Commercial banks are mandated to hold a fixed proportion of their average cash balance, as a reserve with the central bank, the amount of which should not be less than the specified percentage of Net Demand and Time Liabilities is called Cash Reserve Ratio (CRR).

Commercial banks are mandated to hold a fixed proportion of their average cash balance, as a reserve with the central bank, the amount of which should not be less than the specified percentage of Net Demand and Time Liabilities is called Cash Reserve Ratio (CRR).

On the other hand, SLR or Statutory Liquidity Ratio is the amount which a commercial bank is required to maintain in the form of liquid assets, i.e. cash, gold and bonds, before extending loans to its customers.

Basically, every scheduled bank and non-scheduled bank, have to maintain a prescribed level of CRR and SLR.

What are Demand Liabilities?

Demand liabilities means the amount of money which is made payable to the customer at the time when it is demanded, i.e. the withdrawal can be made by the customer at any time. Hence, these are the liabilities which are payable on demand and includes:

- Current deposits

- Balance in overdue fixed deposits

- Cash certificates and recurring deposits

- Unclaimed deposits

- Credit balance in a cash credit account

- Outstanding Telegraphic Transfer, Mail Transfer, Demand Drafts.

- Margins held against the letter of credit or guarantee

- Demand Liabilities part of the savings bank account.

What are Time Liabilities?

Time Liabilities mean the amount of money which is made payable to the customer after a period of time, i.e. the withdrawal from the account cannot be made immediately, rather the customer has to wait till the completion of that period. In other words, these are the liabilities which are not payable on demand, such as:

- Fixed deposits

- Recurring Deposits

- Cash Certificates

- Time liabilities part of saving bank deposits

- Staff security Deposits

- Margin held against the letter of credit, which are not payable on demand

- Deposits held as security, not payable on demand.

- Gold Deposits

In this post, we will explore the differences between Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR), in detail.

Content: CRR Vs SLR

- Comparison Chart

- Definition

- Key Differences

- Video

- Important Points

- Similarities

- Effect of change in Rates

- Example

- Conclusion

Comparison Chart

| Basis for Comparison | CRR | SLR |

|---|---|---|

| Meaning | CRR is the amount of money that the banks are obligated to park with the central bank, in the form of cash. | SLR is the amount of funds which the banks are required to maintain as liquid assets, i.e. cash, gold, approved securities. etc. |

| Regulates | Monetary stability in the country | Bank's leverage for credit expansion |

| Use | To drain out excess money out of the economic system. | To ensure the solvency of the commercial bank. |

| Maintenance with | Central Bank of India i.e. RBI | Bank itself |

| Form | Cash and cash equivalents | Liquid Assets |

| Return | Banks don't earn any interest as return on the money kept as CRR. | Banks usually earn interest as return on the funds kept as SLR. |

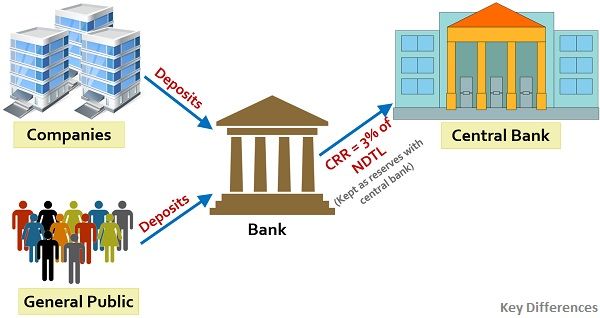

Definition of CRR

Cash Reserve Ratio, or otherwise called as CRR is the percentage of Net Demand and Time Deposits, that the commercial banks are obligated to keep with the central bank of India, i.e. RBI – Reserve Bank of India, in the form of cash. So, the banks are not allowed to use that money, kept with RBI, for economic and commercial purposes.

CRR is an effective tool which governs the banks lending capacity, as well as control the supply of money in the economy. Typically, it is in the form of the cash available in bank vault physically or deposits made with the apex bank.

CRR Rate

- Generally, the rate of CRR falls between 3% to 15%.

- As of January 2021, the rate of CRR is 3% which implies the banks are required to keep Rs. 3 with the Central bank whenever there is an increase in the bank deposits by Rs. 100.

- So, a higher CRR reflects that the banks will have a lower amount to invest or extend credit to customers, and vice versa.

Therefore, if the RBI wants to raise the supply of money in the system, it will reduce the rate of CRR while, if RBI seeks to decrease the money supply in the market then it will increase the rate of CRR.

In which year CRR was introduced?

Cash Reserve Ratio (CRR) was introduced in the year 1950 for the very first time, as a measure to ensure safety and liquidity of bank deposits.

Also Read: Difference Between Commercial Bank and Central Bank

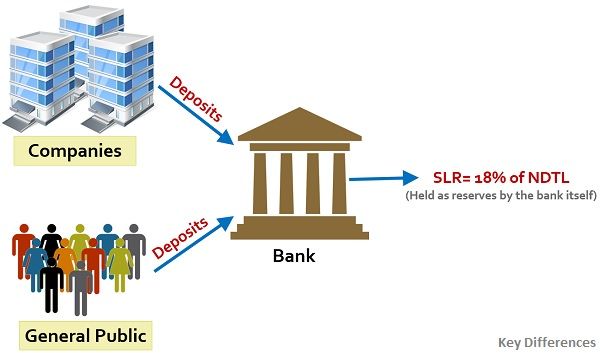

Definition of SLR

At the close of business every day, the banks are required to maintain a minimum proportion of their NDTL as liquid assets, which is called as SLR. Statutory Liquidity Ratio, or SLR refers to the percentage of Net Demand and Time Deposits, that the banks are obligated to keep with themselves as reserves at any point in time, in the form of:

- Cash

- Gold or

- Investments in the given instruments:

- Treasury Bills of Government of India

- Dated securities issued from time to time by the government under the market borrowing programme and the Market Stabilization Scheme;

- State Development Loans (SDLs) issued from time to time by the State Government under the market borrowing programme; and

- Any other instrument stipulated by the central bank

Objectives of SLR

- To limit the expansion of bank credit.

- To increase the bank’s investment in government securities.

- To ensure the solvency of banks.

- To control inflation and propel growth.

SLR Rate

The rate of SLR is decided by the Central bank, i.e. the Reserve Bank of India so as to control the expansion of bank credit. This means that SLR can increase or decrease the expansion of bank credit just by changing the rates of Statutory Liquidity Ratio.

- As of January 2021, the rate of SLR is 18%, which can be invested in government bonds, precious metals and other specified investments.

- So a higher SLR reflects that that banks will have less money for commercial transactions and extension of credit.

- The central bank is authorized to increase this rate up to 40%.

Therefore, this will lead to a rise in the interest rate of loans and advances. And when the SLR falls, there will be a fall in the rate of interest of loans and advances.

Also Read: Difference Between Repo Rate and Reverse Repo Rate

Key Differences Between CRR and SLR

The points of differences between CRR and SLR are discussed here in detail:

- CRR is an abbreviation for Cash Reserve Ratio which is the percentage of Net Demand and Time Liabilities which the commercial banks need to park with the Central Bank. On the contrary, SLR or Statutory Liquidity Ratio is the percentage of money which the banks need to maintain with themselves in the form of liquid assets, at any point in time.

- With CRR the central bank aims at maintaining monetary stability in the country, whereas, SLR governs the bank’s leverage for credit extension. So, a change in SLR determines the bank’s leverage position to pump or pour money into the economy.

- The central bank can use CRR as a tool to drain out excess money out of the system or release funds required for the economy from time to time. Conversely, SLR is another tool in the hands of Central bank which ensures the solvency of the banks and increases the investment of banks in government security.

- While CRR is to be maintained with the Central bank, i.e. the Reserve Bank of India, SLR is to be maintained by the bank themselves.

- As the name suggests, cash reserve ratio involves maintenance of reserves in the form of cash and cash equivalents, whereas statutory liquidity ratio requires maintenance of reserves as liquid assets, i.e. cash, gold and investment in a government bond, bills and securities.

- Banks don’t earn any interest as return on the money kept as CRR. However, Banks usually earn interest as return on the funds kept as SLR.

Video: CRR Vs SLR

Important Points

- CRR and SLR have to be maintained by the Banks on a daily basis as a percentage of Net Demand and Time Liabilities (NDTL), on the last Friday of the second preceding fortnight.

- Failure on maintaining CRR and SLR may lead to Penalties, which can be:

- Bank Rate + 3% on shortfall

- Bank Rate + 5% on subsequent default days.

Also Read: Difference Between Bank Rate and MSF Rate

Similarities

- Both are reserve ratios, which are mandatory for the banks to maintain.

- Both are prescribed by the Central Bank of India.

- Both can affect inflation to rise or fall, in the economy.

- Both influence the degree to which banks can lend money to their customers.

Effect of Change in Rates

The increase and decrease CRR and SLR will have the following effect:

| Increase in CRR | When there is an increase in CRR, the commercial banks are required to keep a higher percentage of their net demand and time deposits as reserves with the central bank. In such a case, the credit availability with the banks will be reduced, resulting in a decrease in their lending capacity. Ultimately, there will be a decrease in the flow of credit or supply of money in the economy. |

| Decrease in CRR | If there is a decrease in the CRR, the commercial banks have to keep a lower percentage of their net demand and time liabilities as reserves with the Central Bank. Hence, the credit availability with the bank will be increased, which will lead to the increase in their lending capacity and in turn there will be an increase in the flow of credit or supply of money in the economy. |

| Increase in SLR | When there is an increase in the SLR, it tends to reduce the bank's ability to extend credit, so the lending capacity of the banks will be decreased, which will be reflected in the reduction in the flow of credit or supply of money in the economy. |

| Decrease in SLR | On the decrease of the SLR, the bank's ability to extend credit will be increased, thus improving their lending capacity, which will be indicated in the increase in the flow of credit or supply of money in the economy. |

Example

Suppose the rate of CRR and SLR is 3% and 18% respectively, and the net demand and time liabilities (NDTL) of the bank is Rs. 100 crores. So, the bank has to keep 3 crores (3% of 100 crores to maintain CRR) in the form of cash and cash equivalents with Reserve Bank of India (RBI). Along with that banks has to reserve 18 crores (18% of 100 crores to maintain SLR) in the form of liquid assets with themselves.

Therefore, the loanable amount with the bank would be 100 crores – (3 crores + 18 crores) = 79 crores, which can be used for extending credit to customers.

Conclusion

In CRR, banks have to keep cash reserves of a certain percentage with RBI, but in the case of SLR, banks have to keep reserves of liquid assets with themselves. CRR is a measure used by the Central Bank of India to regulate the liquidity in the economy and control the flow of money in the country.

On the other hand, SLR is another measure used by the Central bank to maintain the stability of the economic system by limiting the credit facility offered to its customers.

Alimamy Sesay says

I am overwhelmed going through your explicit publications defining and differentiating between words that are most of the time being confused. You have really made very easy and straight for lots of people. God richly bless you. Please continue the good work. Thank you abundantly.

Surbhi S says

Thanks for your support, appreciation and blessings, keep reading and sharing your views with us. 🙂

Sprith Shrivastava says

This is a wonderful article. All the concepts regarding the CRR and SLR have been explained lucidly. Thank you so much.

Aditya Arun says

Wow! This is a brilliant article. One stop to understand the basics of SLR and CRR.

Thank you for your efforts.

lalitha says

Thanks a lot for your efforts. You wrote the article in such a simple language without unnecessarily complicating the content. keep going….

AMARESH KARN says

thanks a lot a great article

SYED says

ITS REALLY VERY INFORMATIVE ARTICLE..KEEP GOING …

Ayesha Khan says

best method to explain.this help me very much

Sanjay says

I love this website I got more knowledge and clear cut information with one shot

Thank you guys make some more information like this

Dr.Aliya Sultana says

Excellent content for differentiating between concepts

Tushar Gadiya says

Ratios explained in very simple language

Thank you.

Murtaza King says

GOOD AND EFFICIENT WAY OF EXPLAINING THE DIFFERENCE

I LIKE IT

THANK YOU VERY MUCH

Ashok k says

I Found such differences only in this website>>

Thank for Helping us understand