Bad Debt refers to the sum due from the debtors, which remains unrealized, and so they are written off in the company’s books of accounts. As against, doubtful debts refer to the debt, with which there is an uncertainty, as to the degree to which amount will be recovered from the debtor.

Bad Debt refers to the sum due from the debtors, which remains unrealized, and so they are written off in the company’s books of accounts. As against, doubtful debts refer to the debt, with which there is an uncertainty, as to the degree to which amount will be recovered from the debtor.

Who are Debtors?

Goods and services are sold for the purpose of generating revenue for the business. However, all the goods are not sold in cash, and goods on credit are allowed to a number of customers. So, the customers to whom goods are sold on credit are called debtors.

Also Read: Difference Between Debtors and Creditors

What is a Debt?

If out of the total sum due, a certain percentage of the sum is not recovered due to non-payment, and the amount due from debtors is called debt.

This post will enlighten you on the difference between Bad Debt and Doubtful Debt.

Content: Bad Debts Vs Doubtful Debts

- Comparison Chart

- Definition

- Key Differences

- Journal Entries

- Explanation of Provision for Bad Debtss

- Conclusion

Comparison Chart

| Basis for Comparison | Bad Debts | Doubtful Debts |

|---|---|---|

| Meaning | Bad Debts amounts to that portion of the debts which are either irrecoverable or whose probability of recovery is very rare. | Doubtful Debt is the debt whose recovery is not certain, i.e. it may or may not be received. |

| Closure of Debtor's Account | Bad Debt Account (Debit), Debtor's Account (Credit) | The debtor's account, whose debt is recognized as doubtful is never closed. |

| Type of Loss | Actual Loss | Anticipated Loss |

| Claim against debtor | Does not exists | Exists |

| Tax-Deductible | Yes | No |

| Related to | Specific Debtor | All the debtors taken together |

| Accounting Treatment | Amount of bad debt is deducted from the amount of sundry debtors and the loss arising due to bad debt can be charged against the Profit and Loss Account or it can be adjusted against Provision for bad debts account. | Provision for doubtful debt is created which is a charge against profit that may cover the loss if the doubtful debt turns out as bad debt. |

| Debt Recovery | The amount is credited to a bad debt recovery account or bad debt dividend account and its balance is transferred to the profit and loss account. | When doubtful debt is realized, the amount is credited to the debtor's account. And the provision created for the doubtful debt is treated as gain and so it is transferred to a profit and loss account. |

| How it is shown in the Balance Sheet? | Bad Debt is not a part of sundry debtors and so it does not appear in the balance sheet. | Doubtful Debts are a part of sundry debtors for the purpose of creation of balance sheet and provision for doubtful debts appear as a deduction from sundry debtors. |

Definition of Bad Debts

When goods are sold to the customer on credit and the customer does not pay the outstanding sum and he/she is declared bankrupt by the Court, then the amount owed by that customer is considered as a bad debt, which is a loss to the firm. The amount which is not recovered is a loss, for the business.

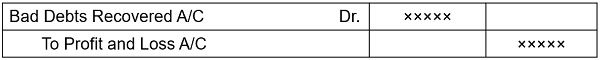

There are instances when a customer does not pay the entire amount of the debt and pays only a certain percentage of it. the amount recovered from the debtor is credited to Bad Debts Recovered Account. And, the remaining portion which is not recovered from the debtors is called bad debt.

The concerned debtor’s account is closed in the books of the firm and at the end of the period, the bad debt’s account is transferred to the debit side of the Profit and Loss Account.

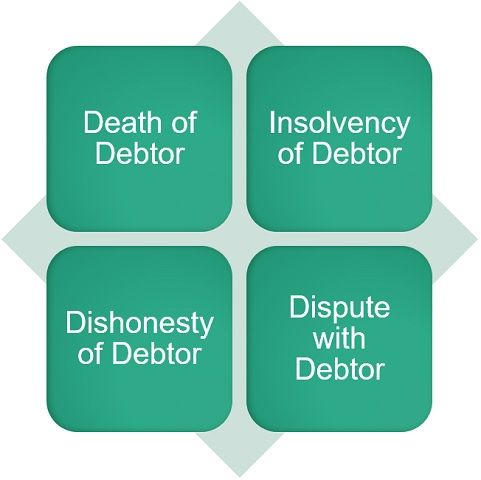

Reasons for Bad Debt

Debts usually turn out as bad because of:

- Sudden demise of the customer whose assets are not sufficient to pay off debts.

- When there is a dispute with the customers.

- When the debtor is declared insolvent by the Court and he is not able to pay the due sum.

- When the customer is dishonest, wherein the party has received goods on credit having no intention to discharge the debt.

What is Provision for Bad Debts?

When it is expected that the outstanding amount to the customers will not be recovered, it is advisable to recognize the anticipated loss. This can be done by decreasing the current year’s profit and entering the amount to the credit of the special account, i.e. Provision for Bad Debts.

Also Read: Difference Between Provision and Reserve

Definition of Doubtful Debts

Doubtful Debt refers to that portion of debt whose recovery is not certain. Therefore, for such debts, there is a possibility that the firm may face losses in the future.

At the end of the financial year, the balances due to customers’ accounts are calculated and the portion which is likely to be irrecoverable is estimated. In practice, the amount whose recovery is uncertain cannot be treated as a loss on the date at which the balance sheet is prepared and so it cannot be written off. However, based on the past history of the firm, it needs to be charged against the Profit and Loss Account of the firm.

Also, with the purpose of protecting against the probable loss, a provision is created called Provision for Doubtful Debts. The provision creates a charge against profit. When we create provision, a certain sum is set aside, so as to make good the loss, if the doubtful debt turns out as bad debts.

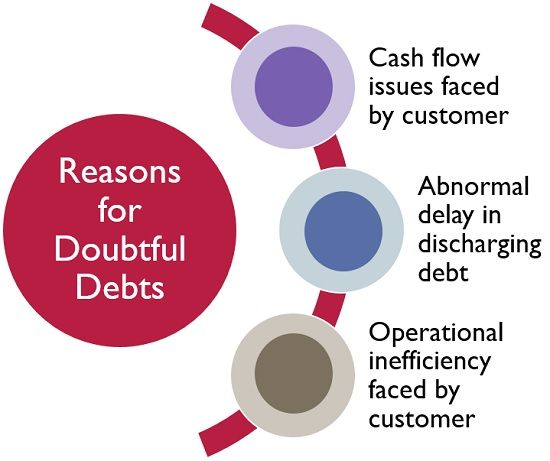

Reasons for Doubtful Debts

Debts usually turn out as doubtful because of:

- When a customer is facing cash flow issues.

- When a customer is taking an abnormally long time to clear the debt

- When operational inefficiencies such as strikes, lockout, disruption in production, etc. are experienced by the customers, resulting in financial difficulties.

What is Provision for Doubtful Debt?

Provision for Doubtful Debt implies the provision made to offset losses of anticipated bad debts, that may arise in the future, using a predetermined percentage of the Sundry Debtors, so as to ensure certainty in the amount of bad debts charged to each financial year.

Also Read: Difference Between Account Receivable and Account Payable

Key Differences Between Bad Debts and Doubtful Debts

After having an in-depth discussion on the meaning of the two terms, now we will discuss the differences between bad debts and doubtful debts:

- Bad Debt refers to the amount which a customer owes to the firm, whose likelihood of recovery is remote as it turns out as irrecoverable. As against, doubtful debt implies the amount which a customer owes to the firm, but whether they will be receivable or not, cannot be ascertained on the date of preparing the financial statement.

- In case of bad debts, the debtor’s account is closed by debiting the bad debt account and crediting the debtor’s account. As against, when it comes to doubtful debts, the debtor’s account, whose debt is identified as doubtful is not closed.

- While bad debts represent actual loss, doubtful debts represent anticipated loss. This is due to the fact that doubtful debts have the probability of turning out as uncollectible in the future, but in the case of bad debt, they are clearly recognized as uncollectible.

- As in the case of bad debt, the amount due is written off in the books of accounts, so the claim against the debtor does not exist, whereas in the case of doubtful debts, the debtor’s account is not closed, so the claim against debtors exists.

- As bad debt is an actual loss to the firm, it is tax-deductible in nature, whereas doubtful debt is just an anticipation of loss that may or may not occur in the future, so it is not tax-deductible.

- When a specific debtor defaults in the payment of the amount due from him, it amounts to bad debt. As against, when there is uncertainty as to the recovery of the amount due from various debtors, it is termed as doubtful debts.

- In accounting, the amount of bad debts is deducted from the number of sundry debtors. Further, the loss occurring due to bad debt can be charged against the profit and loss account, or the amount is adjusted against the provision made in this regard. Conversely, for doubtful debts, a provision is created, which is a charge against profit, so as to cover the loss if the doubtful debt turns out as bad debt.

- In case of bad debts as the debtor’s account is already closed, so when he pays the amount either fully or partially, the amount cannot be credited to his account, rather the amount is credited to a bad debt recovery account or bad debt dividend account and its balance is transferred to profit and loss account. In contrast, in the case of doubtful debts when the amount due to the debtor is realized, the amount is credited to the debtor’s account. And the provision created for the doubtful debt is treated as gain and so it is transferred to a profit and loss account.

- As Bad Debts is not a part of sundry debtors and so it is not shown in the balance sheet of the firm. Oppositely, Doubtful Debts are a part of sundry debtors for the purpose of creation of the balance sheet, and provision for doubtful debts appears as a deduction from sundry debtors.

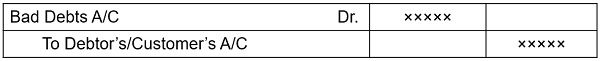

Journal Entries for Bad/Doubtful Debt

- For writing off Bad Debt: As the amount is irrecoverable from the debtor, it is not right to show the amount due as an asset, and so the amount of the respective customer is closed by crediting the same.

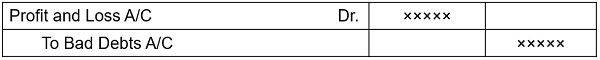

- Transfer of Bad Debt Account to Profit and Loss Account

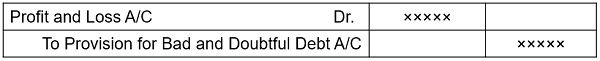

- For Creation of Provision for Bad and Doubtful Debt

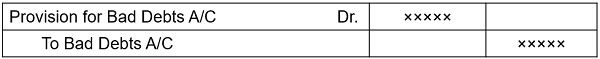

- When provision for Bad Debts has been created, then the bad debts need to be written off from the provision first. The entry will be:

Also Read: Difference Between Debit and Credit

Explanation of Provision for Bad Debts

Suppose the amount due from a customer is Rs. 80,000 and it is doubtful that the customer may not pay the sum. So, the firm does not want to write off the sum for the time being. In the next financial year, the debt becomes bad debt, which needs to be written off.

So, here the question arises, ‘To which year the loss belongs – current year’s or next year’s?‘ Well, obviously it is the current year’s loss, even when the amount is written off next year.

Therefore, the firm must provide for the loss in the current year. As the amount which is to provide for is not known. One can simply make a logical guess and decide on an arbitrary figure to be provided for. In this way, the profit for the current year will be reduced by the said amount and the amount is treated as a provision. So, any amount which is to be written off next year should be deducted from the provision created in this regard.

Conclusion

Bad Debt is a debt of which nothing can be recovered, and it is written-off as uncollectible in the books of account. On the other hand, doubtful debt is just an estimation of the amount whose collection is unsure and may turn out as bad debt in the future.

Leave a Reply