“Luca Pacioli” is the father of accounting. He discovered the concept of a double-entry system of book-keeping. As per this system, each business transaction affects two sides of an account, i.e. debit, and credit. While debit indicates the destination, credit implies the source of monetary benefit.

“Luca Pacioli” is the father of accounting. He discovered the concept of a double-entry system of book-keeping. As per this system, each business transaction affects two sides of an account, i.e. debit, and credit. While debit indicates the destination, credit implies the source of monetary benefit.

As per the Double Entry System: For each debit or credit entry, there is always a corresponding and equal credit or debit entry. The debit and credit entries are made in the ledger accounts to record the changes in value because of business transactions.

So we could say that every accounting transaction involves at least one debit and its corresponding credit. The sum of the debits and sum of the credits for each transaction and the total of all transactions are always equal. We call this process of equalling as balancing.

In an accounting entry, the source account of a transaction is credited. Whereas the destination account is debited. Debit represents the left-hand side of the account. Whereas credit reflects the right-hand side of the account. It is important to understand them because they are the base of the entire accounting system.

Also Read: Difference Between Single Entry system and Double Entry System

Golden Rules of Accounting

| Account Type | Debit | Credit |

|---|---|---|

| Personal Account | The Receiver | The Giver |

| Real Account | What comes in | What goes out |

| Nominal Account | All losses (and expenses) | All incomes (and gains). |

In this post, we will discuss the difference between debit and credit in accounting

Content: Debit Vs Credit in Accounting

- Comparison Chart

- Basic Concept

- What is Debit?

- What is Credit?

- Key Differences

- Meaning of an Account

- Conclusion

Comparison Chart

| Basis for Comparison | Debit | Credit |

|---|---|---|

| Meaning | Debit is an entry that is passed when there is an increase in assets or decrease in liabilities and owner's equity. | Credit is an entry that is passed when there is a decrease in assets or an increase in liabilities and owner's equity. |

| Reflects which side of Account | Left-hand side | Right-hand side |

| Act of recording entry | Debiting | Crediting |

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Capital | Decrease | Increase |

| Income | Decrease | Increase |

| Expense | Increase | Decrease |

| Stock | Increase | Decrease |

Basic Concept

In accounting terminology, the individual who receives the benefit is debited as he is placed under an obligation. On the contrary, the one who provides or gives a benefit is credited because he is entitled to a return of the obligation.

One can use the basic accounting equation i.e. assets = liability + capital, and the rules for debit and credit to check the accuracy of the recorded transactions.

The terms ‘debit’ and ‘credit’ reflects the left-hand side and right-hand side of an account respectively. Now, how could you identify the left and right sides of the account?

Well, you should always remember that if there lies an open book in front of you and it is you who look at the book and not the book looks at you. Hence, your left-hand side will be the left side and your right-hand side will be the right side. And the left side will be the debit side, whereas the right side will be the credit side. Also, we use abbreviations like Dr. for debit and Cr. for credit.

Further, all the accounts indicate entries of increase as well as decrease. There are some accounts in which an increase is entered on the left side i.e. the debit side while the decrease is entered on the right side, i.e. the credit side. But, there are some accounts in which we record the increase on the right side which is the credit one. Whereas we record the decrease on the left side which is the debit one.

So, we could say that debits and credits do not by themselves reflects the increases or decreases. Hence, we need to refer to the specific account to determine if the debit or credit show an increase or decrease.

Types of Account

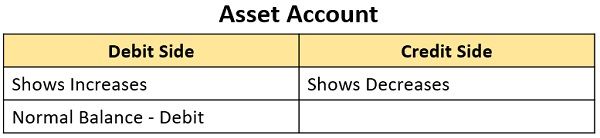

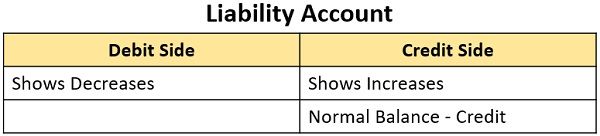

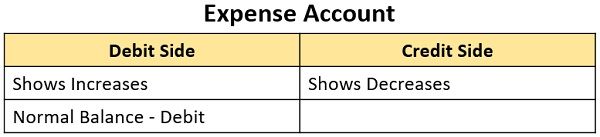

There are five major types of accounts that indicate debit and credit with regard to increases or decreases:

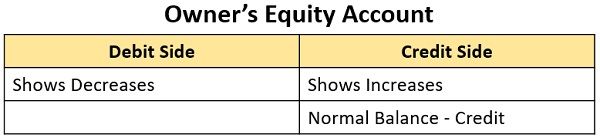

Owner’s Equity (Capital) Account

Note: The word ‘normal balance’ implies the positive balance of an account, i.e. the total of the increases to the account is more than the total of decreases.

Points to Remember

More precisely, we could draw the following inferences:

- Debit is the left side of the account, while credit is the right side of the account.

- Since the accounts must always balance, for every transaction there is going to be a debit made to one or more accounts and a credit made to one or more accounts.

- The Sum of all debits made in each day’s transactions must tally the sum of credits in such transactions. And after a number of transactions, the sum of all accounts with debit balance will tally the sum of all accounts with a credit balance.

- There will be a debit in case of an increase in assets and expenses. So they have debit balances. Whereas an increase in liability, owner’s equity i.e. capital and revenue or incomes are credited. So they have credit balances.

What is Debit?

The word ‘debit’ comes from the Italian term ‘debito‘, which comes from Latin term ‘debita‘. It implies ‘owed to the proprietor’. It shows ‘what we are going to receive’. So, it is the destination that enjoys the benefit of the transaction.

In the particulars column of the debit side, we enter the account’s name from which the benefit is received. The word ‘To‘ is affixed to the name of the account recorded on the credit side.

On the debit side of an account, we usually enter the uses or applications of business funds. For example:

- Purchase of fixed assets

- Payment of expenses like rent, salary, electricity bill and so on.

- Services provided during the course of business.

We post such transactions on the left-hand side of the account. This means these items are debited.

Debits increase balances in:

- Asset account

- Expense account

But it decreases balances in:

- Liability account

- Revenue account, i.e.incomes or gains account

- Capital account.

So, asset and expense accounts have a debit balance. This means that the total debits are more than the total credits in each account.

Also Read: Difference Between Journal and Ledger

What is Credit?

The word ‘credit’ comes from the Italian term ‘credito‘ which originates from Latin word ‘credo‘. It refers ‘to trust’ or ‘belief’ (in the proprietor or owed by the proprietor). Hence, it implies ‘what we will have to pay. It indicates the source which sacrifices for the benefit.

In the particulars column on the credit side, we enter the account’s name to which benefit is given. Also, we affix the word ‘By‘ to the name of the account recorded on the credit side.

The verb ‘to credit’ means to post an entry on the right side of an account. It reflects the sources of funds to:

- Meet the expenses of the business

- Acquire assets

- Pay off debts or liabilities.

Therefore, we enter these transactions on the right-hand side of the account, which means that these items are credited.

Credits increase the balance in:

- Liability accounts

- Revenue accounts and

- Capital accounts.

However, it decreases balances in:

- Asset accounts and

- Expense accounts.

Thus, revenue accounts, i.e. incomes and gains accounts, and liability accounts have a credit balance. The credit balance is when the total credits are more than the total debits in each account.

Also Read: Difference Between Accounting and Accountancy

Key Differences Between Debit and Credit in Accounting

- An entry made in an account on the left side is the debit entry or debit. Whereas, when an entry made is on the right side of the account is credit entry or credit.

- The act of recording entries on the left side is known as debiting the account. As against, the act of recording the entries on the credit side of the account is called crediting the account.

-

Personal Account

- In case of a new account party whose account is debited becomes the debtor of the business.

- If the party whose account is debited is already a debtor, then a new debit reflects an increase in the sum due from him.

- If the party whose account is debited is a creditor, the new debit represents a decrease in the amount due from the person by the amount of debit. Or the party may become a debtor if the amount of debit exceeds the amount of credit.

- In the case of a new account, the party whose account is credited becomes a creditor of the business.

- If the party whose account is credited is already a creditor, then new credit reflects an increase in the sum owed to him with the amount of fresh credit.

- If the party whose account is credited is a debtor, new credit represents a reduction in the amount which the debtor has to pay from the amount of credit. Or the party may turn out as a creditor, if the amount of credit exceeds the amount of debit.

-

Real Account

- The value of an asset that is being debited has increased or the firm has purchased more of that asset.

- The value of an asset that is being credited has decreased or the firm has disposed of a part or the entire asset.

-

Nominal Account

- There has been an increase in expense or loss by the amount debited. Or there is a reduction in the income or profit by the amount debited.

- There has been an increase in the income or profit by the amount credited. Or there has been a reduction in the expense or loss by the amount credited.

Meaning of an Account

An account is like a summary or history of a particular type of transaction for a business. It is a ledger record, in a condensed form. It contains all the transactions that happened with a particular party or thing. Suppose a firm deals with customers and suppliers, the firm will create separate accounts of both the parties in their books.

It has eight columns and comprises of two sides, i.e. left side and the right side which represents the debit and credit sides respectively. The debit and credit sides are commonly represented by Dr. and Cr.

Conclusion

Debit and Credit are the two sides of the same coin. One must note that debit entries of each transaction must tally its credit entries.

cueen bello says

it really helps me for my demo teaching tomorrow. thankyou so much

SM Alamgir says

It really helped me to understand debit and credit transactions.

Girish says

Really helpful

Maina Carol says

Now differentiation between the two is well understood. I can now be able to apply.

Thank you