When a shareholder pays the amount due on calls before it is demanded, it refers to the calls in advance, and the amount received by the company, is kept in a separate account, i.e. Calls in Advance A/c, and so it is not indicated as the capital of the company until it is demanded by the company from the shareholders.

When a shareholder pays the amount due on calls before it is demanded, it refers to the calls in advance, and the amount received by the company, is kept in a separate account, i.e. Calls in Advance A/c, and so it is not indicated as the capital of the company until it is demanded by the company from the shareholders.

In contrast, when the company issues notice to all the shareholders regarding the payment of allotment or call money due on the shares, it needs to be paid within the specified time. Suppose, one or more shareholders fails to pay the amount called by the company, the amount unpaid by the shareholders becomes calls in arrears. Further, the money owed by the shareholder is transferred to an account called Calls in Arrears A/c.

What is a call?

A call can be understood as a demand made by the company regarding the payment of a certain portion of the issue price of the shares or debentures, which has not been paid, and whose date of payment is not specified, in terms of issue.

In this post, the difference between calls in arrears and calls in advance has been discussed.

Content: Calls in Arrear Vs Calls in Advance

Comparison Chart

| Basis for Comparison | Calls in Arrears | Calls in Advance |

|---|---|---|

| Meaning | Calls in arrears is the non-payment of the amount due on allotment/calls by one or more shareholders. | Calls in advance is the prepayment of uncalled amount on the shares by one or more shareholders. |

| Nature of Balance | It shows a debit balance | It shows a credit balance |

| Where is appears on the Balance Sheet? | It is always deducted from called up capital to arrive at paid up capital in Balance Sheet, irrespective of its accounting treatment. | It is shown on the liabilities side of the Balance Sheet. |

| Maximum rate of interest | Company can charge interest @ 10% for the intervening period, if it has adopted Table F. | Company is required to pay interest @ 12% from the date it is paid to the date it is appropriated, if it has adopted Table F. |

| Instalment | The company has called the instalment. | The company has not yet called the instalment. |

| Authority under articles | No question of authority under articles arises. | Company accepts calls in advance provided the articles of association of the company authorizes it. |

Definition of Calls in Arrears

The amount of allotment and calls must be paid by the shareholders on the due date. However, if the shareholder fails in the payment of the amount due within the prescribed time, then that amount is called Calls in Arrears or Unpaid Calls.

- It represents the difference between call money due and call money actually received by the company.

- When the company does not maintain a separate account, then the unpaid amount appears as a Notes to Accounts. As against, when the company maintains a separate call-in arrears account, then the unpaid amount is transferred to the Calls in Arrears Account.

Concept of Calls in Arrears

On applying for shares of a company, a company makes a valid offer and when the company accepts the application and allots these shares to that applicant it turns out as a valid contract between the company and the applicant. And the shareholder becomes liable to pay the entire sum due on the shares held by him/her.

When the applicant defaults in sending the money due on allotment or calls, then the amount not sent is called calls in arrears. It is the liability of the shareholder to pay the sum due, which may lead to the forfeiture of shares.

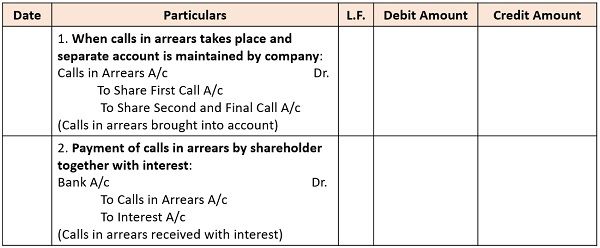

Entries regarding Calls in Arrears

- Without Opening Calls in arrear account: No separate call-in arrear account is opened in this case, rather the amount actually received from the shareholder (actual call money received) is credited to the concerned call account. Hence, the debit balance is indicated by different call accounts which are equal to the amount not paid on each call.

- Opening Calls in Arrears Account: A separate account can be maintained for calls in arrears. The calls in arrears account are credited with the sum, that has not been paid by one or more applicants. And so the share allotment and other calls account won’t show any balance, however, calls in arrears will show a debit balance, which is equal to the total unpaid amount on calls. In case any amount is received from the defaulting shareholders, it is credited to the calls in the arrears account.

Effect of Calls in Arrears in Balance Sheet

Calls in Arrears are deducted from the called-up capital to determine paid-up capital.

Also Read: Difference Between Authorized Capital and Issued Capital

Definition of Calls in Advance

There are instances when the shareholders pay in the advance partial or full amounts of the calls, which is not yet made by the company. Then the amount received beforehand is termed as Calls in Advance.

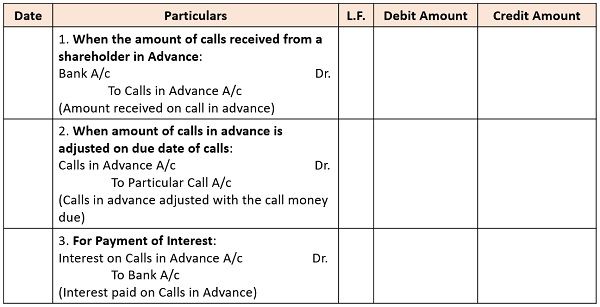

It is quite obvious that the amount received in advance indicates the liability of the company and needs to be credited to Calls in advance A/c. And in the future, when the call is actually made by the company, the amount received from the shareholders in advance is adjusted towards the payment of calls.

Here, it is to be noted that, as per the Companies Act, 2013, a company can only accept calls in advance from a shareholder only if the company’s articles of association authorizes to do so. Also, no dividend is allowed to the shareholder on the amount paid as calls in advance.

Concept of Calls in Advance

When the shareholder pays more money than called by the company on the shares held by him, the excess amount so received is termed as calls in advance. Further, the amount received in advance is a liability for the company and so it is indicated separately at the liabilities side of the balance sheet and not included in the capital.

Points to consider

- It is not included in the current liabilities of the Balance sheet, rather it is included in other current liabilities.

- No extra voting rights are given to the shareholder who pays calls in advance.

- No dividend on calls in advance is given to the shareholder because it is not treated as a part of called-up capital.

- In the event of winding up of the company, the amount of calls in advance shall not be refunded.

Rate of Interest on Calls in Advance

Interest is payable to the shareholders on calls in advance at a rate stated in the Articles of Association of the company, from the date on which the amount is received to the date when the call becomes due.

Nevertheless, if the articles of association of the company are silent on this matter, then model Table F is applicable on the public company limited by shares, which gives an option to the shareholders to pay interest on calls in advance @12% per annum or less.

Effect on Balance Sheet

If the call is yet uncalled on the date at which the balance sheet is prepared. It is displayed as a separate item at the liabilities side of the Balance Sheet under the subhead other current liabilities. Further interest on calls in advance is calculated for the period between the date on which call money is received in advance and the date on which call is due for payment.

Also Read: Difference Between Over Subscription and Under Subscription

Key Differences Between Calls in Arrears and Calls in Advance

As we have understood the meaning of these two thoroughly, now we will talk about the difference between calls in arrears and calls in advance:

- When the shareholder fails to pay the call money due on allotment or on subsequent calls, the unpaid amount is called calls in arrears. As against, Calls in advance refer to the amount received by the company against calls not yet made by the company.

- Calls in arrears account have a debit balance, this is due to the fact that calls in arrears are an asset for the company. Conversely, calls in the advance account have a credit balance, because it is a liability for the company.

- Calls in advance are a liability for the company that represents the uncalled money received in advance from shareholders. Hence, it appears on the liabilities side of the balance sheet under the head Current Liabilities and subhead other current liabilities. On the other hand, Calls in arrears are shown as a deduction from the called-up capital to ascertain the paid-up capital, on the date at which the balance sheet is created, no matter separate calls in arrears account is maintained by the company or not.

- As per Table F, the maximum rate of interest that can be charged by the company on calls in arrears is @ 10% per annum for the intervening period. The term ‘intervening period‘ refers to the period between the date of non-receipt of the said amount to the date on which the amount is actually received by the company. In contrast, as per Table F, the maximum rate of interest that can be paid by the company on calls in advance is 12% per annum from the date advance is received to the date it is appropriated

- In case of calls in arrears, the company has called the installment but has not received it from one or more shareholders. As against, in case of calls in advance, the company’s call on installment is awaited, but one or more shareholders have paid them beforehand.

- There is no question of authorization in articles of association arises in calls in arrears. Conversely, the company accepts calls in advance provided the articles of association of the company authorizes it.

Example

Calls in Arrears

100 shares of ₹ 10 each were allotted to Mr Alpha. He paid application money @ ₹ 4 and allotment money @ ₹ 2 per share. However, he failed to pay ₹ 2 per share on the first call and ₹ 2 per share on the second call. In this case, calls in arrears will be: 4 × 100 = 400

Calls in Advance

Suppose a Company issued 1000 shares of ₹ 100 each, in which ₹ 20 per share is payable on application, ₹ 30 per share is payable on the allotment, ₹ 30 per share on the first call, and ₹ 20 per share on the second and final call. The company issued notice for the payment of allotment money, but Mr. Beta who is a holder of 100 shares paid the entire sum together with the allotment. Hence, the payments of First Call and Second Call are regarded as calls in advance.

Journal Entry

Calls in Arrears

Calls in Advance

Conclusion

In a nutshell, calls in advance imply the uncalled-up amount received by the company from a shareholder in advance. On the other hand, calls in arrears represent the unpaid-up amount on shares which is due but not yet received.

Christine says

Your style is so unique compared to other people I have read stuff from.

Thank you for posting when you’ve got the opportunity, Guess I will just bookmark this site.