There are instances when all the shares which a company offers are not subscribed by the company, in that case, the total number of shares applied for is less than the number of shares offered by the company to the public. This is a situation of under subscription.

There are instances when all the shares which a company offers are not subscribed by the company, in that case, the total number of shares applied for is less than the number of shares offered by the company to the public. This is a situation of under subscription.

On the other hand, there are also certain cases when the general public subscribes for more shares than the shares offered by the company, then in this case over subscription takes place. In this regard, first of all, we need to understand the term full subscription:

What is a Full Subscription?

When the subscription received from the public is equal to the shares offered by the company it is called a full subscription.

In this post, we are going to talk about the difference between over subscription and under subscription.

Content: Over Subscription Vs Under Subscription

- Comparison Chart

- Definition

- Key Differences

- Example

- Procedure for Proportionate or Pro-rata Allotment

- Conclusion

| Basis for Comparison | Over Subscription | Under Subscription |

|---|---|---|

| Meaning | The issue is said to be oversubscribed when the total number of shares applied for is greater than the number of shares offered. | The issue is said to be undersubscribed when the total number of shares applied for is less in comparison to the shares offered to the public. |

| Acceptance | As the shares offered are less than the subscribed, hence some applications have to be rejected. | All the applications received are accepted. |

| Minimum Subscription | No question of minimum subscription arises in this case. | The company needs to make certain that the condition of the minimum subscription is satisfied. |

| Refund or Adjustment | Excess application money is either refunded or adjusted against allotment or both can be adopted in combination. | As no excess application money is received, there is no requirement for a refund or adjustment. |

| Investor's Mindset | It takes place when investors have a positive mindset regarding the company's performance in the future. | It takes place when the investors do not have a strong positive sentiment about the company's performance in the future. |

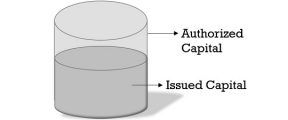

| Issued Capital | The amount of share capital in the company's balance sheet is equal to the issued capital. | The amount of share capital in the company's balance sheet is less than the issued capital. |

Definition of Oversubscription

Oversubscription can be understood as the situation in which the application money received by the company is in excess of the number of shares offered to the public for the purpose of subscription. In such a situation, the company cannot allot shares to all the persons who have applied for it. This is because the total number of shares to be allotted will not exceed the number of shares offered by the company.

When the shares of the company are traded in the recognized stock exchange, then the excess money received in connection to the application cannot be used towards allotments or calls. And the amount in excess needs to be refunded, or else the directors would require to return the sum with interest @ 12% per annum. However, when the company has obtained approval from the stock exchange then it can utilize the excess amount towards allotment or calls.

Alternatives for Over Subscription

Over subscription, there are three alternatives available to the company with respect to the allotment:

1. Full Allotment and Rejection of Excess Application: Rejection of some excess applications and allotment is made in full to other applicants. Those applicants whose applications are rejected are sent a letter of regret along with the refund of the money paid by them. Also, the applicants whose applications are accepted are sent a letter of allotment.

2. Pro-rata Allotment: Proportionate distribution of available shares can be made by the Board of Directors for allotment among applicants. The applicants get a lesser number of shares than the shares they have applied for, proportionately, which is called a pro-rata allotment. The allotment is based on the ratio between the number of shares to be allotted and the number of shares applied for.

Letter of allotment is delivered to all the applicants and excess application money received in the application is not refunded rather it is retained and adjusted towards allotment and calls. If the entire issue price is needed to be paid along with the application, the excess amount over and above 10% of the securities offered has to be refunded.

3. Combination of the above two alternatives:

- Reject some applications and make pro-rata allotment of the remaining applicants: In this case letter of regret is sent to the rejected applicants and a letter of allotment is sent to the ones accepted over.

- Full allotment to some applicants and making pro-rata allotment of the left ones: In this case letter of allotment is sent to all the applicants.

- Rejection of some applications, full allotment to some applicants, and making pro-rata allotment to the remaining ones: Letter of regret is sent to the rejected ones. And the letter of allotment is sent to the applicants whose applications have been accepted.

Note: Oversubscription received to the extent of 10% of the net offer made to the general public is allowable so as to round off the figure to the nearest multiple of 100, at the time of completing the allotment.

SEBI Guidelines for Over Subscription

- There should be a categorization of the applicants on the basis of the number of shares they have applied for.

- Half of the net offer of shares to the public should be made to those companies or organizations that have made applications for more than 1000 shares.

- Half of the net offer of shares to the public should be given to those applicants, who have made applications of 1000 or less than 1000 shares.

- The Board of Directors has the authority to reject some applications on the grounds of a technicality like incomplete application forms or forms not bearing signatures or applications with less money.

- Any basis for allotment of shares can be adopted, but allotment has to be made in tradable lots, and the amount over and above received at the time of application should be adjusted towards allotment and calls, while the remaining excess sum is to be refunded.

Also Read: Difference Between Authorized Capital and Issued Capital

Definition of Under subscription

Under subscription, as the name signifies, is a situation in which the application received by the company from the public is less than the shares offered. In this case, the company will keep a record of the actual number of shares purchased by public

Here, it is to be noted that the condition for a minimum subscription must be fulfilled by the company i.e. 90% of the issued shares must be subscribed for by the public, so as to allot shares to the public.

Accounting Treatment for Under subscription

Accounting is done in the basic manner as no special treatment is given. Further, journal entries are made as per the actual number of shares applied for and allotted to the public. By doing so the company can satisfy all the applicants.

What is a Minimum Subscription?

Minimum Subscription implies the least amount of capital mentioned in the company’s prospectus, that the general public should subscribe to, prior to proceeding for allotment. This is the amount which according to the company’s directors must be raised by issuing shares, to provide for the following:

- Purchase Price of any asset acquired or to be acquired which is to be met out of the proceeds of the issue of shares,

- Preliminary expenses payable by the company and any commission payable with respect to the issue of shares,

- Repayment of any money borrowed by the company concerning the above two matters,

- Working capital and

- Any other expenditure indicating the nature and purpose of that and the estimated amount in each case.

SEBI Guidelines for Under Subscription

When the company has not received 90% of the amount issued from public subscription and accepted devolvement of shares from underwriters and other sources, in case of under subscription, within a period of 60 days, counting from the date of closure of share issue, the company is required to refund the full amount of subscription to the applicants within 78 days without interest and with interest for the delayed period past 78 days, @ 15% per annum.

Also Read: Difference Between Calls in Arrears and Calls in Advance

Key Differences Between Over Subscription and Under Subscription

So, after going through the meaning and the basic guidelines, let us understand the difference between over subscription and under subscription:

- When the subscription received for the shares by the company, is more than the shares offered, then the situation of oversubscription arises. On the other hand, when the company receives lesser applications than the total number of shares offered to the general public, the issue is said to be undersubscribed.

- It is quite obvious that in no case the company can increase the number of shares offered. Therefore, if they are less than the shares subscribed, some applications will be rejected. Conversely, all the applications received are accepted.

- In case of under subscription, it must be made certain that the company has received a minimum subscription. As per the provisions, the company can issue shares only when the minimum subscription has been received. As against, in case of over subscription, shares are already subscribed in excess of the shares offered, so no question of minimum subscription arises in such a case.

- In case of over subscription, the excess application money is either refunded or adjusted against allotment or both can be adopted in combination. In contrast, as no excess application money is received in case of under subscription, there is no requirement for refund or adjustment.

- The situation of over subscription arises when investors have a positive mindset regarding the company’s performance in the future and also when the company is one of the top companies in a specific category. Oppositely, the situation of under subscription arises when the investors do not have a strong positive sentiment about the company’s performance in the future, and also when the company is in its budding stage and does not have earned goodwill in the market.

- In oversubscription, the amount of share capital in the balance sheet of the company is equal to the issued capital. In contrast, the amount of share capital in the balance sheet of the company is less than the issued capital.

Example

Over subscription

Suppose ABC Ltd. has offered 10,000 shares to the public, however, the general public applied for 11,000 shares, it is called over-subscription.

Under subscription

Suppose ABC Ltd. has offered 10000 shares of Rs. 10 each, but the public has applied for 8500 shares only, then the issue is said to be undersubscribed.

Also Read: Difference Between Memorandum of Association and Articles of Association

Procedure for proportionate allotment of shares

- First of all, a list of the total number of shares applied for in each category, i.e. 100 shares or 200 shares is created.

- Thereafter, a list of the number of applicants in each category is created.

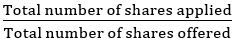

- Now, compute the total number of shares applied for in each category using the given formula:

= Number of shares applied for in a category × Number of applicants in that category - Thereafter, you need to calculate the oversubscription ratio, and for this, you need to use the given formula:

Oversubscription Ratio =

- After that, you need to calculate the proportionate allocation of shares in each category by:

Total number of shares applied for in a category × Inverse of Over subscription ratio - Lastly, compute the number of shares to be allotted to an applicant of each category on a proportionate basis:

= Number of shares applied for by each applicant × Inverse of Over subscription Ratio

Conclusion

For the purpose of accounting, the total number of shares issued to the public are used in case of over subscription, whereas a total number of shares applied for and allotted are used for the purpose of calculation, in case of under subscription.

Leave a Reply