While autonomous investment is not influenced by the change in the level of income, output, profit and sales, induced investment is generally affected by these factors, and that is the crucial difference between these two types of investment.

While autonomous investment is not influenced by the change in the level of income, output, profit and sales, induced investment is generally affected by these factors, and that is the crucial difference between these two types of investment.

What is Investment?

Investment can be understood as that part of the person’s income which is spent into financial schemes, with an aim of further production of capital assets. While making an investment, the following factors should be taken into account:

- Safety of funds

- Degree of Risk and Uncertainty

- Return on investment

- Multiplier

- Marginal Efficiency of Funds

Investments are preferred over deposits, as they fetch higher returns, subject to the safety of funds and return is guaranteed. From the points of view of the whole economy, there are two types of investments: Autonomous Investment and Induced Investment.

Autonomous Investment is called so because it is independent of the national income. But on the other hand, induced investment is related to the changes in national income

Content: Autonomous Investment Vs Induced Investment

Comparison Chart

Definition of Autonomous Investment

Autonomous Investment can be defined as the outlay of funds on capital formation, which is not dependent on the change in the level of income, interest rate and rate of profit.

Primarily, investment in public utility services such as postal, transport, communication, infrastructure, etc. by the Government falls under this category because the investment made by the government does not rely on the decisional profit or loss.

It is the investment made by the government in any developmental project without concerning its level of economic growth or the future prospects to generate good returns, but with an aim of increasing the level of effective demand, at the time of depression and unemployment.

The amount of autonomous investment is influenced by factors like:

- Change in technique

- Rise in population

- Budget allotted for investment

- Weather changes

- War and peace conditions

- Revolution

- Search for new resources.

This means that these are the factors which may shift the slope of autonomous investment upwards or downwards.

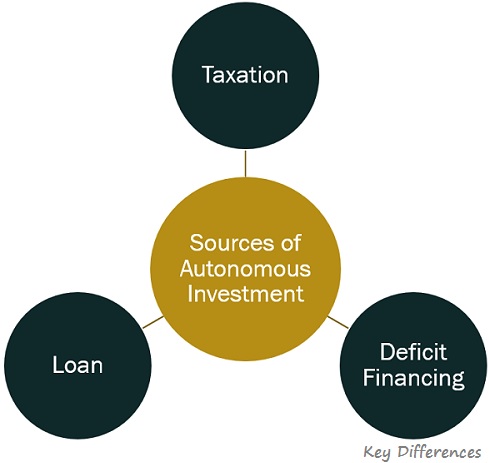

Sources of Autonomous Investment

The sources of autonomous investment are:

- Taxation: Taxes are the primary source of government revenue. The amount collected from the general public in the form of taxes is spent on providing public utility services.

- Loan: Loans are also one of the important sources of public investment, as they facilitate the mobilization of unused or idle money with the public. People deposit their funds into banks, so the banks have huge funds, which is mobilized by advancing loans to the public at interest.

- Deficit Financing: Printing new money, i.e. currency notes or Selling of Government bonds, so as to finance the deficit, due to excess of expenditure over revenue, is a deficit financing. This is one of the easiest methods of autonomous investment, however, as it will increase the flow of money in the economy, it may result in inflation.

Also Read: Difference Between Savings and Investment

Definition of Induced Investment

Induced Investment typically means the spending of funds on fixed assets and stocks, which are needed when the income level and demand for goods rises in an economy.

In simple words, induced investment is that investment that differs according to the income, i.e. the more amount an individual or firm has, the more they will spend.

So, we can say that it is a function of income.

As we said earlier, induced investment is directly related to the national income, so when the national income increases, it tends to increase the demand for goods and services. And to meet the increasing demand, the supply for the goods and services needs to be increased. Therefore, the increase in economic activities calls for more investment.

This is why, national income and induced investment are directly related, i.e. when the national income falls, the induced investment also declines and when the former goes up, the latter also tends to rise. Apart from income, induced investment is also affected by technological innovations, government policies, integration and structure of the population.

Determinants of Induced Investment

It is mainly determined by two factors:

- Marginal Efficiency of Capital: Highest expected rate of return from the additional project, i.e. capital asset over its cost. Its determinants are:

- Prospective Yield

- Supply Price

- Rate of Interest: Rate of interest refers to the rate at which interest to be charged for the use of money. When money is invested in purchasing a capital asset, then the interest has to be forgone. It is ascertained by demand and supply of money, based on two factors:

- Liquidity

- Preference

So, the greater the liquidity and preference the higher will be the rate of return and vice versa.

Also Read: Difference Between Investment and Speculation

Key Differences Between Autonomous Investment and Induced Investment

Upcoming points discuss the differences between autonomous investment and induced investment:

- Autonomous Investment means an investment which remains unaffected by the changes in the level of income, rate of interest and rate of profit. On the contrary, induced investment is one which is positively related to the level of income, output and profit.

- When it comes to elasticity, autonomous investment is said to be income inelastic, because the volume of autonomous investment remains constant, at all the income levels. As against, induced investment is income elastic, as the quantum of investment increases with the increase in the level of income.

- While autonomous investment is unrelated to the national income, induced investment is positively related to national income. This is because, autonomous investment remains unchanged or unaffected by the change in income, but induced investment tends to increase or decrease with the change in the income.

- Autonomous investment is undertaken by the government, with social welfare perspective. On the contrary, induced investment is made with a profit motive in mind. It can also be said that it is the profit which induces the investor to invest.

- Induced investment is influenced by the endogenous variables such as the price of factors of production, wages, consumer demand, the existing stock of capital, level of stock exchange activity and interest changes. But on the flip side, autonomous investment is affected by exogenous variables, as in innovation, invention, government policy, political stability, growth in population, researches, labour movement, etc.

- Autonomous investment is not influenced by the consumer demand for goods and services, in fact, it affects the demand. As opposed, demand is one of the factors which influences induced investment, i.e. if the consumption demand rises, investment is made to fulfil the demand by supplying the goods and services.

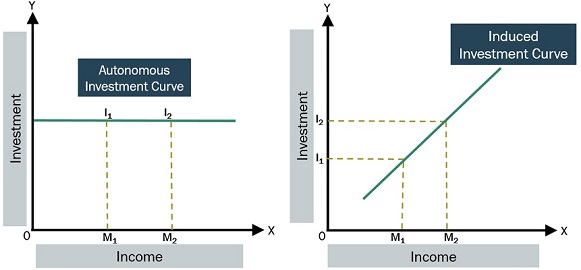

- Talking about the curve, autonomous investment curve is always parallel to X-axis, whereas induced investment curve, slopes upwards towards the right indicating positive functional relation between income and investment.

- Autonomous Investment is generally made by the government, be it Central Government, State Government or Local Self Government. In contrast, induced investment is undertaken by private individuals and firms.

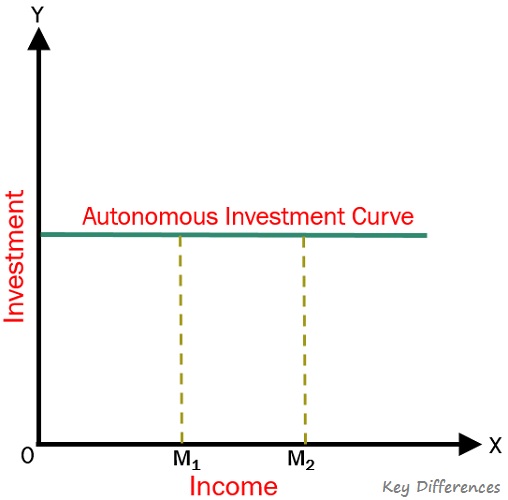

Autonomous Investment Curve

As you can see in the figure, the income increases from M1 to M2 but the investment amount remains constant, at both the levels. So, in the case of autonomous investment, the quantum of investment remains the same on every income level.

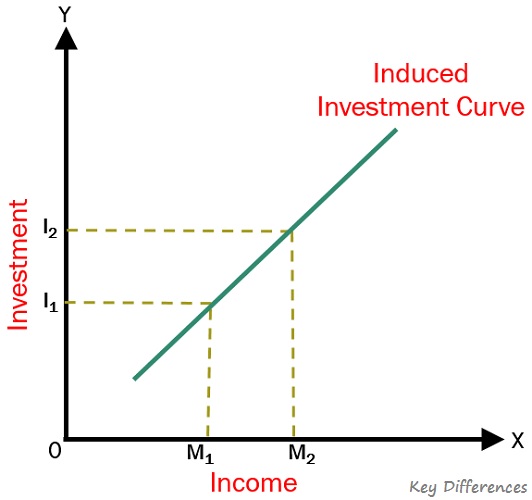

Induced Investment Curve

As you can see in the figure, as the income level increases from M1 to M2, the investment amount also shifts from I1 to I2, denoting that the investment is positively related to the level of income. Therefore, the curve is upward sloping towards the right. So, induced investment is income elastic, that means when the income level is high, the investment will also increase.

Example

Suppose the total capacity of the firm is that it can produce 500 units of output from 100 machines. Now, if the firm makes an investment to change the existing machinery, with more advanced machinery that can produce 500 units of output from 10 machines. It is said to be autonomous investment, as there is no increase in capacity.

Put it another way, if the firm needs to expand the capacity, in order to meet the anticipated increase in demand of 1000 units. Therefore, the additional capacity of 500 units of output will need 100 more machines, to be installed, to meet the demand. The investment undertaken in such a case would be induced investment.

Conclusion

The investment made by the government or private firms in economic and social sectors comes under autonomous investment, i.e. expenditure on buildings, dams, roads, tunnels, canals, flyovers, schools, hospitals, and so forth.

On the other hand, the increase in national income followed by increased consumption, i.e. demand for goods and services will increase. Hence, the firms will be bound to increase the supply for which they need to invest in capital assets, i.e. plant and machinery, which comes under induced investment.

Leave a Reply