Since the last few decades, factoring and forfaiting have gained immense importance, as one of the major sources of export financing. For a layman, these two terms are one and the same thing. Nevertheless, these two terms are different, in their nature, concept, and scope. Factoring is a financial affair which involves the sale of firm’s receivables to another firm or party known as a factor at discounted prices.

Since the last few decades, factoring and forfaiting have gained immense importance, as one of the major sources of export financing. For a layman, these two terms are one and the same thing. Nevertheless, these two terms are different, in their nature, concept, and scope. Factoring is a financial affair which involves the sale of firm’s receivables to another firm or party known as a factor at discounted prices.

On the other hand, forfaiting simply means relinquishing the right. In this, the exporter renounces his/her right due at a future date, in exchange for instant cash payment, at an agreed discount, to the forfaiter.

The first and foremost distinguishing point amidst these two terms is that factoring can be with or without recourse, but forfaiting is always without recourse. Have a glance at this article, to know about some more differences between factoring and forfaiting.

Content: Factoring Vs Forfaiting

Comparison Chart

| Basis for Comparison | Factoring | Forfaiting |

|---|---|---|

| Meaning | Factoring is an arrangement that converts your receivables into ready cash and you don't need to wait for the payment of receivables at a future date. | Forfaiting implies a transaction in which the forfaiter purchases claims from the exporter in return for cash payment. |

| Maturity of receivables | Involves account receivables of short maturities. | Involves account receivables of medium to long term maturities. |

| Goods | Trade receivables on ordinary goods. | Trade receivables on capital goods. |

| Finance up to | 80-90% | 100% |

| Type | Recourse or Non-recourse | Non-recourse |

| Cost | Cost of factoring borne by the seller (client). | Cost of forfaiting borne by the overseas buyer. |

| Negotiable Instrument | Does not deals in negotiable instrument. | Involves dealing in negotiable instrument. |

| Secondary market | No | Yes |

Definition of Factoring

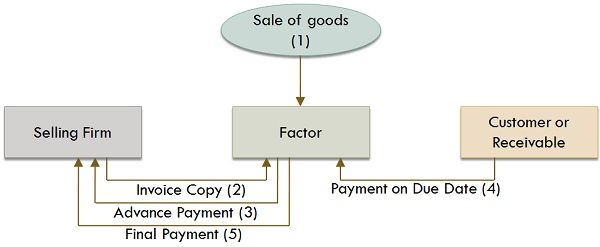

Factoring is defined as a method of managing book debt, in which a business receives advances against the accounts receivables, from a bank or financial institution (called as a factor). There are three parties to factoring i.e. debtor (the buyer of goods), the client (seller of goods) and the factor (financier). Factoring can be recourse or non-recourse, disclosed or undisclosed.

In a factoring arrangement, first of all, the borrower sells trade receivables to the factor and receives an advance against it. The advance provided to the borrower is the remaining amount, i.e. a certain percentage of the receivable is deducted as the margin or reserve, the factor’s commission is retained by him and interest on the advance. After that, the borrower forwards collections from the debtor to the factor to settle down the advances received.

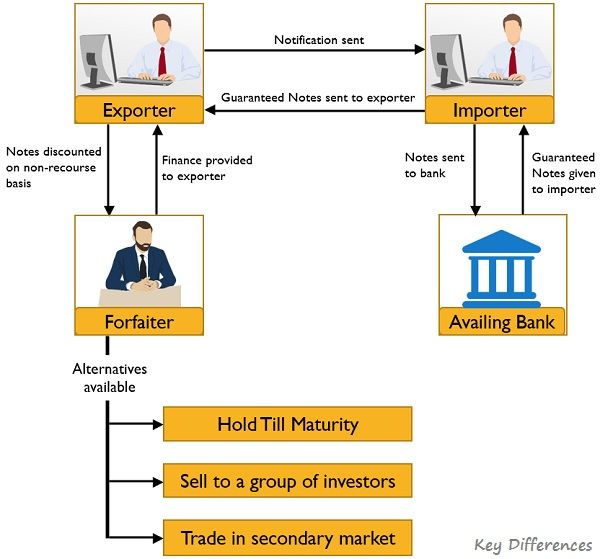

Definition of Forfaiting

Forfaiting is a mechanism, in which an exporter surrenders his rights to receive payment against the goods delivered or services rendered to the importer, in exchange for the instant cash payment from a forfaiter. In this way, an exporter can easily turn a credit sale into cash sale, without recourse to him or his forfaiter.

The forfaiter is a financial intermediary that provides assistance in international trade. It is evidenced by negotiable instruments i.e. bills of exchange and promissory notes. It is a financial transaction, helps to finance contracts of medium to long term for the sale of receivables on capital goods. However, at present forfaiting involves receivables of short maturities and large amounts.

The forfaiter is a financial intermediary that provides assistance in international trade. It is evidenced by negotiable instruments i.e. bills of exchange and promissory notes. It is a financial transaction, helps to finance contracts of medium to long term for the sale of receivables on capital goods. However, at present forfaiting involves receivables of short maturities and large amounts.

Key Differences Between Factoring and Forfaiting

The major differences between factoring and forfaiting are described below:

- Factoring refers to a financial arrangement whereby the business sells its trade receivables to the factor (bank) and receives the cash payment. Forfaiting is a form of export financing in which the exporter sells the claim of trade receivables to the forfaiter and gets an immediate cash payment.

- Factoring deals in the receivable that falls due within 90 days. On the other hand, Forfaiting deals in the accounts receivables whose maturity ranges from medium to long term.

- Factoring involves the sale of receivables on ordinary goods. Conversely, the sale of receivables on capital goods are made in forfaiting.

- Factoring provides 80-90% finance while forfaiting provides 100% financing of the value of export.

- Factoring can be recourse or non-recourse. On the other hand, forfaiting is always non-recourse.

- Factoring cost is incurred by the seller or client. Forfaiting cost is incurred by the overseas buyer.

- Forfaiting involves dealing with negotiable instruments like bills of exchange and promissory note which is not in the case of Factoring.

- In factoring, there is no secondary market, whereas in the forfaiting secondary market exists, which increases the liquidity in forfaiting.

Conclusion

As we have discussed that factoring and forfaiting are two methods of financing international trade. These are mainly used to secure outstanding invoices and account receivables. Factoring involves the purchase of all receivables or all kinds of receivables. Unlike Forfaiting, which is based on transaction or project.

Swamynathan Sankaran says

Thanks for the clarification.

ANIT PRASAD says

Great explanation

shazli says

clear and precise

Amak says

Thanks, good and detailed. Well understood

Saketh says

Explained very clearly for all to understand along with picture illustrations. Fab job . Good work. Keep it up

Surbhi S says

Thank you, all the readers for continuously showing your love and appreciation to Key Differences. Keep liking and sharing. 🙂

Hastings Wauka Mwale says

It is today I have fully understood the difference between factoring and forfaiting. Great work!

Siva Prasad says

Very good article which explains the terms and differences

akib says

very good

Olivia EN says

I really appreciate the way you summarised the key points. 😊😊

Francis Rawh says

Nice article. Thanks, Key differences 😌😌😌