Do you know non-profit organizations don’t need to maintain a large set of books of accounts? However, they need to prepare financial statements at the end of every financial year. So, for this purpose, they prepare receipt and payment accounts and income and expenditure accounts and a Balance Sheet.

Do you know non-profit organizations don’t need to maintain a large set of books of accounts? However, they need to prepare financial statements at the end of every financial year. So, for this purpose, they prepare receipt and payment accounts and income and expenditure accounts and a Balance Sheet.

While receipt and payment account is a simple summary of cash and bank transactions. On the other hand, the income and expenditure account reflects the income and expenditure of the current year of the non-profit organization.

What are Non-Profit Organizations?

Non-Profit Organizations are organizations which are set up for the public or mutual benefit. They do not work to make a profit for owners or investors. In short, members form and run these organizations. Its aim is to serve the members and society as a whole.

The organizations can be colleges and universities, hospitals, libraries, religious organizations, welfare societies, foundations, political parties, trade associations, professional associations and so forth.

Basic Concept

Non-Profit organizations need not require the preparation and maintenance of those accounts that trading enterprises prepare and maintain.

The organizations would like to know the total revenue earned during the financial year and the expenditure made by the organization for earning such revenue. Hence, these organization does not make any distinction between direct or indirect, productive or non-productive, concerning incomes and expenditures.

Here, what matters most is the nature of the income earned and expenditure incurred, i.e. be it capital or revenue. The nature forms the basis for calculating the excess of income over expenditure.

In this post, we will talk about the differences between Receipt and Payment Accounts and Income and Expenditure Accounts.

Content: Receipt and Payment Account Vs Income and Expenditure Account

- Comparison Chart

- What is a Receipt and Payment Account?

- What is an Income and Expenditure Account?

- Key Differences

- Conclusion

Comparison Chart

| Basis for Comparison | Receipt and Payment Account | Income and Expenditure Account |

|---|---|---|

| Meaning | Receipt and Payment Account is a sketch of cash transactions prepared by non-trading enterprises at the end of the financial year. | The Income and Expenditure Account is an account of earnings and outlay prepared by non-trading enterprises at the end of the financial year. |

| Basis of Preparation | Prepared on the basis of cash book. | Prepared on the basis of receipt and payment account. |

| Purpose of preparation | To know cash and bank balance | To know the surplus of income over expenditure or vice versa of the period. |

| Nature of Account | Real Account | Nominal Account |

| Basis of Accounting | Cash Basis | Accrual Basis |

| Opening and Closing Balance | It has an opening and closing cash balance. | It has no such opening balance, but it ends with a surplus or deficit. |

| Period | Items in this account belong to the current period. | Items in this account belong to the current year, last year or next year. |

What is a Receipt and Payment Account?

The Receipts and Payments account is a real account that reflects cash transactions occuring during the financial year. In addition, it is similar to the cash book of profit-making organizations. It is prepared at the end of the period under study.

Further, there will be a debit in the account with each cash receipt and credit with each cash payment. Further, the debits and credits take place in sequential order.

Features of Receipt and Payment Account

- Begins with an opening balance of cash in hand and at the bank.

- It does not record non-cash items like depreciation, bad debts, incomes written off, etc.

- Ends with a closing balance of cash in hand and cash at the bank.

- Accrued incomes and unpaid expenditures are not considered here.

- No net income or net loss is shown by this account.

- Adjustments are not made to this account.

Points to Remember

- Receipt and Payments Account does not make any difference between:

- Capital or revenue receipts,

- Capital or revenue expenditure,

- Recurring items of receipts or payments

- Non-recurring items of receipts or payments

- The items taken into consideration may relate to the current period, preceding period or subsequent period.

- It does not take into account outstanding, due or accrued.

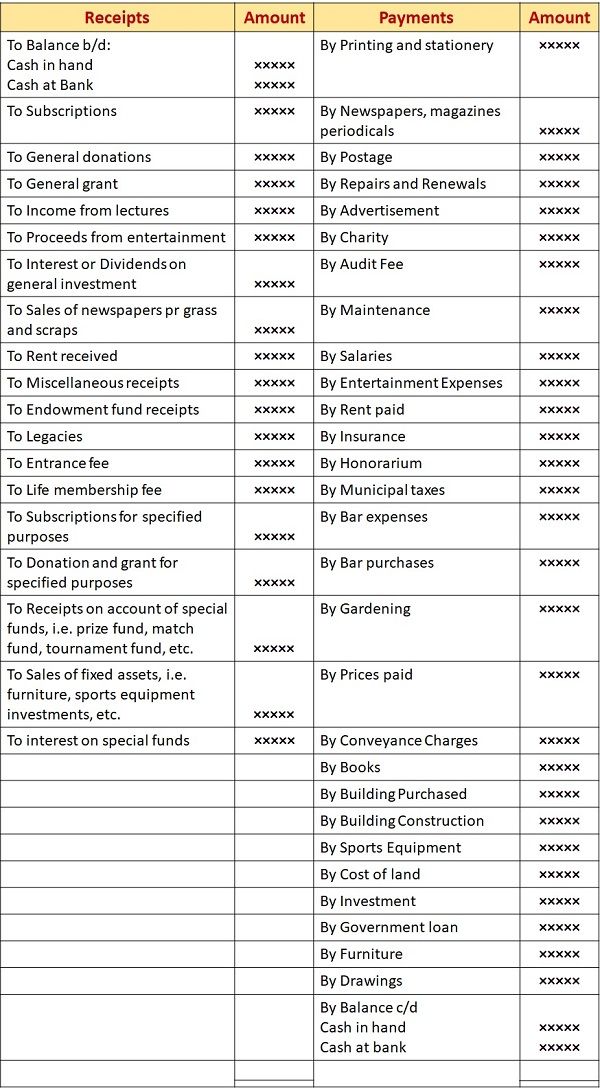

Format

Also Read: Difference Between Trading and Profit & Loss Account

What is an Income and Expenditure Account?

The Income and Expenditure Account is a nominal account. It reflects the summary of earnings and outlays during the financial year and the final result in the form of a surplus or deficit. The account is based on an accrual system.

It presents the classified snapshot of revenue, incomes, expenses and losses for the current year, together with surplus or deficit. This surplus or deficit is taken to Capital Account.

Features of Income and Expenditure Account

- Expenses and losses appear on the debit side, whereas Incomes and gains appear on the credit side.

- It takes into account only revenue nature items.

- We record only current period items in this account. If the expenditure contains any sum of expenditure belonging to the preceding or subsequent year, it is deducted.

- Records both cash and non-cash items.

- The ending balance shows surplus, i.e. excess of income over expenditure when the credit side is more than the debit side, or deficit, i.e. excess of expenditure over income when the debit side is more than the credit side.

- We add the surplus to the capital fund, whereas we deduct the deficit from the capital fund in the Balance Sheet.

- It is accompanied by a Balance Sheet.

Points to Remember

- It includes all adjustments concerning the outstanding or prepaid items.

- The account is prepared on the same rules that are applied to the Profit and Loss Account of the Trading enterprises.

- It takes into consideration incomes and expenses belonging to the current period only be they received or not, paid or not. Also, it does not cover items relating to the preceding year and subsequent year.

- It does not include items of a capital nature.

- At the time of preparation of the income and expenditure account, the income of recurring nature is treated, whereas the income of non-recurring nature is ignored.

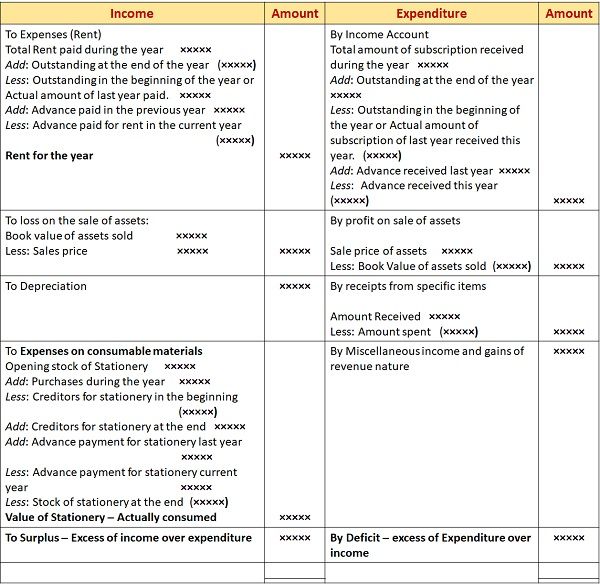

Format

Key Differences Between Receipt and Payment Account and Income and Expenditure Account

- For the preparation of the receipt and payment account, we use a cash account as a basis. Conversely, the preparation of income and Expenditure accounts is on the basis of the receipt and payment account.

- Non-Profit Organizations create receipt and payment accounts to calculate cash receipts and cash payments. On the other hand, Non-Profit Organizations prepare income and expenditure accounts to calculate the amount of income in excess of expenditure and vice versa.

- The Receipt and Payment Account is a real account. It is a snapshot of cash receipts and cash payments. However, the Income and Expenditure Account is a nominal account. In this account, we record expenses on the debit side, whereas we record incomes on the credit side.

- The receipt and payment account follows the cash basis of accounting. It does not take into account whether the receipts and payments belong to the current period. As Against, the Income and expenditure account follows an accrual basis of accounting. It considers all incomes and expenditures, irrespective of the fact that they are received or paid for the period or not.

- Receipts and Payment Account commences with opening cash and bank balance and ends with closing cash and bank balance. On the contrary, the Income and Expenditure Account has no such opening balance. However, it ends with a surplus or deficit.

- The income and expenditure account takes into account only those items which belong to the current accounting year. But, that is not the case with receipt and payment accounts because it takes into account all the items be they related to the current year, last year or next year.

Conclusion

Above all, for non-trading concerns, the receipts and payments account is similar to the cash book, whereas the income and expenditure account is a substitute for the profit and loss account of the trading concerns.

Brand Veloce says

It was of great importance. Thanks for sharing your ideas.