In general, many misconceive hypothecation for a mortgage, however, the difference between these two lies in the factor, on which they are created. A charge can be created on the movable property or immovable property, so when a movable property is under the charge, it is said to be hypothecated, whereas a charge created over an immovable property, it is known as a mortgage.

In general, many misconceive hypothecation for a mortgage, however, the difference between these two lies in the factor, on which they are created. A charge can be created on the movable property or immovable property, so when a movable property is under the charge, it is said to be hypothecated, whereas a charge created over an immovable property, it is known as a mortgage.

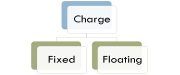

The term ‘charge‘ implies the creation of right by any person (borrower) including a separate legal entity over its assets and properties, in favour of a bank or any other financial institution (lender), to raise funds. It is an impediment in the title which does not permit the borrower to sell the asset or transfer the ownership to any other person or entity. The various types of charge created on the asset include mortgage, hypothecation, pledge, assignment and lien.

In this article, we will be discussing the difference between mortgage and hypothecation, take a read.

Content: Mortgage Vs Hypothecation

Comparison Chart

| Basis for Comparison | Mortgage | Hypothecation |

|---|---|---|

| Meaning | Mortgage implies a legal process wherein the title of real estate property passes from the owner to the lender, as a collateral for the amount borrowed. | Hypothecation refers to an arrangement, wherein a person borrows money from bank by collateralizing an asset, without transferring title and possession. |

| Applicable to | Immovable asset | Movable asset |

| Legal Document | Mortgage deed | Hypothecation agreement |

| Defined under | Transfer of Property Act, 1882 | SARFAESI Act, 2002 |

| Indicates | Transfer of interest in the asset. | Security for payment of an amount. |

| Loan amount | High | Comparatively low |

| Tenure | Long | Comparatively short |

Definition of Mortgage

Mortgage refers to a legal arrangement, wherein there is a transfer of interest in a particular immovable asset or property by the owner, so as to secure the payment of funds raised via loan, on present or future debt or performance of an obligation, which may result in a financial liability.

Hence, the basic element of a mortgage is the ‘transfer of interest in the asset by the owner and that also to secure money paid through a loan’. In simple terms, it is the hypothecation of an immovable asset to a bank or a housing finance company.

Under this process, the transferor is the mortgagor, and the transferee is the mortgagee. The principal amount and interest thereon are called mortgage money, and the mortgage deed is the document which outturns transfer. Various types of mortgage include Simple Mortgage, Mortgage by conditional sale, Anomalous mortgage, Equitable mortgage, Usufructuary mortgage, English mortgage.

The mortgagee has the right to acquire and sell the asset if the mortgagor fails to pay the mortgage money within stipulated time and even if the terms and conditions stated in the deed are not fulfilled in the manner specified. The bank has the first right over the asset mortgaged, and if there are more than one lenders, pari-passu clause will apply.

Definition of Hypothecation

The term ‘hypothecation’ is used to define a charge formed on any movable asset by the owner, to raise funds from the bank, without transferring the ownership and possession to the lender. In this agreement, the borrower (owner) of goods borrows money against the security of assets, i.e. inventories.

The lender is the hypothecatee, and the borrower is considered as hypothecator, under this arrangement. The rights of the hypothecatee are based on the hypothecation agreement between both the parties. If the hypothecator fails in paying the dues within the stipulated time, the hypothecatee can file a suit, to realise the debt by selling the hypothecated asset.

It is important for banks or other financial institution to exercise precautions while extending credit against hypothecation because of the following reasons:

As both ownership and possession of the assets rest with the borrower, it is a bit difficult for the lender to exercise control over it.

- The borrower may sell the asset hypothecated and discharge from other obligations.

- The borrower might raise double finance by hypothecating the same stock to another lender.

- When a borrower fails in paying the dues, asset realisation could be costly.

To overcome these difficulties, banks need to be extra-careful with the assets hypothecated. They can do so by ensuring that the borrower takes such facility with a single bank or by checking periodical stock statements etc.

Key Differences Between Mortgage and Hypothecation

The following points elaborate the differences between mortgage and hypothecation:

- An arrangement, wherein a person, borrows money from the bank by collateralizing an asset, without transferring title and possession, is called hypothecation. A legal agreement wherein the title of real estate property passes from the owner to the lender, as collateral for the amount borrowed, is known as hypothecation

- Hypothecation applies to movable assets only like goods, vehicles, etc. On the other hand, a mortgage is applied to immovable property such as land, flat, shop and so on.

- Hypothecation agreement is the legal document in hypothecation. As against this, the mortgage deed is the legal document which effect the transfer in case of a mortgage.

- The term mortgage is defined under Section 58 (a), Transfer of Property Act, 1882. Conversely, Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, SARFAESI Act defines hypothecation.

- In a mortgage, there is a transfer of interest in the asset. Unlike, Hypothecation is a security for payment of an amount.

- The loan amount is comparatively higher in the case of a mortgage than in hypothecation.

- In general, the tenure for which the funds extended to the borrower by the bank is longer in mortgage, than in hypothecation.

Conclusion

In spite of some differences, the two forms of the charge share some common characteristics, in that, both provides security to the loan and the possession of the asset, remains with the borrower of the asset, while the lender has the first right to it until the dues are cleared. Further, in both the cases, if the borrower defaults in payment, the lender can recover the amount by selling the asset.

Comparing the two types of charge, mortgage is better than hypothecation in terms of safety because in mortgage the charge is created over land, building or house, etc. whose value appreciates with time, whereas in case of hypothecation charge is set up on car, stock, etc. and such asset do not appreciate with time.

Leave a Reply