Absolute advantage is one when a country produces a commodity with the best quality and at a faster rate than another. On the other hand, comparative advantage is when a country has the potential to produce a particular product better than any other country.

Absolute advantage is one when a country produces a commodity with the best quality and at a faster rate than another. On the other hand, comparative advantage is when a country has the potential to produce a particular product better than any other country.

Due to the effect of globalization, one can enjoy Brazilian coffee, while living in the United States or go for a drive in a German car, on the roads of London. International trade helps the countries to expand their market and sell the goods and services across the boundaries of the country.

Mercantilism is the premier body of thought on international trade, introduced in the 17th and 18th century in Europe, wherein the mercantilist writers are of the view that the primary aim of the international trade is to promote favourable Balance of Trade. Here the favourable balance of trade refers to surplus trade between the countries, wherein the value of goods exported is greater than the goods imported.

Mercantilism theory was rebelled by Adam Smith and David Ricardo and propounded the theory of absolute advantage and comparative advantage respectively, which rely on the doctrine of free trade and specialization while producing such goods where inputs are adequate.

Content: Absolute Vs Comparative Advantage

Comparison Chart

| Basis for Comparison | Absolute Advantage | Comparative Advantage |

|---|---|---|

| Meaning | Absolute Advantage implies the unbeatable dominance of a country or business organization in producing a particular commodity. | Comparative Advantage refers to the ability of a country or business organization to produce a specific product or service at lower marginal cost and opportunity cost, than the other countries. |

| Represents difference in | Productivity of nations | Opportunity cost |

| Determines | Resource allocation, trade pattern and trade volume. | Direction of trade and International production. |

| Trade | Not mutual or reciprocal | Mutual or reciprocal |

| Factor involved | Cost | Opportunity Cost |

Definition of Absolute Advantage

The theory of absolute cost advantage was coined by Adam Smith, in the late 17th century in his popular book “The Wealth of Nations“, opposing the Mercantilism approach which believed that trade is a zero-sum game.

In his theory, Smith argued that the nations gain through trading when they specialize as per their production superiority.

According to this theory, a country or business entity is said to have an absolute advantage over others when it can produce the highest number of goods, with the best quality using fewer resources, than another country or entity.

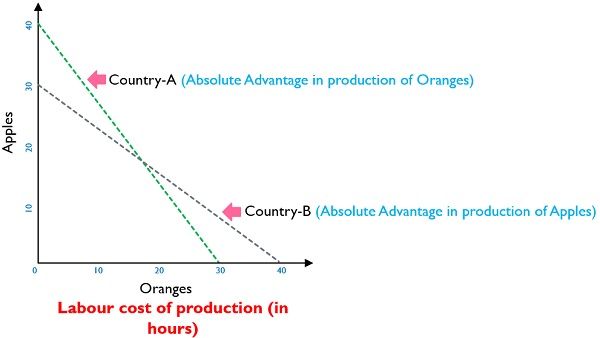

Example

Resources Required to produce one unit of oranges and apples

| Country | One unit of oranges | One unit of apples |

|---|---|---|

| Country-A | 30 | 40 |

| Country-B | 40 | 30 |

With the above example, it might be clear to you due to the absence of trade both the countries produce both the fruits, but if there is a trade between these two countries then they need to produce the goods in which they specialize, i.e. they have an edge over the others. In our example, Country-A produces Oranges more efficiently while Country-B produces apples more efficiently, i.e. at a lower cost.

In our example, Country-A produces Oranges more efficiently while Country-B produces apples more efficiently, i.e. at a lower cost.

Definition of Comparative Advantage

In the early 18th century, David Ricardo followed the ‘Theory of Absolute Cost Advantage given by Adam Smith’ and took it a step further, by emphasizing that cost advantage is not a mandatory condition for trade to take place, between two countries. This is because, the countries can still gain from international trade, even when one country is able to produce all the goods with less labour cost than another country.

In the book Principles of Political Economy, Ricardo indicated that it is beneficial for a nation to specialize in the production of those goods, which it can produce with maximum productivity, and minimum wasted effort and expense and to import those goods from other nations which it produces inefficiently.

According to his theory, a country or business entity is said to have a comparative advantage in the production of goods or services when it can produce/deliver that particular good or services at a comparatively lower opportunity cost than any other country. The opportunity cost as a determinant for analysis in making a choice amidst multiple options for production diversification.

It is used to gauge the efficiency of the countries in terms of relative magnitudes, as resources are limited and so they must go for producing those goods and services in which they possess a comparative advantage.

Example

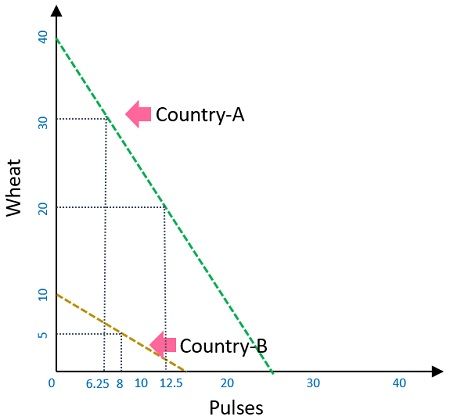

Suppose Country-A has an absolute advantage in the production of wheat and pulses. It takes 10 resources to produce 1 ton of wheat and 16 resources to produce 1 ton of pulses. Hence, with 400 units of resources, Country-A can produce 40 tons of wheat and no pulses, or 25 tons of pulses and no wheat. In Country-B, it takes 40 resources to produce one ton of wheat and 25 resources to produce a ton of pulses. In this way, it can produce 10 tons of wheat and no pulses, or 16 tons of pulses and no wheat

Resources needed for the production of 1 ton of wheat and pulses

| Country | Wheat | Pulses |

|---|---|---|

| Country-A | 10 | 16 |

| Country-B | 40 | 25 |

So, in the absence of trade both the countries use only half of its resources to produce wheat and half to produce pulses. Thus Country-A will produce 20 tons of wheat and 12.5 tons of pulses, whereas Country-B will produce 5 tons of wheat and 8 tons of pulses.

Production and Consumption without Trade

| Country | Wheat | Pulses |

|---|---|---|

| Country-A | 20 | 12.5 |

| Country-B | 5 | 8 |

| Total | 25 | 20.5 |

Considering Country-A’s absolute advantage in the production of both wheat and pulses, but it has a comparative advantage in the production of wheat, as it can produce wheat 4 times of the wheat produced by Country-B, but when it comes to the production of pulses Country-A is only 1.56 times ahead of Country-B.

When the Country A is ready to exploit its comparative advantage in producing the wheat and increases the output from 20 units to 30 tons of wheat, which uses only 300 units of resources and 100 units of resources are still with the country which they can use in the production of pulses. At the same time, Country-B specializes in producing pulses and uses all of its resources to produce it and produces 16 tons of pulses. You can now notice that the overall output of both wheat and pulses have increased.

Production with specialization

| Country | Wheat | Pulses |

|---|---|---|

| Country-A | 30 | 6.25 |

| Country-B | 0 | 16 |

| Total | 30 | 22.5 |

This proves that not only the output has increased, indeed both countries can now enjoy the benefits of trade.

Consumption After Country-A trades 6.5 tons of wheat for 6.5 tons of pulses of Country-B

| Country | Wheat | Pulses |

|---|---|---|

| Country-A | 23.5 | 12.75 |

| Country-B | 6.5 | 9.5 |

| Total | 30 | 22.5 |

Increase in Consumption after specialization and trade

| Country | Wheat | Pulses |

|---|---|---|

| Country-A | 3.5 | 0.5 |

| Country-B | 1.5 | 1.5 |

Have a look at the graph below to understand the example in a better way:

Hence, we can say that there is an overall increase in production and consumption due to trade and specialization.

Hence, we can say that there is an overall increase in production and consumption due to trade and specialization.Key Differences Between Absolute and Comparative Advantage

The difference between absolute and comparative advantage are discussed hereunder:

- Absolute advantage is when a country or business enterprise is impeccably more efficient at a production of a commodity than any other country or business enterprise, then the country is said to have an absolute advantage in the production of that commodity. On the other hand, comparative advantage is when a country or business enterprise is comparatively more efficient, in the production of a commodity than another country or business entity, then that country is said to have a comparative advantage in the production of that particular commodity.

- In absolute advantage, we study the productivity of nations, in the production of a commodity, which is better than its competitors who use the same resources. As against, in comparative advantage, we study how efficiently a country uses its resources, to produce goods at a lower opportunity cost than its competitors.

- While the absolute advantage is used to determine resource allocation, trade pattern and trade volume. Conversely, comparative advantage helps in ascertaining the direction of trade and international production.

- In absolute cost advantage theory, trade is not considered mutual and reciprocal. In contrast, in comparative advantage theory, trade between the countries is considered as mutual and reciprocal.

- Cost is the primary factor in absolute advantage. On the contrary, the opportunity cost is the basic factor in comparative advantage.

Conclusion

The theory of absolute cost advantage rejected the theory of Mercantilism, whereas the theory of comparative advantage is a development over the theory of absolute cost advantage. The essence of the theory of comparative cost advantage is that if unrestricted free trade exists, then the potential world production would be greater, as compared to the restricted trade.

Hence, the theory of comparative advantage makes it clear that trade is a positive-sum game and not a zero-sum game, wherein all the countries that participate in trade, are more or less benefitted through it.

Lemi F says

Wow, I appreciate it.

Emmanuel Destiny Atarhe says

Wow!! this is so refreshing.