The basic difference between fixed asset and current asset lies in the fact that how liquid the assets are, i.e. if they can be converted into cash within one year, then they are considered as a current asset while when the asset is kept by the firm for more than one accounting year, then it is known as fixed assets or non-current assets.

In accounting, we often encounter the term assets, which indicates those items or resources owned by the firm, which is supposed to provide monetary benefit in future, in the form of cash flows. Assets are classified as fixed assets and current assets.

So, let’s take a look at the article provided, to have a better understanding on the two.

Content: Fixed Assets Vs Current Assets

Comparison Chart

| Basis for Comparison | Fixed Assets | Current Assets |

|---|---|---|

| Meaning | Fixed assets are the long terms assets which are acquired by the entity for the purpose of continuing use, to generate income. | Current assets refers to those resources which a company owns for being traded and are held for not longer than one year. |

| Convertibility | Not easily convertible into cash. | Readily convertible into cash. |

| Holding period | More than a year | Less than a year |

| Valuation | Cost less depreciation | Cost or market value whichever is lower. |

| Financing | Long term funds are used for financing fixed assets. | Short term funds are used for financing current assets. |

| Pledge | Cannot be pledged | Can be pledged |

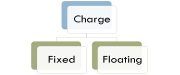

| Charge | Creation of fixed charge. | Creation of floating charge. |

| Sale of asset | Will result in capital profit or loss. | Will result in revenue profit or loss. |

| Revaluation reserve | Created when the value is appreciated. | Not created at all. |

Definition of Fixed Assets

Fixed Assets are the part of non-current assets, which are owned by the company with the aim of productive use by the firm rather than resale. They are expected to provide economic benefits for more than one accounting year and are held by the company for carrying out business operations. On the balance sheet, fixed assets are reported at their net book value, i.e. purchase price less depreciation or amortisation as the case may be.

It consists of tangible fixed assets, intangible fixed assets, capital work in progress, intangible assets under development. It includes land & building, plant & machinery, computer, vehicles, leasehold property, furniture & fixtures, software, copyright, patent, goodwill, and so on.

Definition of Current Assets

An asset is said to be a current asset when it is anticipated to be realised or intended to be sold or consumed within one year or the company’s normal operating cycle. Companies held the current asset in the form of cash or their conversion into cash or for using it in the providing goods and services.

These are acquired for the purpose of being traded. It includes current investments, inventory, short-term loans and advances, trade receivable, cash and cash equivalents, marketable securities, prepaid expenses, etc.

Key Differences Between Fixed Assets and Current Assets

The difference between fixed assets and current assets can be drawn clearly on the following grounds:

- The non-current assets which the entity owns for the purpose of continuing use, to generate income, is called fixed asset. Current assets are defined as the items which are held for the purpose of resale and that too for a maximum period of one year

- The conversion of a fixed asset into cash cannot be done easily. On the contrary, current assets are converted into cash immediately.

- Fixed assets are used by the company to produce goods and services. Thus they are held for more than one year. Conversely, companies kept current assets, in the form or cash or in such form that can be easily converted into cash. Therefore such assets are held for less than one year.

- Fixed assets are valued at net book value, i.e. original cost of the asset less depreciation. As against this, the valuation of a current asset is at cost or market value whichever is lower.

- As the investment in fixed assets requires huge capital investment, so long term funds are utilised for its acquisition. Unlike current assets, which require short-term financing for its acquisition.

- Fixed assets cannot be pledged while current assets can be pledged, as collateral for granting loans.

- The fixed charge is created on fixed assets whereas current assets are subject to floating charge.

- When the company sells current assets, the profit earned or loss suffered is of revenue nature. On the other hand, selling of fixed asset will result in capital profit or loss to the company.

- Revaluation reserve is created, when there is an appreciation in the value of fixed asset, whereas no such reserve is created in the case of appreciation in the worth of current assets.

Conclusion

To end up the discussion, we can say that, it is not about the type of asset, but it is about the purpose of acquiring the asset, i.e. if the asset is held by the company for the purpose of resale, then it is current asset, while if the asset is acquired to assist the firm in operations for a long period, then it is called as fixed asset.

Suppose, there is a firm which deals in calculators, then it is the stock of the company and hence considered as a current asset. As against this, if there is grocery shop, in which calculator is used by the shopkeeper for calculating the total bill amount, then it is a capital asset of the business.

Sam says

Amazing explanation. I passed my +2 Exams with your amazing notes. Can’t thank you enough. Keep it up. Looking forward to master Account this year and study CA.