior to the first cash flow, and the future value is computed as of the last cash flow.

Formula:

- Present Value (PV) of ordinary annuity: PMT × ((1 – (1 + r) ^ -n ) / r)

where, PMT = Period cash payment

r = Interest rate per period

n = Total number of periods

Definition of Annuity Due

Annuity Due or immediate is nothing but the sequence of periodic cash flows (payments or receipts) regularly occurring at the end of each period overtime. The first cash flow of the annuity falls due at the present time. The most common example of an annuity due is the rent, as the payment should be made at the start of the new month.

As in the case of an ordinary annuity, the present and future values of the annuity due are also calculated as first and last cash flows respectively.

Formula:

- Present Value (PV) of Annuity Due: PMT + PMT × ((1 – (1 + r) ^ -(n-1) / r)

where, PMT = Period cash payment

r = Interest rate per period

n = Total number of periods

Key Differences Between Ordinary Annuity and Annuity Due

The points given below are noteworthy, so far as the difference between ordinary annuity and annuity due is concerned:

- Ordinary annuity refers to the sequence of steady cash flow, whose payment is to be made or received at the end of each period. Annuity due implies the stream of payments or receipts which fall due at the beginning of each period.

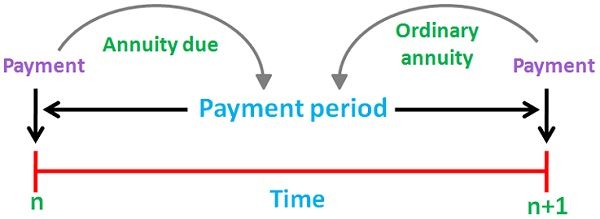

- Each cash inflow or outflow of an ordinary annuity is related to the period preceding its date. On the contrary, an annuity due, represent the cash flow period following its date. As the cash flows belonging to annuity due occur one period earlier than that of an ordinary annuity.

- An ordinary annuity is best when an individual is making payment whereas annuity due is appropriate when a person is collecting payment. As the payment made on annuity due, have a higher present value than the regular annuity. This is because of the principle of time value of money, i.e. the value of one rupee, today is greater than the value of one rupee, after one year.

- Payment of car loan, payment of mortgage and coupon bearing bonds are some examples of an ordinary annuity. On the flip side, the common examples of an annuity due are rental lease payments, car payments, payment of life insurance premium and so on.

Conclusion

Annuity aims at providing a constant stream of income to the annuity holder for a long time. An individual can make a choice between these two annuities considering some factors, such as the income that he wants during retirement and the degree of risk he is able to take.

Maturu flavia says

The content is good

D.M.Sarrower Morshed says

Very good discussion