When it comes to international transfer, ACH, i.e. Automated Clearing House transfer and Wire Transfer are two options with us, to send and receive funds. One of the main difference between these two is while Wire transfer takes place directly between the sender and recipient account, ACH transfer involves an intermediary, which is the automated clearing house.

When it comes to international transfer, ACH, i.e. Automated Clearing House transfer and Wire Transfer are two options with us, to send and receive funds. One of the main difference between these two is while Wire transfer takes place directly between the sender and recipient account, ACH transfer involves an intermediary, which is the automated clearing house.

Wire transfer is instant, as they transfer money in real time, i.e. the money is transferred within that day only if it is a domestic transaction, but an international transfer of funds can take two business days.

On the flip side, the ACH transaction takes some amount of time to transfer funds, as the transfer is performed in batches. However, ACH transfer is economical, as the fee charged for processing the transaction is quite nominal.

Content: ACH Vs Wire Transfer

Comparison Chart

| Basis for Comparison | ACH transfer | Wire transfer |

|---|---|---|

| Meaning | ACH transfer is one of the technique to transfer funds online, by way of automatic clearing house network. | Wire Transfer is an effective way of transferring money electronically from one party to another, using a bank or service provider. |

| Time | It can take one to two business days. | In the United States, the transfer is executed within the same day, but in case of international transfer, it takes one more day. |

| Fee | Nominal | Certain amount is charged. |

| Persons involved | No human is involved. | Bank workers process it. |

| Reversibility | Reversible | Irreversible or irrevocable |

| Security | High | Comparatively higher |

Definition of ACH transfer

ACH expands to Automated Clearing House Transfer, refers to an electronic transfer between two banks, that takes place through an automated clearing house. ACH is introduced for encouraging small payments, having high volume and low fees. It transfers money in batches, so the bank or financial institution collects the transactions all over the day for subsequent batch processing.

ACH payments are processed when an individual, business entity or government agency, creates an ACH payment to transfer money from the savings or current account. Sometimes, it requires authorisation by the parties involved.

ACH network is a well-managed batch processing system that ensures the fund transfer amidst banks and credit unions. It supports transfers like external fund transfer, bill payments, direct deposits/payments and person to person transfer. ACH credit transactions are completed within a business day, or two, whereas ACH debit transactions are completed by the next business day.

Definition of Wire Transfer

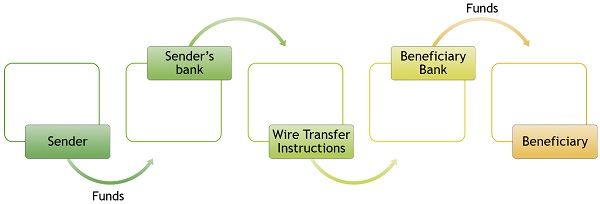

Wire transfer refers to an electronic transfer of funds, from one bank or transfer provides like Western Union, PayPal, MoneyGram or TransferWise, to another by way of a network, like Fedwire or SWIFT. In this system, the transfer takes places across a network of banks or service agencies like credit unions, around the world. So, it lets people from different countries to transfer funds without getting into physical contact with one another.

Various wire transfer systems and operators offer a number of options with respect to the urgency and surety of the settlement and the transaction’s cost, value and volume.

When transferring money through wire transfer, information is communicated between the two banks involved in the transaction such as beneficiary’s identity, account number, money to be transferred. Thereafter sender is required to pay a certain amount as a transaction fee at the remitting bank before it wires funds to the beneficiary. On the communication of information to the beneficiary’s banks, the bank deposits the money to his/her account and the payments are settled by the two banks on the back end, after the recipient receives the money.

FedWire System in the United States of America is similar to Real Time Gross Settlement (RTGS) system that facilitates instant transfer of money, as they offer ‘real time’ and ‘irrevocable’ transfers by making complete entry of the transaction against the electronic account of the operator.

Key Differences Between ACH and Wire Transfer

The difference between ACH and Wire Transfer can be drawn clearly on the following grounds:

- The automated clearing house is a computerised clearing set up and settlement service, that processes the transfer of funds online, between the participating banks and financial institutions. On the other hand, Wire transfer, or otherwise called as Bank Wire is an electronic transfer of funds by one party/entity to another through a bank or transfer provider such as Western Union or TransferWise.

- In ACH transfer, the transfer processes in batches, usually 3 times in a day, whereas in case of wire transfer, the transfer is processed in real time, i.e. within the United States the transaction is processed on the same day, but if it is an international transaction, it may take one more day.

- Wire transfer is more expensive in comparison to ACH transfer, as the fee charged for executing an ACH transfer is nominal.

- In ACH, as the name suggests, the transfer is automatic, i.e. there is no human intervention. As against, the wire transfer is processed by bank workers.

- ACH transactions can be reversed, whereas once the transaction is processed in a Wire transfer, it cannot be reversed or revoked.

- There is a high level of safety and security in an ACH transfer, but wire transfers are relatively much secure.

Conclusion

So, to make a choice between ACH and wire transfer, you must be aware of the differences between these two. Both have their pros and cons. So, if you want to send money faster, you can use a wire transfer as it moves money from one bank to another in real-time, but its cost is quite high. But, if you want to send money with the least cost, ACH is the best choice as it saves your cost, but its speed is quite low.

Leave a Reply