Cash Credit (CC) is a loan account opened by the customer with the bank. The cash credit limit depends upon the assets’ collateral. The limit is flexible, i.e. the banks have the authority to increase or decrease this limit. For this facility, banks charge interest on the actual amount used.

Cash Credit (CC) is a loan account opened by the customer with the bank. The cash credit limit depends upon the assets’ collateral. The limit is flexible, i.e. the banks have the authority to increase or decrease this limit. For this facility, banks charge interest on the actual amount used.

Overdraft (OD) facility is for current account holders wherein the customer can draw excess amount than what is standing to their credit. This means that the bank permits the customer to debit his current account below zero. But, the customer can withdraw only up to a specified limit.

Granting of loans is among the major functions which commercial banks perform. Post maintaining cash reserves as per RBI norms, banks can lend their deposits to those in need. Banks provide such loans and advances against approved security for productive purposes so as to earn interest. Cash Credit and Overdraft are two such short-term loan arrangements.

In this write-up, we have elaborated on the differences between cash credit and overdraft.

Content: Cash Credit Vs Overdraft

- Comparison Chart

- What is Cash Credit?

- What is Overdraft?

- Key Differences

- Video

- Similarities

- Points to Remember

- Conclusion

Comparison Chart

| Basis for Comparison | Cash Credit | Overdraft |

|---|---|---|

| Meaning | Cash Credit is an account, through which banks provide short-term loans to small businessmen who need instant working capital, against collateral. | Overdraft is a short-term loan facility, in which the customer can withdraw excess money than the actual balance, in their current account or it is a secured loan against investments. |

| Arrangement | It is a revolving credit arrangement. | It is not a revolving credit arrangement. |

| Associated with | Cash Credit Account | Current Account or Secured loan against investments. |

| Availability of facility | Businessmen only | Both individuals and businessmen |

| Security | It requires hypothecation of inventory and receivables for availing of the loan. | Unsecured OD: Overdraft on current account depends on average balance, credit history, past relationship with the bank, etc. Secured OD: One can avail overdraft against Fixed Deposit or LIC policies |

| Nature of limit | Flexible because we keep current assets as security. | Usually remains fixed |

| Maximum limit | 50-60% of the value of inventory and receivables. | Unsecured OD: Discretion of bank Secured OD: 60-85% of the security value. |

| Term | Up to 1 year | Unsecured OD: 1 week to 1 month Secured OD: Depending upon the term of security. |

| Purpose | The amount of cash credit should be used for business purposes only, i.e. purchasing raw materials, keeping stock, etc. This is because the amount may turn out as NPA later. So, banks perform a check at periodical intervals. | It can be availed for any purpose, be it personal or business. |

| Change in withdrawal limit | It is changed immediately when the inventory or receivables changes. | It does not change easily, lest there is a change in the average balance. |

| Interest rate | Lower | Unsecured OD: Higher Secured OD: Lower |

What is Cash Credit?

Cash Credit is an arrangement wherein banks extend cash loans to the customer against some tangible security or personal guarantee. It is a drawing account, against a fixed credit limit which banks extend. The operation of this account is in a similar manner as a current account on which overdraft is provided.

This account lets the borrower draw money within the specified limit, whenever required. After that, he must repay the same. That means it allows the customer to withdraw from his cash credit account as per the needs. At the same time, he can deposit any surplus funds lying with him.

Further, the bank charges interest on the amount actually withdrawn. That means the customer need not pay interest on the entire sum granted. Due to this reason, many industrial and commercial undertakings prefer it.

Characteristics of Cash Credit

- Cash Credit is a borrowing facility without any credit balance but limited to the extent of the borrowing limit decided by the banker.

- As the amount is repayable on demand the bank has the right to demand money lent at any time.

- This limit relies upon a certain percentage of the value of securities pledged. The bank specifies the drawing limit and it varies from bank to bank and borrower to borrower.

Do you know?

RBI issued a directive in the early 1970s. In the directive, the RBI prescribed a commitment charge which banks must impose on the non-utilized part of the credit limit. The bank imposes this charge because there is a loss of interest to the bank.

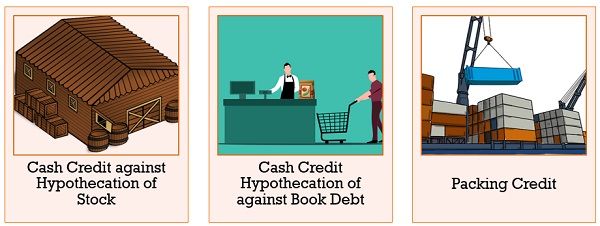

Forms of Cash Credit

- Cash Credit Against Hypothecation of Stock

Banks provide this facility against the security of stock of raw materials, WIP and finished goods. - Cash Credit Against Hypothecation of Book Debts

Banks also allow a cash credit facility against book debts. Here the term ‘book debts‘ includes debit entries in the books of accounts, occurring as a result of the sale. - Packing Credit

Banks provide this facility to exporters for making purchases of raw materials from local markets and making the goods ready for export. Such a facility is extended in domestic currency.

Also Read: Difference Between Current Account and Savings Account

What is Overdraft?

An overdraft facility is a short-term credit that banks extend to their current account holders. In this, the holder can withdraw cash over and above the actual available cash balance from their current accounts up to the sanctioned limit. Banks offer this facility on the basis of the creditworthiness of the borrower.

In this case, the borrower is the businessman or business. The customer can withdraw the amount as per his need. After that, repayment should be made through deposits in the current account.

Moreover, banks also grant overdrafts against the security of self-liquidating investments. In this case, the facility is available to individuals. Here, self-liquidating investments include:

- Shares and debentures

- Term deposits

- National Savings Certificate,

- LIC policies

- UTI units

- Postal Securities

- Government securities etc.

For providing such a facility, the bank seeks security and levy interest on the overdrawn sum. Generally, banks sanction a drawing limit either against security or without security. Banks grant this facility for a short period. It requires repayment on demand along with interest. The bank charges interest on the daily overdrawn balance.

Types of Overdraft

- Clean Overdraft

Overdraft extended in a current account without any tangible security. - Secured Overdraft

Extension of overdraft against self-liquidating securities.

Characteristics of Overdraft

- Every rule that applies to the current account also applies to the overdraft account.

- It is a running account and so it lets the customer perform debits and credits freely.

- Charging of interest takes place on a daily product basis. But, the bank debits the same to the account on monthly basis. However, in case of temporary overdraft bank charges interest on the earliest of the two – whenever it is adjusted or at the end of that month.

- Bank provides this facility to the customer only when he applies for the same in writing. In some cases, banks also demand signing a promissory note. Therefore, an express contract comes into being.

- The bank determines the overdraft limit. It depends on the value of securities pledged or the repayment capacity of the Account holder.

Also Read: Difference Between Overdraft and Loan

Key Differences Between Cash Credit and Overdraft

- A Cash Credit is an account through which the account holder can borrow money from the bank. But, the borrowing is possible up to a specified limit, against some tangible securities. As against, the overdraft is an arrangement that banks provide through which a current account holder can draw money more than the balance available in the account up to a specified limit.

- While cash credit is a revolving credit arrangement. Overdraft is a non-revolving credit arrangement.

- Banks provide overdraft facilities to the current account holders. It can also be provided to individuals against self-liquidating investments. In contrast, banks offer a cash credit facility to the customer who opens a cash credit account.

- Cash Credit is a form of short-term funding for self-employed persons and business owners so that they can meet their working capital needs. Whereas overdraft is meant for both individuals and businesses.

- For availing of cash credit, the business must provide inventory and receivables as security. But, in the case of an unsecured overdraft, there is no requirement for security. But, the limit will depend on average balance, credit history and past relationship with the bank. However, banks provide secured overdrafts against self-liquidating investments.

- While the cash credit limit is flexible because it is taken against the current assets. The overdraft limit is generally fixed unless there is a change in the average balance.

- Banks offer cash credit facilities for a period of 1 year. That means the customer can use the facility and repay the sum withdrawn within one year. Oppositely, in the case of a secured overdraft, the term is dependent upon the term of security. Now you must be wondering-

How can we determine the term of Overdraft?

Well, if your fixed deposit is for 4 years then the term will also be four years. But, in the case of an unsecured overdraft, the term varies from 1 week to 1 month. After which the customer needs to repay the sum.

- In the case of cash credit, the maximum limit will be 50-60% of the value of inventory and receivables. As against, in the case of an unsecured overdraft, the maximum ceiling is at the discretion of the bank. But, in the case of a secured overdraft, the limit will be 60-85% of the value of the security.

- Money lent by the bank through cash credit has to be utilized for the purpose of business. The purpose can be purchasing raw materials or maintaining stock. Because the amount may turn out as Non-Performing Assets (NPA) afterwards. To overcome this, banks perform a check at periodical intervals. As against, an overdraft can be availed for any purpose be it personal or business.

- The withdrawal limit of cash credit changes with the change in the amount of inventory or receivables. Whereas the amount overdraft limit is not changed easily unless there is a change in the average balance in the current account.

- When it comes to interest rate, in the case of cash credit the interest rate is lower in comparison to unsecured overdraft.

Video: Cash Credit Vs Overdraft

Similarities

- Refer to lines of credit

- Banks charge interest on the amount of money utilized and not on the limit sanctioned.

- The amount is repayable on demand.

- Offered against collateral.

- Banks specify a limit in both cases, beyond which the customer cannot withdraw the amount.

Points to Remember

- Processing Fee: It varies from bank to bank.

- Loan Amount Utilization: Limit is specified in case of cash credit against the hypothecation of stock. But, there are a number of banks which charge an additional fee on the unutilized amount of loan after a specified period.

- Foreclosure Charge: There are a few lenders which impose foreclosure charges when the borrower wishes to close the account. They charge a certain percentage of the loan amount for closing the account.

Conclusion

Banks provide overdraft facilities to the customer upon the written request of the customer. Also, the bank may ask for a promissory note or personal security to ensure the safety of the amount withdrawn. In the other case, the borrower has to open a loan account, whose limit is decided by the bank on the basis of the securities pledged.

Judith says

Love it …thank you

Banerjee says

Is net banking possible in Cash Credit account in Indian Banks? Can this account be transferred to a different branch?

Surbhi S says

Yes, net banking is possible in cash credit account in Indian banks. Moreover, CC account can be transferred to another branch, by making an application to the account maintaining branch and certain formalities should be fulfilled, and it can only be transferred at bank’s discretion

hari says

super brief details and catch point easily

VISHNU JAISWAL says

EASY TO UNDERSTAND AND VERY INFORMATIVE

Vishal kumar says

After how many days you have to pay outstanding amount to lender in cash credit

Dilip kumar sachdeva says

Thanks for good knowledge provided by you. How i can contact you or how i can clear doubts from you regarding banking knowedge ?

Ashish Reddy says

Thankxx for the information….

Debojyoti Chakraborty says

I want to know that if I want to take a cash credit of Rs.30 lakh within how many days I have to repay to the bank for e.g. SBI? What would be the maximum time bank would give to repay the loan? Is it anyway 15 to 20 yrs? Kindly let me know with all details.

Narender Kumar says

super brief details and easily catch point

thanks

pratiksha says

Thank you for the information

Sunil patel says

Very useful.

Tom C says

Informative.

fairfax sex crimes attorney says

Thank you for sharing a post, nice to read it, good work keep going

Equify Financial says

This blog post does an excellent job of explaining the differences between the three simply and understandably.”