Sacrificing Ratio is the ratio of sacrifice as to the part of profit made by the old partners, in favor of the one who is entering the firm. On the other side, the gaining ratio is the ratio of gain in the share of profit, received by the continuing partner when one of the partners resigns or leaves the firm.

Sacrificing Ratio is the ratio of sacrifice as to the part of profit made by the old partners, in favor of the one who is entering the firm. On the other side, the gaining ratio is the ratio of gain in the share of profit, received by the continuing partner when one of the partners resigns or leaves the firm.

Change in Profit Sharing Ratio

Change in the Profit Sharing Ratio (PSR) is due to the following reasons

- Purchase of a share of profit by one partner from another leads to a change in profit sharing ratio.

- Entry or Exit of any partner

- Mutual Consent of all partners

Hence, due to the change in the profit-sharing ratio, some partners gain and some partners lose. Therefore, the gaining partner compensates the losing partner, by paying the amount in the form of capital.

In this post, we will discuss the difference between sacrificing ratio and gaining ratio.

Content: Sacrificing Ratio Vs Gaining Ratio

Comparison Chart

| Basis for Comparison | Sacrificing Ratio | Gaining Ratio |

|---|---|---|

| Meaning | Sacrificing Ratio refers to the ratio in which the old partners of the firm give up or surrender their portion of profit in favor of the coming partner. | Gaining Ratio implies the ratio in which the remaining partners of the firm, share the retiring partner's profit share. |

| Event | Admission of new partner, share acquired by one partner from other partners, or change in profit sharing ratio by mutual consent. | On the death or retirement of a partner or change in profit sharing ratio by mutual consent. |

| Objective | To ascertain the amount of goodwill payable to the existing partners, when a new partner enters the firm. | To ascertain the share of goodwill to be paid to the retiring partner, by the staying partners. |

| Effect on capital | The capital accounts of the old partners will be increased with the amount received as goodwill, brought to the firm by the new partner. | The partner who is retired is paid for the goodwill and the capital accounts of the partners who stays in the business will be reduced with the amount paid as goodwill. |

| Calculation Method | New Ratio is deducted from Old Ratio. | Old Ratio is deducted from New Ratio. |

Definition of Sacrificing Ratio

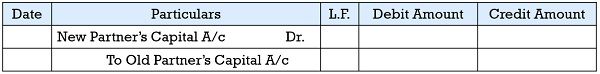

On the admission of a new partner, old partners need to make sacrifices of their profit share either individually or collectively to take in the new partner. It is quite obvious that after giving a definite share to the new partner, the lesser share remains for distribution among the old partners. Hence, the new partner’s share will reduce the share of the existing partners, or sometimes any one partner.

So, at the time of calculating the sacrificing ratio, first of all, the sacrifice made by each partner is calculated, and then the ratio of their sacrifice is determined.

In other words, at the time of admission of a new partner, old partners give up a certain portion of their share in favor of the new one. Hence, the proportion in which new partners old partners sacrifice their share of profit is called sacrificing ratio.

Formula of Sacrificing Ratio

Sacrificing Ratio = Old Ratio – New Ratio

Admission of a New partner

A new partner is admitted to the firm only when all the existing partners agree to it. A new partner enters the firm when there is a need for additional capital or to strengthen the firm’s managerial capacity.

Why Sacrificing Ratio is determined?

Sacrificing ratio is determined to divide the premium for goodwill brought to the firm by the new partners among the old partners in that ratio. Moreover, it can also be determined when one of the partners acquire share from other partners.

Example

Suppose there are two partners in a firm Ali and Priya, sharing profits and losses in a ratio of 3:2. They admit Shreya into the business and the new ratio for sharing profit and loss is 3 : 2 : 1. So, the sacrificing ratio will be:

The sacrificing ratio between Ali and Priya is 3 : 2

Point to Remember

- The main purpose of calculating the two ratios is to ascertain the amount of goodwill to be distributed by the gaining partners to the sacrificing partners when there is a change in the profit-sharing ratio.

- At the time of calculating the sacrifice/gain of the partners, when there is a change in profit sharing ratio with the consent of all the partners, then the new share is deducted from the old share. Further, if the result obtained is positive then it is a sacrifice, if the same is negative, it indicates gain.

Also Read: Difference Between Revaluation Account and Realisation Account

Definition of Gaining Ratio

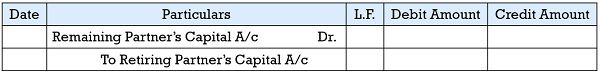

At the time of retirement of a partner, his/her share is transferred to the remaining partners. So, the gaining ratio is the proportion in which the continuing partners gain out of the share of the retiring one.

The remaining partners receive the advantage as the partner retires. So, the profit-sharing ratio which the retiring partner leaves behind is taken by the remaining partners of the firm. Hence, the continuing partners gain a certain proportion out of the share of the retiring partner. The remaining partners gain this additional share, out of the retiring partner’s share, either in the earlier relative ratio or in an agreed ratio.

Further, for the purpose of calculating this ratio, the gain of each remaining partner is determined, which is denoted in the form of a ratio. So, we can say that

Formula of Gaining Ratio

Gaining Ratio = New Ratio – Old Ratio

Retirement of a Partner

Retirement of a partner can take place when all the partners give their consent for it, or when there is an express agreement, or by giving notice.

Why Gaining Ratio is determined?

The objective behind the determination of gaining ratio is to identify the contribution to be made by each partner in payment of goodwill by each partner, who is benefitted by such retirement.

Example

Suppose there are 3 partners in a firm Edward, Bill, and Sherley, whose profit and loss sharing ratio is 5 : 3 : 2. Bill retires from the firm. After the retirement of Bill, the new ratio in which Edward and Sherley will share profit and losses is 2 : 1.

Gain of Edward = New Ratio – Old Ratio

![]()

Gain of Sherley = New Ratio – Old Ratio

![]()

Thus, the gaining ratio of Edward and Sherley is 5 : 4

Also Read: Difference Between Dissolution of Partnership and Dissolution of Firm

Key Differences Between Sacrificing Ratio and Gaining Ratio

As we have discussed the meaning, and formula of these two ratios along with examples, let us understand the difference between sacrificing ratio and gaining ratio in detail:

- Sacrificing ratio indicates the ratio of decrease in the profit sharing ratio of the old partners when a new partner joins the firm. Conversely, Gaining Ratio implies the ratio of increase in the profit-sharing ratio of the continuing partners, out of the share of the retiring partner.

- Sacrificing Ratio is calculated to determine the amount of goodwill payable to the existing partners when a new partner enters the firm. On the contrary, the gaining ratio is calculated to ascertain the share of goodwill to be paid to the retiring partner, by the staying partners.

- Sacrificing ratio is calculated when a new partner is admitted to the firm. On the other hand, the gaining ratio is calculated when a partner takes retirement from the firm.

- To calculate sacrificing ratio, the old ratio is reduced from the new ratio, whereas for the calculation of gaining ratio, the new ratio is reduced from the old ratio.

- The effect on capital, of the sacrifice, is that capital accounts of the old partners will be increased with the amount received as goodwill, brought to the firm by the new partner. On the contrary, the effect on capital, of the gain is that the partner who is retired is paid for the goodwill and the capital accounts of the partners who stay in the business will be reduced with the amount paid as goodwill by each partner.

Example

David, Peter, and Zen are three partners of a firm who share profits and losses in the ratio 3 : 2 : 1. They have agreed to change the profit-sharing ratio from 3 : 2 : 1 to 2 : 2 : 1. Calculate the sacrifice or gain of each partner due to a change in the ratio.

Sacrifice/Gain of David:

Old Ratio – New Ratio![]()

Sacrifice/Gain of Peter:

Old Ratio – New Ratio![]()

Sacrifice/Gain of Zen:

Old Ratio – New Ratio![]()

The sum of the gaining ratio will be equal to the sum of sacrificing ratio.

Also Read: Difference Between Partner and Designated Partner

Journal Entry

Sacrificing Ratio

Gaining Ratio

Conclusion

In general, to accommodate a new partner in a firm, old partners either jointly or separately sacrifice their share, and so as they give up their part in favor of the new partner, old partners receive a lesser share and the ratio which calculates the sacrifice made by each partner is called sacrificing ratio.

Conversely, at the time of retirement of a partner, the remaining partners acquire the share of the retiring partner. This increases the old partner’s share in profit, which is nothing but the gain received by the old partners. And the ratio used to represent the same is called the gaining ratio.

Leave a Reply