Whole life insurance is a type of permanent life insurance that lasts for as long as the insured party pays the premium. Term life insurance lasts for a definite period, i.e. term.

Whole life insurance is a type of permanent life insurance that lasts for as long as the insured party pays the premium. Term life insurance lasts for a definite period, i.e. term.

Whole life insurance differs from term life insurance in the sense that it never expires, i.e. it continues as long as the customer continues making payment of premiums. Also, it allows cash value along with death benefit, which becomes a major source of funds for future needs. Cash Value component is not present in term life insurance.

A sound financial decision depends on thorough research and proper advice. One should not solely depend on financial advisors to make financial decisions for them because the advisors work for commission. So, you should go a step further and research on your own to decide what is best for you. Before deciding which one you should go for, one must know the differences between whole life and term life insurance.

What is Life Insurance Policy?

Life Insurance Policy is a type of plan that pays a certain sum to the beneficiaries if the policyholder passes away. It offers financial security to the family or dependents of the policyholder in the event of their death.

Content: Whole Life Vs Term Life Insurance

- Comparison Chart

- What is Whole Life Insurance?

- What is Term Life Insurance?

- Key Differences

- Conclusion

Comparison Chart

| Basis for Comparison | Whole Life Insurance | Term Life Insurance |

|---|---|---|

| Meaning | Whole life insurance, is an insurance plan that provides life long insurance to the policyholder. It continues till the policy is active. | Term life insurance is an insurance policy which has a life coverage only for a specified period of time. |

| Amount of premium | Higher premium over an agreed period. | Lower premium over an agreed period. |

| Definite Period | No | Yes |

| Benefit | The insurance company will give the insurance benefit to the legal heirs in the event of the death of the policyholder. | If the insured survives till the expiry of the term, the insurance company doesn't pay any amount to the policyholder. |

| Coverage | Covers you for life or upon surrender of the policy. | Covers you for the length of your payment. |

| Period | For a lifetime as long as premiums are paid. | For a certain period say 5, 10, or 20 years. |

| Does the premium amount change on renewal? | Premium remains unchanged | Yes, the amount of premium goes up every time when you renew your policy. |

| Cash value | It has a cash value. One can withdraw the cash value as a loan. But, if the loan is not paid, it reduces the death benefit. | It does not have cash value. Hence, one cannot borrow against the policy. |

| Premiums | Premium amount is lower when you are young but increases with the increase in age. | Premium is expensive but it remains the same. |

| Renewal | No need to renew the policy, because it provides lifetime coverage. | Renewal of term policy is at the maturity of the policy. |

What is Whole Life Insurance?

Whole life insurance, is one that offers the insured party with lifetime coverage. The policy continues, till the survival of the policyholder and expires on his demise. In simple words, whole life insurance gives protection coverage for the entire life. It is one of the basic forms of permanent life insurance.

The insurance company provides this coverage in exchange for premiums. These premiums are of equal amount, paid at periodical intervals. The intervals can be quarterly, half-yearly or annual basis. Further, on the demise of the insured party, the insurer pays remits death benefit to the insurance beneficiaries. In the event of an unexpected death, the insurer pays sum assured i.e. face value plus bonus to the nominee or nominees of the insured.

Policy Highlights

- It has no expiry date. It gets matured when the insured party passes away.

- Once can use it as an investment avenue when the premium paid to the policy matches death benefit, it is deemed to have reached the date of maturity.

- In general, the policies are designed to mature when the insured party reaches the age of 100 years. In some cases, these policies extend to 120 years.

- The amount received will be tax-free (subject to income tax rules).

- Surrender value is also available if the policy holder wants to terminate the contract anytime. So, there is a guaranteed death benefit.

- Growth of cash value at a guaranteed rate.

- Premium remains the same for life.

What is Term Life Insurance?

Term Life insurance is a type of insurance policy, which covers the risk of death of human beings, but up to a certain period only. It provides temporary coverage to the insured person for a specific term. This term may range from 10 to 30 years.

It is pure life insurance, as it pays the sum assured (death benefit) to the beneficiary if the policyholder passes away during the course of the term.

Policy Highlights

- In this a lump sum amount is paid as death benefit when the insured party dies during the term.

- There is no surrender value given to the policyholder.

- It is at the discretion of the policyholder whether to renew the policy or let the contract terminate if he survives after the end of the term.

How does it work?

It is known for its simplified process. Term life insurance gives the coverage to the policyholder for a fixed period of time, i.e. 10 years, 20 years or 30 years. The insurance company remits money to the beneficiary only in the case that the policyholder passes away during that term. This means that the whole amount of the policy lapses and the insurer does not pay any amount as payout.

But, what if the policy holder outlives and coverage ends? Well, in such a case, the beneficiaries do not get any money.

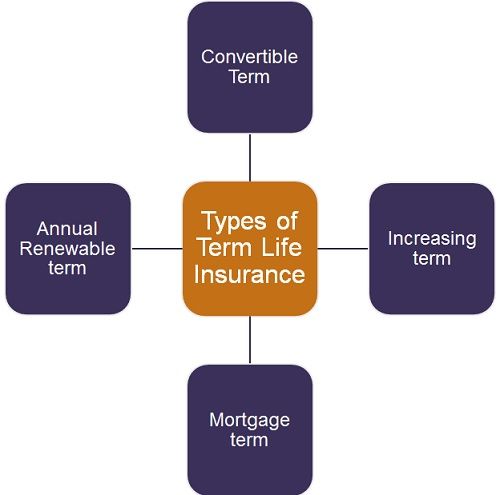

Types of Term Life Insurance

- Convertible Term: It allows the term insurance policy, with a specified period to be converted into whole life insurance before the expiry of its term.

- Increasing term: In this, the death benefit increases as the term progresses.

- Mortgage term: Also called a decreasing term. It is diametrically opposed to the increasing term. It works in a manner that death benefits decrease over time. This is to match the death benefit with the decrease of the outstanding mortgage amount of the insurance policyholder.

- Annual Renewable term: In this, the term insurance renews each year with a higher premium amount, as the policyholder turns a year older. The main benefit of this is that the coverage gets certainly approved year by year.

Key Differences Between Whole Life and Term Life Insurance

The points stated below will explain the difference between whole life and term life insurance:

- Whole life insurance is a type of protection plan, wherein insurance of life of the party is provided by insurer for an unspecified period. On the other hand, term life insurance is a pure protection insurance, wherein insurer provides pure risk cover. In this plan, the policy amount is payable, in the event of the demise of the policyholder, during the term of the policy. It is for a fixed term only and so if the insured survives the full term, nothing is paid.

- When it comes to premiums, in whole life insurance, the insured party has to pay a higher amount of premium over an agreed period. In contrast, in term life insurance, the insured party has to pay a lower amount of premium over an agreed period.

- Whole life insurance is for an indefinite period. This means that the policy continues for the entire life of the policyholder unless he chooses to discontinue the policy. Conversely, term life insurance is for a definite period, i.e. the policy comes with a specific term.

- Talking about the period, whole life insurance is for a lifetime of the insured party, i.e. till he pays the premium. Oppositely, in the case of term life insurance, the period varies from 10 to 30 years.

- In whole life insurance, the insurance benefit is provided to the nominee or beneficiaries on the event of death of the policyholder. In contrast, in term life insurance, the insurance company pays insurance benefits to the beneficiaries if the policyholder dies during the specified term.

And what if the policyholder survives till the expiry of the term?

Well in that case, the insurer doesn’t pays insurance benefits when the policy holder outlives that term.

- Whole life insurance covers you for life or it matures on the surrender of the policy, and the policy holder gets surrender value. Conversely, term life insurance covers you for the length of your payment of premium.

- In the case of whole life insurance, the amount of premium remains unchanged. But, the amount of premium goes up every time on the renewal of term life insurance policy..

- In whole life insurance, there is the cash value. One can withdraw the cash value as a loan. However, if the loan is not paid, it reduces the death benefit. On the other hand, term life insurance does not have cash value. Hence, one cannot borrow money against the policy.

- With whole life insurance, the policyholders cannot avail loan against the plan. Whereas, policyholders of term life insurance have the option of taking a loan against the policy.

- There is no need for renewal of policy in whole life insurance, as the policyholder gets lifetime coverage. Conversely, the policyholder can renew term life insurance if he/she wants to, on the completion of the term.

- Term life insurance is best for those who require pure protection for a specified term. Against, whole life insurance is best for those who want to build corpus funds for future needs.

Conclusion

In the end, the question arises which one is better. Well, it relies on the customer’s needs and wants. Suppose you want insurance for a short period then term life insurance is preferable. But in case you want coverage for a longer period, till the last breath of your life, then obviously you should go for whole life insurance.

Leave a Reply