Revenue deficit indicates indebtedness in the present budget owing to total revenue receipts and expenses proposed in the budget. It is a situation when the revenue expenditure is in excess of the revenue receipt. All such transactions having an influence over the current income and expenditure of the government are covered here.

Revenue deficit indicates indebtedness in the present budget owing to total revenue receipts and expenses proposed in the budget. It is a situation when the revenue expenditure is in excess of the revenue receipt. All such transactions having an influence over the current income and expenditure of the government are covered here.

Conversely, Fiscal deficit is a measure that shows the degree of dependence of the government on borrowings. Fiscal Deficit reflects estimated borrowings by the country’s government, i.e. the higher the fiscal deficit, the more will be the government borrowings.

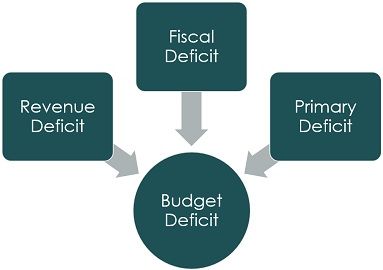

What is Budget Deficit

A budget deficit implies a situation wherein the government’s budget expenditures are in excess of the government’s budget receipt. There are three types of budget deficit, i.e. revenue deficit, fiscal deficit, and primary deficit.

This written material will help you understand the difference between revenue deficit and fiscal deficit.

Content: Revenue Deficit Vs Fiscal Deficit

Comparison Chart

| Basis for Comparison | Revenue Deficit | Fiscal Deficit |

|---|---|---|

| Meaning | Revenue Deficit is the excess of estimated government expenditure over receipts during a fiscal year in revenue account. | Fiscal Deficit is the excess of the total government expenditure over receipts from both tax and non tax sources excluding borrowings, during a fiscal year in both current and capital account. |

| Occurs when | Realized net income is less than the projected net income. | Government spends more than it earns or beyond its resources. |

| Borrowing | Shows the need of borrowing by government for the purpose of managing budgetary expenditure. | Shows the extent of borrowings by the government when interest payment is accounted for. |

| Represents | Dissavings of the government and intertemporal shift to present consumption. | Additional requirement of financial resources to meet government expenditure. |

| Indicator of | Insufficient funds with the government to finance the functioning of government departments. | Increase in future liabilities of the government on interest payment and loan payment. |

Definition of Revenue Deficit

When the revenue expenditure of the government is in excess of the government receipt, it results in a Revenue Deficit. It covers those transactions only that have an impact on the current income and expenditure of the government.

- It is an indicator of dissavings by the government, as well as the utilization of savings of different sectors, to finance a certain portion of its consumption expenditure.

- It shows that the government would need to raise money by borrowing not just for financing its investment but also for fulfilling the consumption requirement.

- It creates a stock of debt and interest liabilities and pushes the government to reduce expenditure.

Revenue Deficit is the Deficit on Revenue Account. Conventionally, the budgeting is classified into two accounts revenue account and capital account.

Formula for Revenue Deficit

Revenue Deficit = Revenue Expenditure – Revenue Receipts

Or

Revenue deficit = Total Revenue expenditure – (Tax Revenue + Non Tax Revenue)

What is Revenue Account?

Revenue Account refers to the revenue on the current account, which includes typical Government receipts from taxes as well as non-tax sources. Tax receipts are the revenue generated from different taxes like income tax, gift tax, customs duty, GST, etc. levied by the government. And nontax receipts include administrative revenue, commercial revenue from public sector undertaking, grants, and donations, fines, income from the sale of spectrum, escheat, fees such as court fees, fines, and so forth.

Expenditure on Revenue Account is an element of government expenditure, which is incurred to purchase goods and services for consumption in a particular financial year. Hence, this expenditure is called consumption expenditure. This may include salaries, interest payments, and subsidies.

Also Read: Difference Between Debt and Deficit

Definition of Fiscal Deficit

A Fiscal Deficit is a measure that expresses the entire shortfall in the non-debt resources to finance operations of the Central Government. It indicates the projected borrowing by the government to cope with its expenditures during a budget year. It is generally denoted as a percentage of GDP.

A fiscal deficit is when there is a difference between the government’s total expenditure and total receipts not including borrowings, during a fiscal year. The reason behind the exclusion of borrowings is that borrowings are not considered as a part of government receipts.

The fiscal deficit reflects the borrowing needs of the government, during a budget year, so as to finance the expenditure, including interest payments.

Formula for Fiscal Deficit

Fiscal Deficit = Total budget expenditure – Total budget receipts excluding borrowings

Or

Fiscal Deficit = Revenue expenditure + Capital expenditure – Revenue receipts – Capital Receipts excluding borrowings

Or

Fiscal Deficit = Revenue expenditure + Capital expenditure – Tax Revenue – Non Tax Revenue – Recovery of loans – Disinvestment

Or

Fiscal Deficit = Total borrowing requirement of the government

Also Read: Difference Between Fiscal Policy and Monetary Policy

Key Differences Between Revenue Deficit and Fiscal Deficit

As we have discussed the meaning of these terms, let us now take a peep into the differences between revenue deficit and fiscal deficit:

- Revenue Deficit refers to the gap between government revenue expenditure and government revenue receipts, whereas Fiscal Deficit implies the gap between total expenditure and total non-debt receipts of the government.

- Revenue Deficit takes place when the realized net income of the government is less than the estimated net income. As against, Fiscal Deficit arises when the spending of the government is more than its earning or beyond its financial inflow/resources.

- Revenue Deficit shows the need for borrowing by the government to manage budgetary expenditure. Conversely, Fiscal Deficit shows the extent of borrowings by the government when an interest payment is accounted for.

- Revenue Deficit signifies that spending of the government is beyond its limit, to carry out day-to-day operations. It indicates dissavings of the government and intertemporally, a shift to present consumption. In contrast, a Fiscal Deficit denotes additional requirements of financial resources to meet government expenditure.

- Revenue Deficit signals insufficiency of funds in the hands of the government to finance the operations of government departments or agencies. Contrastingly, Fiscal Deficit signals an increase in future liabilities of the government on interest payment and loan repayment. The government has to repay the borrowed sum in the future. As a result of which the government has to raise the funds from people or increase the rate of taxes in the future to pay the interest and principal loan amount, which ultimately gives rise to inflation.

Example

Budget Estimates of the Government are given for the year 2020-2021 are given below:

| Revenue Receipts | 4000 crores |

| Revenue Expenditure | 6000 crores |

| Capital Receipts | 3000 crores |

| Capital Expenditure | 1000 crores |

| Loan Recoveries and Other Receipts | 400 crores |

| Interest Payments | 2200 crores |

Now, we need to calculate the revenue deficit and fiscal deficit from the given information:

Revenue Deficit = Revenue Expenditure – Revenue Receipts

= 6,000 – 4,000

= Rs. 2,000 crores

Fiscal Deficit = Total Expenditure – Revenue Receipts – (Recoveries of Loan and Other receipts)

= (6,000+1,000) – 4,000 – 400

= 2,600 Crores

Or Fiscal Deficit = Borrowings = 2600 crores

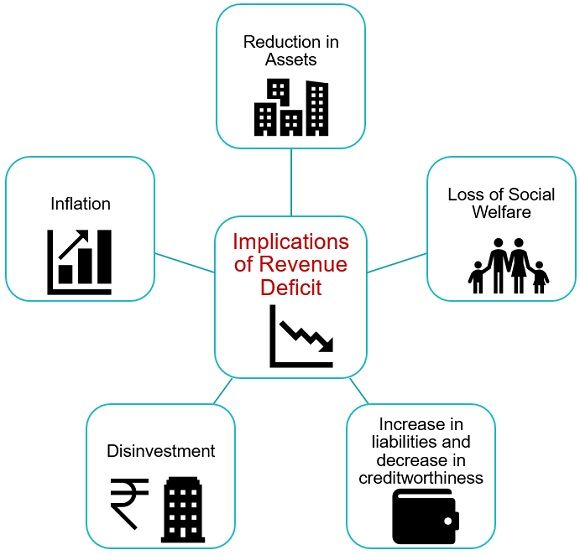

Implications of Revenue Deficit

The implications of revenue deficit are:

- Reduction in Assets: To meet its revenue expenditure, the government needs to borrow or sell its assets.

- Loss of Social Welfare: The government may have to reduce its expenditure on a number of welfare programs, and subsidies provided to the people, which results in loss of social welfare.

- Increase in liabilities and decrease in creditworthiness: The government may need to raise funds by way of borrowings from the general public, RBI, World Bank, etc, which not just increases liabilities but also reduces its creditworthiness.

- Disinvestment: The government is left with an option of disinvestment i.e. selling the ownership stake in public sector undertaking, i.e. either to foreign companies or private individuals.

- Inflation: To meet consumption expenditure capital receipts are utilized by the government. As borrowed funds do not amount to investments, it is used up for the purpose of consumption, which results in inflation.

Implications of Fiscal Deficit

The implications of fiscal deficit are:

- Inflationary Spiral: Borrowing from RBI, increases the supply of money in the economy, which increases the general price level. A prolonged increase in the general price level results in an inflationary spiral, i.e. borrowing from RBI > Increase in money supply > Increase in prices > Inflationary Spiral.

- National Debt: Fiscal Deficit gives birth to the national debt. It hampers GDP growth, as a large portion of the national income is spent on repaying past debts.

- Vicious Circle of High Fiscal Deficit and Low GDP Growth: When there is a high fiscal deficit constantly, it gives rise to a situation in which GDP growth remains low due to high fiscal deficit and the fiscal deficit remains high due to low GDP growth.

- Debt trap: Borrowing leads to two main problems, with respect to the repayment of loan and payment of interest, because the payment of interest again increases the revenue deficit. And more borrowing will be required to finance interest payments which results in a debt trap.

- Crowding Out: Crowding Out Effect is an outcome of Fiscal Deficit. It refers to a condition when high government borrowings because of high fiscal deficit, decreases the availability of funds for private investors. This reduces overall investment in the economy.

- Erosion of Government Credibility: High fiscal deficit destroys the credibility of the government in both domestic and international markets. This lowers down the government’s credit rating, and the foreign investors will begin withdrawing money that they have invested in the domestic economy. As a result of which GDP is reduced.

Conclusion

By and large, the government must take necessary steps to control the fiscal deficit to rise beyond the manageable level. In general, a Fiscal Deficit of around 3% of the GDP is regarded as manageable. High fiscal deficit is an indicator of fiscal indiscipline. It represents an economic situation wherein GDP growth is low and unemployment is high. Further, the economy moves towards stagnation and the revival becomes tough due to a lack of t foreign direct investment.

Conversely, Revenue Deficit indicates a shortage that has to be made up from capital receipts i.e. borrowings. To be precise it is a repayment burden in the future which do not match with any investment.

Leave a Reply